Money

How Small Investments Make a Big Impact Over Time

![]() See this visualization first on the Voronoi app.

See this visualization first on the Voronoi app.

How Small Investments Make a Big Impact Over Time

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Time is an investor’s biggest ally, even if they start with just a modest portfolio.

The reason behind this is compounding interest, of course, thanks to its ability to magnify returns as interest earns interest on itself. With a fortune of $159 billion, Warren Buffett largely credits compound interest as a vital ingredient to his success—describing it like a snowball collecting snow as it rolls down a very long hill.

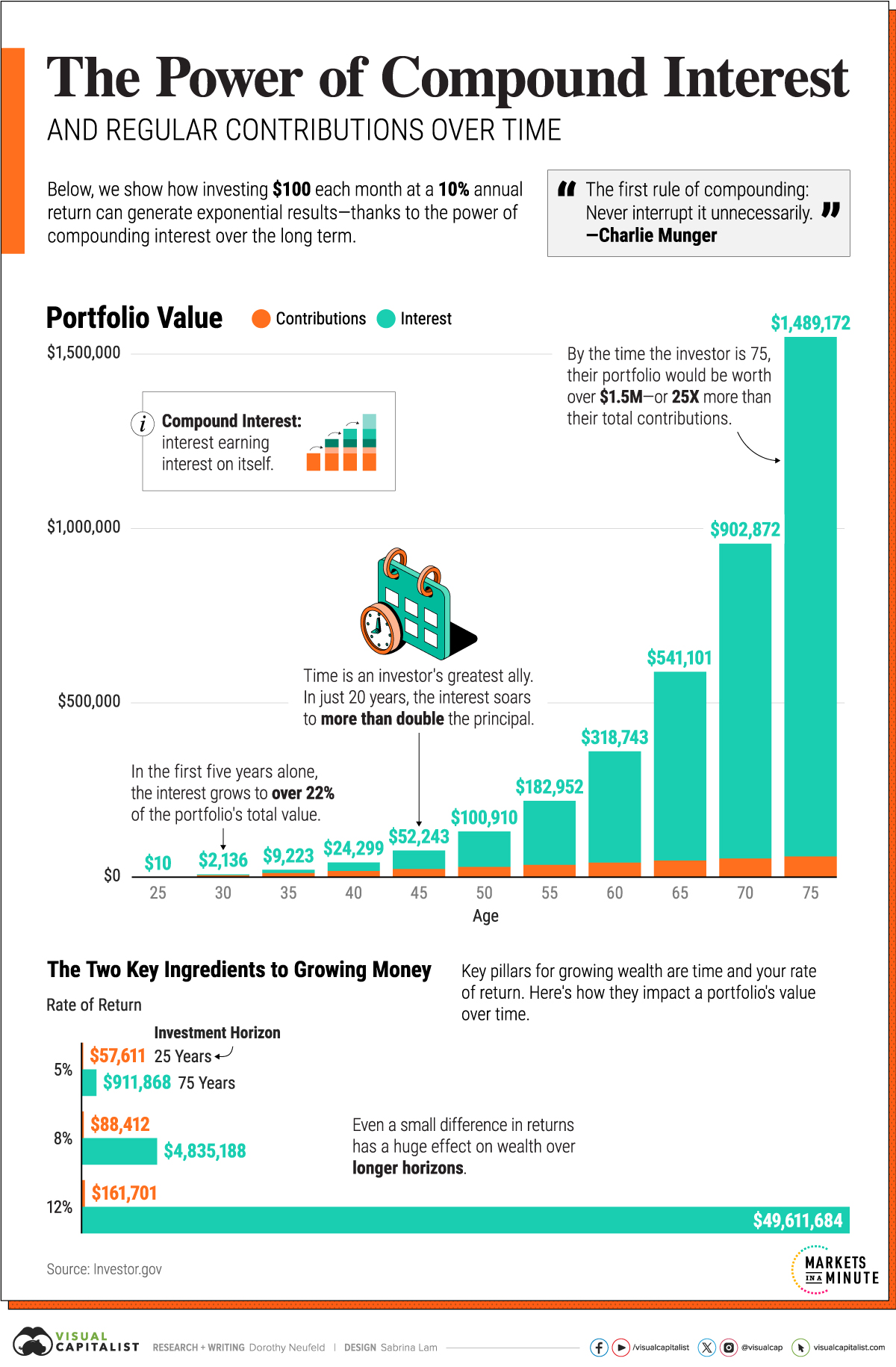

This graphic shows how compound interest can dramatically impact the value of an investor’s portfolio over longer periods of time, based on data from Investor.gov.

Why Compound Interest is a Powerful Force

Below, we show how investing $100 each month, with a 10% annual return starting at the age of 25 can generate outsized returns by simply staying the course:

| Age | Total Contributions | Interest | Portfolio Value |

|---|---|---|---|

| 25 | $1,300 | $10 | $1,310 |

| 30 | $7,300 | $2,136 | $9,436 |

| 35 | $13,300 | $9,223 | $22,523 |

| 40 | $19,300 | $24,299 | $43,599 |

| 45 | $25,300 | $52,243 | $77,543 |

| 50 | $31,300 | $100,910 | $132,210 |

| 55 | $37,300 | $182,952 | $220,252 |

| 60 | $43,300 | $318,743 | $362,043 |

| 65 | $49,300 | $541,101 | $590,401 |

| 70 | $55,300 | $902,872 | $958,172 |

| 75 | $61,300 | $1,489,172 | $1,550,472 |

Portfolio value is at end of each time period. All time periods are five years except for the first year (Age 25) which includes a $100 initial contribution. Interest is computed annually.

As we can see, the portfolio grows at a relatively slow pace over the first five years.

But as the portfolio continues to grow, the interest earned begins to exceed the contributions in under 15 years. That’s because interest is earned not only on the total contributions but on the accumulated interest itself. So by the age of 40, the total contributions are valued at $19,300 while the interest earned soars to $24,299.

Not only that, the interest earned soars to double the value of the investor’s contributions over the next five years—reaching $52,243 compared to the $25,300 in principal.

By the time the investor is 75, the power of compound interest becomes even more eye-opening. While the investor’s lifetime contributions totaled $61,300, the interest earned ballooned to 25 times that value, reaching $1,489,172.

In this way, it shows that investing consistently over time can benefit investors who stick it through stock market ups and downs.

The Two Key Ingredients to Growing Money

Generally speaking, building wealth involves two key pillars: time and rate of return.

Below, we show how these key factors can impact portfolios based on varying time horizons using a hypothetical example. Importantly, just a small difference in returns can make a huge impact on a portfolio’s end value:

| Annual Return | Portfolio Value 25 Year Investment Horizon | Portfolio Value 75 Year Investment Horizon |

|---|---|---|

| 5% | $57,611 | $911,868 |

| 8% | $88,412 | $4,835,188 |

| 12% | $161,701 | $49,611,684 |

With this in mind, it’s important to take into account investment fees which can erode the value of your investments.

Even the difference of 1% in investment fees adds up over time, especially over the long run. Say an investor paid 1% in fees, and had an after-fee return of 9%. If they had a $100 starting investment, contributed monthly over a 25-year time span, their portfolio would be worth over $102,000 at the end of the period.

By comparison, a 10% return would have made over $119,000. In other words, they lost roughly $17,000 on their investment because of fees.

Another important factor to keep in mind is inflation. In order to preserve the value of your portfolio, its important to choose investments that beat inflation, which has historically averaged around 3.3%.

For perspective, since 1974 the S&P 500 has returned 12.5% on average annually (including reinvested dividends), 10-Year U.S. Treasury bonds have returned 6.6%, while real estate has averaged 5.6%. As we can see, each of these have outperformed inflation over longer horizons, with varying degrees of risk and return.

Money

Charted: Which City Has the Most Billionaires in 2024?

Just two countries account for half of the top 20 cities with the most billionaires. And the majority of the other half are found in Asia.

Charted: Which Country Has the Most Billionaires in 2024?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Some cities seem to attract the rich. Take New York City for example, which has 340,000 high-net-worth residents with investable assets of more than $1 million.

But there’s a vast difference between being a millionaire and a billionaire. So where do the richest of them all live?

Using data from the Hurun Global Rich List 2024, we rank the top 20 cities with the highest number of billionaires in 2024.

A caveat to these rich lists: sources often vary on figures and exact rankings. For example, in last year’s reports, Forbes had New York as the city with the most billionaires, while the Hurun Global Rich List placed Beijing at the top spot.

Ranked: Top 20 Cities with the Most Billionaires in 2024

The Chinese economy’s doldrums over the course of the past year have affected its ultra-wealthy residents in key cities.

Beijing, the city with the most billionaires in 2023, has not only ceded its spot to New York, but has dropped to #4, overtaken by London and Mumbai.

| Rank | City | Billionaires | Rank Change YoY |

|---|---|---|---|

| 1 | 🇺🇸 New York | 119 | +1 |

| 2 | 🇬🇧 London | 97 | +3 |

| 3 | 🇮🇳 Mumbai | 92 | +4 |

| 4 | 🇨🇳 Beijing | 91 | -3 |

| 5 | 🇨🇳 Shanghai | 87 | -2 |

| 6 | 🇨🇳 Shenzhen | 84 | -2 |

| 7 | 🇭🇰 Hong Kong | 65 | -1 |

| 8 | 🇷🇺 Moscow | 59 | No Change |

| 9 | 🇮🇳 New Delhi | 57 | +6 |

| 10 | 🇺🇸 San Francisco | 52 | No Change |

| 11 | 🇹🇭 Bangkok | 49 | +2 |

| 12 | 🇹🇼 Taipei | 45 | +2 |

| 13 | 🇫🇷 Paris | 44 | -2 |

| 14 | 🇨🇳 Hangzhou | 43 | -5 |

| 15 | 🇸🇬 Singapore | 42 | New to Top 20 |

| 16 | 🇨🇳 Guangzhou | 39 | -4 |

| 17T | 🇮🇩 Jakarta | 37 | +1 |

| 17T | 🇧🇷 Sao Paulo | 37 | No Change |

| 19T | 🇺🇸 Los Angeles | 31 | No Change |

| 19T | 🇰🇷 Seoul | 31 | -3 |

In fact all Chinese cities on the top 20 list have lost billionaires between 2023–24. Consequently, they’ve all lost ranking spots as well, with Hangzhou seeing the biggest slide (-5) in the top 20.

Where China lost, all other Asian cities—except Seoul—in the top 20 have gained ranks. Indian cities lead the way, with New Delhi (+6) and Mumbai (+3) having climbed the most.

At a country level, China and the U.S combine to make up half of the cities in the top 20. They are also home to about half of the world’s 3,200 billionaire population.

In other news of note: Hurun officially counts Taylor Swift as a billionaire, estimating her net worth at $1.2 billion.

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Environment2 weeks ago

Environment2 weeks agoTop Countries By Forest Growth Since 2001