Money

Charting the Relationship Between Wealth and Happiness, by Country

The Relationship Between Wealth and Happiness, by Country

Throughout history, the pursuit of happiness has been a preoccupation of humankind.

Of course, we humans are not just content with measuring our own happiness, but also our happiness in relation to the people around us—and even other people around the world. The annual World Happiness Report, which uses global survey data to report how people evaluate their own lives in more than 150 countries, helps us do just that.

The factors that contribute to happiness are as subjective and specific as the billions of humans they influence, but there are a few that have continued to resonate over time. Family. Love. Purpose. Wealth. The first three examples are tough to measure, but the latter can be analyzed in a data-driven way.

Does money really buy happiness? Let’s find out.

Wealth and Happiness

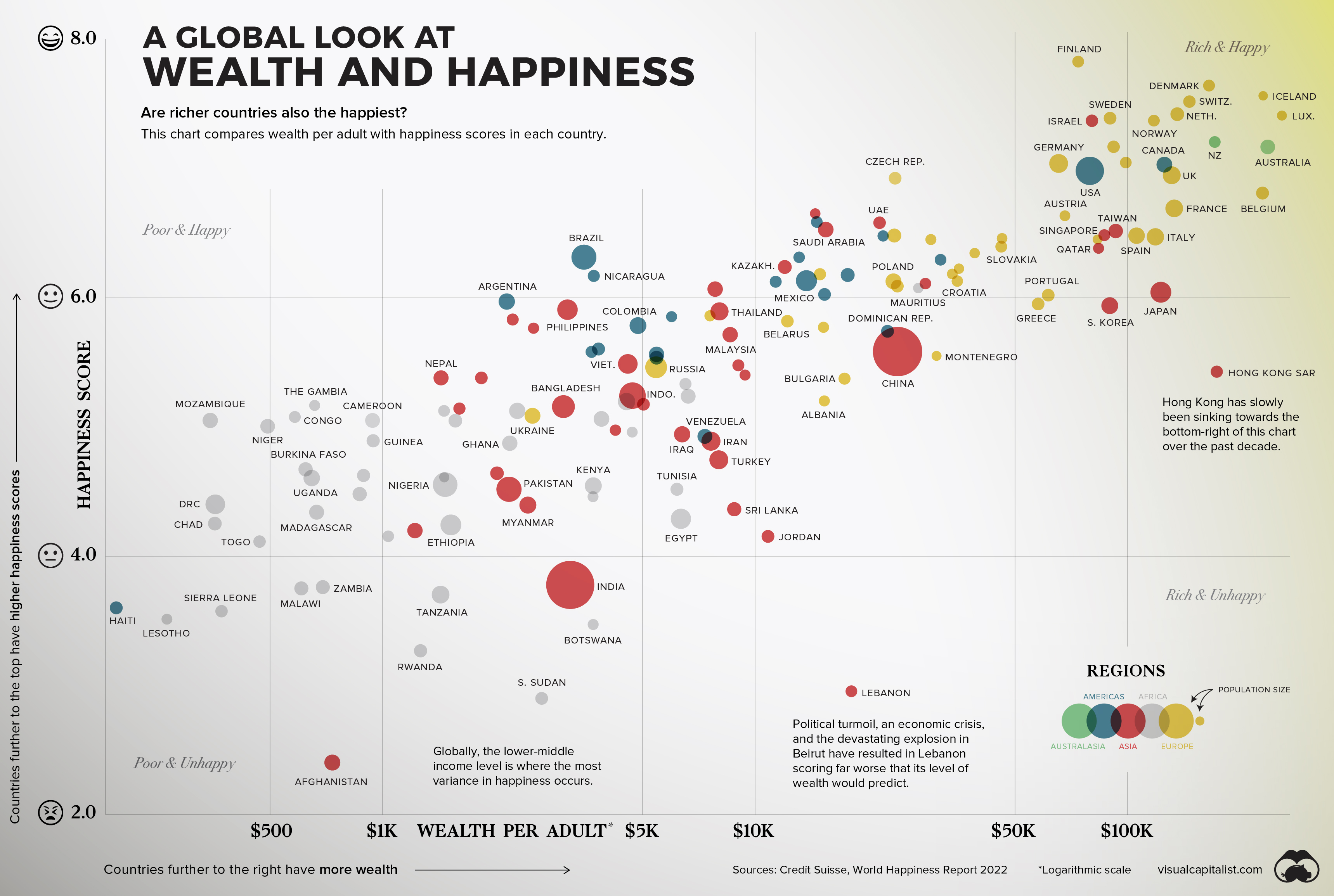

To crunch the numbers, we looked at data from Credit Suisse, which breaks down the average wealth per adult in various countries around the world.

The table below looks at 146 countries by their happiness score and wealth per adult:

| Country | Median Wealth per Adult (US$) | Happiness Score |

|---|---|---|

| 🇫🇮 Finland | 73,775 | 7.8 |

| 🇩🇰 Denmark | 165,622 | 7.6 |

| 🇮🇸 Iceland | 231,462 | 7.6 |

| 🇨🇭 Switzerland | 146,733 | 7.5 |

| 🇮🇱 Israel | 80,315 | 7.4 |

| 🇸🇪 Sweden | 89,846 | 7.4 |

| 🇳🇴 Norway | 117,798 | 7.4 |

| 🇳🇱 Netherlands | 136,105 | 7.4 |

| 🇱🇺 Luxembourg | 259,899 | 7.4 |

| 🇦🇹 Austria | 91,833 | 7.2 |

| 🇳🇿 New Zealand | 171,624 | 7.2 |

| 🇦🇺 Australia | 238,072 | 7.2 |

| 🇩🇪 Germany | 65,374 | 7.0 |

| 🇺🇸 United States | 79,274 | 7.0 |

| 🇮🇪 Ireland | 99,028 | 7.0 |

| 🇨🇦 Canada | 125,688 | 7.0 |

| 🇨🇿 Czech Republic | 23,794 | 6.9 |

| 🇬🇧 United Kingdom | 131,522 | 6.9 |

| 🇧🇪 Belgium | 230,548 | 6.8 |

| 🇫🇷 France | 133,559 | 6.7 |

| 🇧🇭 Bahrain | 14,520 | 6.6 |

| 🇨🇷 Costa Rica | 14,662 | 6.6 |

| 🇦🇪 United Arab Emirates | 21,613 | 6.6 |

| 🇸🇮 Slovenia | 67,961 | 6.6 |

| 🇸🇦 Saudi Arabia | 15,495 | 6.5 |

| 🇺🇾 Uruguay | 22,088 | 6.5 |

| 🇷🇴 Romania | 23,675 | 6.5 |

| 🇽🇰 Kosovo | 46,087 | 6.5 |

| 🇸🇬 Singapore | 86,717 | 6.5 |

| 🇹🇼 Taiwan | 93,044 | 6.5 |

| 🇪🇸 Spain | 105,831 | 6.5 |

| 🇮🇹 Italy | 118,885 | 6.5 |

| 🇱🇹 Lithuania | 29,679 | 6.4 |

| 🇸🇰 Slovakia | 45,853 | 6.4 |

| 🇶🇦 Qatar | 83,680 | 6.4 |

| 🇲🇹 Malta | 84,390 | 6.4 |

| 🇧🇷 Brazil | 3,469 | 6.3 |

| 🇵🇦 Panama | 13,147 | 6.3 |

| 🇬🇹 Guatemala | 30,586 | 6.3 |

| 🇪🇪 Estonia | 38,901 | 6.3 |

| 🇳🇮 Nicaragua | 3,694 | 6.2 |

| 🇰🇿 Kazakhstan | 12,029 | 6.2 |

| 🇷🇸 Serbia | 14,954 | 6.2 |

| 🇨🇱 Chile | 17,747 | 6.2 |

| 🇱🇻 Latvia | 33,884 | 6.2 |

| 🇨🇾 Cyprus | 35,300 | 6.2 |

| 🇺🇿 Uzbekistan | 7,821 | 6.1 |

| 🇸🇻 El Salvador | 11,372 | 6.1 |

| 🇲🇽 Mexico | 13,752 | 6.1 |

| 🇵🇱 Poland | 23,550 | 6.1 |

| 🇭🇺 Hungary | 24,126 | 6.1 |

| 🇲🇺 Mauritius | 27,456 | 6.1 |

| 🇰🇼 Kuwait | 28,698 | 6.1 |

| 🇭🇷 Croatia | 34,945 | 6.1 |

| 🇦🇷 Argentina | 2,157 | 6.0 |

