Money

Visualized: How Long Does it Take to Double Your Money?

Subscribe to the Advisor Channel free mailing list for more like this

Visualized: How Long Does it Take to Double Your Money?

This was originally posted on Advisor Channel. Sign up to the free mailing list to get beautiful visualizations on financial markets that help advisors and their clients.

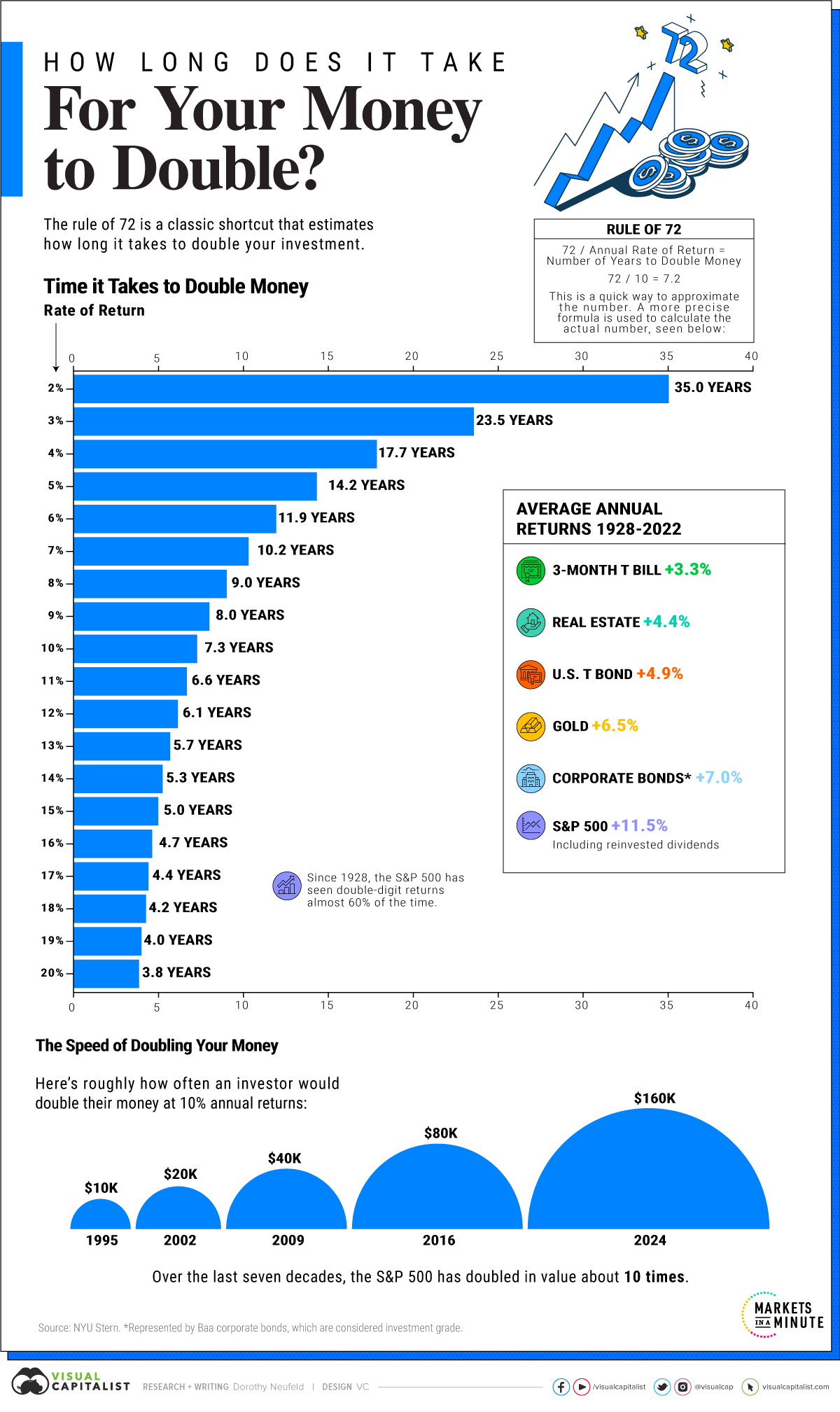

At first glance, a 7% return on your investment may not seem that impressive. Yet what if you heard that your money could double in roughly 10 years?

The above graphic takes the rule of 72 shortcut and uses the more precise logarithmic formula to show how long it takes to grow your money at different annualized returns.

Why it Pays to Know the Math

Using the classic rule of 72, an investor can estimate how long it takes to double their money. At 7% annual returns, an investor would see $10,000 grow to $20,000 in about a decade by taking 72 and dividing it by 7%, the rate of return.

While the rule of 72 serves as a guide to estimating when your money will double, the more accurate way to arrive at this number is through a logarithmic equation.

In short, it divides the natural log of 2 by the natural log of 1 and adds this to the rate of return. We can see in the table below how leads to different results from the rule of 72:

| Rate of Return | Rule of 72 # of Years to Double Money | Logarithmic Formula # of Years to Double Money |

|---|---|---|

| 2% | 36.0 | 35.0 |

| 3% | 24.0 | 23.5 |

| 4% | 18.0 | 17.7 |

| 5% | 14.4 | 14.2 |

| 6% | 12.0 | 11.9 |

| 7% | 10.3 | 10.2 |

| 8% | 9.0 | 9.0 |

| 9% | 8.0 | 8.0 |

| 10% | 7.2 | 7.3 |

| 11% | 6.5 | 6.6 |

| 12% | 6.0 | 6.1 |

| 13% | 5.5 | 5.7 |

| 14% | 5.1 | 5.3 |

| 15% | 4.8 | 5.0 |

| 16% | 4.5 | 4.7 |

| 17% | 4.2 | 4.4 |

| 18% | 4.0 | 4.2 |

| 19% | 3.8 | 4.0 |

| 20% | 3.6 | 3.8 |

Consider if an investor put their money in the S&P 500. Historically, it has averaged 11.5% returns between 1928 and 2022. In 6.4 years, their money would double, assuming these average returns.

If they were to put this money in a savings account, where the average savings rate is 0.6%, it would take 120 more years for their money to reach this potential.

In real terms, which takes inflation into account, an investor would see their money lose value if they parked it in a savings account. Historically, inflation has averaged 3.3% over the last century.

Historical Asset Returns

Here’s how often different assets double, based on historical returns between 1928 and 2022:

| Asset | Average Annual Return 1928-2022 | # of Years to Double Money | End Value of $100 Invested 1928-2022 |

|---|---|---|---|

| 3-Month T Bill | +3.32% | 21.22 | $2,140.51 |

| Real Estate | +4.42% | 16.03 | $5,121.52 |

| U.S. T Bond | +4.87% | 14.58 | $7,006.75 |

| Gold | +6.48% | 11.04 | $8,866.76 |

| Corporate Bonds* | +6.96% | 10.30 | $46,379.53 |

| S&P 500** | +11.51% | 6.36 | $624,534.55 |

Source: NYU Stern. *Represents Baa corporate bonds, which are considered investment grade. **Includes reinvested dividends.

We can see that 3-month T-Bills, often considered among the safest assets, doubled about every 21 years. Often, investors consider this a place to put cash that is low-risk and highly liquid.

Interestingly, real estate assets had returns of 4.4%, doubling roughly every 16 years. Between 1928 and 2022, the value of $100 invested in real estate assets would be worth $5,121.52. By contrast, the value of $100 invested in the S&P 500, including reinvested dividends, would have reached over $624,000.

Data from NYU Stern shows that the S&P 500 has doubled about 10 times since 1949—through recessions and bull markets—illustrating the power of investing over the long run.

Money

Charted: Which City Has the Most Billionaires in 2024?

Just two countries account for half of the top 20 cities with the most billionaires. And the majority of the other half are found in Asia.

Charted: Which Country Has the Most Billionaires in 2024?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Some cities seem to attract the rich. Take New York City for example, which has 340,000 high-net-worth residents with investable assets of more than $1 million.

But there’s a vast difference between being a millionaire and a billionaire. So where do the richest of them all live?

Using data from the Hurun Global Rich List 2024, we rank the top 20 cities with the highest number of billionaires in 2024.

A caveat to these rich lists: sources often vary on figures and exact rankings. For example, in last year’s reports, Forbes had New York as the city with the most billionaires, while the Hurun Global Rich List placed Beijing at the top spot.

Ranked: Top 20 Cities with the Most Billionaires in 2024

The Chinese economy’s doldrums over the course of the past year have affected its ultra-wealthy residents in key cities.

Beijing, the city with the most billionaires in 2023, has not only ceded its spot to New York, but has dropped to #4, overtaken by London and Mumbai.

| Rank | City | Billionaires | Rank Change YoY |

|---|---|---|---|

| 1 | 🇺🇸 New York | 119 | +1 |

| 2 | 🇬🇧 London | 97 | +3 |

| 3 | 🇮🇳 Mumbai | 92 | +4 |

| 4 | 🇨🇳 Beijing | 91 | -3 |

| 5 | 🇨🇳 Shanghai | 87 | -2 |

| 6 | 🇨🇳 Shenzhen | 84 | -2 |

| 7 | 🇭🇰 Hong Kong | 65 | -1 |

| 8 | 🇷🇺 Moscow | 59 | No Change |

| 9 | 🇮🇳 New Delhi | 57 | +6 |

| 10 | 🇺🇸 San Francisco | 52 | No Change |

| 11 | 🇹🇭 Bangkok | 49 | +2 |

| 12 | 🇹🇼 Taipei | 45 | +2 |

| 13 | 🇫🇷 Paris | 44 | -2 |

| 14 | 🇨🇳 Hangzhou | 43 | -5 |

| 15 | 🇸🇬 Singapore | 42 | New to Top 20 |

| 16 | 🇨🇳 Guangzhou | 39 | -4 |

| 17T | 🇮🇩 Jakarta | 37 | +1 |

| 17T | 🇧🇷 Sao Paulo | 37 | No Change |

| 19T | 🇺🇸 Los Angeles | 31 | No Change |

| 19T | 🇰🇷 Seoul | 31 | -3 |

In fact all Chinese cities on the top 20 list have lost billionaires between 2023–24. Consequently, they’ve all lost ranking spots as well, with Hangzhou seeing the biggest slide (-5) in the top 20.

Where China lost, all other Asian cities—except Seoul—in the top 20 have gained ranks. Indian cities lead the way, with New Delhi (+6) and Mumbai (+3) having climbed the most.

At a country level, China and the U.S combine to make up half of the cities in the top 20. They are also home to about half of the world’s 3,200 billionaire population.

In other news of note: Hurun officially counts Taylor Swift as a billionaire, estimating her net worth at $1.2 billion.

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001