Investor Education

Ranking Asset Classes by Historical Returns (1985-2020)

Historical Returns by Asset Class (1985-2020)

Mirror, mirror, on the wall, is there one asset class to rule them all?

From stocks to bonds to alternatives, investors can choose from a wide variety of investment types. The choices can be overwhelming—leaving people to wonder if there’s one investment that consistently outperforms, or if there’s a predictable pattern of performance.

This graphic, which is inspired by and uses data from The Measure of a Plan, shows historical returns by asset class for the last 36 years.

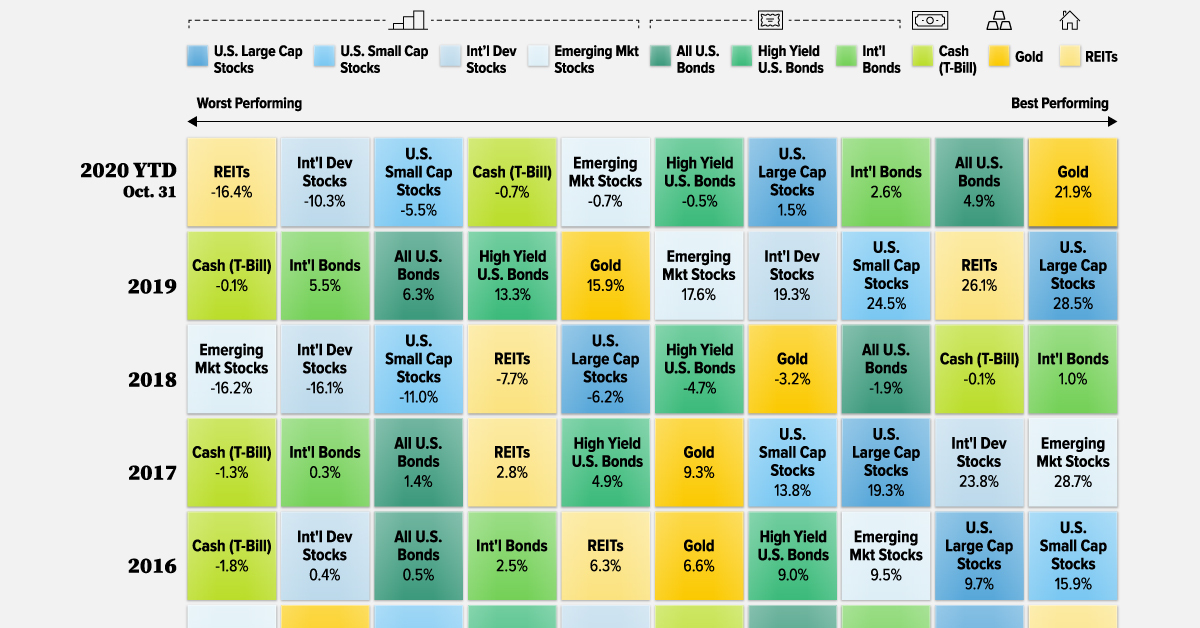

Asset Class Returns by Year

This analysis includes assets of various types, geographies, and risk levels. It uses real total returns, meaning that they account for inflation and the reinvestment of dividends.

