Investor Education

The 20 Most Common Investing Mistakes, in One Chart

Subscribe to the Advisor Channel free mailing list for more like this

The 20 Most Common Investing Mistakes

This was originally posted on Advisor Channel. Sign up to the free mailing list to get beautiful visualizations on financial markets that help advisors and their clients.

No one is immune to errors, including the best investors in the world.

Fortunately, investing mistakes can provide valuable lessons over time, providing investors an opportunity to gain insights on investing—and build more resilient portfolios.

This graphic shows the top 20 most common investing mistakes to watch out for, according to the CFA Institute.

20 Investment Mistakes to Avoid

From emotionally-driven investment decisions to paying too much on fees, here are some of the most common investing mistakes:

| Top 20 Mistakes | Description |

|---|---|

| 1. Expecting Too Much | Having reasonable return expectations helps investors keep a long-term view without reacting emotionally. |

| 2. No Investment Goals | Often investors focus on short-term returns or the latest investment craze instead of their long-term investment goals. |

| 3. Not Diversifying | Diversifying prevents a single stock from drastically impacting the value of your portfolio. |

| 4. Focusing on the Short Term | It’s easy to focus on the short term, but this can make investors second-guess their original strategy and make careless decisions. |

| 5. Buying High and Selling Low | Investor behavior during market swings often hinders overall performance. |

| 6. Trading Too Much | One study shows that the most active traders underperformed the U.S. stock market by 6.5% on average annually. Source: The Journal of Finance |

| 7. Paying Too Much in Fees | Fees can meaningfully impact your overall investment performance, especially over the long run. |

| 8. Focusing Too Much on Taxes | While tax-loss harvesting can boost returns, making a decision solely based on its tax consequences may not always be merited. |

| 9. Not Reviewing Investments Regularly | Review your portfolio quarterly or annually to make sure you’re staying on track or if your portfolio is in need of rebalancing. |

| 10. Misunderstanding Risk | Too much risk can take you out of your comfort zone, but too little risk may result in lower returns that do not reach your financial goals. Recognize the right balance for your personal situation. |

| 11. Not Knowing Your Performance | Often, investors don’t actually know the performance of their investments. Review your returns to track if you are meeting your investment goals factoring in fees and inflation. |

| 12. Reacting to the Media | Negative news in the short-term can trigger fear, but remember to focus on the long run. |

| 13. Forgetting About Inflation | Historically, inflation has averaged 4% annually. Value of $100 at 4% Annual Inflation After 1 Year: $96 After 20 Years: $44 |

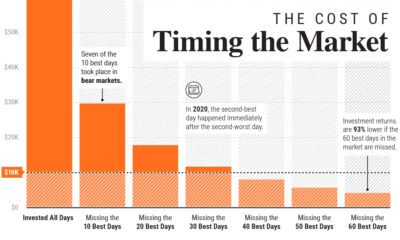

| 14. Trying to Time the Market | Market timing is extremely hard. Staying in the market can generate much higher returns versus trying to time the market perfectly. |

| 15. Not Doing Due Diligence | Check the credentials of your advisor through sites like BrokerCheck, which shows their employment history and complaints. |

| 16. Working With the Wrong Advisor | Taking the time to find the right advisor is worth it. Vet your advisor carefully to ensure your goals are aligned. |

| 17. Investing With Emotions | Although it can be challenging, remember to stay rational during market fluctuations. |

| 18. Chasing Yield | High-yielding investments often carry the highest risk. Carefully assess your risk profile before investing in these types of assets. |

| 19. Neglecting to Start | Consider two people investing $200 monthly assuming a 7% annual rate of return until the age of 65. If one person started at age 25, their end portfolio would be $520K, if the other started at 35 it would total about $245K. |

| 20. Not Controlling What You Can | While no one can predict the market, investors can control small contributions over time, which can have powerful outcomes. |

For instance, not properly diversifying can expose you to higher risk. Holding one concentrated position can drastically impact the value of your portfolio when prices fluctuate.

In fact, one study shows that the optimal diversification for a large-cap portfolio is holding 15 stocks. In this way, it helps capture the highest possible return relative to risk. When it came to a small-cap portfolio, the number of stocks rose to 26 for optimal risk reduction.

It’s worth noting that one size does not fit all, and seeking financial advice can help you find the right balance based on your financial goals.

Another common mistake is trading too much. Since each trade can rake up fees, this can impact your overall portfolio performance. A separate study showed that the most active traders saw the worst returns, underperforming the U.S. stock market by 6.5% on average annually.

Finally, it’s important to carefully monitor your investments regularly as market conditions change, factoring in fees and inflation. This will let you know if your investments are on track, or if you need to adjust based on changing personal circumstances or other factors.

Controlling What You Can

To help avoid these common investing mistakes, investors can remember to stay rational and focus on their long-term goals. Building a solid portfolio often involves assessing the following factors:

- Financial goals

- Current income

- Spending habits

- Market environment

- Expected returns

With these factors in mind, investors can avoid focusing on short-term market swings, and control what they can. Making small investments over the long run can have powerful effects, with the potential to accumulate significant wealth simply by investing consistently over time.

