Economy

The World’s Largest Consumer Markets in 2030

![]() See this visualization first on the Voronoi app.

See this visualization first on the Voronoi app.

Forecast: The World’s Largest Consumer Markets in 2030

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Consumers are the lifeblood of the global economy, the driving force behind market dynamics, and the ultimate arbiters of demand.

But where are the biggest congregations of consumers, and are they growing?

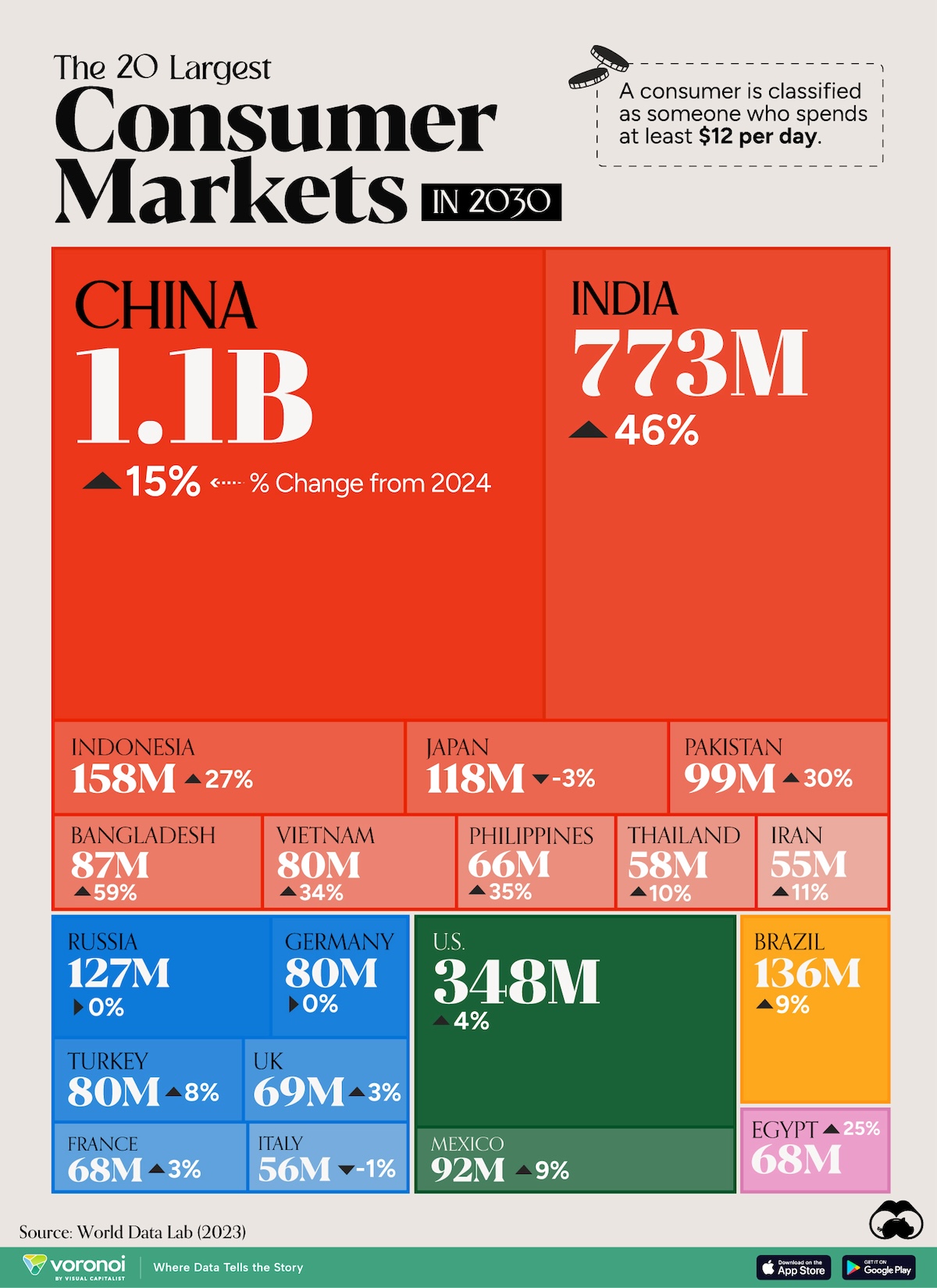

We visualize the 20 largest consumer markets in the world, based on 2030 projections from World Data Lab, an enterprise focused on creating estimates on global consumer spending.

In this dataset, a consumer is classified as someone who spends at least $12 per day. Sources for the data include the World Bank, UN, Eurostat, and OECD databases.

Ranked: Largest Consumer Markets in 2030

Ranked first, China is expected to have slightly more than 1 billion consumers by 2030, a 15% increase from 2024. Just across the Himalayas, at second place, India will have 773 million consumers, up from 529 million today, a staggering 46% increase.

The rise of the global middle class, thanks to expanding economies and wealth, is expected to boom in this region, in turn increasing local spending ability.

This nearly 2 billion-strong consumer market in India and China could have wide-ranging effects on the global economy. Businesses may shift their focus to cater to these markets, offering more customized products and employing different marketing strategies. This could also require businesses to realign their supply chains and build new distribution networks closer to these markets.

| Rank | Country | Consumer Market (2030 Projections) | % Change (from 2024) |

|---|---|---|---|

| 1 | 🇨🇳 China | 1,062,294,436 | +15% |

| 2 | 🇮🇳 India | 772,929,623 | +46% |

| 3 | 🇺🇸 U.S. | 348,393,863 | +4% |

| 4 | 🇮🇩 Indonesia | 158,448,996 | +27% |

| 5 | 🇧🇷 Brazil | 135,902,978 | +9% |

| 6 | 🇷🇺 Russia | 127,324,784 | 0% |

| 7 | 🇯🇵 Japan | 118,264,539 | -3% |

| 8 | 🇵🇰 Pakistan | 99,263,255 | +30% |

| 9 | 🇲🇽 Mexico | 91,698,269 | +9% |

| 10 | 🇧🇩 Bangladesh | 87,183,060 | +59% |

| 11 | 🇻🇳 Vietnam | 80,383,445 | +34% |

| 12 | 🇩🇪 Germany | 80,370,656 | 0% |

| 13 | 🇹🇷 Turkey | 79,955,332 | +8% |

| 14 | 🇬🇧 UK | 69,179,607 | +3% |

| 15 | 🇫🇷 France | 67,980,532 | +3% |

| 16 | 🇪🇬 Egypt | 67,710,385 | +25% |

| 17 | 🇵🇭 Philippines | 65,545,279 | +35% |

| 18 | 🇹🇭 Thailand | 58,237,555 | +10% |

| 19 | 🇮🇹 Italy | 55,596,017 | -1% |

| 20 | 🇮🇷 Iran | 55,219,774 | +11% |

Following current population rankings, the U.S. (348 million consumers), and Indonesia (158 million consumers) rank third and fourth respectively. Brazil, the sixth-most populated country, will have the fifth-largest consumers class by 2030, close to 136 million people.

At the same time, not all countries will see a growing consumer base. Russia and Germany are expected to stagnate, while Japan and Italy could even see a decline, a direct representation of plateauing population growth within these countries.

Economy

Economic Growth Forecasts for G7 and BRICS Countries in 2024

The IMF has released its economic growth forecasts for 2024. How do the G7 and BRICS countries compare?

G7 & BRICS Real GDP Growth Forecasts for 2024

The International Monetary Fund’s (IMF) has released its real gross domestic product (GDP) growth forecasts for 2024, and while global growth is projected to stay steady at 3.2%, various major nations are seeing declining forecasts.

This chart visualizes the 2024 real GDP growth forecasts using data from the IMF’s 2024 World Economic Outlook for G7 and BRICS member nations along with Saudi Arabia, which is still considering an invitation to join the bloc.

Get the Key Insights of the IMF’s World Economic Outlook

Want a visual breakdown of the insights from the IMF’s 2024 World Economic Outlook report?

This visual is part of a special dispatch of the key takeaways exclusively for VC+ members.

Get the full dispatch of charts by signing up to VC+.

Mixed Economic Growth Prospects for Major Nations in 2024

Economic growth projections by the IMF for major nations are mixed, with the majority of G7 and BRICS countries forecasted to have slower growth in 2024 compared to 2023.

Only three BRICS-invited or member countries, Saudi Arabia, the UAE, and South Africa, have higher projected real GDP growth rates in 2024 than last year.

| Group | Country | Real GDP Growth (2023) | Real GDP Growth (2024P) |

|---|---|---|---|

| G7 | 🇺🇸 U.S. | 2.5% | 2.7% |

| G7 | 🇨🇦 Canada | 1.1% | 1.2% |

| G7 | 🇯🇵 Japan | 1.9% | 0.9% |

| G7 | 🇫🇷 France | 0.9% | 0.7% |

| G7 | 🇮🇹 Italy | 0.9% | 0.7% |

| G7 | 🇬🇧 UK | 0.1% | 0.5% |

| G7 | 🇩🇪 Germany | -0.3% | 0.2% |

| BRICS | 🇮🇳 India | 7.8% | 6.8% |

| BRICS | 🇨🇳 China | 5.2% | 4.6% |

| BRICS | 🇦🇪 UAE | 3.4% | 3.5% |

| BRICS | 🇮🇷 Iran | 4.7% | 3.3% |

| BRICS | 🇷🇺 Russia | 3.6% | 3.2% |

| BRICS | 🇪🇬 Egypt | 3.8% | 3.0% |

| BRICS-invited | 🇸🇦 Saudi Arabia | -0.8% | 2.6% |

| BRICS | 🇧🇷 Brazil | 2.9% | 2.2% |

| BRICS | 🇿🇦 South Africa | 0.6% | 0.9% |

| BRICS | 🇪🇹 Ethiopia | 7.2% | 6.2% |

| 🌍 World | 3.2% | 3.2% |

China and India are forecasted to maintain relatively high growth rates in 2024 at 4.6% and 6.8% respectively, but compared to the previous year, China is growing 0.6 percentage points slower while India is an entire percentage point slower.

On the other hand, four G7 nations are set to grow faster than last year, which includes Germany making its comeback from its negative real GDP growth of -0.3% in 2023.

Faster Growth for BRICS than G7 Nations

Despite mostly lower growth forecasts in 2024 compared to 2023, BRICS nations still have a significantly higher average growth forecast at 3.6% compared to the G7 average of 1%.

While the G7 countries’ combined GDP is around $15 trillion greater than the BRICS nations, with continued higher growth rates and the potential to add more members, BRICS looks likely to overtake the G7 in economic size within two decades.

BRICS Expansion Stutters Before October 2024 Summit

BRICS’ recent expansion has stuttered slightly, as Argentina’s newly-elected president Javier Milei declined its invitation and Saudi Arabia clarified that the country is still considering its invitation and has not joined BRICS yet.

Even with these initial growing pains, South Africa’s Foreign Minister Naledi Pandor told reporters in February that 34 different countries have submitted applications to join the growing BRICS bloc.

Any changes to the group are likely to be announced leading up to or at the 2024 BRICS summit which takes place October 22-24 in Kazan, Russia.

Get the Full Analysis of the IMF’s Outlook on VC+

This visual is part of an exclusive special dispatch for VC+ members which breaks down the key takeaways from the IMF’s 2024 World Economic Outlook.

For the full set of charts and analysis, sign up for VC+.

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Environment2 weeks ago

Environment2 weeks agoTop Countries By Forest Growth Since 2001