Globalization

An Investing Megatrend: How Emerging Wealth is Shaping the Future

Globalisation is a rising tide that lifts all boats.

In an increasingly connected world, countries are engaging with global markets more than ever before. As a result, global wealth is shifting towards emerging markets. This megatrend—a global trend with sustained impacts—is profoundly influencing everyday life, society, and business.

Shifting Economic Power

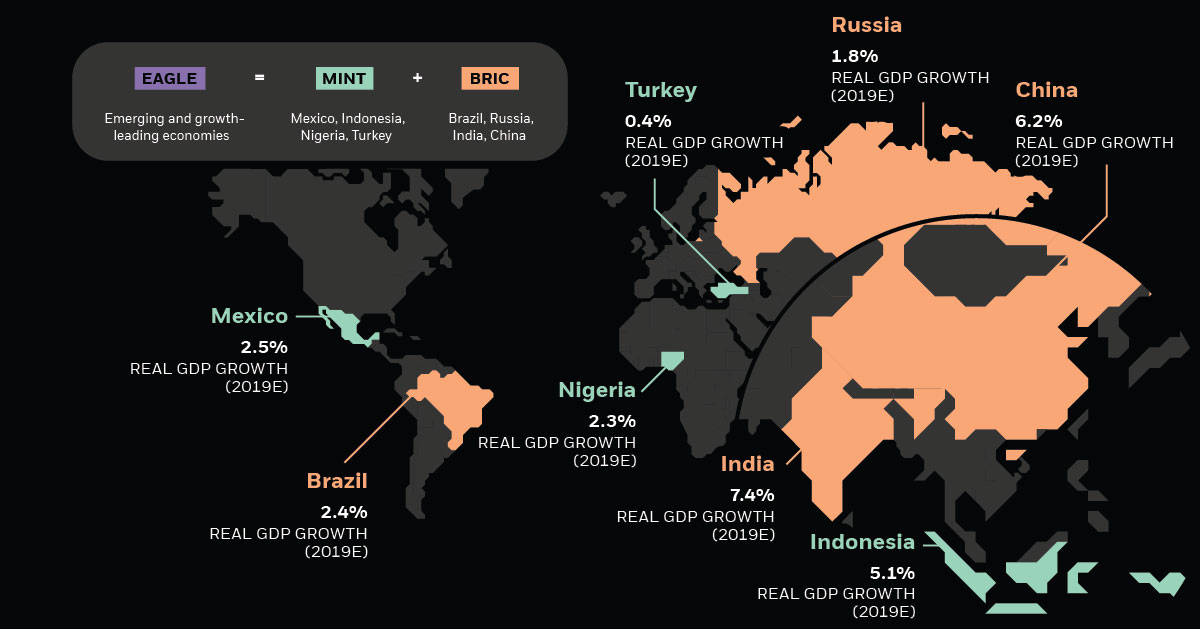

Today’s infographic from iShares by BlackRock explains how emerging markets are classified, along with which countries are growing the fastest—and how investors can follow the money.

What Is An Emerging Market?

Every economy goes through five distinct stages of growth:

- Traditional Society: Based on primary industries, such as subsistence farming.

- The Pre-Conditions of Take-off: Spread of technology creates a more productive agricultural economy.

- Take-off: Industrialisation begins, and technological breakthroughs occur.

- Drive to Maturity: More complex manufacturing, and large-scale infrastructure investment takes place.

- Age of Mass Consumption: Urban society and a tertiary industry dominate, as disposable income grows.

- Pro: Greater return potential, growing middle class, increasing consumption

- Risk: Political instability, lack of infrastructure, lack of market access

Emerging markets fall into the transitory stages between ‘Take-off’ and ‘Drive to maturity’ as their economies modernise. Today, such countries offer lots of promise, but also come with a range of challenges:

Between 2000–2018, emerging markets’ share of global wealth has more than doubled from 10% to 24%. China is a major player in this transformation.

China’s Economic Might

China’s impressive trajectory from agricultural economy to global superpower cannot be ignored. The nation is on track to overtake the U.S. in terms of gross domestic product (GDP, nominal) by the year 2030.

| Year | 🇨🇳 China GDP | 🇺🇸 U.S. GDP |

|---|---|---|

| 2000 | $2.2T | $12.6T |

| 2010 | $6.1T | $15T |

| 2018 | $10.8T | $17.8T |

| 2020E | $16T | $20.2T |

| 2030E | $26.5T | $23.5T |

| 2040E | $36.6T | $28.3T |

| 2050E | $50T | $34.1T |

China’s enormous growth has a ripple effect on its GDP composition. A more affluent middle class is buying higher-priced discretionary goods—such as cars and electronics—boosting the country’s domestic consumption.

Investors must keep an eye out for other emerging markets that are emulating China’s example.

One Piece Of the Puzzle

China is just one case study—several other economies are also making strides on the world stage. Each country brings unique advantages, but also barriers to overcome.

| Country | Real GDP Growth (2019E) | Strengths | Weaknesses |

|---|---|---|---|

| 🇮🇳 India | 7.4% | ✔ Rapidly growing economy ✔ Vast working-age population | ✘ Red tape ✘ Lack of infrastructure |

| 🇨🇳 China | 6.2% | ✔ Good infrastructure ✔ High R&D spending | ✘ Ageing population ✘ High debt |

| 🇮🇩 Indonesia | 5.1% | ✔ Cheap labour ✔ Diversifying economy | ✘Wide income gap ✘ Lack of infrastructure |

| 🇲🇽 Mexico | 2.5% | ✔ Integrated with global economy ✔ Cheap and qualified labour | ✘ Political unrest ✘ Reliant on U.S. ties |

| 🇧🇷 Brazil | 2.4% | ✔ Diversifying economy ✔ Strategic location | ✘ High production costs ✘ Inflation |

| 🇳🇬 Nigeria | 2.3% | ✔ High FDI ✔ Diversifying economy | ✘ Political unrest ✘ Lack of infrastructure |

| 🇷🇺 Russia | 1.8% | ✔ Natural resources ✔ Educated workforce | ✘ Political unrest ✘ Lack of FDI |

| 🇹🇷 Turkey | 0.4% | ✔ Cheap labour ✔ Strategic location | ✘ Political unrest ✘ Red tape |

Source: Global Finance Magazine

With these major emerging markets in mind, how can investors tap into the global wealth shift?

Where Are the Opportunities?

There are several avenues for an investor to play into this megatrend: structural solutions, consumer goods, and international investment.

Structural solutions

Emerging markets are increasingly gaining access to technology. Growth in connectivity is closely linked with improved productivity, and many countries are ripe for a surge in online users.

However, much can still be done to speed up technological adoption, such as boosting 3G/4G network volume and coverage, and lowering the cost of data and smartphones to be more economical.

By helping solve some of these structural constraints through technological innovation, investors can tap into the economic growth of emerging markets.

Consumer goods

As disposable income increases, a sizeable middle class will seek out products that elevate the quality of life. In India, domestic consumption is estimated to hit $6 trillion by 2023—four times its 2018 level.

The region’s spending will likely be propelled by higher-priced goods, as well as a wider variety of choices across food, transport, and fitness categories.

Global brands that plan to expand into emerging markets, or companies with a proven track record in these areas, are potential winners for investment.

International investment

Last but not least, investors can identify local winners in emerging wealth markets, through active or passive investing.

An active investment strategy would be to directly buy into individual company stocks, listed on a country’s stock exchange. Meanwhile, a passive investing strategy would be to seek out exchange-traded funds (ETFs) covering specific markets, and/or sectors within emerging markets. Many of these are also listed on major exchanges.

Diversifying either or both strategies across two or more countries can help mitigate risk. Investors can also choose index funds that broadly encompass all emerging markets.

As countries climb the economic ladder, the emerging wealth shift continues to gain momentum. By staying attuned to these macro changes, investors may unlock long-term growth from emerging markets.

Politics

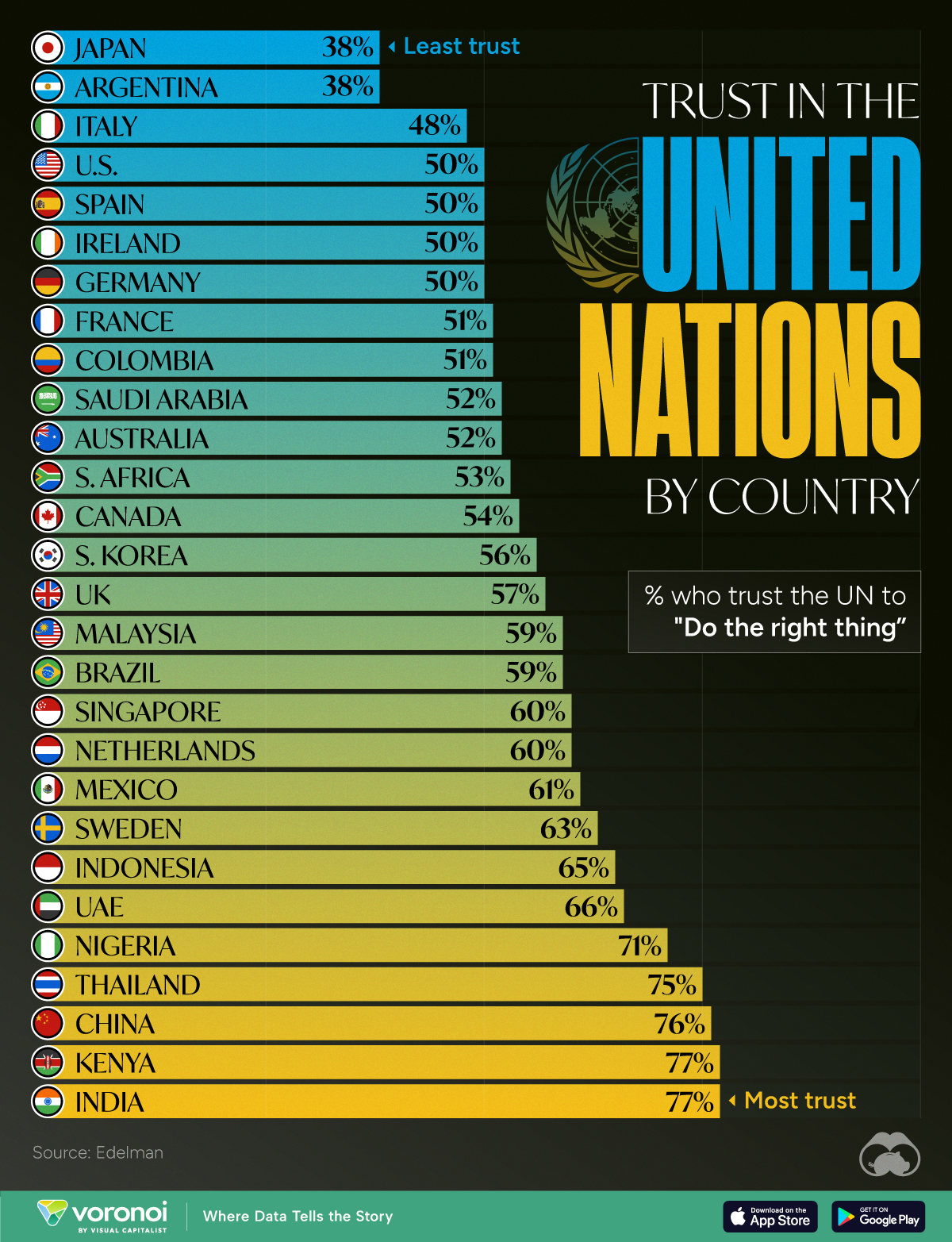

Charted: How Much Do Countries Trust the United Nations?

Which countries trust the United Nations to do the right thing the most, and the least?

How Much Do Countries Trust the United Nations?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Do you trust the United Nations (UN) in carrying out its objectives of maintaining peace and security, protecting human rights, and upholding international law?

Survey results from Edelman’s 2024 Trust Barometer Global Report show that some countries’ citizens believe strongly in the UN to “do the right thing,” while others are less trusting.

Ranked: 28 Countries Trust Levels in the United Nations in 2024

To gauge trust in the United Nations, Edelman surveyed more than 32,000 respondents between 28 countries in November 2023. Each country sample of 1,150 people is statistically significant and representative.

According to the results, respondents from Japan and Argentina had the least amount of trust in the UN when it came to “doing the right thing.”

| Country | % who trust the UN to "Do the right thing" |

|---|---|

| 🇯🇵 Japan | 38% |

| 🇦🇷 Argentina | 38% |

| 🇮🇹 Italy | 48% |

| 🇺🇸 U.S. | 50% |

| 🇪🇸 Spain | 50% |

| 🇮🇪 Ireland | 50% |

| 🇩🇪 Germany | 50% |

| 🇫🇷 France | 51% |

| 🇨🇴 Colombia | 51% |

| 🇸🇦 Saudi Arabia | 52% |

| 🇦🇺 Australia | 52% |

| 🇿🇦 South Africa | 53% |

| 🇨🇦 Canada | 54% |

| 🇰🇷 South Korea | 56% |

| 🇬🇧 UK | 57% |

| 🇲🇾 Malaysia | 59% |

| 🇧🇷 Brazil | 59% |

| 🇸🇬 Singapore | 60% |

| 🇳🇱 Netherlands | 60% |

| 🇲🇽 Mexico | 61% |

| 🇸🇪 Sweden | 63% |

| 🇮🇩 Indonesia | 65% |

| 🇦🇪 UAE | 66% |

| 🇳🇬 Nigeria | 71% |

| 🇹🇭 Thailand | 75% |

| 🇨🇳 China | 76% |

| 🇰🇪 Kenya | 77% |

| 🇮🇳 India | 77% |

Just 38% of Japanese and Argentinian people had faith in the UN, by far the lowest levels of trust. Only one other country was below the 50% trust mark: Italy at 48%.

Many major economies and G7 countries had trust levels hovering between 50–60%, including the U.S. and Germany at 50% and the UK at 57%.

Meanwhile, India and Kenya had the highest levels of trust in the UN at 77%, with China right behind at 76%. In general, African and Asian nations tended to have higher levels of trust in the UN, though there were exceptions like South Africa (53%) and South Korea (56%)

It’s also worth noting that views within countries can differ significantly. Separate data on this topic from Pew Research shows that public opinion of the UN is split along ideological lines. In the U.S., there’s a 45 percentage point difference, with more conservative respondents having significantly lower trust in the UN.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees