Technology

Mapped: Cryptocurrency Regulations Around the World

Mapped: Cryptocurrency Regulations Around the World

Following the unprecedented cryptocurrency boom in 2017, investors and governments alike could no longer ignore the growth of decentralized finance.

The world has become increasingly fascinated with cryptocurrencies and the ways they are enabling greater access, such as being able to send funds to remote places or securing capital for small businesses.

To aid this, cryptocurrency regulations are being slowly introduced into global financial markets. Regulations help to monitor these emerging digital currencies, and to allow for clearer guidelines and a measure of security.

The Regulatory Landscape

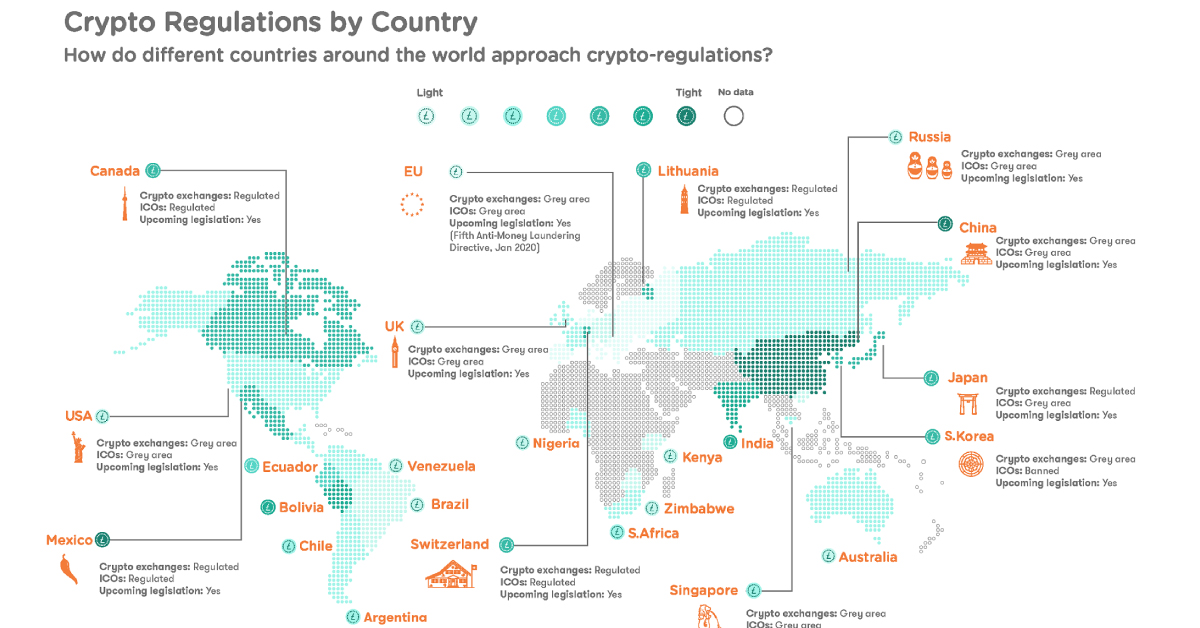

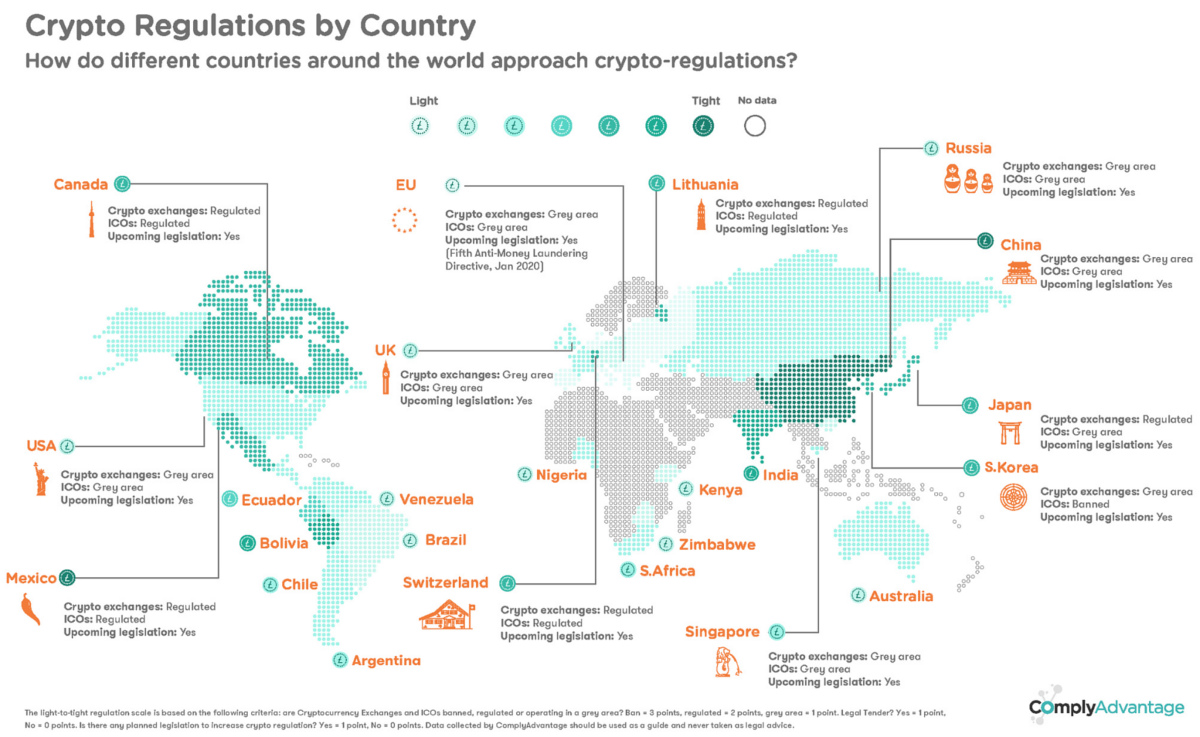

Today’s graphic from ComplyAdvantage maps out major regulatory cryptocurrency and exchange landscapes around the world, showing how sentiments towards digital currencies are evolving.

To do this, ComplyAdvantage measured cryptocurrency regulatory environments using their own Light-to-Tight scale, based on the following criteria:

- Cryptocurrencies and exchanges status? (Ban = 3 points, Regulated = 2 points, Grey Area = 1 point)

- Cryptocurrency considered legal tender? (Yes = 1 point, No = 0 points)

- Planned legislation to increase crypto regulation? (Yes = 1 point, No = 0 points)

Which jurisdictions have the strictest and most relaxed regulations for cryptocurrencies?

Regulations by Region

Global attitudes towards the rise of cryptocurrencies have shifted greatly over the past few years. While the term cryptocurrency is a bit of a misnomer, some countries do consider digital currencies legal tender, with many viewing cryptocurrencies as commodities.

Below is a table of the major countries that are pursuing cryptocurrency regulations:

| Country | Cryptocurrencies | Exchanges | Initial Coin Offerings (ICOs) |

|---|---|---|---|

| Australia | Legal; treated as property | Legal, must register with AUSTRAC | Regulated |

| Switzerland | Legal; generally accepted as payment | Legal, regulated by SFTA | Regulated |

| Malta | Not legal tender | Legal, regulated under the VFA Act | Regulated |

| Estonia | Not legal tender | Legal, must register with the Financial Intelligence Unit | Regulated |

| Gibraltar | Not legal tender | Legal, must register with the GFSC | Regulated |

| Luxembourg | Not legal tender | Legal, must register with the CSSF | Regulated |

| Canada | Not legal tender; some retailers accept as payment | Legal, regulation varies by province; final federal regulations expected late 2019 | Regulated |

| Mexico | Legal, accepted as payment in some contexts | Grey area; first crypto exchange in opened mid 2019 | Regulated |

| Lithuania | Not legal tender | Legal, must register with the Lithuanian Finance Ministry | Grey area |

| United States | Not legal tender; some retailers accept as payment | Legal, regulation varies by state; SEC expected to publish updated crypto regulations late 2019 | Grey area |

| UK | Not legal tender; considered assets | Legal, registration requirements with FCA | Grey area |

| Russia | Not legal tender | Grey area; regulations to be determined by the end of 2019 | Grey area |

| Japan | Legal; treated as property | Legal, must register with the Financial Services Agency | Grey area |

| Nigeria | Legal | Grey area; regulations upcoming from Central Bank of Nigeria | Grey area |

| Singapore | Not legal tender | Legal, no registration required | Grey area |

| South Korea | Not legal tender | Legal and regulated, must register with FSS | Banned |

| India | Not legal tender; digital rupee may be in the works | Effectively illegal, but global and federal regulations being considered | Banned |

| China | Bitcoin considered property; all other cryptocurrencies banned | Illegal, but a global regulatory framework being considered | Banned |

Sources: ComplyAdvantage, HedgeTrade, CoinDesk

Asia

Japan has one of the most progressive regulatory climates for cryptocurrencies, widely considering bitcoin as legal tender and passing a law in mid-2017 recognizing cryptocurrencies as legal property. In late 2018, Japan also approved self-regulation for the crypto industry.

By contrast, China currently has one of the most restrictive environments in the world for cryptocurrency. China banned bitcoin transactions in 2013, as well as ICOs and crypto exchanges in 2017─though many have found workarounds through sites not yet firewalled.

Europe

Cryptocurrency and exchange regulations in the EU are determined by individual member states, and are considered legal across the bloc.

Digital currency offers great promise, through its ability to reach people and businesses in remote and marginalized regions.

—Christine Lagarde, Managing Director of IMF

Perhaps unsurprisingly, Switzerland has one of the most open climates for cryptocurrencies and exchanges in Europe. In 2016, the city of Zug, known as “Crypto Valley”, started accepting bitcoin as payment for city fees. Swiss Economics Minister Johann Schneider-Ammann announced his goal in 2018 to make Switzerland the world’s first “crypto-nation”.

North America

Both Canada and the U.S. take a similar approach to cryptocurrency legislation at the federal level, as both countries view cryptocurrencies as securities. However, provincial and state regulations differ widely in their taxation requirements of profits from crypto investments.

Latin America

Regulations throughout Latin and South America run the full legislative spectrum.

- Bolivia: unilateral ban on cryptocurrencies and exchanges

- Ecuador: the first country to launch its own token; ban on all cryptocurrencies aside from its government-issued SDE token (Sistema de Dinero Electrónico = electronic money system)

- Mexico, Argentina, Brazil, Chile: cryptocurrencies widely accepted as payment

- Venezuela: cryptocurrencies widely accepted; this makes sense, considering the economic crisis and subsequent freefall of the bolívar

The Importance of Cryptocurrency Regulations

Cryptocurrency’s journey is the story of a technology rapidly outpacing the laws that govern it.

Governments around the world are keenly aware of this problem. Members of the G20 published a request in June 2019 for a global regulatory framework for cryptocurrencies to be implemented to better manage the benefits and challenges that cryptocurrencies bring.

Regulation for both cryptocurrencies and crypto exchanges is essential for the future of digital finance─bringing legitimacy to the digital financial market, and making it more attractive for new businesses, established banks, and investors worldwide to more easily conduct business within this emerging ecosystem.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees