Technology

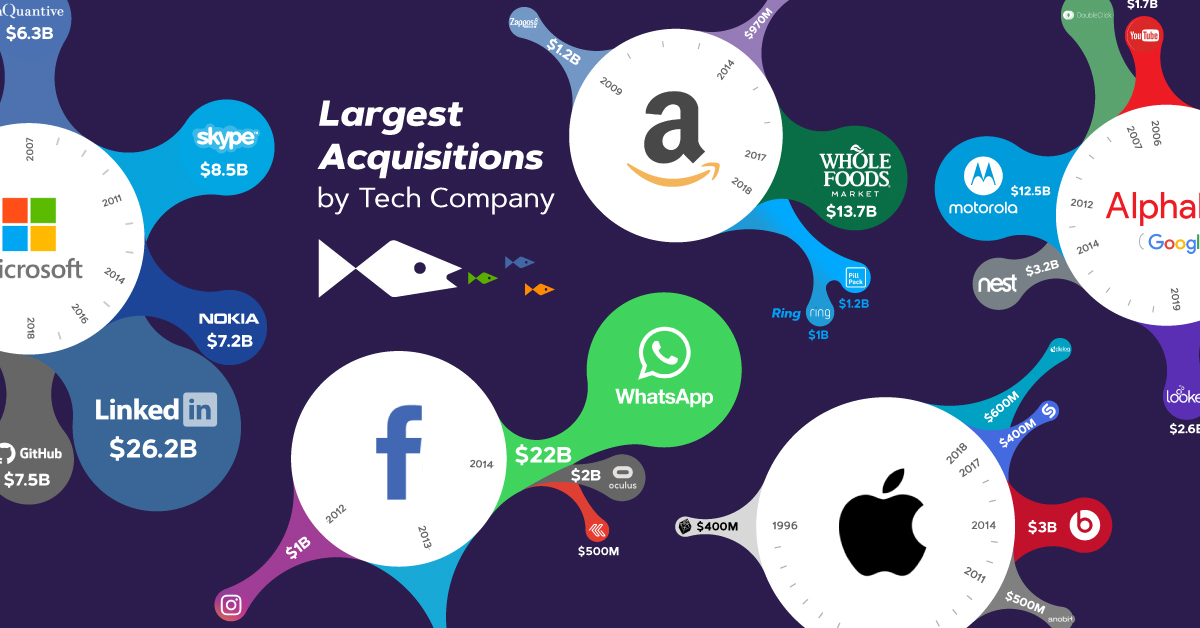

The Big Five: Largest Acquisitions by Tech Company

The Big Five: Largest Acquisitions by Tech Company

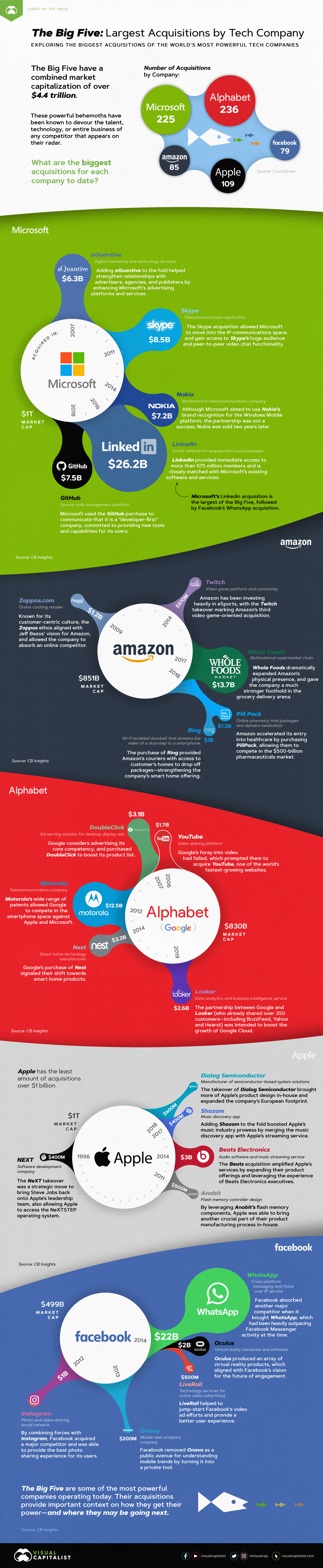

The Big Five tech giants, or “FAAMG”—Facebook, Amazon, Apple, Microsoft, and Google (Alphabet)—have a combined market capitalization of over $4 trillion.

These powerful tech behemoths often devour the talent, technology, or entire businesses of aspiring competitors. Given their financial weight, mergers and acquisitions have become a key tactic in maintaining their strong grip on tech supremacy.

Today’s Chart of the Week explores the world’s most powerful tech companies and their biggest acquisitions to date.

Which Acquisitions Were a Success?

While these tech giants may have had big aspirations for these exceedingly large deals, they have mixed success rates.

Microsoft

Microsoft made its big move 2016 to buy LinkedIn for $26.2 billion, and it’s the most sizable acquisition by any of the Big Five tech companies.

