Money

Which States Have the Highest Minimum Wage in America?

![]() See this visualization first on the Voronoi app.

See this visualization first on the Voronoi app.

Which States Have the Highest Minimum Wage in America?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This year, 22 states are raising their minimum wage, impacting almost 10 million workers across the country.

Many states raise the minimum wage each year to adjust to a cost of living index, while others have raised the pay floor for delivery drivers and fast-food workers. Today, the federal minimum wage stands at $7.25, a rate that has remained the same for 15 years.

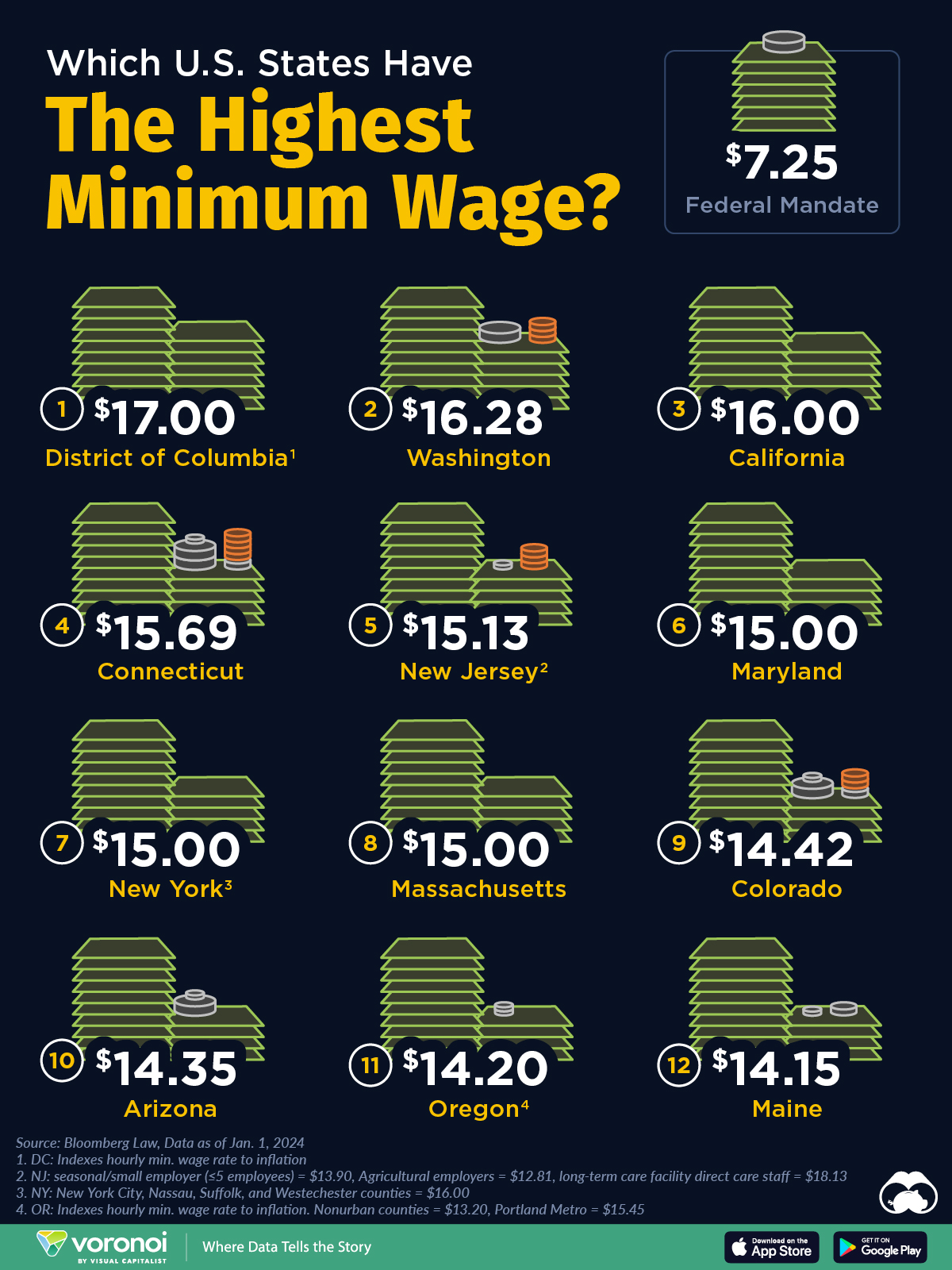

This graphic shows the states with the highest minimum wage in America, based on data from Bloomberg Law.

The Highest Minimum Wages, by State

Here are the states with the highest minimum wage as of January 1, 2024:

| Rank | State | Minimum Wage |

|---|---|---|

| 1 | District of Columbia1 | $17.00 |

| 2 | Washington | $16.28 |

| 3 | California | $16.00 |

| 4 | Connecticut | $15.69 |

| 5 | New Jersey2 | $15.13 |

| 6 | Maryland | $15.00 |

| 7 | New York3 | $15.00 |

| 8 | Massachusettes | $15.00 |

| 9 | Colorado | $14.42 |

| 10 | Arizona | $14.35 |

| 11 | Oregon4 | $14.20 |

| 12 | Maine | $14.15 |

| U.S. Federal Mandate | $7.25 |

1District of Columbia: Indexes hourly minimum wage rate to inflation

2New Jersey: Seasonal/small employer with five employees or less= $13.90, agricultural employers= $12.81, long term care facility direct care staff= $18.13

3New York: New York City, Nassau, Suffolk, and Westchester counties= $16.00

4Oregon: Indexes hourly minimum wage rate to inflation. Nonurban counties= $13.20, Portland metro= $15.45

The District of Columbia has the highest minimum wage in the country, at $17 an hour.

Next in line is Washington state, where the minimum wage was raised to $16.28 an hour at the start of the year, up from $15.74. Both jurisdictions tie their minimum wage increases to inflation, along with several of the states on this list such as New York, Colorado, and Arizona.

With the largest planned increase nationally, Hawaii is raising its minimum wage to $18 an hour by 2028. Currently, the minimum wage stands at $14 an hour in the Aloha State.

As we can see, many of the top states have minimum wages that are more than double the federal minimum wage, which has declined in real value for many years. For context, the real value of the federal minimum wage hit a peak in 1970, where it would be worth $12.61 today.

California’s New Fast-Food Wage Hike

Fast-food workers in California recently received a pay bump after a new law raised the minimum wage to $20 an hour, $4 more than the state’s minimum wage.

In response, Pizza Hut announced it was laying off over 1,200 delivery drivers, while McDonalds said that it would increase prices in California due to higher wage costs. Other chain operators are reducing hours, while El Pollo Loco plans to automate part of how it makes salsa.

Affecting half a million workers at 33,000 restaurants, the law applies to chains with 60 or more locations across the country, making it the highest minimum wage in America.

Economy

Ranked: The Top 20 Countries in Debt to China

The 20 nations featured in this graphic each owe billions in debt to China, posing concerns for their economic future.

Ranked: The Top 20 Countries in Debt to China

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

In this graphic, we ranked the top 20 countries by their amount of debt to China. These figures are as of 2022, and come from the World Bank (accessed via Yahoo Finance).

The data used to make this graphic can be found in the table below.

| Country | Total external debt to China ($B) |

|---|---|

| 🇵🇰 Pakistan | $26.6 |

| 🇦🇴 Angola | $21.0 |

| 🇱🇰 Sri Lanka | $8.9 |

| 🇪🇹 Ethiopia | $6.8 |

| 🇰🇪 Kenya | $6.7 |

| 🇧🇩 Bangladesh | $6.1 |

| 🇿🇲 Zambia | $6.1 |

| 🇱🇦 Laos | $5.3 |

| 🇪🇬 Egypt | $5.2 |

| 🇳🇬 Nigeria | $4.3 |

| 🇪🇨 Ecuador | $4.1 |

| 🇰🇭 Cambodia | $4.0 |

| 🇨🇮 Côte d'Ivoire | $3.9 |

| 🇧🇾 Belarus | $3.9 |

| 🇨🇲 Cameroon | $3.8 |

| 🇧🇷 Brazil | $3.4 |

| 🇨🇬 Republic of the Congo | $3.4 |

| 🇿🇦 South Africa | $3.4 |

| 🇲🇳 Mongolia | $3.0 |

| 🇦🇷 Argentina | $2.9 |

This dataset highlights Pakistan and Angola as having the largest debts to China by a wide margin. Both countries have taken billions in loans from China for various infrastructure and energy projects.

Critically, both countries have also struggled to manage their debt burdens. In February 2024, China extended the maturity of a $2 billion loan to Pakistan.

Soon after in March 2024, Angola negotiated a lower monthly debt payment with its biggest Chinese creditor, China Development Bank (CDB).

Could China be in Trouble?

China has provided developing countries with over $1 trillion in committed funding through its Belt and Road Initiative (BRI), a massive economic development project aimed at enhancing trade between China and countries across Asia, Africa, and Europe.

Many believe that this lending spree could be an issue in the near future.

According to a 2023 report by AidData, 80% of these loans involve countries in financial distress, raising concerns about whether participating nations will ever be able to repay their debts.

While China claims the BRI is a driver of global development, critics in the West have long warned that the BRI employs debt-trap diplomacy, a tactic where one country uses loans to gain influence over another.

Learn More About Debt from Visual Capitalist

If you enjoyed this post, check out our breakdown of $97 trillion in global government debt.

-

Demographics6 days ago

Demographics6 days agoThe Countries That Have Become Sadder Since 2010

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023

-

Green2 weeks ago

Green2 weeks agoRanking the Top 15 Countries by Carbon Tax Revenue

-

Markets2 weeks ago

Markets2 weeks agoU.S. Debt Interest Payments Reach $1 Trillion

-

Mining2 weeks ago

Mining2 weeks agoGold vs. S&P 500: Which Has Grown More Over Five Years?

-

Energy2 weeks ago

Energy2 weeks agoThe World’s Biggest Nuclear Energy Producers

-

Misc2 weeks ago

Misc2 weeks agoHow Hard Is It to Get Into an Ivy League School?

-

Debt2 weeks ago

Debt2 weeks agoHow Debt-to-GDP Ratios Have Changed Since 2000