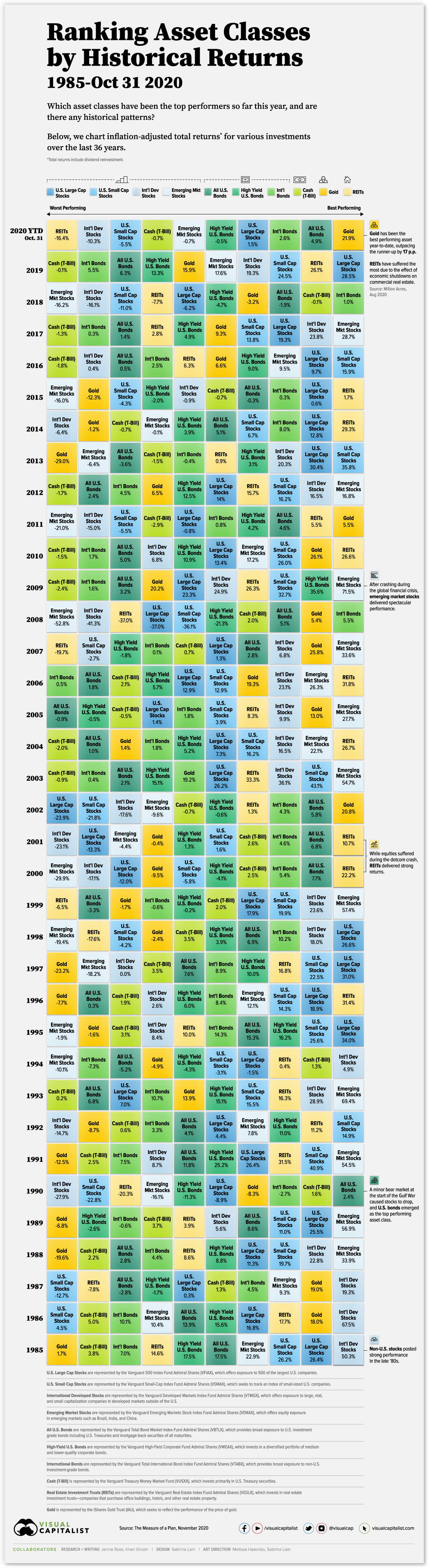

Here’s how the data breaks down, this time organized by asset class rather than year:

| U.S. Large Cap Stocks | U.S. Small Cap Stocks | Int'l Dev Stocks | Emerging Stocks | All U.S. Bonds | High-Yield U.S. Bonds | Int'l Bonds | Cash (T-Bill) | REIT | Gold | |

|---|---|---|---|---|---|---|---|---|---|---|

| Ticker | VFIAX | VSMAX | VTMGX | VEMAX | VBTLX | VWEAX | VTABX | VUSXX | VGSLX | IAU |

| 2020* | 1.5% | -5.5% | -10.3% | -0.7% | 4.9% | -0.5% | 2.6% | -0.7% | -16.4% | 21.9% |

| 2019 | 28.5% | 24.5% | 19.3% | 17.6% | 6.3% | 13.3% | 5.5% | -0.1% | 26.1% | 15.9% |

| 2018 | -6.2% | -11.0% | -16.1% | -16.2% | -1.9% | -4.7% | 1.0% | -0.1% | -7.7% | -3.2% |

| 2017 | 19.3% | 13.8% | 23.8% | 28.7% | 1.4% | 4.9% | 0.3% | -1.3% | 2.8% | 9.3% |

| 2016 | 9.7% | 15.9% | 0.4% | 9.5% | 0.5% | 9.0% | 2.5% | -1.8% | 6.3% | 6.6% |

| 2015 | 0.6% | -4.3% | -0.9% | -16.0% | -0.3% | -2.0% | 0.3% | -0.7% | 1.6% | -12.3% |

| 2014 | 12.8% | 6.7% | -6.4% | -0.2% | 5.1% | 3.9% | 8.0% | -0.7% | 29.3% | -1.2% |

| 2013 | 30.4% | 35.8% | 20.3% | -6.4% | -3.6% | 3.1% | -0.4% | -1.5% | 0.9% | -29.0% |

| 2012 | 14.0% | 16.2% | 16.5% | 16.8% | 2.4% | 12.5% | 4.5% | -1.7% | 15.7% | 6.5% |

| 2011 | -0.9% | -5.5% | -15.0% | -21.0% | 4.6% | 4.2% | 0.8% | -2.9% | 5.5% | 5.5% |

| 2010 | 13.4% | 26.0% | 6.8% | 17.2% | 5.0% | 10.9% | 1.7% | -1.5% | 26.6% | 26.0% |

| 2009 | 23.3% | 32.7% | 24.9% | 71.5% | 3.2% | 35.6% | 1.6% | -2.4% | 26.3% | 20.2% |

| 2008 | -37.0% | -36.1% | -41.3% | -52.8% | 5.1% | -21.3% | 5.5% | 2.0% | -37.0% | 5.4% |

| 2007 | 1.3% | -2.7% | 6.8% | 33.6% | 2.8% | -1.8% | 0.1% | 0.7% | -19.7% | 25.8% |

