Money

How Much Does it Take to Be Wealthy in America?

How Much Does it Take to Be Wealthy in America?

Is it possible to pin down an exact number on what it takes to be wealthy, or is wealth far more complex and nuanced than that?

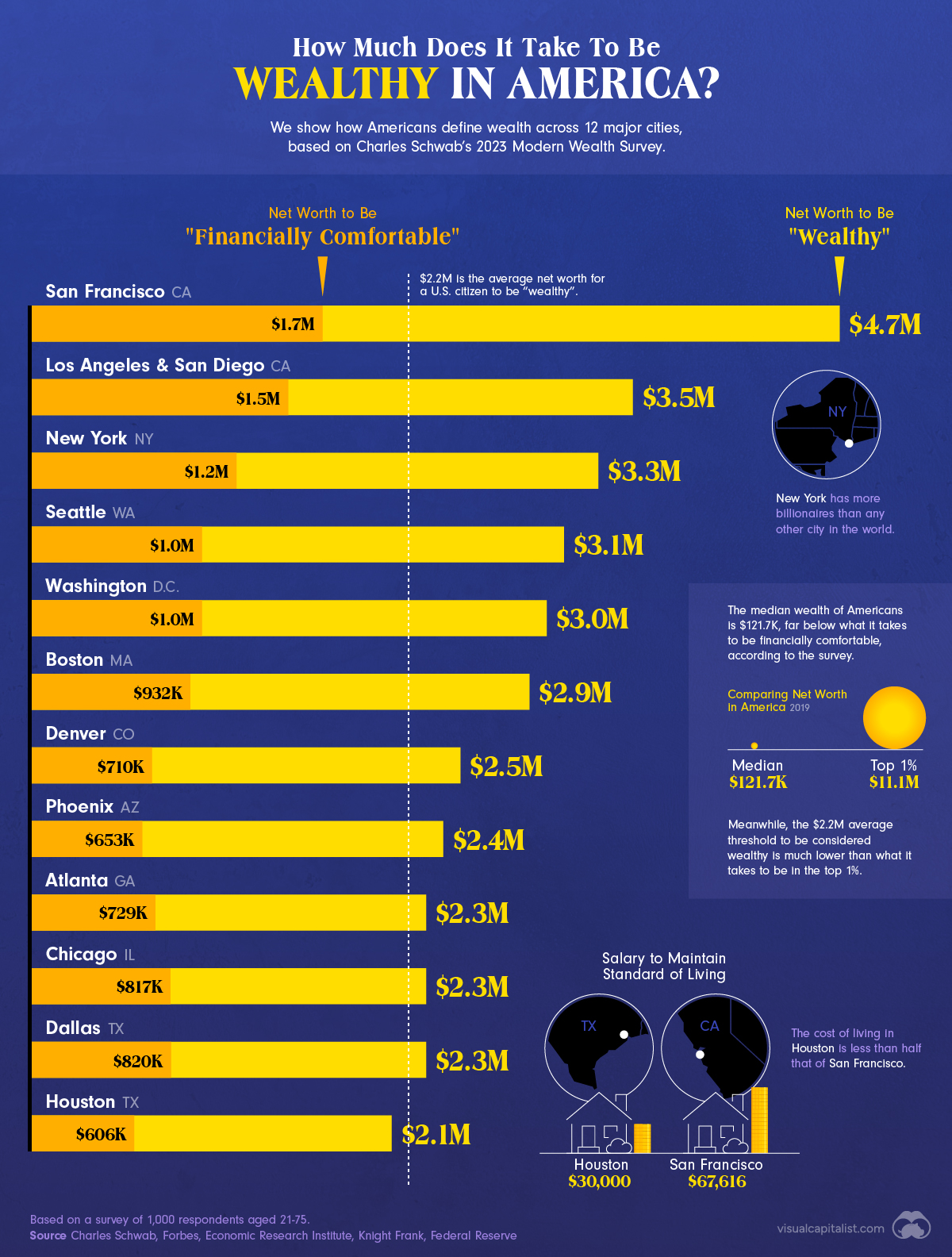

The above graphic looks at data from the 2023 Modern Wealth Survey by Charles Schwab, which asks respondents what net worth is required to be considered wealthy in America.

Later, we look at data that partially contradicts those findings, showing that wealth is more than just a number for many of those same respondents.

Wealthy in America: A Closer Look

Overall, the net worth that Americans say that is needed to be “wealthy” in the United States is $2.2 million in 2023.

Here are the average wealth numbers indicated by respondents across 12 major U.S. cities, based on a survey of 1,000 people between 21 and 75:

| Rank | City | Net Worth to Be "Wealthy" | Net Worth to Be "Financially Comfortable" |

|---|---|---|---|

| 1 | San Francisco, CA | $4.7M | $1.7M |

| 2 | Los Angeles & San Diego, CA | $3.5M | $1.5M |

| 3 | New York, NY | $3.3M | $1.2M |

| 4 | Seattle, WA | $3.1M | $1.0M |

| 5 | Washington, D.C. | $3.0M | $1.0M |

| 6 | Boston, MA | $2.9M | $932,000 |

| 7 | Denver, CO | $2.5M | $710,000 |

| 8 | Phoenix, AZ | $2.4M | $653,000 |

| 9 | Atlanta, GA | $2.3M | $729,000 |

| 10 | Chicago, IL | $2.3M | $817,000 |

| 11 | Dallas, TX | $2.3M | $820,000 |

| 12 | Houston, TX | $2.1M | $606,000 |

In San Francisco, respondents said they needed $4.7 million in net worth to be wealthy, the highest across all cities surveyed, and more than double the national average.

