Technology

Visualizing the Social Media Universe in 2020

Visualizing the Social Media Universe in 2020

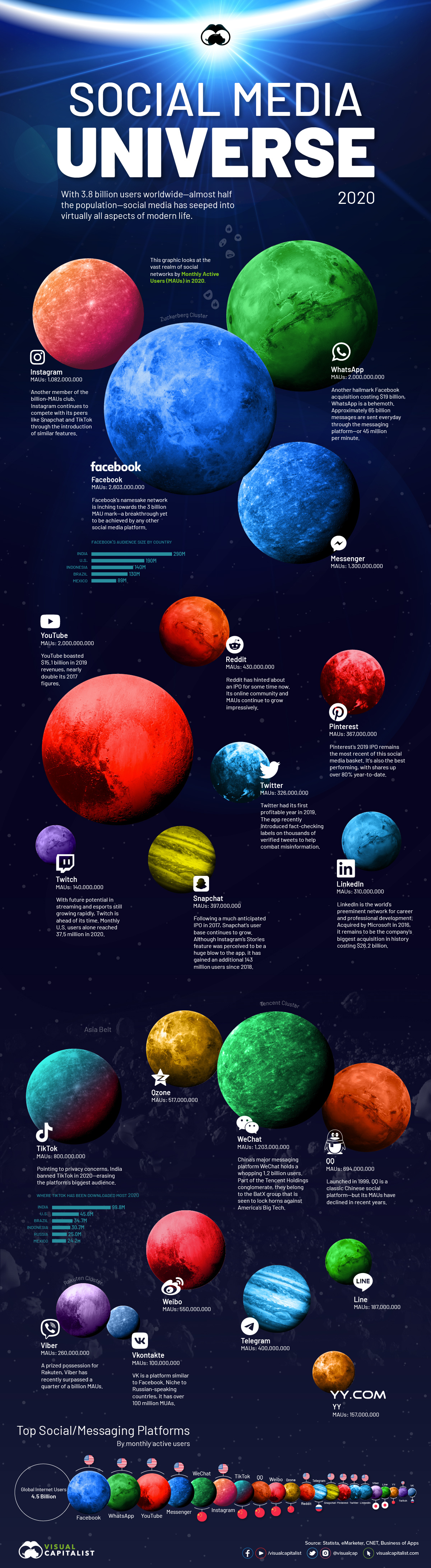

Social media has seeped into virtually all aspects of modern life. The vast social media universe collectively now holds 3.8 billion users, representing roughly 50% of the global population.

With an additional billion internet users projected to come online in the coming years, it’s possible that the social media universe could expand even further.

How the Networks Stack Up

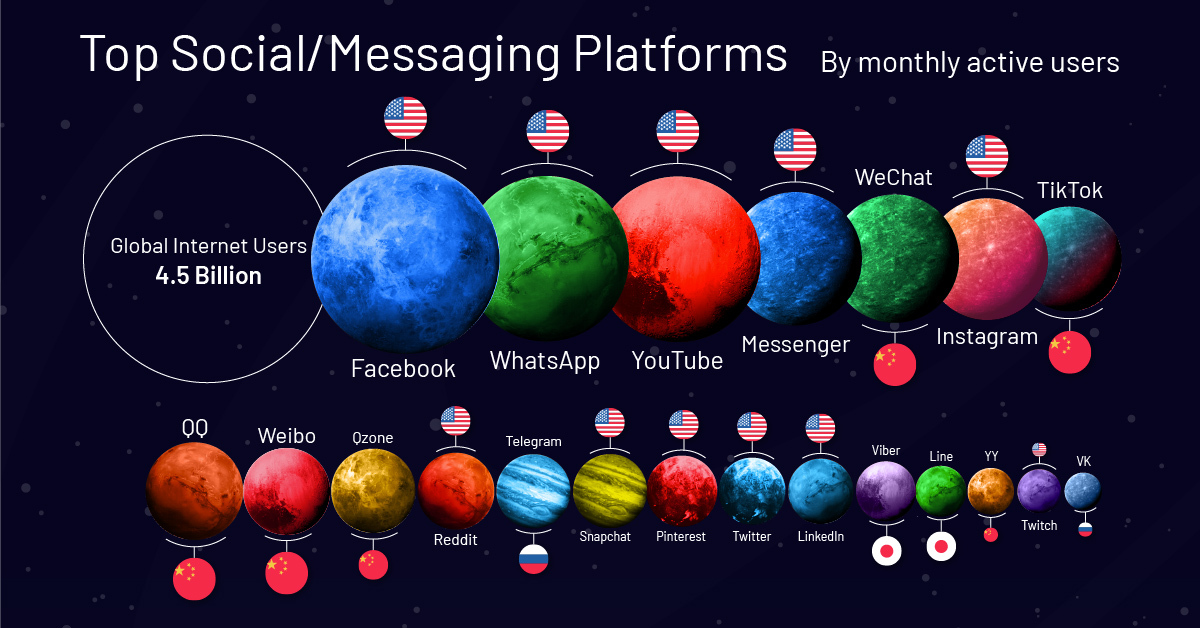

To begin, let’s take a look at how social networks compare in terms of monthly active users (MAUs)—an industry metric widely used to gauge the success of these platforms.

| Rank | Social Network | MAUs In Millions | Country of Origin |

|---|---|---|---|

| #1 | 2,603 | 🇺🇲 U.S. | |

| #2 | 2,000 | 🇺🇲 U.S. | |

| #3 | YouTube | 2,000 | 🇺🇲 U.S. |

| #4 | Messenger | 1,300 | 🇺🇲 U.S. |

| #5 | 1,203 | 🇨🇳 China | |

| #6 | 1,082 | 🇺🇲 U.S. | |

| #7 | TikTok | 800 | 🇨🇳 China |

| #8 | 694 | 🇨🇳 China | |

| #9 | 550 | 🇨🇳 China | |

| #10 | Qzone | 517 | 🇨🇳 China |

| #11 | 430 | 🇺🇲 U.S. | |

| #12 | Telegram | 400 | 🇷🇺 Russia |

| #13 | Snapchat | 397 | 🇺🇲 U.S. |

| #14 | 367 | 🇺🇲 U.S. | |

| #15 | 326 | 🇺🇲 U.S. | |

| #16 | 310 | 🇺🇲 U.S. | |

| #17 | Viber | 260 | 🇯🇵 Japan |

| #18 | Line | 187 | 🇯🇵 Japan |

| #19 | YY | 157 | 🇨🇳 China |

| #20 | Twitch | 140 | 🇺🇲 U.S. |

| #21 | Vkontakte | 100 | 🇷🇺 Russia |

Here’s a closer look at individual social platforms, and their trials and tribulations:

To put it mildly, Facebook has had its hands full. A flurry of companies are boycotting Facebook’s ads, while the platform struggles to fend off the spread of misinformation.

Yet, its stock price continues to advance to new highs while the traditional economy faces less than rosy forecasts. Facebook still possesses the largest cohort of users, inching closer to the 3 billion MAU mark—a breakthrough yet to be achieved by any company.

Snapchat

Snapchat and founder Evan Spiegel have had a bumpy road since their IPO in 2017. The stock price reached its nadir near $4 in 2018, reflecting investor concerns tied to the introduction of Instagram Stories. In recent times, the stock has advanced past the $20 mark, although there is still long-term unclarity around monetization and profitability.

YouTube

YouTube competes head on against traditional television and streaming programs for eyeballs. The platform raked in revenues of $15.1 billion in 2019, nearly double their figures in 2017.

Parent company Alphabet has invested in YouTube with new rollouts like YouTube Music (merged with what was once Google Music) and YouTube Premium—a bundled subscription-based platform providing music, ad-free content, and YouTube Originals. By the looks of it, the future of YouTube will be much more than just videos.

The biggest social platform in China, WeChat has flourished, now holding a whopping 1.2 billion MAUs. As part of the Tencent Holdings conglomerate, they belong to the BATX group that is seen to lock horns with America’s Big Tech.

There have been whispers of a Reddit IPO on Wall Street for some time now. While such an event has not yet materialized, Reddit’s success certainly has. With 430 million MAUs relative to 330 million in 2018, the company continues to attract a larger audience. The notion of community has taken on a different meaning in the digital age, and Reddit represents this transition with their ever-growing network of users.

Instagram has been vital to Facebook’s success, since its $1 billion acquisition in 2012. The platform attracts a younger audience compared to Facebook and it has demonstrated an ability to remain versatile, specifically by implementing Instagram Stories and Reels.

Busy schedules don’t seem to faze Jack Dorsey who has not one, but two CEO jobs in Twitter and Square. Twitter has been able to achieve profitability in the last two years, reporting net income figures of $1.2 and $1.5 billion in 2018 and 2019 respectively. They no doubt have their work cut out for them as they continue to combat fake news and similar controversies on their platform.

TikTok

If any publicity is good publicity, then 2020 has been TikTok’s year. Headlines include privacy breaches with alleged ties to the Chinese Communist Party, a banning of the app by India Prime Minister Narendra Modi, and now, talks of a partial U.S. acquisition. Potential acquirers include leaders Microsoft, Twitter, and Oracle.

Social Media Under Trial?

Despite the list of headwinds social media has faced, about half of the world is now on it—and there seems to be no end in sight for future growth.

How have companies with exposure to the social media universe fared in 2020 so far?

| Companies With Exposure To Social Media | YTD Price Returns |

|---|---|

| 83% | |

| Tencent Holdings | 43% |

| Snapchat | 32% |

| 30% | |

| 22% | |

| Alphabet | 17% |

Widespread participation in social media comes with its fair set of problems. Some companies such as Facebook have found themselves in the crosshairs on both sides of the political spectrum. As concerns grow around privacy and data, social media will be front and center in shaping the future of government, business, and politics.

Only time will tell just how high user counts will reach. The long-term trajectory suggests there’s more room left in the engine. There are still parts of the world that are just beginning to possess the technological infrastructure for social media to be a possibility. It’s plausible future growth will come from that avenue.

If stock prices of companies linked to social media are of relevance, their performance this year paired with the fact that they are trading near all-time highs supports such a growth thesis.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001