Technology

Chart: Vetting Alphabet’s $4 Billion in “Other Bets”

Chart: Vetting Alphabet’s $4 Billion in “Other Bets”

The Chart of the Week is a weekly Visual Capitalist feature on Fridays.

Regardless of whether the policy remains in place today, one of Google’s most famous management philosophies has been the “20% rule”. Legend goes that especially in Google’s earlier days, employees were encouraged to spend 20% of their time working on new initiatives that could potentially benefit Google outside of their regular workflows, teams, and projects. This meant there was time to explore new ideas or to challenge existing status quos within the organization.

It’s a seemingly arbitrary and systematic way to spur innovation, but it has worked well over the years. The 20% rule has apparently led to new products such as Gmail, Google News, and AdSense, which are all important aspects of Google’s business today.

It should not be surprising then, that Google’s parent company Alphabet also takes a systematic approach to innovating outside of its core search business. By making ambitious “Other Bets” and keeping investors up-to-date with their own segment on the company’s financial statements, Alphabet shows both commitment and discipline in finding its next multi-billion dollar game-changer.

“Other Bets”

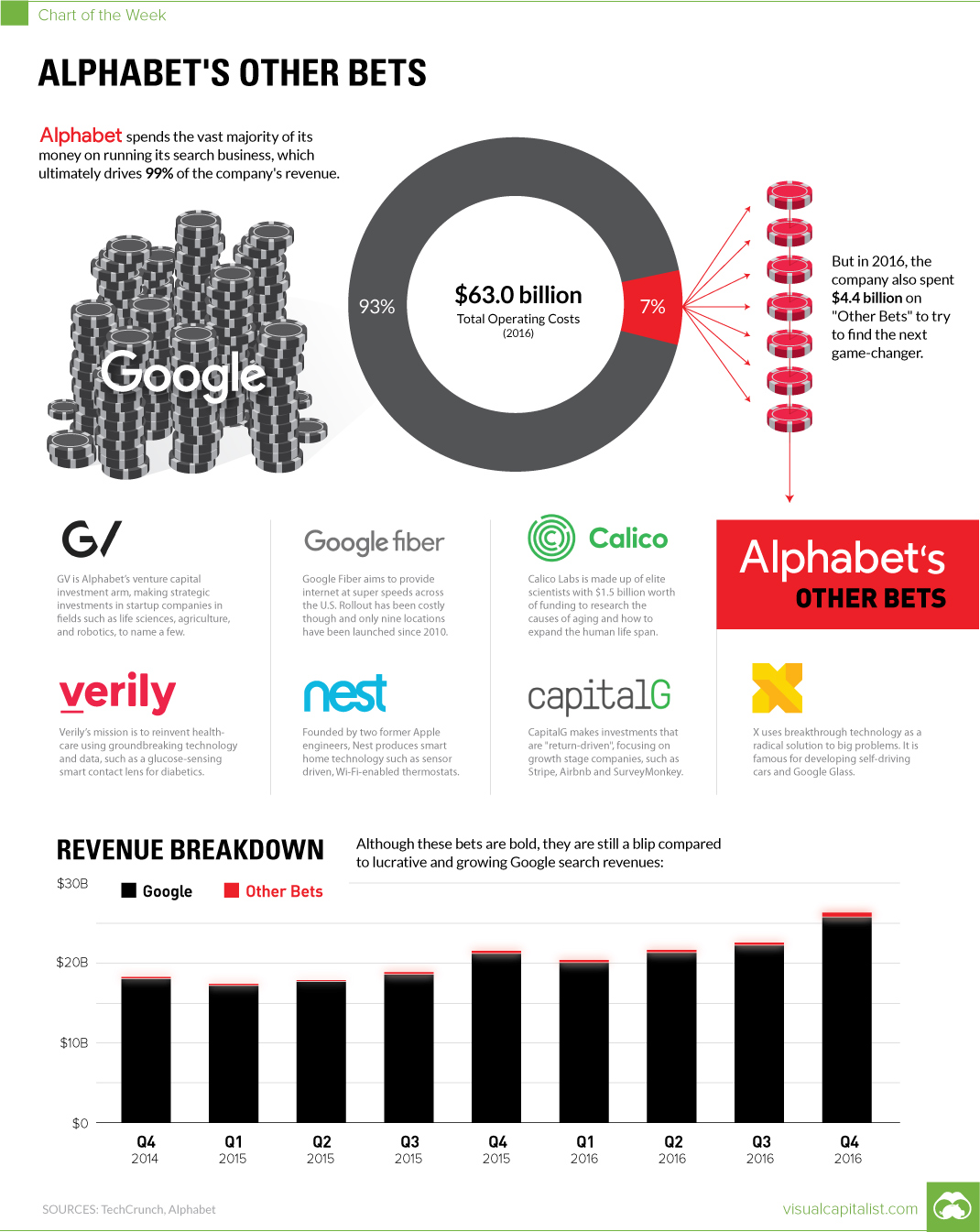

In 2016, Alphabet was a cash machine. The company raked in $19.5 billion of profit off of a whopping $87.4 billion of revenue.

