Money

Charted: What Frustrates Americans About the Tax System

![]() See this visualization first on the Voronoi app.

See this visualization first on the Voronoi app.

What Frustrates Americans About the Tax System

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

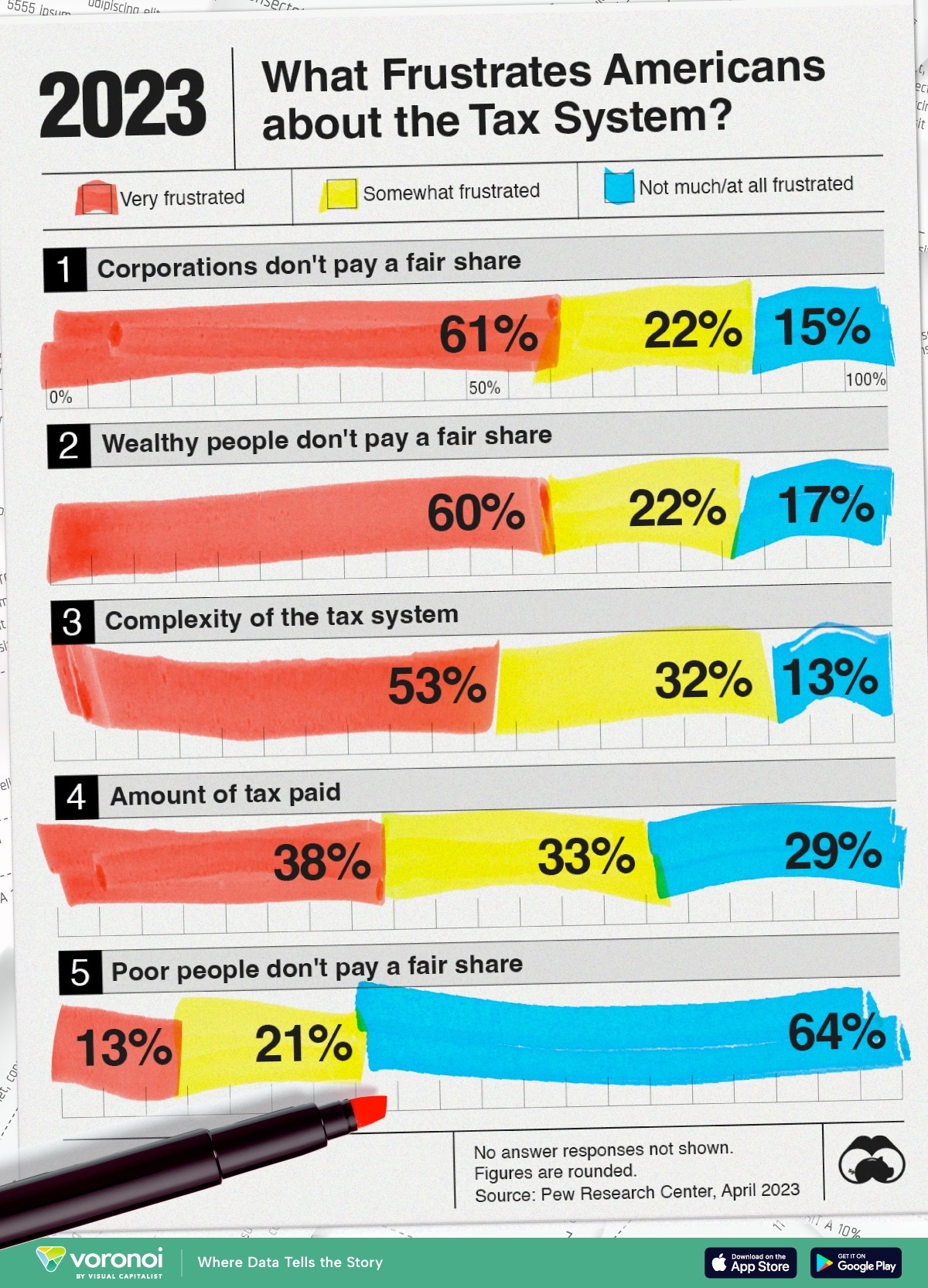

In this visualization, we show Pew Research’s findings on what bothers Americans the most about the tax system.

This data was collected after surveying more than 5,000 American adults between the period of March 27-April 2, 2023.

The survey was weighted to be representative of the U.S. adult population. Visit Pew Research’s methodology page for more details.

Americans Want More Taxes for Some

Six in every 10 Americans feel that both corporations and the wealthy don’t pay their fair share in federal taxes.

Their sentiments are not entirely unfounded.

| Very frustrated | Somewhat frustrated | Not much/ at all frustrated |

|

|---|---|---|---|

| 🏦 Corporations don't pay a fair share | 61% | 22% | 15% |

| 💼 Wealthy people don't pay a fair share | 60% | 22% | 17% |

| 🤔 Complexity of the tax system | 53% | 32% | 13% |

| 💸 Amount of tax paid | 38% | 33% | 29% |

| 🧑🤝🧑 Poor people don't pay a fair share | 13% | 21% | 64% |

Note: No answer responses are not shown, thus percentages may not sum to 100.

A 2021 ProPublica investigation found some of the wealthiest Americans—also the wealthiest people in the world—did not pay a single penny in federal income taxes in some years.

A significant part of why this is possible is how taxes are collected depending on the source. Since much of the top 1% grow their wealth in equity and property, they are not subject to taxes until they make an actual transaction.

As this Brookings Institution article explains: most Americans make money through their wages, and wages are subject to heavier taxation than capital income. Thus, the tax share of America’s highest-income households is often lower than America’s middle-income households.

Finally, Pew Research noted that their findings were essentially unchanged since 2021.

Markets

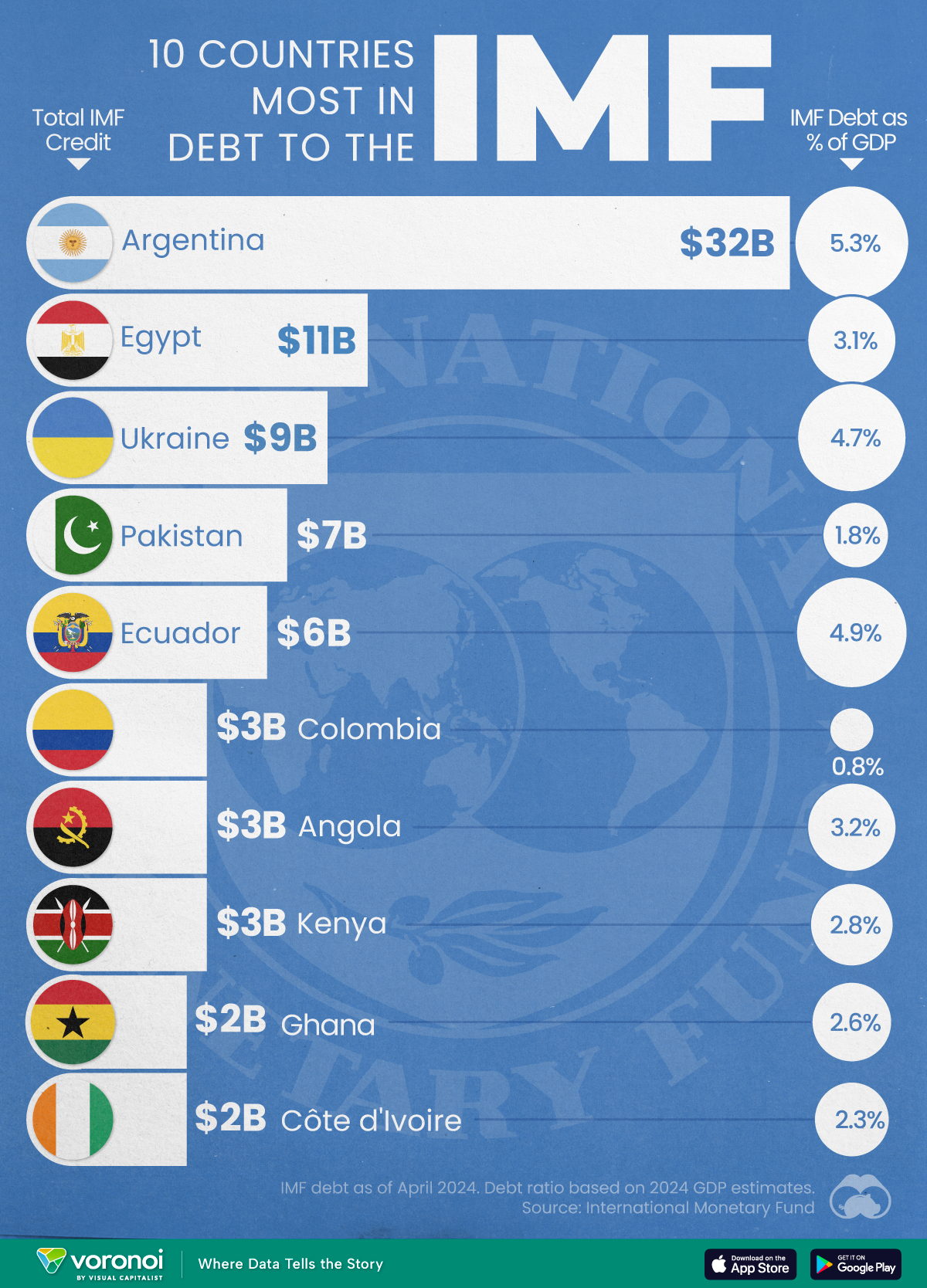

Top 10 Countries Most in Debt to the IMF

Argentina tops the ranking, with a debt equivalent to 5.3% of the country’s GDP.

Top 10 Countries Most in Debt to the IMF

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Established in 1944, the International Monetary Fund (IMF) supports countries’ economic growth by providing financial aid and guidance on policies to enhance stability, productivity, and job opportunities.

Countries seek loans from the IMF to address economic crises, stabilize their currencies, implement structural reforms, and alleviate balance of payments difficulties.

In this graphic, we visualize the 10 countries most indebted to the fund.

Methodology

We compiled this ranking using the International Monetary Fund’s data on Total IMF Credit Outstanding. We selected the latest debt data for each country, accurate as of April 29, 2024.

Argentina Tops the Rank

Argentina’s debt to the IMF is equivalent to 5.3% of the country’s GDP. In total, the country owns more than $32 billion.

| Country | IMF Credit Outstanding ($B) | GDP ($B, 2024) | IMF Debt as % of GDP |

|---|---|---|---|

| 🇦🇷 Argentina | 32 | 604.3 | 5.3 |

| 🇪🇬 Egypt | 11 | 347.6 | 3.1 |

| 🇺🇦 Ukraine | 9 | 188.9 | 4.7 |

| 🇵🇰 Pakistan | 7 | 374.7 | 1.8 |

| 🇪🇨 Ecuador | 6 | 121.6 | 4.9 |

| 🇨🇴 Colombia | 3 | 386.1 | 0.8 |

| 🇦🇴 Angola | 3 | 92.1 | 3.2 |

| 🇰🇪 Kenya | 3 | 104.0 | 2.8 |

| 🇬🇭 Ghana | 2 | 75.2 | 2.6 |

| 🇨🇮 Ivory Coast | 2 | 86.9 | 2.3 |

A G20 member and major grain exporter, the country’s history of debt trouble dates back to the late 1890s when it defaulted after contracting debts to modernize the capital, Buenos Aires. It has already been bailed out over 20 times in the last six decades by the IMF.

Five of the 10 most indebted countries are in Africa, while three are in South America.

The only European country on our list, Ukraine has relied on international support amidst the conflict with Russia. It is estimated that Russia’s full-scale invasion of the country caused the loss of a third of the country’s economy. The country owes $9 billion to the IMF.

In total, almost 100 countries owe money to the IMF, and the grand total of all of these debts is $111 billion. The above countries (top 10) account for about 69% of these debts.

-

United States5 days ago

United States5 days agoMapped: Countries Where Recreational Cannabis is Legal

-

Technology2 weeks ago

Technology2 weeks agoMapped: The Number of AI Startups By Country

-

Healthcare2 weeks ago

Healthcare2 weeks agoLife Expectancy by Region (1950-2050F)

-

Markets2 weeks ago

Markets2 weeks agoThe Growth of a $1,000 Equity Investment, by Stock Market

-

Markets2 weeks ago

Markets2 weeks agoMapped: Europe’s GDP Per Capita, by Country

-

Technology1 week ago

Technology1 week agoCountries With the Highest Rates of Crypto Ownership

-

Mining1 week ago

Mining1 week agoWhere the World’s Aluminum is Smelted, by Country

-

Wealth1 week ago

Wealth1 week agoVisualizing the Tax Burden of Every U.S. State