Technology

The World’s Largest Corporate Holders of Bitcoin

![]() See this visualization first on the Voronoi app.

See this visualization first on the Voronoi app.

The World’s Largest Corporate Holders of Bitcoin

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

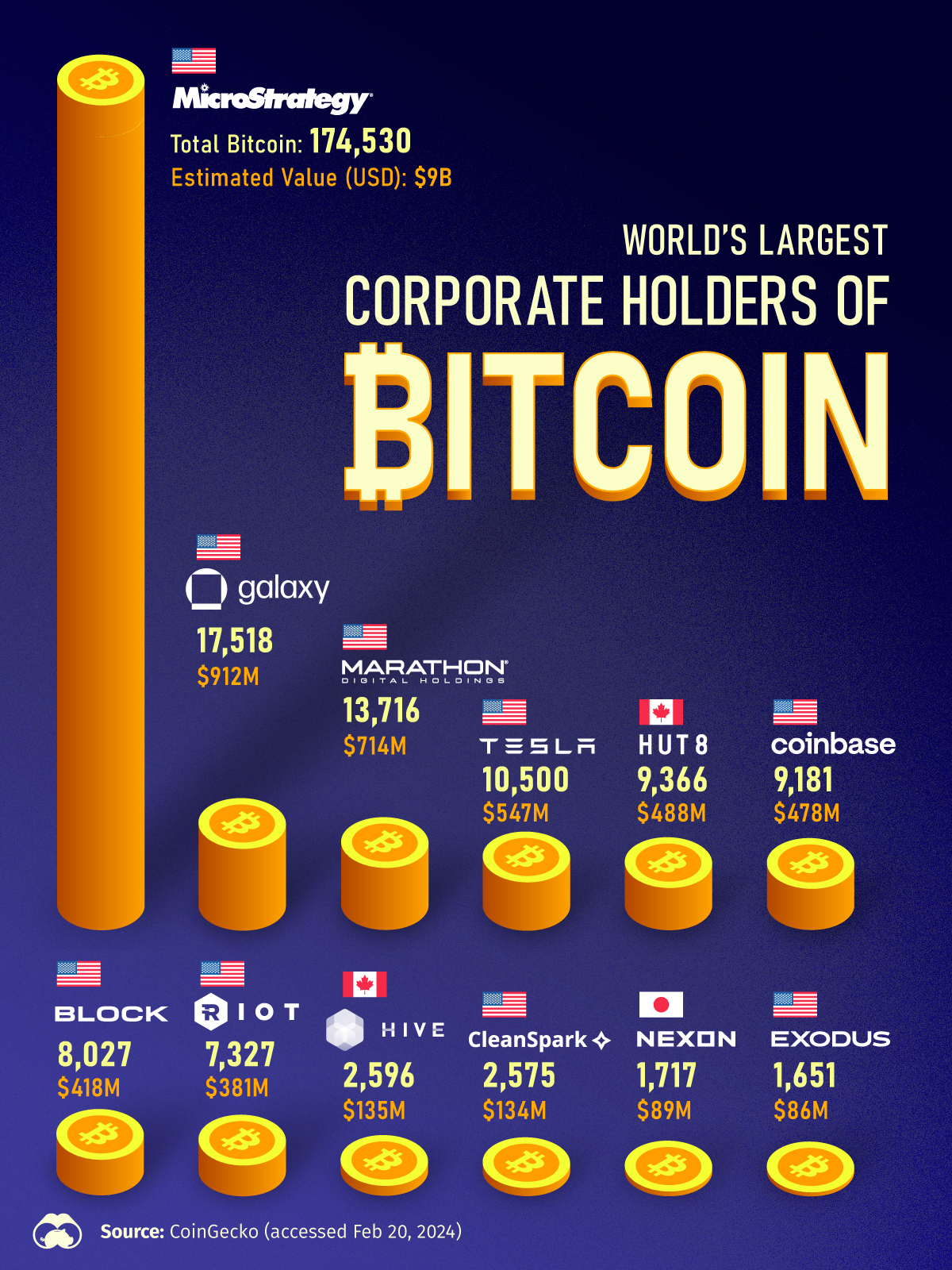

Who holds the most bitcoins across publicly traded companies?

While Tesla is the most familiar name across the world’s largest corporate buyers, several companies have amassed far more bitcoin—leading their share prices to skyrocket in value last year. At the same time, the vast majority are found in North America, with the exception of Nexon, a Japanese-based video game publisher.

This graphic shows the public companies that own the most bitcoin, based on data from CoinGecko.

MicroStrategy at the Top

As the world’s largest corporate owner of bitcoin, MicroStrategy holds 174,530 bitcoin valued at an estimated $9.1 billion as of February 22, 2024.

Headquartered in Virginia, the intelligence software firm first began buying bitcoin in 2020 and has since grown its holdings to become roughly 10 times bigger than the next highest corporate owner. MicroStrategy shares soared over 350% in 2023 thanks to its scale of bitcoin holdings.

Here’s who holds the most bitcoins globally across public companies as of February 22, 2024:

| Rank | Company | Country | Total Bitcoin | Estimated Value as of Feb 22, 2024 |

|---|---|---|---|---|

| 1 | MicroStrategy | 🇺🇸 U.S. | 174,530 | $9.1B |

| 2 | Galaxy Digital | 🇺🇸 U.S. | 17,518 | $912.1M |

| 3 | Marathon Digital | 🇺🇸 U.S. | 13,716 | $714.1M |

| 4 | Tesla | 🇺🇸 U.S. | 10,500 | $546.7M |

| 5 | Hut 8 | 🇨🇦 Canada | 9,366 | $487.6M |

| 6 | Coinbase | 🇺🇸 U.S. | 9,181 | $478.0M |

| 7 | Block Inc. | 🇺🇸 U.S. | 8,027 | $417.9M |

| 8 | Riot Platforms | 🇺🇸 U.S. | 7,327 | $381.5M |

| 9 | Hive Blockchain | 🇨🇦 Canada | 2,596 | $135.2M |

| 10 | CleanSpark | 🇺🇸 U.S. | 2,575 | $134.1M |

| 11 | NEXON | 🇯🇵 Japan | 1,717 | $89.4M |

| 12 | Exodus | 🇺🇸 U.S. | 1,651 | $86.0M |

Tesla is the fourth-largest owner on the list, with bitcoin holdings worth $546.7 million.

In 2021, the company announced that it bought $1.5 billion in bitcoin to help boost the company’s bottom line. It also served as a way to provide liquidity to customers who could buy its products with the cryptocurrency. Yet the following year, the company sold a large share of its holdings at a steep loss during the crypto crash.

Two Canadian companies, Hut 8 and Hive Blockchain, are top holders of bitcoin. These cryptocurrency mining companies have seen their shares surge over 191% and 144%, respectively.

With even stronger returns, bitcoin miner CleanSpark saw its shares boom over 425% in 2023. This year, the company announced plans to purchase four new facilities for mining bitcoin. Three of these are located in Mississippi, purchased for a total of $19.8 million.

As bitcoin climbs to fresh record highs, corporate interest in bitcoin may continue to increase in tandem with a wider scope of buyers. Newly regulated spot bitcoin ETFs have also fueled demand, leading bitcoin’s market cap to hit $1 trillion for the first time since 2021.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Environment2 weeks ago

Environment2 weeks agoTop Countries By Forest Growth Since 2001

/>

/>