| 2006 | 12.9% | 12.9% | 23.1% | 26.3% | 1.8% | 5.7% | 0.5% | 2.1% | 31.8% | 19.3% |

| 2005 | 1.4% | 3.9% | 9.8% | 27.7% | -0.9% | -0.5% | 1.8% | -0.5% | 8.3% | 13.0% |

| 2004 | 7.3% | 16.2% | 16.5% | 22.1% | 1.0% | 5.2% | 1.8% | -2.0% | 26.7% | 1.4% |

| 2003 | 26.2% | 43.1% | 36.1% | 54.7% | 2.1% | 15.1% | 0.4% | -0.9% | 33.3% | 19.2% |

| 2002 | -23.9% | -21.8% | -17.6% | -9.6% | 5.8% | -0.6% | 4.2% | -0.7% | 1.3% | 20.8% |

| 2001 | -13.3% | 1.6% | -23.1% | -4.4% | 6.8% | 1.3% | 4.6% | 2.6% | 10.7% | -0.4% |

| 2000 | -12.0% | -5.8% | -17.1% | -29.9% | 7.7% | -4.1% | 5.4% | 2.5% | 22.2% | -9.6% |

| 1999 | 17.9% | 19.9% | 23.6% | 57.3% | -3.4% | -0.2% | -0.6% | 2.0% | -6.5% | -1.7% |

| 1998 | 26.6% | -4.2% | 18.0% | -19.4% | 6.9% | 3.9% | 10.2% | 3.5% | -17.7% | -2.4% |

| 1997 | 31.0% | 22.5% | 0.0% | -18.2% | 7.6% | 10.0% | 8.9% | 3.5% | 16.8% | -23.2% |

| 1996 | 18.9% | 14.3% | 2.6% | 12.1% | 0.3% | 6.0% | 8.3% | 1.9% | 31.4% | -7.7% |

| 1995 | 34.0% | 25.6% | 8.4% | -1.9% | 15.3% | 16.2% | 14.3% | 3.1% | 10.0% | -1.7% |

| 1994 | -1.5% | -3.1% | 4.9% | -10.1% | -5.2% | -4.3% | -7.3% | 1.3% | 0.4% | -4.9% |

| 1993 | 7.0% | 15.5% | 28.9% | 69.4% | 6.7% | 15.1% | 10.7% | 0.2% | 16.3% | 13.9% |

| 1992 | 4.4% | 14.9% | -14.7% | 7.8% | 4.1% | 11.0% | 3.3% | 0.6% | 11.2% | -8.7% |

| 1991 | 26.3% | 40.9% | 8.7% | 54.5% | 11.8% | 25.2% | 7.5% | 2.5% | 31.5% | -12.5% |

| 1990 | -8.9% | -22.8% | -27.9% | -16.1% | 2.4% | -11.3% | -2.7% | 1.6% | -20.3% | -8.3% |

| 1989 | 25.5% | 11.0% | 5.6% | 56.9% | 8.6% | -2.6% | -0.6% | 3.7% | 3.9% | -6.8% |

| 1988 | 11.3% | 19.7% | 22.8% | 33.9% | 2.8% | 8.8% | 4.4% | 2.1% | 8.6% | -19.6% |

| 1987 | 0.3% | -12.7% | 19.3% | 9.3% | -2.8% | -1.7% | 4.5% | 1.3% | -7.8% | 19.0% |

| 1986 | 16.8% | 4.5% | 67.5% | 10.4% | 13.9% | 15.6% | 10.1% | 5.0% | 17.7% | 17.9% |

| 1985 | 26.4% | 26.2% | 50.3% | 22.9% | 17.6% | 17.5% | 7.0% | 3.8% | 14.6% | 1.7% |

*Data for 2020 is as of October 31

The top-performing asset class so far in 2020 is gold, with a return more than four times that of second-place U.S. bonds. On the other hand, real estate investment trusts (REITs) have been the worst-performing investments. Needless to say, economic shutdowns due to COVID-19 have had a devastating effect on commercial real estate.

Over time, the order is fairly random with asset classes moving up and down the ranks. For example, emerging market stocks plummeted to last place amid the global financial crisis in 2008, only to rise to the top the following year. International bonds were near the bottom of the barrel in 2017, but rose to the top during the 2018 market selloff.

