Money

The World’s Richest Countries Across 3 Metrics

![]() See this visualization first on the Voronoi app.

See this visualization first on the Voronoi app.

The World’s Richest Countries Across 3 Metrics

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

How do you measure the economic success of a country?

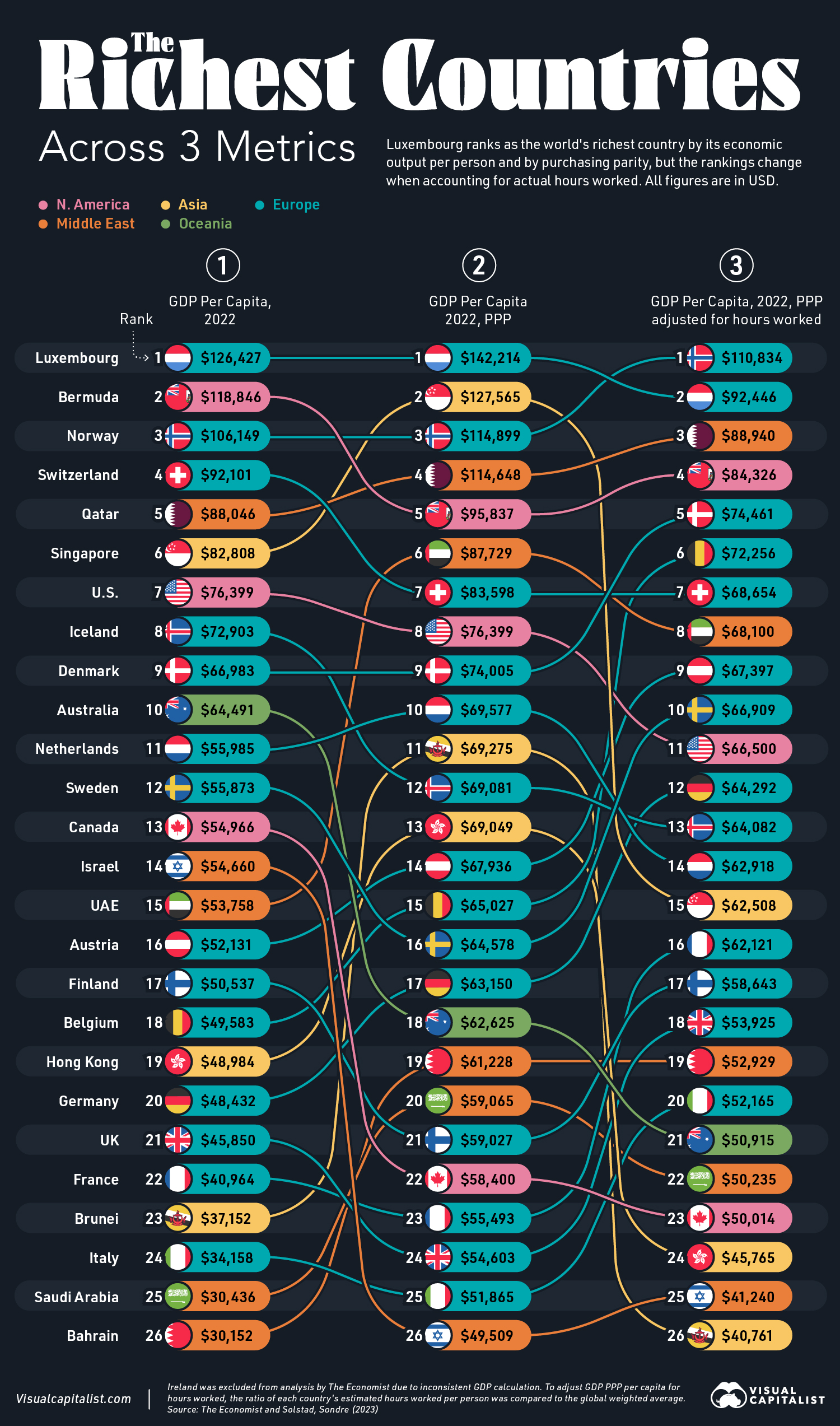

By one classic measure, GDP per capita shows individual economic prosperity. But comparing countries simply by this metric doesn’t tell the whole story. To get a better idea of living standards, it helps to look at how far your money will go along with adjusting for labor productivity.

This graphic shows the world’s richest countries by three different measures, based on data from The Economist and Sondre Solstad. All figures are in U.S. dollars.

World’s Richest Countries, by GDP per Capita

As the table below shows, smaller countries fare much better—of the top 10 richest countries, eight of them have populations under 10 million people.

| Rank | Country | GDP per Capita 2022 |

|---|---|---|

| 1 | 🇱🇺 Luxembourg | $126,426 |

| 2 | 🇧🇲 Bermuda | $118,846 |

| 3 | 🇳🇴 Norway | $106,149 |

| 4 | 🇨🇭 Switzerland | $92,101 |

| 5 | 🇶🇦 Qatar | $88,046 |

| 6 | 🇸🇬 Singapore | $82,808 |

| 7 | 🇺🇸 United States | $76,399 |

| 8 | 🇮🇸 Iceland | $72,903 |

| 9 | 🇩🇰 Denmark | $66,983 |

| 10 | 🇦🇺 Australia | $64,491 |

| 11 | 🇳🇱 Netherlands | $55,985 |

| 12 | 🇸🇪 Sweden | $55,873 |

| 13 | 🇨🇦 Canada | $54,966 |

| 14 | 🇮🇱 Israel | $54,660 |

| 15 | 🇦🇪 UAE | $53,758 |

| 16 | 🇦🇹 Austria | $52,131 |

| 17 | 🇫🇮 Finland | $50,537 |

| 18 | 🇧🇪 Belgium | $49,583 |

| 19 | 🇭🇰 Hong Kong SAR | $48,984 |

| 20 | 🇩🇪 Germany | $48,432 |

| 21 | 🇬🇧 UK | $45,850 |

| 22 | 🇫🇷 France | $40,964 |

| 23 | 🇧🇳 Brunei Darussalam | $37,152 |

| 24 | 🇮🇹 Italy | $34,158 |

| 25 | 🇸🇦 Saudi Arabia | $30,436 |

| 26 | 🇧🇭 Bahrain | $30,152 |

Luxembourg, whose financial sector makes up 25% of its GDP, is the world’s richest country by GDP per capita.

With a population of just 660,000, the country is also considered a tax haven, incentivizing foreign investment due to its favorable tax policies. Due to the small nation’s considerable wealth, its citizens enjoy free education, healthcare, and transportation.

Bermuda, like Luxembourg, is known as a tax haven. Several multinationals shelter billions in the island nation—including Google, which moved $23 billion in a shell company in 2017 to lower foreign tax costs.

With a GDP per capita of $82,808, Singapore is the richest country in Asia thanks to its role as a global hub for finance, trade, and tourism.

A New Lens: Purchasing Power Parity (PPP)

Another way to compare countries adjusts GDP per capita based on the relative price of goods and services in order to account for differences in the cost of living and local currency strength.

This provides a clearer comparison of living standards across countries since the value of a dollar can buy more goods in different countries. Below, we show how countries perform differently based on this measure, known as GDP per capita adjusted by purchasing power parity (PPP):

| Rank | Country | GDP per Capita 2022, PPP |

|---|---|---|

| 1 | 🇱🇺 Luxembourg | $142,214 |

| 2 | 🇸🇬 Singapore | $127,565 |

| 3 | 🇳🇴 Norway | $114,899 |

| 4 | 🇶🇦 Qatar | $114,648 |

| 5 | 🇧🇲 Bermuda | $95,837 |

| 6 | 🇦🇪 UAE | $87,729 |

| 7 | 🇨🇭 Switzerland | $83,598 |

| 8 | 🇺🇸 United States | $76,399 |

| 9 | 🇩🇰 Denmark | $74,005 |

| 10 | 🇳🇱 Netherlands | $69,577 |

| 11 | 🇧🇳 Brunei Darussalam | $69,275 |

| 12 | 🇮🇸 Iceland | $69,081 |

| 13 | 🇭🇰 Hong Kong SAR | $69,049 |

| 14 | 🇦🇹 Austria | $67,936 |

| 15 | 🇧🇪 Belgium | $65,027 |

| 16 | 🇸🇪 Sweden | $64,578 |

| 17 | 🇩🇪 Germany | $63,150 |

| 18 | 🇦🇺 Australia | $62,625 |

| 19 | 🇧🇭 Bahrain | $61,228 |

| 20 | 🇸🇦 Saudi Arabia | $59,065 |

| 21 | 🇫🇮 Finland | $59,027 |

| 22 | 🇨🇦 Canada | $58,400 |

| 23 | 🇫🇷 France | $55,493 |

| 24 | 🇬🇧 UK | $54,603 |

| 25 | 🇮🇹 Italy | $51,865 |

| 26 | 🇮🇱 Israel | $49,509 |

As we can see, Singapore significantly jumps up the ranking, when adjusting for PPP.

Looking at the world’s richest countries this way shows that living standards are high in Singapore since their currency can go further than in other countries. Often, richer countries will have higher prices as a result of higher labor productivity, advanced technology, and other factors.

Similarly, the UAE rises into the top 10, outpacing both Switzerland and America. As one of the top oil-producing countries worldwide, it made $100 billion in oil revenues in 2022, equal to about $100,000 per citizen.

World’s Richest Countries, Adjusted for Hours Worked

How do the rankings change when accounting for productivity?

