Pensions

Ranked: The Top 25 Countries for Retirement

Ranked: The Top 25 Countries for Retirement in 2024

In 1881, Otto von Bismarck proposed a radical idea for retirement: people above the age of 70 would be given a state pension, encouraging them to stop working.

This model has since been adopted en masse and most countries now have a retirement age, after which workers can claim benefits paid through years of their work.

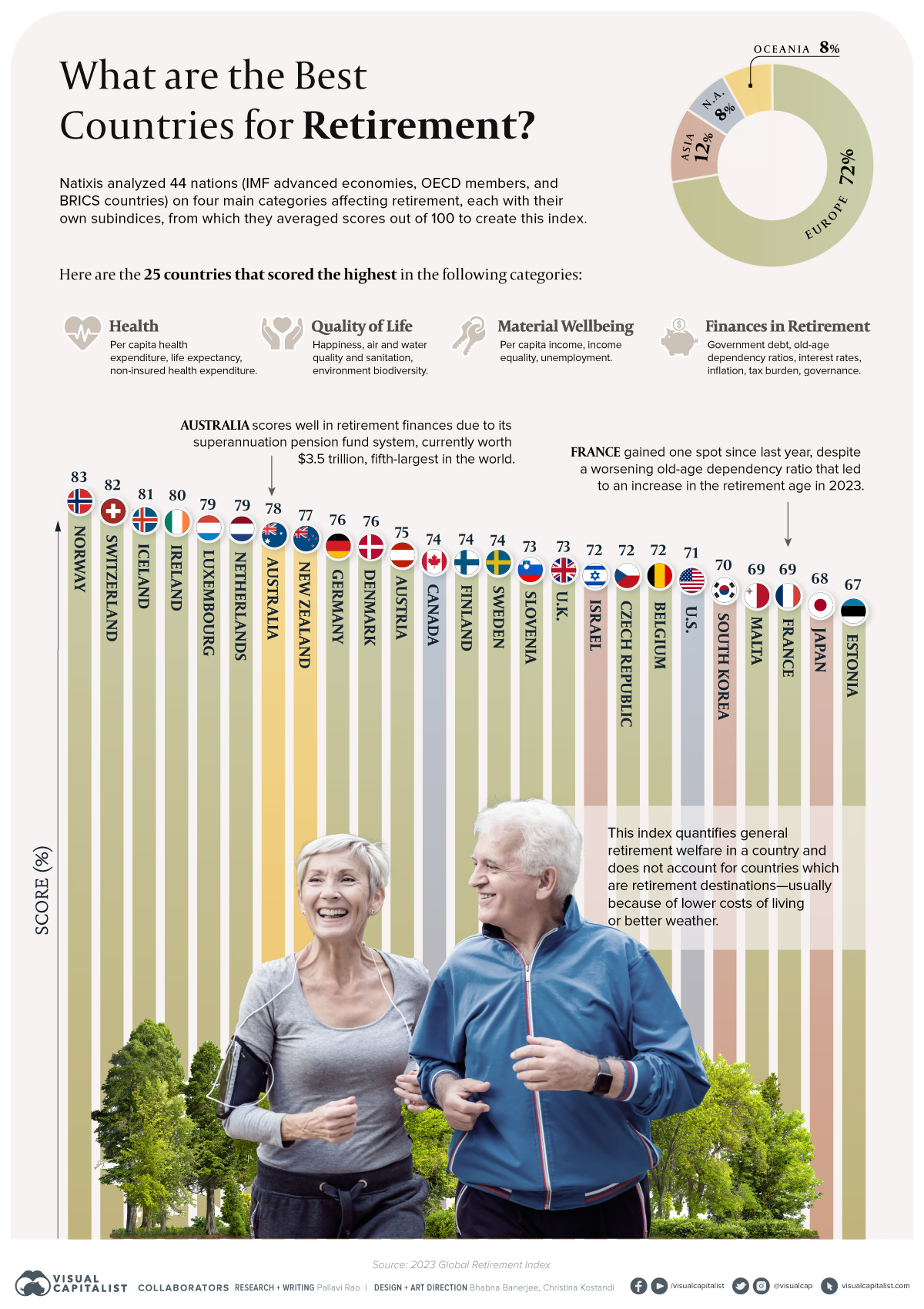

However, modern-day retirement is much more than just finances. Wealth management company Natixis analyzed 44 nations on four main categories affecting the ability for their residents to retire well in the 2023 Global Retirement Index. Each category has subindices, from which they averaged scores out of 100 to create this ranking.

The categories are:

- Health: Per capita spend on healthcare, life expectancy, and non-insured health spend.

- Quality of Life: Happiness levels, water and sanitation, air quality, environment, and biodiversity.

- Material Well-being: Per capita income, income equality, and employment levels.

- Retirement Finances: Government debt, old-age dependency, interest rates, inflation, governance, taxes, and bank non-performing loans.

So, with one-third of the world expected to be 65 and older by 2050, how are countries stacking up against each other when it comes to creating supportive environments for retirement?

Of the countries analyzed for the best retirement conditions, here are the top 25.

What Are the Best Countries for Retirement?

Norway ranks first as the best country for retirement in this study, helped by top scores in health and material well-being.

For health metrics, Norway was one of the few countries to see life expectancy improve over the pandemic. It now sits at 83.3 years at birth, and is one of the highest rates in the world. This is in contrast to many other countries in the index (Canada, Austria, the U.S.) that saw life expectancies drop recently due to the higher mortality rate during the pandemic.

For well-being, Norway’s current low unemployment rate (3.8%) reduces undue pressure on their social security net.

In fact, Norway along with the next top three countries (Switzerland, Iceland, and Ireland) all retain their rankings from last year, along with Estonia, which is ranked 25th. Every other country gained or lost a spot as seen below.

| Rank | Country | Score | Rank Change (from 2022) |

|---|---|---|---|

| 1 | 🇳🇴 Norway | 83% | 0 |

| 2 | 🇨🇭 Switzerland | 82% | 0 |

| 3 | 🇮🇸 Iceland | 81% | 0 |

| 4 | 🇮🇪 Ireland | 80% | 0 |

| 5 | 🇱🇺 Luxembourg | 79% | +2 |

| 6 | 🇳🇱 Netherlands | 79% | +2 |

| 7 | 🇦🇺 Australia | 78% | -2 |

| 8 | 🇳🇿 New Zealand | 77% | -2 |

| 9 | 🇩🇪 Germany | 76% | +2 |

| 10 | 🇩🇰 Denmark | 76% | -1 |

| 11 | 🇦🇹 Austria | 75% | +3 |

| 12 | 🇨🇦 Canada | 74% | +3 |

| 13 | 🇫🇮 Finland | 74% | -1 |

| 14 | 🇸🇪 Sweden | 74% | -1 |

| 15 | 🇸🇮 Slovenia | 73% | +6 |

| 16 | 🇬🇧 UK | 73% | +3 |

| 19 | 🇧🇪 Belgium | 72% | +1 |

| 17 | 🇮🇱 Israel | 72% | -1 |

| 18 | 🇨🇿 Czech Republic | 72% | -8 |

| 20 | 🇺🇸 U.S. | 71% | -2 |

| 21 | 🇰🇷 South Korea | 70% | -4 |

| 22 | 🇲🇹 Malta | 69% | +1 |

| 23 | 🇫🇷 France | 69% | +1 |

| 24 | 🇯🇵 Japan | 68% | -2 |

| 25 | 🇪🇪 Estonia | 67% | 0 |

Other highlights in the top 25 include: Australia, at 7th, which is the highest-ranked non-European country in the index. The country scores well in retirement finances due to its superannuation pension fund system, currently worth $3.5 trillion, fifth-largest in the world.

Meanwhile, France, just outside the top 20, saw widespread protests in early 2023 when a law to raise the retirement age to 64 was passed through special constitutional powers. Raising the retirement age will presumably keep people working longer, paying mandatory payroll tax to fund retirement benefits, and will improve their steadily worsening old-age dependency ratio.

A worsening old-age dependency ratio is where the share of older, dependent people to younger, employed people keeps increasing, reducing the sustainability of retirement benefits.

How Countries are Preparing for the “Silver Tsunami”

France is not the only country trying to keep its population working longer. The Chinese government is also looking to raise its retirement age in gradual shifts, as it grapples not only with an aging population but also a declining one.

Immigration has also been frequently cited as a near-term measure to boost the working-age population and increase the benefits pool. Canada, for example, had 6 workers for every retiree in 1980. In 2015 that had dropped to 4. By 2030, it will drop further to 3. As a result the country has pursued aggressive immigration for more than a decade now and has grown its population by 10 million since 2010.

Finally, there has been a push towards increasing overall productivity by targeting technological advancements and automation. However both need to occur in tandem with re-skilling so that they don’t result in net job losses, which will only further burden social security systems.

Where Does This Data Come From?

Source: Global Retirement Index.

Methodology: Under 18 metrics, a score from 0.01 to 1 is determined for each country in each indicator, which is then averaged to an overall percentage. The geometric mean is used for all averages to ensure consistency in results across variable scales. Furthermore, the index uses unit-elastic substitution. Thus, if a country has very low scores in certain subindices, improving another subindex to a high score will lead to a less-than-proportional increase in the overall index score. This is necessary since the underlying assumption of the index is that at least a basic level of health, finances, well-being, and quality of life is needed to enjoy retirement. To read Natixis’ full methodology, refer to page 54-58 in the linked report.

Personal Finance

Charted: Top 10 Retirement Planning Mistakes

What are the top retirement planning mistakes people make? Here are the top 10 common mistakes to avoid as seen by financial professionals.

Top 10 Retirement Planning Mistakes

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

When planning financially for the future, what are the most common retirement planning mistakes people make?

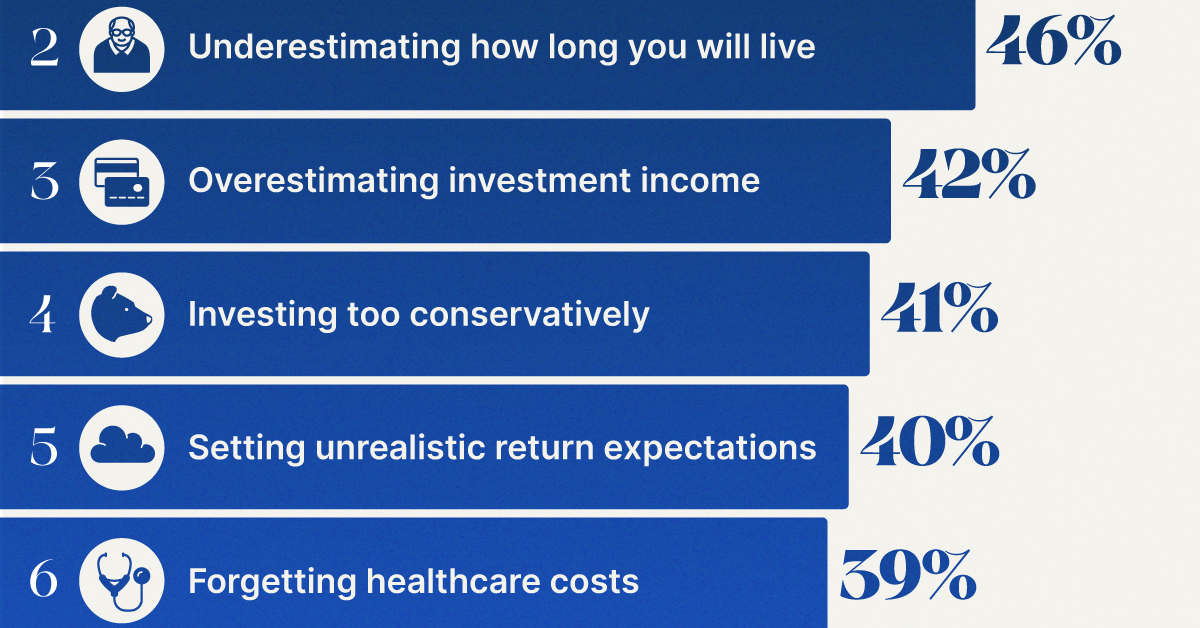

This chart uses data from the 2022 Natixis Global Survey, which polled 2,700 financial professionals across 16 countries between March and April 2022.

Most Common Retirement Mistakes

According to professionals, the most common retirement planning mistakes are time-related, like outliving savings or not understanding how inflation can affect a portfolio over time.

The number one mistake? According to 49% of financial planners, it’s underestimating the sizable impact inflation has on the value of retirement savings.

| Rank | Most Common Mistakes | Share |

|---|---|---|

| 1 | Underestimating the impact of inflation | 49% |

| 2 | Underestimating how long you will live | 46% |

| 3 | Overestimating investment income | 42% |

| 4 | Investing too conservatively | 41% |

| 5 | Setting unrealistic return expectations | 40% |

| 6 | Forgetting healthcare costs | 39% |

| 7 | Failing to understand income sources | 35% |

| 8 | Relying too heavily on public benefits | 33% |

| 9 | Underestimating real estate costs | 23% |

| 10 | Investing too aggressively | 21% |

Meanwhile, 46% of advisors see the underestimating of life spans as the second-most-common retirement mistake. The longer you live, the more retirement savings you’ll need to supplant income. And that’s not including the healthcare costs associated with aging, which 39% of advisors point out as another common retirement planning mistake.

Most of the other top retirement mistakes revolve around investment planning, including overestimating investment income (42%), investing too conservatively (41%), and setting unrealistic return expectations (40%).

On the flip side, 21% of retirees invest too aggressively according to financial professionals. While investing aggressively can be extremely beneficial especially in one’s earlier years, it can cause big problems later in life. That’s because later on, retirees need liquidity and must have access to their savings to cover life expenses. If a portfolio is volatile or not diversified, it may be hard to make up any short-term or sudden losses.

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Environment2 weeks ago

Environment2 weeks agoTop Countries By Forest Growth Since 2001