Technology

The Smart Home of Tomorrow

Today, people want everything to be “smart”.

Smart phones, smart appliances, smart autos, smart cities, smart grids, and even smart trash cans are either already in our lives today, or will be in our near future.

In some cases the “smart” moniker may be applied loosely to new products, but the trend is real and overarching. It all stems from spreading adoption of the internet of things. With smart technology, many objects that were once quite simple are now automated, controlled by a phone, or optimized based on your personal preferences – and over time, this is going to change many aspects of our personal and professional lives.

One “smart” trend that is on a trajectory to impact almost everyone is one that concerns the most basic rung of our hierarchy of needs: our shelter.

Introducing The Smart Home of Tomorrow

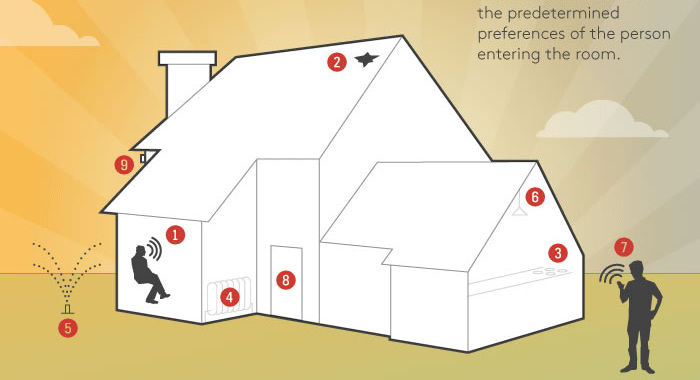

Today’s infographic from Vibrant Doors shows how the new smart home will change everyday living for most people. It also shows consumer preferences, expected demand, and the obstacles to widespread adoption of this new “smart” technology.

The biggest obstacle for adoption of smart home technology is an interesting one: choice.

It’s expected that the smart home market will be worth $122 billion by 2022, and every company wants a piece of that pie. As a result, there is a multitude of brands trying to solve the smart home equation in order to break through as market leaders for this technology. The names in this battle range from giant tech companies like Apple, Amazon, Samsung, and Alphabet, to upstart competitors focusing on small niches within the home.

Consumers, for the most part, are willing to wait until the timing is right. Currently there is intense competition in the early stages of the smart home market and consumers are willing to watch brands duke it out. After all, adopting smart home devices and infrastructure is not cheap, and consumers only want to buy brands that are going to stand the test of time.

Technology

Visualizing AI Patents by Country

See which countries have been granted the most AI patents each year, from 2012 to 2022.

Visualizing AI Patents by Country

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This infographic shows the number of AI-related patents granted each year from 2010 to 2022 (latest data available). These figures come from the Center for Security and Emerging Technology (CSET), accessed via Stanford University’s 2024 AI Index Report.

From this data, we can see that China first overtook the U.S. in 2013. Since then, the country has seen enormous growth in the number of AI patents granted each year.

| Year | China | EU and UK | U.S. | RoW | Global Total |

|---|---|---|---|---|---|

| 2010 | 307 | 137 | 984 | 571 | 1,999 |

| 2011 | 516 | 129 | 980 | 581 | 2,206 |

| 2012 | 926 | 112 | 950 | 660 | 2,648 |

| 2013 | 1,035 | 91 | 970 | 627 | 2,723 |

| 2014 | 1,278 | 97 | 1,078 | 667 | 3,120 |

| 2015 | 1,721 | 110 | 1,135 | 539 | 3,505 |

| 2016 | 1,621 | 128 | 1,298 | 714 | 3,761 |

| 2017 | 2,428 | 144 | 1,489 | 1,075 | 5,136 |

| 2018 | 4,741 | 155 | 1,674 | 1,574 | 8,144 |

| 2019 | 9,530 | 322 | 3,211 | 2,720 | 15,783 |

| 2020 | 13,071 | 406 | 5,441 | 4,455 | 23,373 |

| 2021 | 21,907 | 623 | 8,219 | 7,519 | 38,268 |

| 2022 | 35,315 | 1,173 | 12,077 | 13,699 | 62,264 |

In 2022, China was granted more patents than every other country combined.

While this suggests that the country is very active in researching the field of artificial intelligence, it doesn’t necessarily mean that China is the farthest in terms of capability.

Key Facts About AI Patents

According to CSET, AI patents relate to mathematical relationships and algorithms, which are considered abstract ideas under patent law. They can also have different meaning, depending on where they are filed.

In the U.S., AI patenting is concentrated amongst large companies including IBM, Microsoft, and Google. On the other hand, AI patenting in China is more distributed across government organizations, universities, and tech firms (e.g. Tencent).

In terms of focus area, China’s patents are typically related to computer vision, a field of AI that enables computers and systems to interpret visual data and inputs. Meanwhile America’s efforts are more evenly distributed across research fields.

Learn More About AI From Visual Capitalist

If you want to see more data visualizations on artificial intelligence, check out this graphic that shows which job departments will be impacted by AI the most.

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Money2 weeks ago

Money2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries