Markets

Top Emerging Markets for Investment in 2024

![]() See this visualization first on the Voronoi app.

See this visualization first on the Voronoi app.

Top Emerging Markets for Investment in 2024

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Foreign direct investment (FDI) refers to the investment made by individuals, companies, or entities from one country into businesses, assets, or ventures located in another country.

FDI plays a pivotal role in global economic development, as it facilitates capital flows, fosters business expansion, and contributes to job creation and economic growth.

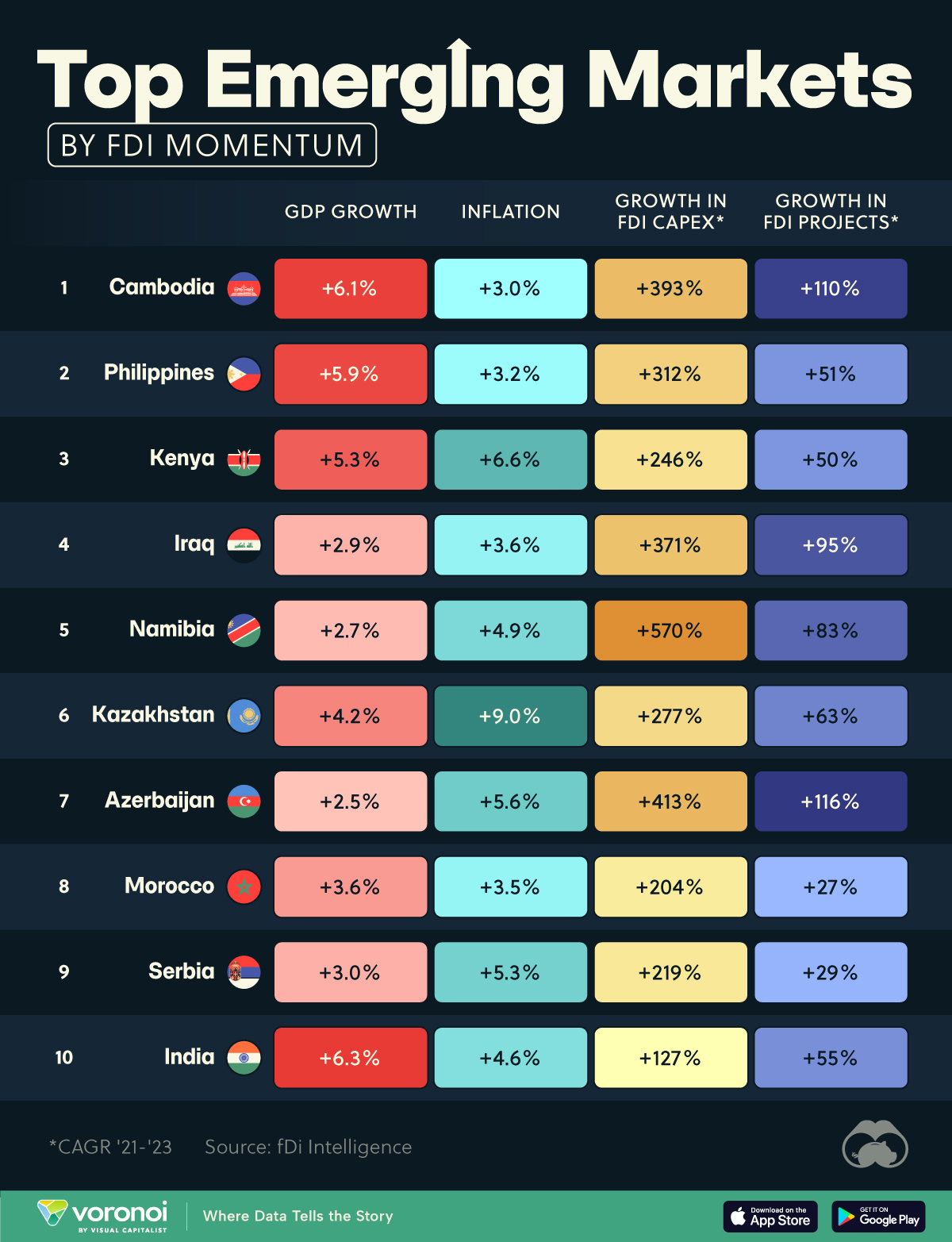

In this graphic, we illustrate the top 10 emerging markets according to their FDI momentum in 2024. This ranking comes from fDi Intelligence and was published in December 2023.

Cambodia Tops the List

The 10 countries with the strongest FDI prospects for 2024 are spread across Asia, Africa, the Middle East, and Europe.

Asia features six countries on the list, with Cambodia expected to carry the strongest investment momentum this year.

With a GDP growth forecasted at 6.1% in 2024, up from 5.6% in 2023, the IMF expects Cambodia to be the fastest-growing economy in Southeast Asia. The country has strengthened its trade relationships with China, South Korea, and the EU.

Additionally, Cambodia has benefited from a recovery in tourism since China started lifting its COVID-related travel restrictions earlier in 2023.

| Country | GDP Growth | Growth in FDI Capex (CAGR '21-'23) | Growth in FDI Projects (CAGR '21-'23) |

|---|---|---|---|

| 🇰🇭 Cambodia | 6.1% | 393% | 110% |

| 🇵🇭 Philippines | 5.9% | 312% | 51% |

| 🇰🇪 Kenya | 5.3% | 246% | 50% |

| 🇮🇶 Iraq | 2.9% | 371% | 95% |

| 🇳🇦 Namibia | 2.7% | 570% | 83% |

| 🇰🇿 Kazakhstan | 4.2% | 277% | 63% |

| 🇦🇿 Azerbaijan | 2.5% | 413% | 116% |

| 🇲🇦 Morocco | 3.6% | 204% | 27% |

| 🇷🇸 Serbia | 3.0% | 219% | 29% |

| 🇮🇳 India | 6.3% | 127% | 55% |

Meanwhile, the IMF expects the Philippines, in second place, increase GDP growth from 5.3% to 5.9% in 2024. Both public and private investment have played a key role in reinforcing its growth, bolstered by the opening of the renewable energy sector to foreign investors.

Kenya occupies the third spot.

The African nation has seen increasing foreign direct investment in various sectors. Recently, the U.S.-based pharmaceutical company Moderna finalized an agreement to invest up to $500 million to build its first African facility for the production of messenger RNA (mRNA) vaccines in Kenya—one of the first of its kind in Africa.

The country’s energy sector has also attracted strong FDI interest, with Dubai-based AMEA Power announcing in September 2023 the intention to produce green hydrogen in Mombasa, with total investment estimated at $2.29 billion.

Serbia was the only country outside Asia and Africa to make it into the top 10, securing ninth place.

Markets

The Best U.S. Companies to Work for According to LinkedIn

We visualized the results of a LinkedIn study on the best U.S. companies to work for in 2024.

The Best U.S. Companies to Work for According to LinkedIn

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

In this graphic, we list the 15 best U.S. companies to work for in 2024, according to LinkedIn data.

LinkedIn ranked companies based on eight pillars: ability to advance, skills growth, company stability, external opportunity, company affinity, gender diversity, educational background, and employee presence in the country.

To be eligible, companies must have had 5,000 or more global employees, with at least 500 in the country as of December 31, 2023.

Data and Highlights

Financial institutions dominate the ranking of the best U.S. companies to work for in 2024, with JP Morgan Chase & Co. ranking first.

| Rank | Company | Industry |

|---|---|---|

| 1 | JP Morgan Chase & Co. | Financial Services |

| 2 | Amazon | E-commerce |

| 3 | Wells Fargo | Financial Services |

| 4 | Deloitte | Professional Services |

| 5 | PwC | Professional Services |

| 6 | UnitedHealth Group | Healthcare |

| 7 | AT&T | Telecommunications |

| 8 | Verizon | Telecommunications |

| 9 | Moderna | Pharmaceuticals |

| 10 | Alphabet Inc. | Technology |

| 11 | General Motors | Automotive |

| 12 | Bank of America | Financial Services |

| 13 | Mastercard | Financial Services |

| 14 | Capital One | Financial Services |

| 15 | Northrop Grumman | Aerospace & Defense |

J.P. Morgan has a program that offers opportunities for candidates without a university degree. In fact, in 2022, 75% of job descriptions at the bank for experienced hires did not require a college degree.

Meanwhile, Deloitte and Amazon offer a variety of free training courses, including in AI.

Moderna includes in its employee package benefits to help avoid employee burnout — from subsidized commuter expenses and pop-up daycare centers, to wellness coaches.

Mastercard offers flexible work availability, with 11.5% remote and 89% hybrid options.

It’s also interesting to note that only Amazon and Alphabet made the cut from the ‘Magnificent Seven’ companies (Apple, Microsoft, Google parent Alphabet, Amazon, Nvidia, Meta Platforms, and Tesla).

See more about the best companies to work for in this infographic, which covers a separate ranking from Glassdoor.

-

Demographics6 days ago

Demographics6 days agoThe Countries That Have Become Sadder Since 2010

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023

-

Green2 weeks ago

Green2 weeks agoRanking the Top 15 Countries by Carbon Tax Revenue

-

Markets2 weeks ago

Markets2 weeks agoU.S. Debt Interest Payments Reach $1 Trillion

-

Mining2 weeks ago

Mining2 weeks agoGold vs. S&P 500: Which Has Grown More Over Five Years?

-

Energy2 weeks ago

Energy2 weeks agoThe World’s Biggest Nuclear Energy Producers

-

Misc2 weeks ago

Misc2 weeks agoHow Hard Is It to Get Into an Ivy League School?

-

Debt2 weeks ago

Debt2 weeks agoHow Debt-to-GDP Ratios Have Changed Since 2000