This figure dropped from last year, when it stood at $5.4 million. The vast majority of people in San Francisco say that inflation has had an impact on their finances, and over half say that living in the city impedes their ability to reach their financial goals, citing steep costs of living.

In Los Angeles and San Diego, it takes $3.5 million to be wealthy, the second-highest across cities surveyed. In New York, it takes $3.3 million in net worth to reach this target. It is home to over 345,000 millionaires, the highest worldwide.

Houston, where the cost of living is less than half of San Francisco, respondents said a net worth of $2.1 million is needed to be wealthy. The average salary is $67,000 in Houston, while in San Francisco it falls at $81,000.

The Wealth Paradox

Separately, the survey asked whether respondents “feel wealthy” themselves.

Overall, 48% of all respondents said they feel wealthy, and those people had an average net worth of $560,000. This is a considerable divergence from the $2.2 million benchmark they said was needed to be wealthy.

Here’s the breakdown for major cities, illustrating the paradox:

Millennials were most likely to feel wealthy, at 57% of respondents, while 40% of boomers felt wealthy, the lowest across generations surveyed.

Explaining the Divergence

When digging deeper, it becomes clear that wealth is not simply a number.

In fact, the survey indicates that many Americans place greater importance on non-monetary assets over monetary assets when they think of wealth.

For instance, 72% said having a fulfilling personal life was a better descriptor of wealth than working on a career, which was only chosen by 28% of respondents. Meanwhile, enjoying experiences (70%) was a better reflection of wealth compared to owning many nice things (30%).

Interestingly, there was a narrower margin in choosing between the importance of time (61%) over money (39%).

Beyond monetary figures, these findings illustrate the layers that influence what it means to feel financially healthy today, and how this affects an individual’s overall quality of life.

Economy

Ranked: The Top 20 Countries in Debt to China

The 20 nations featured in this graphic each owe billions in debt to China, posing concerns for their economic future.

Ranked: The Top 20 Countries in Debt to China

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

In this graphic, we ranked the top 20 countries by their amount of debt to China. These figures are as of 2022, and come from the World Bank (accessed via Yahoo Finance).

The data used to make this graphic can be found in the table below.

| Country | Total external debt to China ($B) |

|---|---|

| 🇵🇰 Pakistan | $26.6 |

| 🇦🇴 Angola | $21.0 |

| 🇱🇰 Sri Lanka | $8.9 |

| 🇪🇹 Ethiopia | $6.8 |

| 🇰🇪 Kenya | $6.7 |

| 🇧🇩 Bangladesh | $6.1 |

| 🇿🇲 Zambia | $6.1 |

| 🇱🇦 Laos | $5.3 |

| 🇪🇬 Egypt | $5.2 |

| 🇳🇬 Nigeria | $4.3 |

| 🇪🇨 Ecuador | $4.1 |

| 🇰🇭 Cambodia | $4.0 |

| 🇨🇮 Côte d'Ivoire | $3.9 |

| 🇧🇾 Belarus | $3.9 |

| 🇨🇲 Cameroon | $3.8 |

| 🇧🇷 Brazil | $3.4 |

| 🇨🇬 Republic of the Congo | $3.4 |

| 🇿🇦 South Africa | $3.4 |

| 🇲🇳 Mongolia | $3.0 |

| 🇦🇷 Argentina | $2.9 |

This dataset highlights Pakistan and Angola as having the largest debts to China by a wide margin. Both countries have taken billions in loans from China for various infrastructure and energy projects.

Critically, both countries have also struggled to manage their debt burdens. In February 2024, China extended the maturity of a $2 billion loan to Pakistan.

Soon after in March 2024, Angola negotiated a lower monthly debt payment with its biggest Chinese creditor, China Development Bank (CDB).

Could China be in Trouble?

China has provided developing countries with over $1 trillion in committed funding through its Belt and Road Initiative (BRI), a massive economic development project aimed at enhancing trade between China and countries across Asia, Africa, and Europe.

Many believe that this lending spree could be an issue in the near future.

According to a 2023 report by AidData, 80% of these loans involve countries in financial distress, raising concerns about whether participating nations will ever be able to repay their debts.

While China claims the BRI is a driver of global development, critics in the West have long warned that the BRI employs debt-trap diplomacy, a tactic where one country uses loans to gain influence over another.

Editor’s note: The debt shown in this visualization focuses only on direct external debt, and does not include publicly-traded, liquid, debt securities like bonds. Furthermore, it’s worth noting the World Bank data excludes some countries with data accuracy or reporting issues, such as Venezuela.

Learn More About Debt from Visual Capitalist

If you enjoyed this post, check out our breakdown of $97 trillion in global government debt.

-

Technology6 days ago

Technology6 days agoAll of the Grants Given by the U.S. CHIPS Act

-

Uranium2 weeks ago

Uranium2 weeks agoThe World’s Biggest Nuclear Energy Producers

-

Education2 weeks ago

Education2 weeks agoHow Hard Is It to Get Into an Ivy League School?

-

Debt2 weeks ago

Debt2 weeks agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Sports2 weeks ago

Sports2 weeks agoThe Highest Earning Athletes in Seven Professional Sports

-

Science2 weeks ago

Science2 weeks agoVisualizing the Average Lifespans of Mammals

-

Brands1 week ago

Brands1 week agoHow Tech Logos Have Evolved Over Time

-

Energy1 week ago

Energy1 week agoRanked: The Top 10 EV Battery Manufacturers in 2023