Investor Education

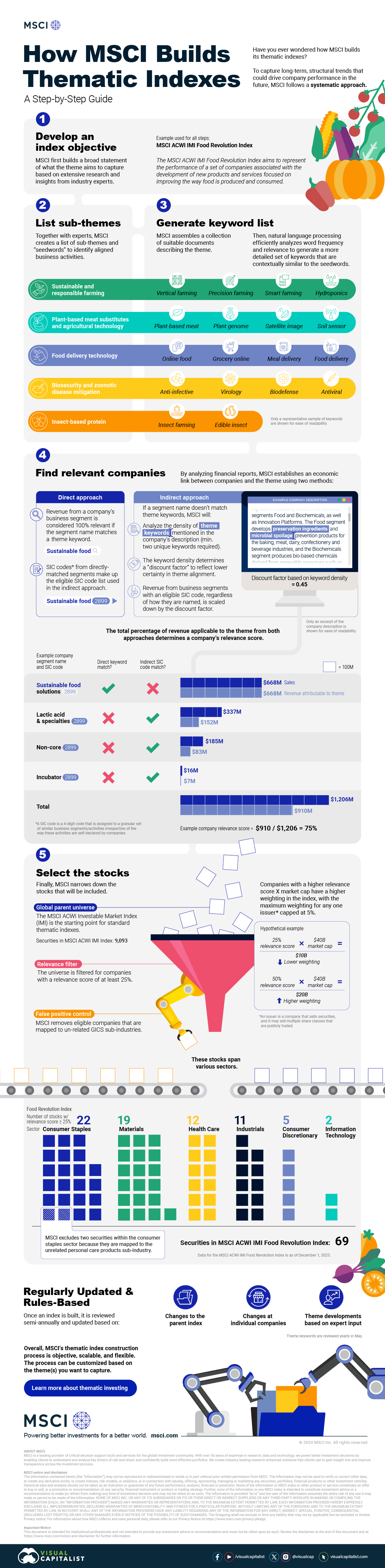

How MSCI Builds Thematic Indexes: A Step-by-Step Guide

From developing an index objective to choosing relevant stocks, this graphic breaks down how MSCI builds thematic indexes using examples.

How MSCI Builds Thematic Indexes: A Step-by-Step Guide

Have you ever wondered how MSCI builds its thematic indexes?

To capture long-term, structural trends that could drive business performance in the future, the company follows a systematic approach. This graphic from MSCI breaks down each step in the process used to create its thematic indexes.

Step 1: Develop an Index Objective

MSCI first builds a broad statement of what the theme aims to capture based on extensive research and insights from industry experts.

Steps 2 and 3: List Sub-Themes, Generate Keyword List

Together with experts, MSCI creates a list of sub-themes or “seedwords” to identify aligned business activities.

The team then assembles a collection of suitable documents describing the theme. Natural language processing efficiently analyzes word frequency and relevance to generate a more detailed set of keywords contextually similar to the seedwords.

Step 4: Find Relevant Companies

By analyzing financial reports, MSCI picks companies relevant to the theme using two methods:

- Direct approach: Revenue from a company’s business segment is considered 100% relevant if the segment name matches a theme keyword. Standard Industrial Classification (SIC) codes from these directly-matched segments make up the eligible SIC code list used in the indirect approach.

- Indirect approach: If a segment name doesn’t match theme keywords, MSCI will:

- Analyze the density of theme keywords mentioned in the company’s description. A minimum of two unique keywords is required.

- The keyword density determines a “discount factor” to reflect lower certainty in theme alignment.

- Revenue from business segments with an eligible SIC code, regardless of how they are named, is scaled down by the discount factor.

The total percentage of revenue applicable to the theme from both approaches determines a company’s relevance score.

Step 5: Select the Stocks

Finally, MSCI narrows down the stocks that will be included:

- Global parent universe: The ACWI Investable Market Index (IMI) is the starting point for standard thematic indexes.

- Relevance filter: The universe is filtered for companies with a relevance score of at least 25%.

- False positive control: Eligible companies that are mapped to un-related GICS sub-industries are removed.

Companies with higher relevance scores and market caps have a higher weighting in the index, with the maximum weighting for any one issuer capped at 5%. The final selected stocks span various sectors.

MSCI Thematic Indexes: Regularly Updated and Rules-Based

Once an index is built, it is reviewed semi-annually and updated based on:

- Changes to the parent index

- Changes at individual companies

- Theme developments based on expert input

Theme keywords are reviewed yearly in May. Overall, MSCI’s thematic index construction process is objective, scalable, and flexible. The process can be customized based on the theme(s) you want to capture.

Learn more about MSCI’s thematic indexes.

-

Investor Education6 months ago

Investor Education6 months agoThe 20 Most Common Investing Mistakes, in One Chart

Here are the most common investing mistakes to avoid, from emotionally-driven investing to paying too much in fees.

-

Investor Education10 months ago

Investor Education10 months agoVisualizing BlackRock’s Top Equity Holdings

BlackRock is the world’s largest asset manager, with over $9 trillion in holdings. Here are the company’s top equity holdings.

-

Investor Education11 months ago

Investor Education11 months ago10-Year Annualized Forecasts for Major Asset Classes

This infographic visualizes 10-year annualized forecasts for both equities and fixed income using data from Vanguard.

-

Investor Education1 year ago

Investor Education1 year agoVisualizing 90 Years of Stock and Bond Portfolio Performance

How have investment returns for different portfolio allocations of stocks and bonds compared over the last 90 years?

-

Investor Education2 years ago

Investor Education2 years agoCountries with the Highest Default Risk in 2022

In this infographic, we examine new data that ranks the top 25 countries by their default risk.

-

Markets2 years ago

Markets2 years agoThe Best Months for Stock Market Gains

This infographic analyzes over 30 years of stock market performance to identify the best and worst months for gains.

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001