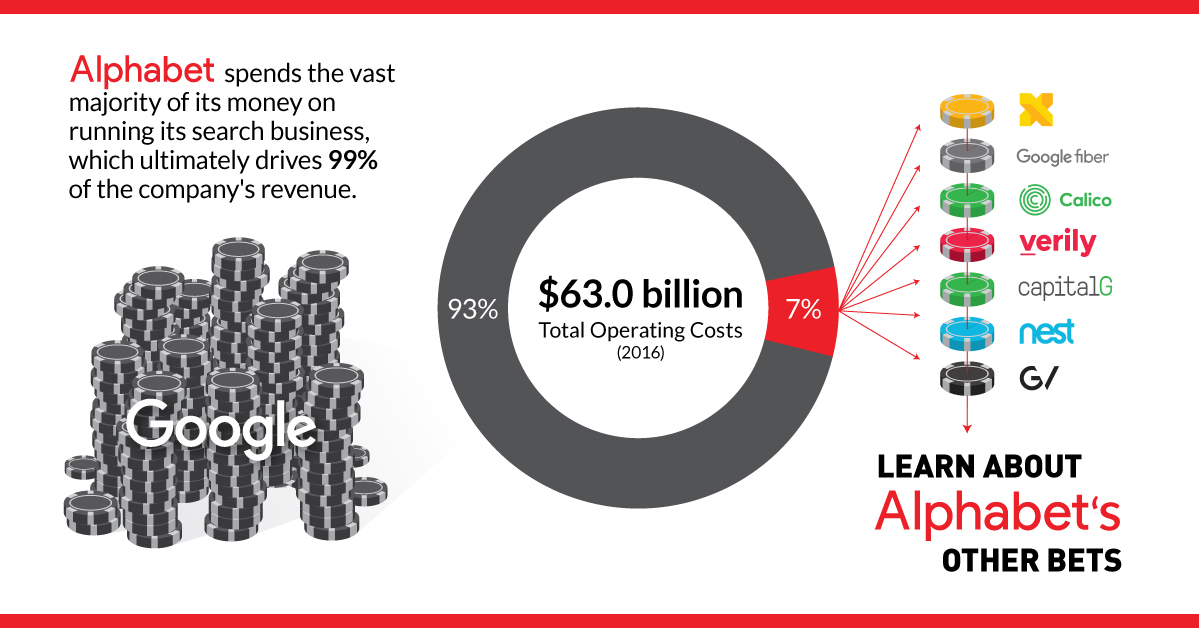

The only challenge? If you do the math, 99% of that revenue comes from Google, which currently dominates digital advertising with a 41% share of the entire market.

Wisely, the company does not want to put all of its eggs in one basket – and it spends about 7% of its annual operating costs on facilitating “Other Bets”. Here is what else Alphabet is up to:

Google Fiber

Google Fiber aims to provide internet at super speeds across the United States. Rollout has been costly though and only nine locations have been launched since 2010.

Calico Labs

Calico Labs is made up of elite scientists with $1.5 billion worth of funding to research the causes of aging and how to expand the human life span.

Nest

Founded by two former Apple engineers, Nest produces smart-home technology such as sensor-driven, Wi-Fi-enabled thermostats.

Verily

Verily’s mission is to reinvent healthcare using groundbreaking technology and data, such as a glucose-sensing smart contact lens for diabetics.

GV

GV, formerly known as Google Ventures, is Alphabet’s venture capital investment arm, making strategic investments in startup companies in fields such as life sciences, agriculture, and robotics, to name a few.

CapitalG

CapitalG makes investments that are “return-driven”, focusing on growth stage companies, such as Stripe, Airbnb and SurveyMonkey.

X

X uses breakthrough technology as a radical solution to big problems. Its most famous projects are its self-driving car and Google Glass.

Which “Other Bets” are Paying Off?

“Other Bets” generated $809 million in revenue in 2016, which is a 82% increase over 2015. This revenue came mostly from Nest, Fiber, and Verily.

Nest, which aims to dominate the smart home of tomorrow, was acquired for $3.2 billion in 2014. And while it does generate revenue for Alphabet, it has been viewed mostly as a disappointment even from the company’s perspective.

Verily is Alphabet’s business in life sciences, and is apparently profitable already. The unit partners with pharmaceutical companies to make money, and it will also eventually move forward with human clinical trials on its smart contact lens product.

Lastly, Fiber has been rolled out in nine cities across the United States to provide ultra-fast broadband speeds for internet and television. In recent news, Fiber has laid off employees, while halting many further expansion plans.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Science1 week ago

Science1 week agoVisualizing the Average Lifespans of Mammals

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023

-

Green2 weeks ago

Green2 weeks agoRanking the Top 15 Countries by Carbon Tax Revenue