To analyze this, GDP per capita on a PPP basis is adjusted by the estimated hours worked per person. Economies that have high quality, productive workforces with strong standards of living tend to rank well using this measure.

| Rank | Country | GDP per Capita 2022, PPP adjusted for hours worked |

|---|---|---|

| 1 | 🇳🇴 Norway | $110,834 |

| 2 | 🇱🇺 Luxembourg | $92,446 |

| 3 | 🇶🇦 Qatar | $88,940 |

| 4 | 🇧🇲 Bermuda | $84,326 |

| 5 | 🇩🇰 Denmark | $74,461 |

| 6 | 🇧🇪 Belgium | $72,256 |

| 7 | 🇨🇭 Switzerland | $68,654 |

| 8 | 🇦🇪 UAE | $68,100 |

| 9 | 🇦🇹 Austria | $67,397 |

| 10 | 🇸🇪 Sweden | $66,909 |

| 11 | 🇺🇸 United States | $66,500 |

| 12 | 🇩🇪 Germany | $64,292 |

| 13 | 🇮🇸 Iceland | $64,082 |

| 14 | 🇳🇱 Netherlands | $62,918 |

| 15 | 🇸🇬 Singapore | $62,508 |

| 16 | 🇫🇷 France | $62,121 |

| 17 | 🇫🇮 Finland | $58,643 |

| 18 | 🇬🇧 UK | $53,925 |

| 19 | 🇧🇭 Bahrain | $52,929 |

| 20 | 🇮🇹 Italy | $52,165 |

| 21 | 🇦🇺 Australia | $50,915 |

| 22 | 🇸🇦 Saudi Arabia | $50,235 |

| 23 | 🇨🇦 Canada | $50,014 |

| 24 | 🇭🇰 Hong Kong SAR | $45,765 |

| 25 | 🇮🇱 Israel | $41,240 |

| 26 | 🇧🇳 Brunei Darussalam | $40,761 |

In this case, Norway has the best ranking globally. This strong showing is likely influenced by working fewer hours compared to the American population due to greater holiday allowances, among other factors.

Meanwhile, the U.S. is in 11th place when adjusting for hours worked, with mainly Western European nations ahead in the ranking. Similarly, countries including the Netherlands, Singapore, Hong Kong, and Brunei drop when adjusting for working hours.

Importantly, the world’s richest countries can’t be understood by a single measure. It’s only by looking at a range of metrics that we can see how countries vary in the rankings depending on the measure and criteria chosen.

Money

Charted: Which City Has the Most Billionaires in 2024?

Just two countries account for half of the top 20 cities with the most billionaires. And the majority of the other half are found in Asia.

Charted: Which Country Has the Most Billionaires in 2024?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Some cities seem to attract the rich. Take New York City for example, which has 340,000 high-net-worth residents with investable assets of more than $1 million.

But there’s a vast difference between being a millionaire and a billionaire. So where do the richest of them all live?

Using data from the Hurun Global Rich List 2024, we rank the top 20 cities with the highest number of billionaires in 2024.

A caveat to these rich lists: sources often vary on figures and exact rankings. For example, in last year’s reports, Forbes had New York as the city with the most billionaires, while the Hurun Global Rich List placed Beijing at the top spot.

Ranked: Top 20 Cities with the Most Billionaires in 2024

The Chinese economy’s doldrums over the course of the past year have affected its ultra-wealthy residents in key cities.

Beijing, the city with the most billionaires in 2023, has not only ceded its spot to New York, but has dropped to #4, overtaken by London and Mumbai.

| Rank | City | Billionaires | Rank Change YoY |

|---|---|---|---|

| 1 | 🇺🇸 New York | 119 | +1 |

| 2 | 🇬🇧 London | 97 | +3 |

| 3 | 🇮🇳 Mumbai | 92 | +4 |

| 4 | 🇨🇳 Beijing | 91 | -3 |

| 5 | 🇨🇳 Shanghai | 87 | -2 |

| 6 | 🇨🇳 Shenzhen | 84 | -2 |

| 7 | 🇭🇰 Hong Kong | 65 | -1 |

| 8 | 🇷🇺 Moscow | 59 | No Change |

| 9 | 🇮🇳 New Delhi | 57 | +6 |

| 10 | 🇺🇸 San Francisco | 52 | No Change |

| 11 | 🇹🇭 Bangkok | 49 | +2 |

| 12 | 🇹🇼 Taipei | 45 | +2 |

| 13 | 🇫🇷 Paris | 44 | -2 |

| 14 | 🇨🇳 Hangzhou | 43 | -5 |

| 15 | 🇸🇬 Singapore | 42 | New to Top 20 |

| 16 | 🇨🇳 Guangzhou | 39 | -4 |

| 17T | 🇮🇩 Jakarta | 37 | +1 |

| 17T | 🇧🇷 Sao Paulo | 37 | No Change |

| 19T | 🇺🇸 Los Angeles | 31 | No Change |

| 19T | 🇰🇷 Seoul | 31 | -3 |

In fact all Chinese cities on the top 20 list have lost billionaires between 2023–24. Consequently, they’ve all lost ranking spots as well, with Hangzhou seeing the biggest slide (-5) in the top 20.

Where China lost, all other Asian cities—except Seoul—in the top 20 have gained ranks. Indian cities lead the way, with New Delhi (+6) and Mumbai (+3) having climbed the most.

At a country level, China and the U.S combine to make up half of the cities in the top 20. They are also home to about half of the world’s 3,200 billionaire population.

In other news of note: Hurun officially counts Taylor Swift as a billionaire, estimating her net worth at $1.2 billion.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)