Microsoft’s 5 Biggest Acquisitions:

| Acquisition (Year) | Amount | Category |

|---|---|---|

| LinkedIn (2016) | $26.2 billion | Social Media |

| Skype (2011) | $8.5 billion | Telecommunications |

| GitHub (2018) | $7.5 billion | Software |

| Nokia (2014) | $7.2 billion | Telecommunications |

| aQuantive (2007) | $6.3 billion | Marketing |

The LinkedIn deal was made due to the synergy between the two companies’ offerings, and Microsoft’s desire to gain access to LinkedIn’s 575 million members.

However, not all of Microsoft’s acquisitions have been as successful, such as its 2014 purchase of Nokia’s Devices & Services business for $7.2 billion. This seemed like a smart move at the time, considering the Finnish company held 41% of the global handset market.

Yet, Microsoft sold the asset for a mere $350 million just two years later. Microsoft shifted its strategy and exited the feature phone market, choosing to focus on a narrow, niche market for their hardware.

Amazon

Amazon has closed more than $20 billion in acquisitions and investments since 2017. This includes the purchase of Whole Foods, which Amazon bought for $13.7 billion, and is the company’s largest acquisition to date.

Amazon’s 5 Biggest Acquisitions:

| Acquisition (Year) | Amount | Category |

|---|---|---|

| Whole Foods (2017) | $13.7 billion | Retail |

| Zappos (2009) | $1.2 billion | Retail |

| Ring (2018) | $1.2 billion | Technology |

| PillPack (2018) | $1 billion | Pharmaceuticals |

| Twitch (2014) | $970 million | Social Media |

From purchases to bolster the AI of smart assistant Alexa, to Wi-Fi enabled doorbell Ring, recent additions clearly show the company intends to cement its presence in people’s homes.

After acquiring Whole Foods, Amazon began offering store discounts to Prime customers, in an attempt to bundle its home offerings and provide a more holistic customer experience.

Alphabet

Alphabet has made several daring moves into the hardware and data science sectors. The company’s biggest acquisition was Motorola, which it bought in 2012 for $12.5 billion.

Alphabet’s 5 Biggest Acquisitions:

| Acquisition (Year) | Amount | Category |

|---|---|---|

| Motorola (2012) | $12.5 billion | Telecommunications |

| Nest (2014) | $3.2 billion | Technology |

| DoubleClick (2007) | $3.1 billion | Marketing |

| Looker (2019) | $2.6 billion | Software |

| YouTube (2006) | $1.7 billion | Social Media |

However, the purchase of Motorola was a bet that didn’t pay off. Alphabet sold off much of Motorola’s assets for less than $3 billion in 2014, a little less than two years after it had originally acquired it.

Alphabet continues to consolidate its acquisitions in order to simplify its organizational structure. DoubleClick, acquired in 2007, merged with Google Analytics 360 Suite under the Google Marketing Platform—making it easier for marketers to access their metrics using one platform.

Apple

Out of the Big Five companies, Apple has the fewest acquisitions over $1 billion. Its largest purchase was for Beats Electronics, which it acquired for $3 billion in 2014.

Apple’s 5 Biggest Acquisitions

| Acquisition (Year) | Amount | Category |

|---|---|---|

| Beats (2014) | $3 billion | Music |

| Dialog Semiconductor (2018) | $600 million | Manufacturing |

| Anobit (2011) | $500 million | Manufacturing |

| Shazam (2017) | $400 million | Music |

| NeXT Computer (1996) | $400 million | Technology |

Apple’s increasing music streaming efforts have been evident, with the acquisition of Shazam three years after it purchased Beats Electronics.

In an intriguing recent turn of events, Apple recently announced it will acquire the majority of Intel’s smartphone modem business. This $1 billion deal will allow Apple to build all of its devices in-house, and better prepare the iPhone for the upcoming 5G push.

Facebook’s largest acquisition has been WhatsApp Messenger, which it purchased for $22 billion in 2014. The WhatsApp acquisition is the second largest of the Big Five, following Microsoft’s LinkedIn purchase.

Facebook’s 5 Biggest Acquisitions:

| Acquisition (Year) | Amount | Category |

|---|---|---|

| WhatsApp (2014) | $22 billion | Social Media |

| Oculus (2014) | $2 billion | Technology |

| Instagram (2012) | $1 billion | Social Media |

| LiveRail (2014) | $500 million | Marketing |

| Onavo (2013) | $200 million | Analytics |

Aside from absorbing any competitors who encroach on Facebook’s turf—such as WhatsApp and Instagram—Facebook’s takeovers have been aimed at venturing into uncharted territory. The acquisition of virtual reality manufacturer, Oculus, is evidence of Facebook’s bet on virtual reality as the future of engagement.

“After games, we’re going to make Oculus a platform for many other experiences. Imagine enjoying a court side seat at a game, or studying in a classroom of students and teachers all over the world —just by putting on goggles in your home.”

—Mark Zuckerberg

Predicting the Next Shift

The Big Five are some of the most influential companies in the world today.

Beyond rapidly reshaping the global tech landscape, these acquisitions provide important context on how tech companies consolidate power—and, more importantly, what will fuel their next phase of growth.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees