Personal Finance

Chart: The Declining Value of the U.S. Federal Minimum Wage

![]() See this visualization first on the Voronoi app.

See this visualization first on the Voronoi app.

The Declining Value of the U.S. Federal Minimum Wage

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This graphic illustrates the history of the U.S. federal minimum wage using data compiled by Statista, in both nominal and real (inflation-adjusted) terms. The federal minimum wage was raised to $7.25 per hour in July 2009, where it has remained ever since.

Nominal vs. Real Value

The data we used to create this graphic can be found in the table below.

| Year | Nominal value ($/hour) | Real value ($/hour) |

|---|---|---|

| 1940 | 0.3 | 6.5 |

| 1945 | 0.4 | 6.82 |

| 1950 | 0.75 | 9.64 |

| 1955 | 0.75 | 8.52 |

| 1960 | 1 | 10.28 |

| 1965 | 1.25 | 12.08 |

| 1970 | 1.6 | 12.61 |

| 1975 | 2.1 | 12.04 |

| 1980 | 3.1 | 11.61 |

| 1985 | 3.35 | 9.51 |

| 1990 | 3.8 | 8.94 |

| 1995 | 4.25 | 8.49 |

| 2000 | 5.15 | 9.12 |

| 2005 | 5.15 | 8.03 |

| 2010 | 7.25 | 10.09 |

| 2015 | 7.25 | 9.3 |

| 2018 | 7.25 | 8.78 |

| 2019 | 7.25 | 8.61 |

| 2020 | 7.25 | 8.58 |

| 2021 | 7.25 | 8.24 |

| 2022 | 7.25 | 7.61 |

| 2023 | 7.25 | 7.25 |

What our graphic shows is how inflation has eroded the real value of the U.S. minimum wage over time, despite nominal increases.

For instance, consider the year 1960, when the federal minimum wage was $1 per hour. After accounting for inflation, this would be worth around $10.28 today!

The two lines converge at 2023 because the nominal and real value are identical in present day terms.

Many States Have Their Own Minimum Wage

According to the National Conference of State Legislatures (NCSL), 30 states and Washington, D.C. have implemented a minimum wage that is higher than $7.25.

The following states have adopted the federal minimum: Georgia, Idaho, Indiana, Iowa, Kansas, Kentucky, New Hampshire, North Carolina, North Dakota, Oklahoma, Pennsylvania, Texas, Utah, Wisconsin, and Wyoming.

Meanwhile, the states of Alabama, Louisiana, Mississippi, South Carolina, and Tennessee have no wage minimums, but have to follow the federal minimum.

How Does the U.S. Minimum Wage Rank Globally?

If you found this topic interesting, check out Mapped: Minimum Wage Around the World to see which countries have the highest minimum wage in monthly terms, as of January 2023.

Personal Finance

Ranked: What People Value Most in a Financial Advisor

Positive reviews and recommendations are some of the least important factors—so what do people look for in a financial advisor?

Ranked: What People Value Most in a Financial Advisor

Are advisors putting their focus where it matters? You might think that positive reviews and recommendations would be a top consideration for people choosing a financial advisor. However, other qualities appear to be much more important.

This graphic uses data from Morningstar’s Voice of the Advisor report to outline what people value most in a financial advisor.

The Qualities Investors Value

Morningstar surveyed 400 people: 100 Caucasian women, 150 women of color, and 150 men of color. The values below show how often people chose an item as most or least important when working with an advisor.

| Quality | Most Important | Least Important |

|---|---|---|

| Expertise and knowledge in financial planning and investments | 60% | 11% |

| Personalized financial advice that meets my specific goals and needs | 54% | 16% |

| Ability to understand my risk tolerance and appropriately align my investments | 47% | 17% |

| Specialization in specific financial situations, such as retirement planning | 45% | 17% |

| Ability to communicate complex financial concepts in an understandable way | 42% | 22% |

| Transparent fee structure and pricing for my advisor’s services | 42% | 22% |

| Trust and rapport established during the initial meetings with my advisor | 36% | 24% |

| Ability to incorporate investment options that reflect my values | 22% | 41% |

| Positive online reviews or ratings about my advisor’s services | 22% | 46% |

| Recommendations from friends or family who had a positive experience with my advisor | 20% | 47% |

| Commitment to diversity and inclusion, making me feel comfortable and respected | 20% | 47% |

| Recommendations from other professionals, such as accountants or attorneys | 19% | 50% |

| Shares a similar background or cultural understanding | 10% | 68% |

Participants were asked the following question: “On each screen, we will show you 3 items to think about when working with a financial advisor. Select which one is most important and which one is the least important of the items. You will see more than one screen and items may appear more than once.”

Enjoying this content? Dive into more insights in the Voice of the Advisor Report:

Even among a survey pool that was mostly people of color, the majority of respondents didn’t think a commitment to diversity or a shared background were important.

Instead, three of the top four factors were related to personalization.

Personalization: A Key Quality in a Financial Advisor

People cared deeply about personalization regardless of gender and race. It was even more important to those with more than $250,000 in assets, suggesting that personalization may become more critical as a person’s portfolio value increases.

Even investors not currently working with an advisor and non-investors noted that personalization would be a top quality they would look for in a financial advisor.

Within personalization, people noted risk management was a very important element. Financial advisors can highlight their ability to tailor financial plans based on each person’s risk tolerance in order to attract clients.

Looking for tips on how to grow your advisory business? Get insights on what investors want, and how other advisors are evolving, in Morningstar’s Voice of the Advisor report.

-

Personal Finance1 month ago

Personal Finance1 month agoChart: The Declining Value of the U.S. Federal Minimum Wage

This graphic compares the nominal vs. inflation-adjusted value of the U.S. minimum wage, from 1940 to 2023.

-

Money3 months ago

Money3 months agoRanked: The Top 25 Countries for Retirement

Of the 44 nations analyzed for retirement welfare, these 25 score well on health, financial, and social support for their aging populations.

-

Pensions4 months ago

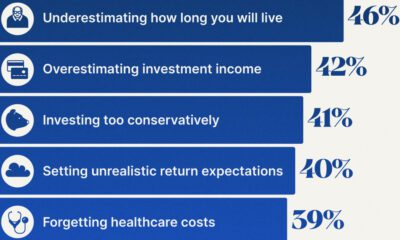

Pensions4 months agoCharted: Top 10 Retirement Planning Mistakes

What are the top retirement planning mistakes people make? Here are the top 10 common mistakes to avoid as seen by financial professionals.

-

Money4 months ago

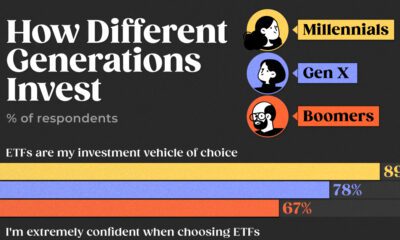

Money4 months agoCharted: Investment Preferences by Generation in the U.S.

How personal are your investments? We chart investment preferences by generation in the U.S. based on a survey of 2,200 investors in 2023.

-

United States6 months ago

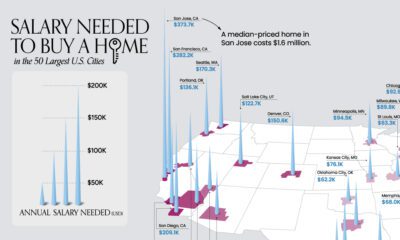

United States6 months agoMapped: What You Need to Earn to Own a Home in 50 American Cities

What does it take to own a home in the U.S. in 2023? Here’s a look at the salary needed for home ownership in the top…

-

Personal Finance7 months ago

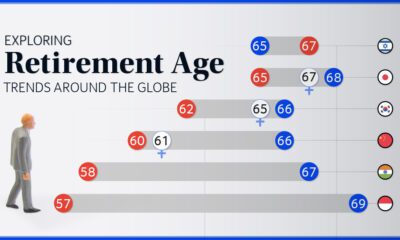

Personal Finance7 months agoCharted: Retirement Age by Country

We chart current and effective retirement ages for 45 countries, revealing some stark regional differences.

-

Misc1 week ago

Misc1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001