Wealth

Charted: Which Country Has the Most Billionaires in 2024?

![]() See this visualization first on the Voronoi app.

See this visualization first on the Voronoi app.

Charted: Which Country Has the Most Billionaires in 2024?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

The world has always had people with incredible wealth: from Roman emperors to John D. Rockefeller who became the world’s first billionaire in measurable dollars. But where do the very wealthiest people live right now?

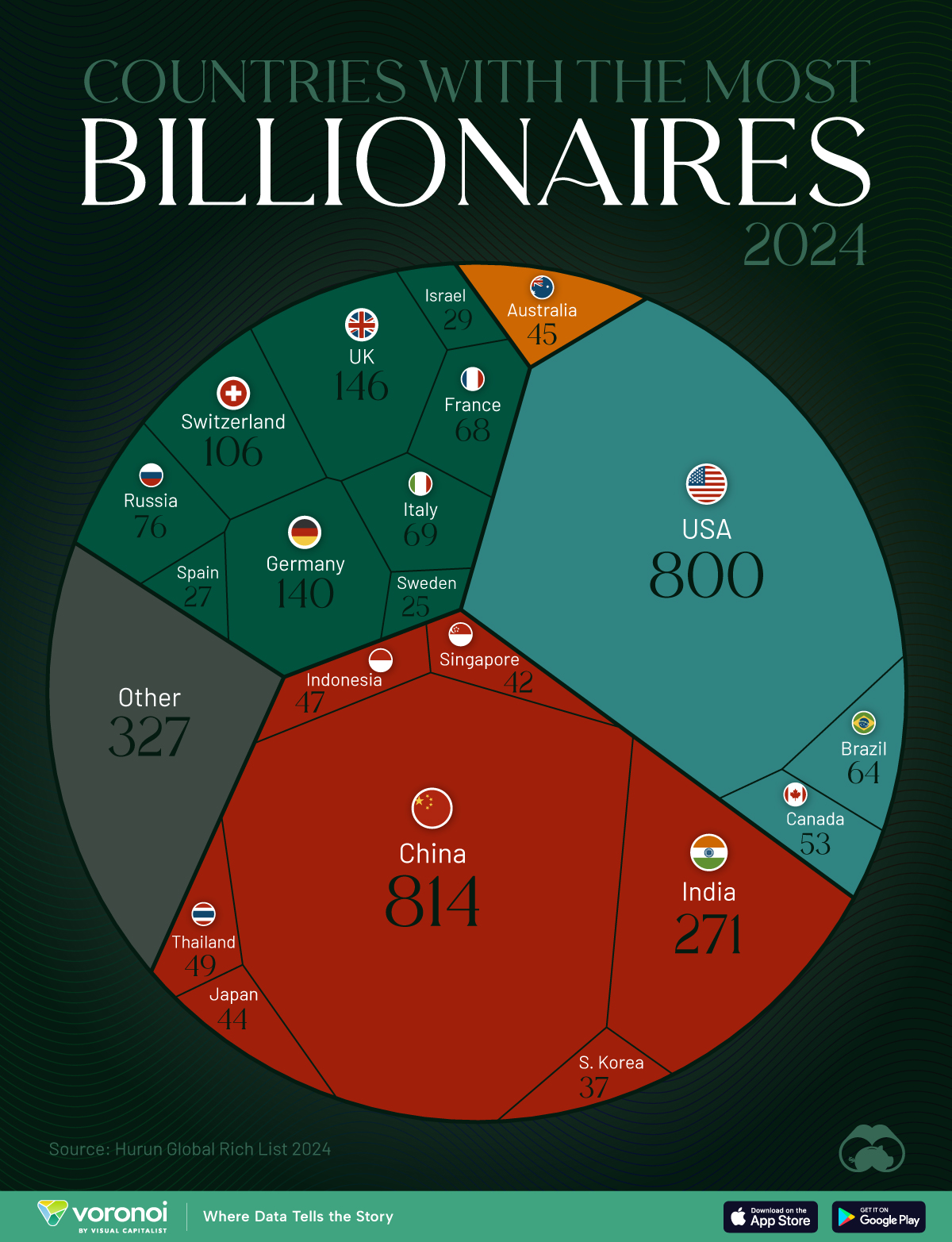

We visualize the countries with the most billionaires in 2024, sourced from the annual Hurun Global Rich list. A country and city aggregate is also available here.

A caveat to this data. Total wealth estimates are notoriously difficult to get right, and different sources can vary in their billionaire data. For example, Forbes, switches ranks for the U.S. and China, though the overall top three remain the same.

Forbes also has Bernard Arnault as the current richest individual, while Hurun places Elon Musk atop the ranks. Nevertheless, their overall top 10 is similar with a few ranking differences.

Ranked: Countries with the Most Billionaires in 2024

China has 814 billionaires, the most in the world, according to the Hurun Global Rich List 2024. Despite holding on to the top spot, China lost 155 billionaires year-over-year, while the U.S. gained 109. The gap between the two countries has now reduced to just 14 billionaires.

| Rank | Country | Billionaires | Change YoY |

|---|---|---|---|

| 1 | 🇨🇳 China | 814 | -155 |

| 2 | 🇺🇸 U.S. | 800 | +109 |

| 3 | 🇮🇳 India | 271 | +84 |

| 4 | 🇬🇧 UK | 146 | +12 |

| 5 | 🇩🇪 Germany | 140 | -4 |

| 6 | 🇨🇭 Switzerland | 106 | +6 |

| 7 | 🇷🇺 Russia | 76 | +6 |

| 8 | 🇮🇹 Italy | 69 | +11 |

| 9 | 🇫🇷 France | 68 | -4 |

| 10 | 🇧🇷 Brazil | 64 | +13 |

| 11 | 🇨🇦 Canada | 53 | +8 |

| 12 | 🇹🇭 Thailand | 49 | +3 |

| 13 | 🇮🇩 Indonesia | 47 | +12 |

| 14 | 🇦🇺 Australia | 45 | 0 |

| 15 | 🇯🇵 Japan | 44 | +12 |

| 16 | 🇸🇬 Singapore | 42 | +5 |

| 17 | 🇰🇷 South Korea | 37 | +4 |

| 18 | 🇮🇱 Israel | 29 | +9 |

| 19 | 🇪🇸 Spain | 27 | +1 |

| 20 | 🇸🇪 Sweden | 25 | -2 |

| N/A | 🌍 Other | 327 | N/A |

Together, the U.S. and China account for nearly half of the 3,279 billionaires globally, leagues ahead of closest peers, #3 India (271) and #4 UK (146).

Collectively however, European countries account for six of the top 10 and eight of the top 20 countries with the most billionaires.

Naturally, the world’s largest economies tend to be overrepresented on billionaire counts, as they provide more opportunities for wealth creation.

Switzerland, Singapore, and Sweden are outliers in this regard, with only one of them making the top 20 economies by total gross domestic product.

All three countries are perceived to have high tax rates, generally not conducive to amassing wealth. But perceptions can be misleading. Sweden, for example, has no inheritance tax, a flat rate on capital gains, and a corporate tax rate at 21%.

Personal Finance

Visualizing the Tax Burden of Every U.S. State

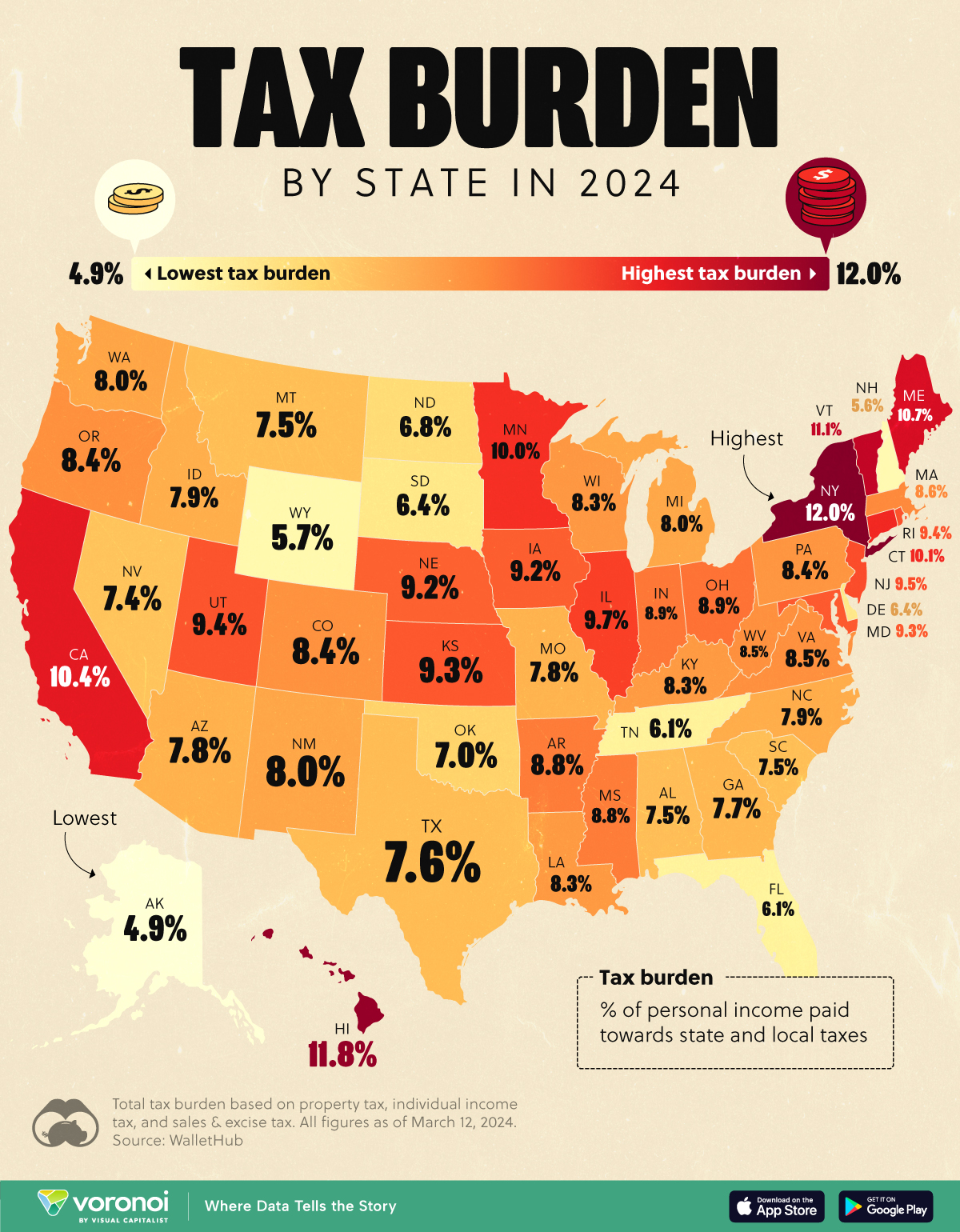

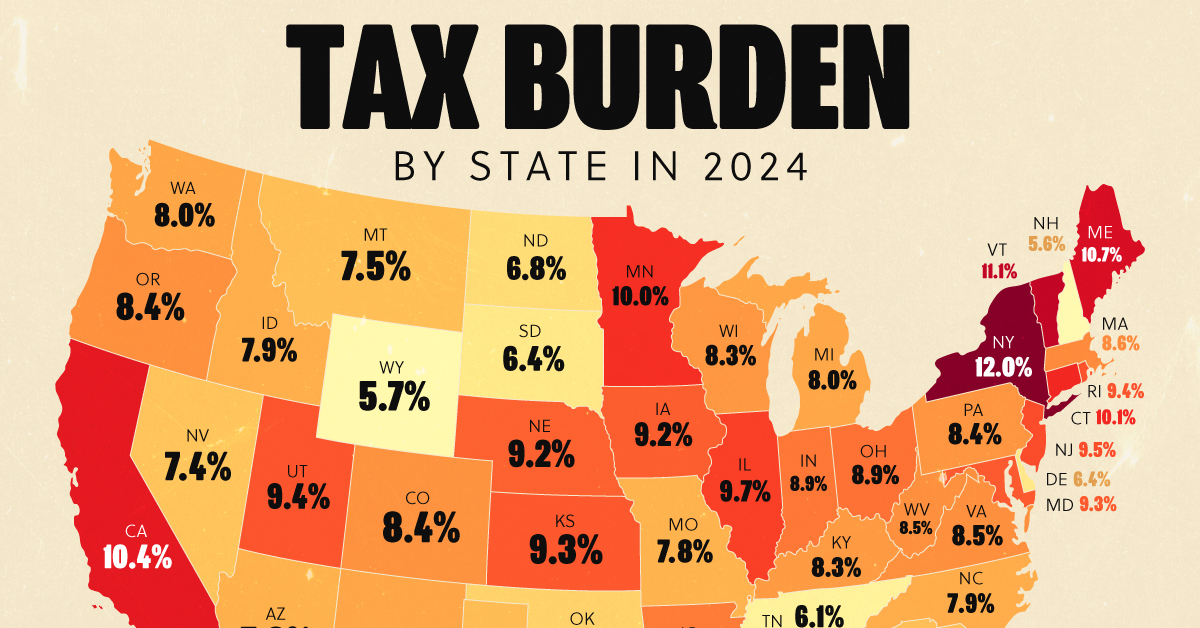

Tax burden measures the percent of an individual’s income that is paid towards taxes. See where it’s the highest by state in this graphic.

Visualizing the Tax Burden of Every U.S. State

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This map graphic visualizes the total tax burden in each U.S. state as of March 2024, based on figures compiled by WalletHub.

It’s important to understand that under this methodology, the tax burden measures the percent of an average person’s income that is paid towards state and local taxes. It considers property taxes, income taxes, and sales & excise tax.

Data and Methodology

The figures we used to create this graphic are listed in the table below.

| State | Total Tax Burden |

|---|---|

| New York | 12.0% |

| Hawaii | 11.8% |

| Vermont | 11.1% |

| Maine | 10.7% |

| California | 10.4% |

| Connecticut | 10.1% |

| Minnesota | 10.0% |

| Illinois | 9.7% |

| New Jersey | 9.5% |

| Rhode Island | 9.4% |

| Utah | 9.4% |

| Kansas | 9.3% |

| Maryland | 9.3% |

| Iowa | 9.2% |

| Nebraska | 9.2% |

| Ohio | 8.9% |

| Indiana | 8.9% |

| Arkansas | 8.8% |

| Mississippi | 8.8% |

| Massachusetts | 8.6% |

| Virginia | 8.5% |

| West Virginia | 8.5% |

| Oregon | 8.4% |

| Colorado | 8.4% |

| Pennsylvania | 8.4% |

| Wisconsin | 8.3% |

| Louisiana | 8.3% |

| Kentucky | 8.3% |

| Washington | 8.0% |

| New Mexico | 8.0% |

| Michigan | 8.0% |

| North Carolina | 7.9% |

| Idaho | 7.9% |

| Arizona | 7.8% |

| Missouri | 7.8% |

| Georgia | 7.7% |

| Texas | 7.6% |

| Alabama | 7.5% |

| Montana | 7.5% |

| South Carolina | 7.5% |

| Nevada | 7.4% |

| Oklahoma | 7.0% |

| North Dakota | 6.8% |

| South Dakota | 6.4% |

| Delaware | 6.4% |

| Tennessee | 6.1% |

| Florida | 6.1% |

| Wyoming | 5.7% |

| New Hampshire | 5.6% |

| Alaska | 4.9% |

From this data we can see that New York has the highest total tax burden. Residents in this state will pay, on average, 12% of their income to state and local governments.

Breaking this down into its three components, the average New Yorker pays 4.6% of their income on income taxes, 4.4% on property taxes, and 3% in sales & excise taxes.

At the other end of the spectrum, Alaska has the lowest tax burden of any state, equaling 4.9% of income. This is partly due to the fact that Alaskans do not pay state income tax.

Hate Paying Taxes?

In addition to Alaska, there are several other U.S. states that don’t charge income taxes. These are: Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming.

It’s also worth noting that New Hampshire does not have a regular income tax, but does charge a flat 4% on interest and dividend income according to the Tax Foundation.

Learn More About Taxation From Visual Capitalist

If you enjoyed this post, be sure to check out this graphic which ranks the countries with the lowest corporate tax rates, from 1980 to today.

-

Mining6 days ago

Mining6 days agoWhere the World’s Aluminum is Smelted, by Country

-

Markets2 weeks ago

Markets2 weeks agoVisualized: Interest Rate Forecasts for Advanced Economies

-

Economy2 weeks ago

Economy2 weeks agoThe Most Valuable Companies in Major EU Economies

-

Markets2 weeks ago

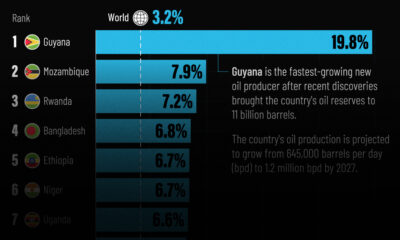

Markets2 weeks agoThe World’s Fastest Growing Emerging Markets (2024-2029 Forecast)

-

Markets2 weeks ago

Markets2 weeks agoVisualizing Global Inflation Forecasts (2024-2026)

-

Misc1 week ago

Misc1 week agoCharted: What Southeast Asia Thinks About China & the U.S.

-

Misc1 week ago

Misc1 week agoThe Evolution of U.S. Beer Logos

-

Healthcare1 week ago

Healthcare1 week agoWhat Causes Preventable Child Deaths?