| 🇭🇳 Honduras | 15,380 | 6.0 |

| 🇵🇹 Portugal | 61,306 | 6.0 |

| 🇯🇵 Japan | 122,980 | 6.0 |

| 🇵🇭 Philippines | 3,155 | 5.9 |

| 🇯🇲 Jamaica | 5,976 | 5.9 |

| 🇲🇩 Moldova | 7,577 | 5.9 |

| 🇹🇭 Thailand | 8,036 | 5.9 |

| 🇬🇷 Greece | 57,595 | 5.9 |

| 🇰🇷 South Korea | 89,671 | 5.9 |

| 🇰🇬 Kyrgyzstan | 2,238 | 5.8 |

| 🇲🇳 Mongolia | 2,546 | 5.8 |

| 🇨🇴 Colombia | 4,854 | 5.8 |

| 🇧🇾 Belarus | 12,168 | 5.8 |

| 🇧🇦 Bosnia and Herzegovina | 15,283 | 5.8 |

| 🇲🇾 Malaysia | 8,583 | 5.7 |

| 🇩🇴 Dominican Republic | 22,701 | 5.7 |

| 🇵🇾 Paraguay | 3,644 | 5.6 |

| 🇧🇴 Bolivia | 3,804 | 5.6 |

| 🇵🇪 Peru | 5,445 | 5.6 |

| 🇨🇳 China | 24,067 | 5.6 |

| 🇻🇳 Vietnam | 4,559 | 5.5 |

| 🇷🇺 Russia | 5,431 | 5.5 |

| 🇪🇨 Ecuador | 5,444 | 5.5 |

| 🇹🇲 Turkmenistan | 9,030 | 5.5 |

| 🇲🇪 Montenegro | 30,739 | 5.5 |

| 🇳🇵 Nepal | 1,437 | 5.4 |

| 🇹🇯 Tajikistan | 1,844 | 5.4 |

| 🇦🇲 Armenia | 9,411 | 5.4 |

| 🇧🇬 Bulgaria | 17,403 | 5.4 |

| 🇭🇰 Hong Kong SAR | 173,768 | 5.4 |

| 🇱🇾 Libya | 6,512 | 5.3 |

| 🇧🇩 Bangladesh | 3,062 | 5.2 |

| 🇿🇦 South Africa | 4,523 | 5.2 |

| 🇮🇩 Indonesia | 4,693 | 5.2 |

| 🇦🇿 Azerbaijan | 5,022 | 5.2 |

| 🇨🇮 Côte d'Ivoire | 6,621 | 5.2 |

| 🇦🇱 Albania | 15,363 | 5.2 |

| 🇲🇰 North Macedonia | 51,788 | 5.2 |

| 🇬🇲 The Gambia | 658 | 5.2 |

| 🇱🇷 Liberia | 1,464 | 5.1 |

| 🇱🇦 Laos | 1,610 | 5.1 |

| 🇩🇿 Algeria | 2,302 | 5.1 |

| 🇺🇦 Ukraine | 2,529 | 5.1 |

| 🇲🇦 Morocco | 3,874 | 5.1 |

| 🇨🇬 Congo | 582 | 5.1 |

| 🇸🇳 Senegal | 1,570 | 5.0 |

| 🇬🇪 Georgia | 4,223 | 5.0 |

| 🇬🇦 Gabon | 4,685 | 5.0 |

| 🇲🇿 Mozambique | 345 | 5.0 |

| 🇳🇪 Niger | 492 | 5.0 |

| 🇨🇲 Cameroon | 941 | 5.0 |

| 🇬🇭 Ghana | 2,198 | 4.9 |

| 🇮🇶 Iraq | 6,378 | 4.9 |

| 🇻🇪 Venezuela | 7,341 | 4.9 |

| 🇮🇷 Iran | 7,621 | 4.9 |

| 🇬🇳 Guinea | 938 | 4.9 |

| 🇹🇷 Turkey | 8,001 | 4.7 |

| 🇧🇫 Burkina Faso | 622 | 4.7 |

| 🇰🇲 Comoros | 1,466 | 4.6 |

| 🇳🇬 Nigeria | 1,474 | 4.6 |

| 🇰🇭 Cambodia | 2,031 | 4.6 |

| 🇺🇬 Uganda | 646 | 4.6 |

| 🇧🇯 Benin | 890 | 4.6 |

| 🇵🇰 Pakistan | 2,187 | 4.5 |

| 🇳🇦 Namibia | 3,677 | 4.5 |

| 🇰🇪 Kenya | 3,683 | 4.5 |

| 🇹🇳 Tunisia | 6,177 | 4.5 |

| 🇲🇱 Mali | 869 | 4.5 |

| 🇲🇲 Myanmar | 2,458 | 4.4 |

| 🇱🇰 Sri Lanka | 8,802 | 4.4 |

| 🇨🇩 DR Congo | 356 | 4.4 |

| 🇪🇬 Egypt | 6,329 | 4.3 |

| 🇹🇩 Chad | 355 | 4.3 |

| 🇲🇬 Madagascar | 666 | 4.3 |

| 🇲🇷 Mauritania | 1,037 | 4.2 |

| 🇾🇪 Yemen | 1,223 | 4.2 |

| 🇪🇹 Ethiopia | 1,527 | 4.2 |

| 🇯🇴 Jordan | 10,842 | 4.2 |

| 🇹🇬 Togo | 468 | 4.1 |

| 🇮🇳 India | 3,194 | 3.8 |

| 🇲🇼 Malawi | 606 | 3.8 |

| 🇿🇲 Zambia | 692 | 3.8 |

| 🇹🇿 Tanzania | 1,433 | 3.7 |

| 🇭🇹 Haiti | 193 | 3.6 |

| 🇸🇱 Sierra Leone | 370 | 3.6 |

| 🇧🇼 Botswana | 3,680 | 3.5 |

| 🇱🇸 Lesotho | 264 | 3.5 |

| 🇷🇼 Rwanda | 1,266 | 3.3 |

| 🇱🇧 Lebanon | 18,159 | 3.0 |

| 🇸🇸 South Sudan | 2,677 | 2.9 |

| 🇦🇫 Afghanistan | 734 | 2.4 |

While the results don’t definitively point to wealth contributing to happiness, there is a strong correlation across the board. Broadly speaking, the world’s poorest countries have the lowest happiness scores, and the richest report being the most happy.

Regional and Country-Level Observations

While many of the countries follow an obvious trend (more wealth = more happiness), there are nuances and outliers worth exploring.

- In Latin America, people self-report more happiness than the trend between wealth and happiness would predict.

- On the flip side, many nations in the Middle East report slightly less happiness than levels of wealth would predict.

- Political turmoil, an economic crisis, and the devastating explosion in Beirut have resulted in Lebanon scoring far worse than would be expected. Over the past decade, the country’s score has fallen by nearly two full points.

- Hong Kong has seen its happiness score sink for years now. Inequality, protests, instability, and now COVID-19 outbreaks have placed the region in an unusual zone on the chart: rich and unhappy.

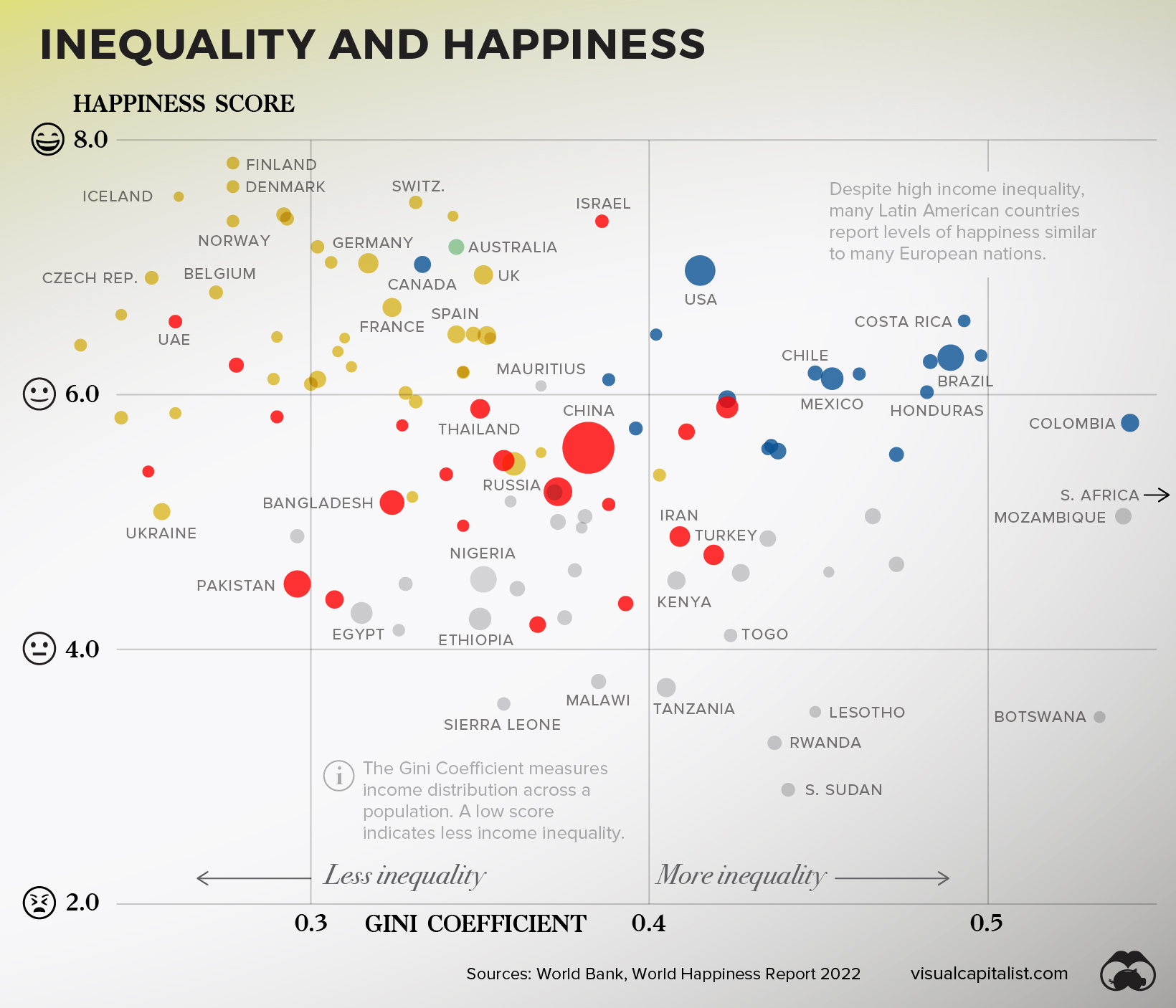

Examining Inequality and Happiness

We’ve looked at the relationship between wealth and happiness between countries, but what about within countries?

The Gini Coefficient is a tool that allows us to do just that. This measure looks at income distribution across a population, and applies a score to that population. Simply put, a score of 0 would be “perfect equality”, and 1 would be “perfect inequality” (i.e. an individual or group of recipients is receiving the entire income distribution).

Combined with the same happiness scale as before, this is how countries shape up.

While there is no ironclad conclusion that can be derived from this dataset, there are big picture observations worth highlighting.

The 15 Countries With Highest Income Inequality

| Countries with High inequality | Happiness Score | Gini Score |

|---|---|---|

| 🇿🇦 South Africa | 5.2 | 0.63 |

| 🇳🇦 Namibia | 4.5 | 0.59 |

| 🇿🇲 Zambia | 3.8 | 0.57 |

| 🇨🇴 Colombia | 5.8 | 0.54 |

| 🇲🇿 Mozambique | 5.0 | 0.54 |

| 🇧🇼 Botswana | 3.5 | 0.53 |

| 🇿🇼 Zimbabwe | 3.0 | 0.50 |

| 🇵🇦 Panama | 6.3 | 0.50 |

| 🇨🇷 Costa Rica | 6.6 | 0.49 |

| 🇧🇷 Brazil | 6.3 | 0.49 |

| 🇬🇹 Guatemala | 6.3 | 0.48 |

| 🇭🇳 Honduras | 6.0 | 0.48 |

| 🇧🇫 Burkina Faso | 4.7 | 0.47 |

| 🇪🇨 Ecuador | 5.5 | 0.47 |

| 🇨🇲 Cameroon | 5.0 | 0.47 |

| Average | 5.2 | 52 |

First, countries with lower income inequality tend to also report more happiness. The 15 countries in this dataset with the highest inequality (shown above) have an average happiness score 1.3 lower than the 15 countries with the lowest inequality (shown below).

The 15 Countries With Lowest Income Inequality

| Countries with low inequality | Happy Score | Gini Score |

|---|---|---|

| 🇸🇰 Slovakia | 6.4 | 23.2 |

| 🇧🇾 Belarus | 5.8 | 24.4 |

| 🇸🇮 Slovenia | 6.6 | 24.4 |

| 🇦🇲 Armenia | 5.4 | 25.2 |

| 🇨🇿 Czech Republic | 6.9 | 25.3 |

| 🇺🇦 Ukraine | 5.1 | 25.6 |

| 🇲🇩 Moldova | 5.9 | 26 |

| 🇦🇪 United Arab Emirates | 6.6 | 26 |

| 🇮🇸 Iceland | 7.6 | 26.1 |

| 🇧🇪 Belgium | 6.8 | 27.2 |

| 🇩🇰 Denmark | 7.6 | 27.7 |

| 🇫🇮 Finland | 7.8 | 27.7 |

| 🇳🇴 Norway | 7.4 | 27.7 |

| 🇰🇿 Kazakhstan | 6.2 | 27.8 |

| 🇭🇷 Croatia | 6.1 | 28.9 |

| Average | 6.5 | 26 |

Next, interesting regional differences emerge.

Despite high income inequality, many Latin American countries report levels of happiness similar to many much-wealthier European nations.

The Bottom Line

People have been seeking understanding on happiness for millennia now, and it’s unlikely that slicing and dicing datasets will crack the code. Still though, much like the pursuit of happiness, the pursuit of understanding is human nature.

And, in more concrete terms, the more policymakers and the public understand the link between wealth and happiness, the more likely we can shape societies that give us a better chance at living a happy life.

Where does this data come from?

Source: Credit Suisse Global Wealth Databook 2021, World Happiness Report 2022, World Bank

Data notes: This visualization includes countries that had available data for both happiness and wealth per adult. Credit Suisse notes that due to incomplete data, the following countries are estimates of average wealth per adult: North Macedonia, Kosovo, Guatemala, Dominican Republic, Honduras, Uzbekistan, Côte d’Ivoire, and South Sudan. Happiness data for countries is from the 2022 report, with the exception of: Qatar, DRC, Haiti, and South Sudan, which pull from the 2019 report. For Gini Coefficient calculations, only countries with data from 2014 onward were included. As a result, major economies such as India and Japan are excluded from that visualization.

Chart note: The wealth axis was plotted logarithmically to better show the trend visually. This approach is often used when a small number of results skew the visualization, making it harder to glean insight from. In this case, there are large extremes between the richest and poorest countries around the world.

Money

Charted: Which City Has the Most Billionaires in 2024?

Just two countries account for half of the top 20 cities with the most billionaires. And the majority of the other half are found in Asia.

Charted: Which Country Has the Most Billionaires in 2024?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Some cities seem to attract the rich. Take New York City for example, which has 340,000 high-net-worth residents with investable assets of more than $1 million.

But there’s a vast difference between being a millionaire and a billionaire. So where do the richest of them all live?

Using data from the Hurun Global Rich List 2024, we rank the top 20 cities with the highest number of billionaires in 2024.

A caveat to these rich lists: sources often vary on figures and exact rankings. For example, in last year’s reports, Forbes had New York as the city with the most billionaires, while the Hurun Global Rich List placed Beijing at the top spot.

Ranked: Top 20 Cities with the Most Billionaires in 2024

The Chinese economy’s doldrums over the course of the past year have affected its ultra-wealthy residents in key cities.

Beijing, the city with the most billionaires in 2023, has not only ceded its spot to New York, but has dropped to #4, overtaken by London and Mumbai.

| Rank | City | Billionaires | Rank Change YoY |

|---|---|---|---|

| 1 | 🇺🇸 New York | 119 | +1 |

| 2 | 🇬🇧 London | 97 | +3 |

| 3 | 🇮🇳 Mumbai | 92 | +4 |

| 4 | 🇨🇳 Beijing | 91 | -3 |

| 5 | 🇨🇳 Shanghai | 87 | -2 |

| 6 | 🇨🇳 Shenzhen | 84 | -2 |

| 7 | 🇭🇰 Hong Kong | 65 | -1 |

| 8 | 🇷🇺 Moscow | 59 | No Change |

| 9 | 🇮🇳 New Delhi | 57 | +6 |

| 10 | 🇺🇸 San Francisco | 52 | No Change |

| 11 | 🇹🇭 Bangkok | 49 | +2 |

| 12 | 🇹🇼 Taipei | 45 | +2 |

| 13 | 🇫🇷 Paris | 44 | -2 |

| 14 | 🇨🇳 Hangzhou | 43 | -5 |

| 15 | 🇸🇬 Singapore | 42 | New to Top 20 |

| 16 | 🇨🇳 Guangzhou | 39 | -4 |

| 17T | 🇮🇩 Jakarta | 37 | +1 |

| 17T | 🇧🇷 Sao Paulo | 37 | No Change |

| 19T | 🇺🇸 Los Angeles | 31 | No Change |

| 19T | 🇰🇷 Seoul | 31 | -3 |

In fact all Chinese cities on the top 20 list have lost billionaires between 2023–24. Consequently, they’ve all lost ranking spots as well, with Hangzhou seeing the biggest slide (-5) in the top 20.

Where China lost, all other Asian cities—except Seoul—in the top 20 have gained ranks. Indian cities lead the way, with New Delhi (+6) and Mumbai (+3) having climbed the most.

At a country level, China and the U.S combine to make up half of the cities in the top 20. They are also home to about half of the world’s 3,200 billionaire population.

In other news of note: Hurun officially counts Taylor Swift as a billionaire, estimating her net worth at $1.2 billion.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)