Politics

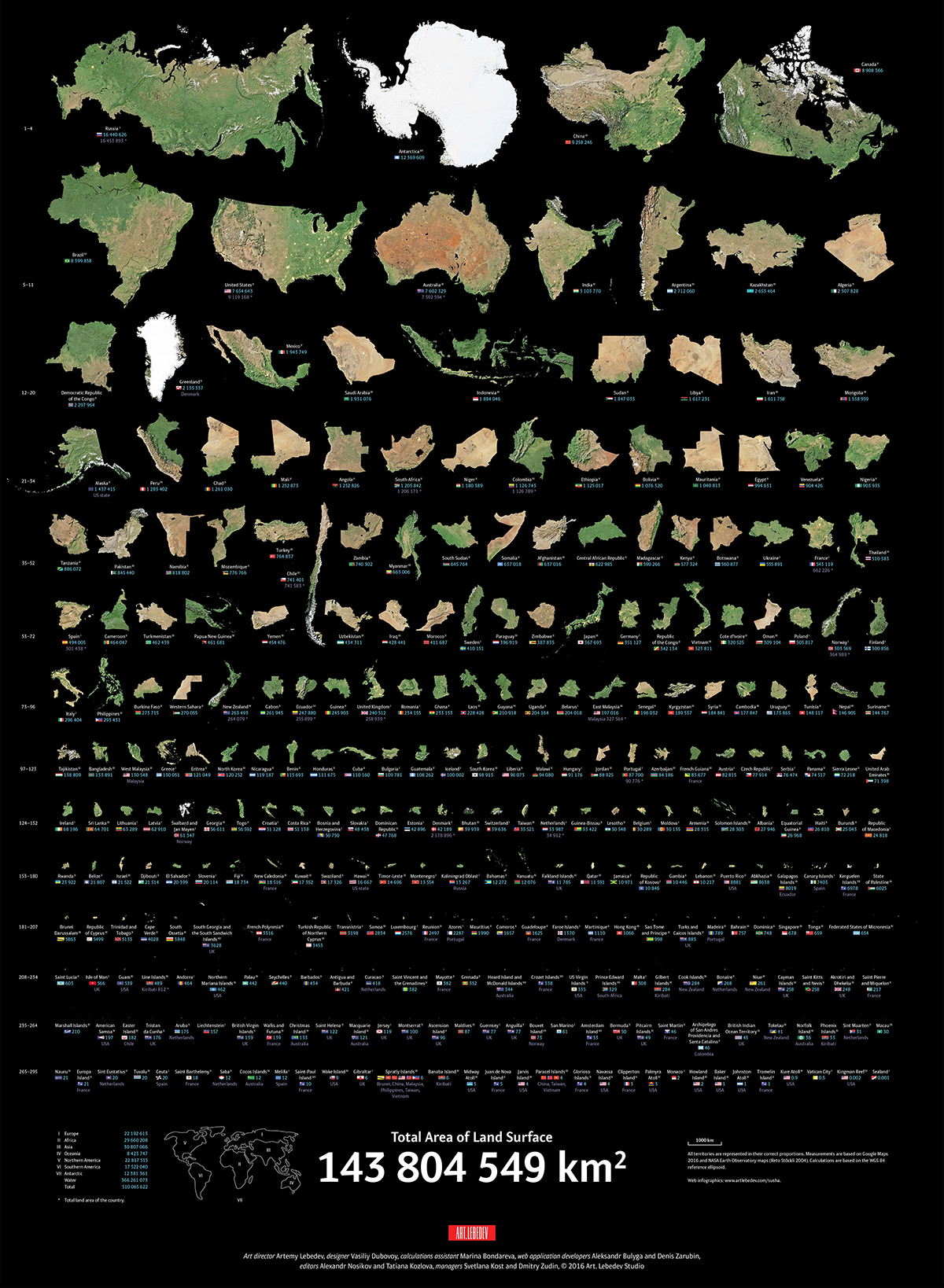

Visualizing the True Size of Land Masses from Largest to Smallest

View the full resolution version of this infographic

Note: Some of the land areas depicted in this graphic by Art.Lebedev are shown in separate components (e.g. U.S. and Malaysia) or are disputed and/or occupied territories (e.g. Abkhazia, Crimea, and Taiwan).

The True Size of Land Masses from Largest to Smallest

Is Greenland the size of the entire African continent?

No…

But looking at a map based on the Mercator projection, you would think so.

Today’s infographic comes from the design studio Art.Lebedev and shows the true size of the world’s land masses in order from largest to smallest using data from NASA and Google.

Check out the actual shape and size of each land mass without any distortions.

Distorting Reality: Mercator Misconceptions

Maps can deceive your eyes but they are still powerful tools for specific purposes. In 1569, the legendary cartographer, Gerardus Mercator, created a new map based on a cylindrical projection of sections of the Earth. These types of maps were suited for nautical navigation since every line on the sphere is a constant course, or loxodrome.

Despite the map’s nautical utility, the Mercator projection has an unwanted downside. The map type increases the sizes of land masses close to the poles (such as in North America, Europe, or North Asia) as a side effect. As a result, Canada and Russia appear to take up approximately 25% of the Earth’s surface, when in reality these nations only occupy 5%.

“Things are not always what they seem; the first appearance deceives many.” – Phaedrus

This collection of images above represents the world’s land masses in their correct proportions. Measurements are based on Google Maps 2016 and NASA Earth Observatory maps, with calculations based on the WGS84 reference ellipsoid, or more simply, a specific model of the Earth’s shape in two dimensions.

We take for granted Google Maps and satellite imaging. Making these accurate representations is no small task – the designers went through six steps and many different iterations of the graphic.

Countries are arranged by descending size and shown without external or dependent territories. For example, the total area for the contiguous United States shown does not include Hawaii, Alaska, or overseas territories.

Top 10 Largest Land Masses

Although Mercator maps distort the size of land masses in the Northern Hemisphere, many of these countries still cover massive territories.

| Jurisdiction | Area (km²) |

|---|---|

| Russia | 16,440,626 |

| Antarctica | 12,269,609 |

| China | 9,258,246 |

| Canada | 8,908,366 |

| Brazil | 8,399,858 |

| United States (contiguous) | 7,654,643 |

| Australia | 7,602,329 |

| India | 3,103,770 |

| Argentina | 2,712,060 |

| Kazakhstan | 2,653,464 |

The top 10 land masses by size account for 55% of the Earth’s total land. The remainder is split by the world’s 195 or so other countries.

Top 10 Smallest Land Masses

Here are the 10 tiniest jurisdictions highlighted on the map:

| Jurisdiction | Area (km²) |

|---|---|

| Sealand | 0.001 |

| Kingman Reef | 0.002 |

| Vatican City | 0.5 |

| Kure Atoll | 0.9 |

| Tromelin Island | 1 |

| Johnston Atoll | 1 |

| Baker Island | 1 |

| Howland Island | 2 |

| Monaco | 2 |

| Palmyra Atoll | 3 |

While the Earth’s land surface has been claimed by many authorities, the actual impact of human activity is less than one would think.

Human Impact: Humbled by Nature

Political borders have claimed virtually every piece of land available. Despite this, only 20% of land on the planet has been visibly impacted by human activity, and only 15% of Earth’s land surface is formally under protection.

The remaining 80% of the land hosts natural ecosystems that help to purify air and water, recycle nutrients, enhance soil fertility, pollinate plants, and break down waste products. The value of maintaining these services to the human economy is worth trillions of U.S. dollars each year.

While some nations are not as big as they look on the map, every piece of land counts.

Economy

The Bloc Effect: International Trade with Geopolitical Allies on the Rise

Rising geopolitical tensions are shaping the future of international trade, but what is the effect on trading among G7 and BRICS countries?

The Bloc Effect: International Trade with Allies on the Rise

International trade has become increasingly fragmented over the last five years as countries have shifted to trading more with their geopolitical allies.

This graphic from The Hinrich Foundation, the first in a three-part series covering the future of trade, provides visual context to the growing divide in trade in G7 and pre-expansion BRICS countries, which are used as proxies for geopolitical blocs.

Trade Shifts in G7 and BRICS Countries

This analysis uses IMF data to examine differences in shares of exports within and between trading blocs from 2018 to 2023. For example, we looked at the percentage of China’s exports with other BRICS members as well as with G7 members to see how these proportions shifted in percentage points (pp) over time.

Countries traded nearly $270 billion more with allies in 2023 compared to 2018. This shift came at the expense of trade with rival blocs, which saw a decline of $314 billion.

Country Change in Exports Within Bloc (pp) Change in Exports With Other Bloc (pp)

🇮🇳 India 0.0 3.9

🇷🇺 Russia 0.7 -3.8

🇮🇹 Italy 0.8 -0.7

🇨🇦 Canada 0.9 -0.7

🇫🇷 France 1.0 -1.1

🇪🇺 EU 1.1 -1.5

🇩🇪 Germany 1.4 -2.1

🇿🇦 South Africa 1.5 1.5

🇺🇸 U.S. 1.6 -0.4

🇯🇵 Japan 2.0 -1.7

🇨🇳 China 2.1 -5.2

🇧🇷 Brazil 3.7 -3.3

🇬🇧 UK 10.2 0.5

All shifts reported are in percentage points. For example, the EU saw its share of exports to G7 countries rise from 74.3% in 2018 to 75.4% in 2023, which equates to a 1.1 percentage point increase.

The UK saw the largest uptick in trading with other countries within the G7 (+10.2 percentage points), namely the EU, as the post-Brexit trade slump to the region recovered.

Meanwhile, the U.S.-China trade dispute caused China’s share of exports to the G7 to fall by 5.2 percentage points from 2018 to 2023, the largest decline in our sample set. In fact, partly as a result of the conflict, the U.S. has by far the highest number of harmful tariffs in place.

The Russia-Ukraine War and ensuing sanctions by the West contributed to Russia’s share of exports to the G7 falling by 3.8 percentage points over the same timeframe.

India, South Africa, and the UK bucked the trend and continued to witness advances in exports with the opposing bloc.

Average Trade Shifts of G7 and BRICS Blocs

Though results varied significantly on a country-by-country basis, the broader trend towards favoring geopolitical allies in international trade is clear.

Bloc Change in Exports Within Bloc (pp) Change in Exports With Other Bloc (pp)

Average 2.1 -1.1

BRICS 1.6 -1.4

G7 incl. EU 2.4 -1.0

Overall, BRICS countries saw a larger shift away from exports with the other bloc, while for G7 countries the shift within their own bloc was more pronounced. This implies that though BRICS countries are trading less with the G7, they are relying more on trade partners outside their bloc to make up for the lost G7 share.

A Global Shift in International Trade and Geopolitical Proximity

The movement towards strengthening trade relations based on geopolitical proximity is a global trend.

The United Nations categorizes countries along a scale of geopolitical proximity based on UN voting records.

According to the organization’s analysis, international trade between geopolitically close countries rose from the first quarter of 2022 (when Russia first invaded Ukraine) to the third quarter of 2023 by over 6%. Conversely, trade with geopolitically distant countries declined.

The second piece in this series will explore China’s gradual move away from using the U.S. dollar in trade settlements.

Visit the Hinrich Foundation to learn more about the future of geopolitical trade

-

Economy2 days ago

Economy2 days agoEconomic Growth Forecasts for G7 and BRICS Countries in 2024

The IMF has released its economic growth forecasts for 2024. How do the G7 and BRICS countries compare?

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

We visualized the top U.S. companies by employees, revealing the massive scale of retailers like Walmart, Target, and Home Depot.

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

We visualized product categories that saw the highest % increase in price due to U.S. inflation as of March 2024.

-

Economy1 month ago

Economy1 month agoG20 Inflation Rates: Feb 2024 vs COVID Peak

We visualize inflation rates across G20 countries as of Feb 2024, in the context of their COVID-19 pandemic peak.

-

Jobs1 month ago

Jobs1 month agoMapped: Unemployment Claims by State

This visual heatmap of unemployment claims by state highlights New York, California, and Alaska leading the country by a wide margin.

-

Markets2 months ago

Markets2 months agoConfidence in the Global Economy, by Country

Will the global economy be stronger in 2024 than in 2023?

-

Misc1 week ago

Misc1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Environment2 weeks ago

Environment2 weeks agoTop Countries By Forest Growth Since 2001