There are also large swings in the returns investors can expect in any given year. While the best-performing asset class returned just 1% in 2018, it returned a whopping 71.5% in 2009.

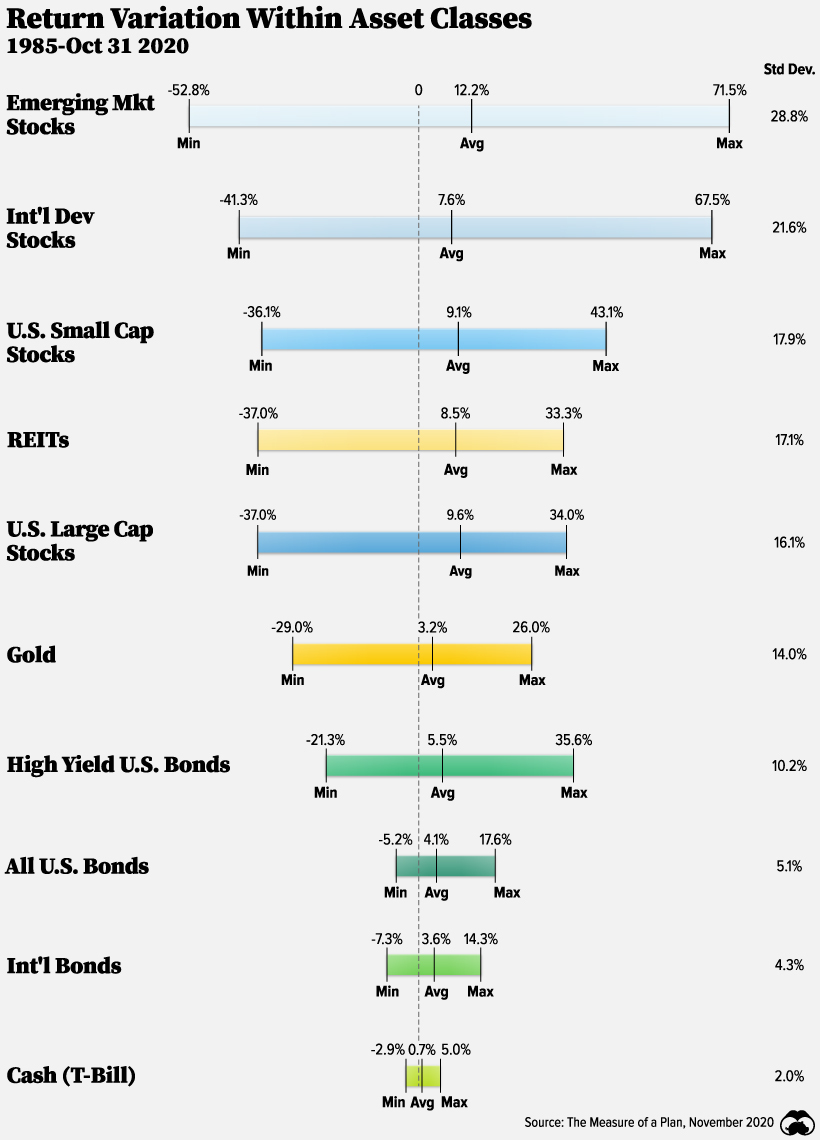

Variation Within Asset Classes

Within individual asset classes, the range in returns can also be quite large. Here’s the minimum, maximum, and average returns for each asset class. We’ve also shown each investment’s standard deviation, which is a measure of volatility or risk.

Although emerging market stocks have seen the highest average return, they have also seen the highest standard deviation. On the flip side, T-bills have seen returns lower than inflation since 2009, but have come with the lowest risk.

Investors should factor in risk when they are looking at the return potential of an asset class.

Variety is the Spice of Portfolios

Upon reviewing the historical returns by asset class, there’s no particular investment that has consistently outperformed. Rankings have changed over time depending on a number of economic variables.

However, having a variety of asset classes can ensure you are best positioned to take advantage of tailwinds in any particular year. For instance, bonds have a low correlation with stocks and can cushion against losses during market downturns.

If your mirror could talk, it would tell you there’s no one asset class to rule them all—but a mix of asset classes may be your best chance at success.

Investor Education

How MSCI Builds Thematic Indexes: A Step-by-Step Guide

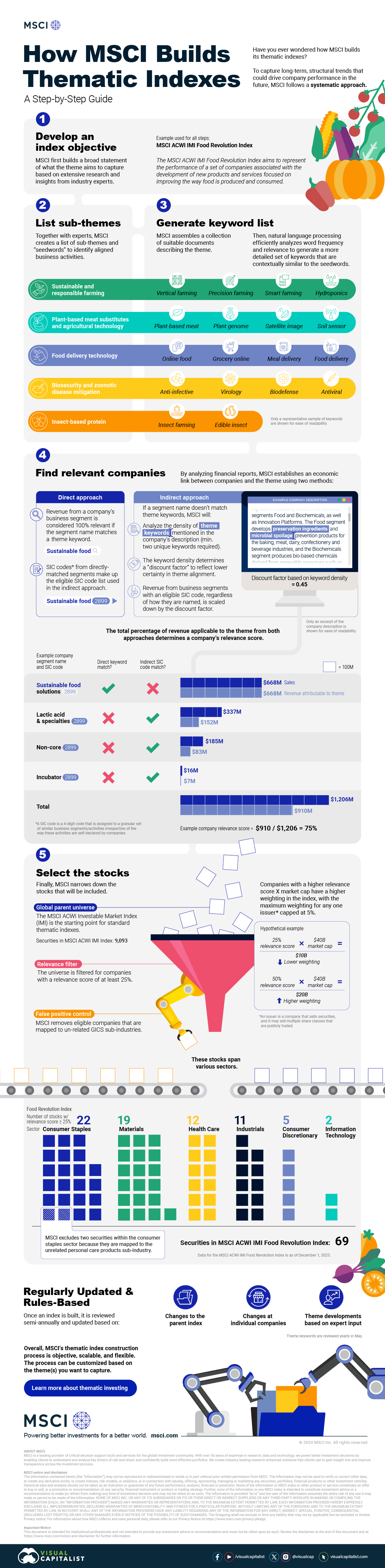

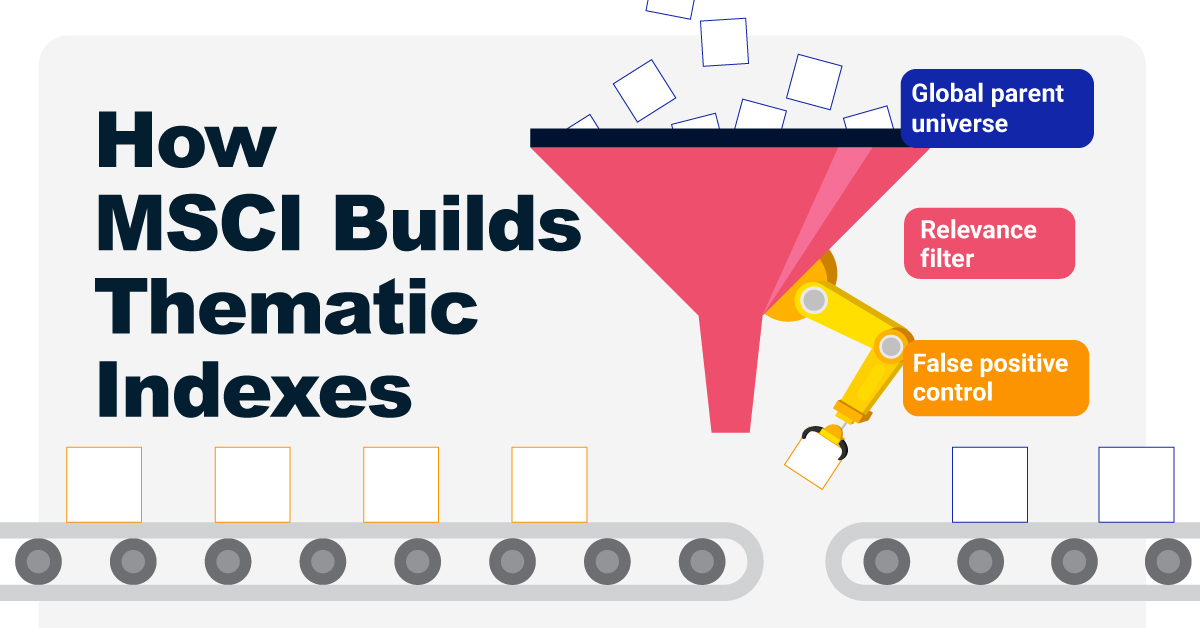

From developing an index objective to choosing relevant stocks, this graphic breaks down how MSCI builds thematic indexes using examples.

How MSCI Builds Thematic Indexes: A Step-by-Step Guide

Have you ever wondered how MSCI builds its thematic indexes?

To capture long-term, structural trends that could drive business performance in the future, the company follows a systematic approach. This graphic from MSCI breaks down each step in the process used to create its thematic indexes.

Step 1: Develop an Index Objective

MSCI first builds a broad statement of what the theme aims to capture based on extensive research and insights from industry experts.

Steps 2 and 3: List Sub-Themes, Generate Keyword List

Together with experts, MSCI creates a list of sub-themes or “seedwords” to identify aligned business activities.

The team then assembles a collection of suitable documents describing the theme. Natural language processing efficiently analyzes word frequency and relevance to generate a more detailed set of keywords contextually similar to the seedwords.

Step 4: Find Relevant Companies

By analyzing financial reports, MSCI picks companies relevant to the theme using two methods:

- Direct approach: Revenue from a company’s business segment is considered 100% relevant if the segment name matches a theme keyword. Standard Industrial Classification (SIC) codes from these directly-matched segments make up the eligible SIC code list used in the indirect approach.

- Indirect approach: If a segment name doesn’t match theme keywords, MSCI will:

- Analyze the density of theme keywords mentioned in the company’s description. A minimum of two unique keywords is required.

- The keyword density determines a “discount factor” to reflect lower certainty in theme alignment.

- Revenue from business segments with an eligible SIC code, regardless of how they are named, is scaled down by the discount factor.

The total percentage of revenue applicable to the theme from both approaches determines a company’s relevance score.

Step 5: Select the Stocks

Finally, MSCI narrows down the stocks that will be included:

- Global parent universe: The ACWI Investable Market Index (IMI) is the starting point for standard thematic indexes.

- Relevance filter: The universe is filtered for companies with a relevance score of at least 25%.

- False positive control: Eligible companies that are mapped to un-related GICS sub-industries are removed.

Companies with higher relevance scores and market caps have a higher weighting in the index, with the maximum weighting for any one issuer capped at 5%. The final selected stocks span various sectors.

MSCI Thematic Indexes: Regularly Updated and Rules-Based

Once an index is built, it is reviewed semi-annually and updated based on:

- Changes to the parent index

- Changes at individual companies

- Theme developments based on expert input

Theme keywords are reviewed yearly in May. Overall, MSCI’s thematic index construction process is objective, scalable, and flexible. The process can be customized based on the theme(s) you want to capture.

Learn more about MSCI’s thematic indexes.

-

Investor Education6 months ago

Investor Education6 months agoThe 20 Most Common Investing Mistakes, in One Chart

Here are the most common investing mistakes to avoid, from emotionally-driven investing to paying too much in fees.

-

Stocks10 months ago

Stocks10 months agoVisualizing BlackRock’s Top Equity Holdings

BlackRock is the world’s largest asset manager, with over $9 trillion in holdings. Here are the company’s top equity holdings.

-

Investor Education11 months ago

Investor Education11 months ago10-Year Annualized Forecasts for Major Asset Classes

This infographic visualizes 10-year annualized forecasts for both equities and fixed income using data from Vanguard.

-

Investor Education1 year ago

Investor Education1 year agoVisualizing 90 Years of Stock and Bond Portfolio Performance

How have investment returns for different portfolio allocations of stocks and bonds compared over the last 90 years?

-

Debt2 years ago

Debt2 years agoCountries with the Highest Default Risk in 2022

In this infographic, we examine new data that ranks the top 25 countries by their default risk.

-

Markets2 years ago

Markets2 years agoThe Best Months for Stock Market Gains

This infographic analyzes over 30 years of stock market performance to identify the best and worst months for gains.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees