History

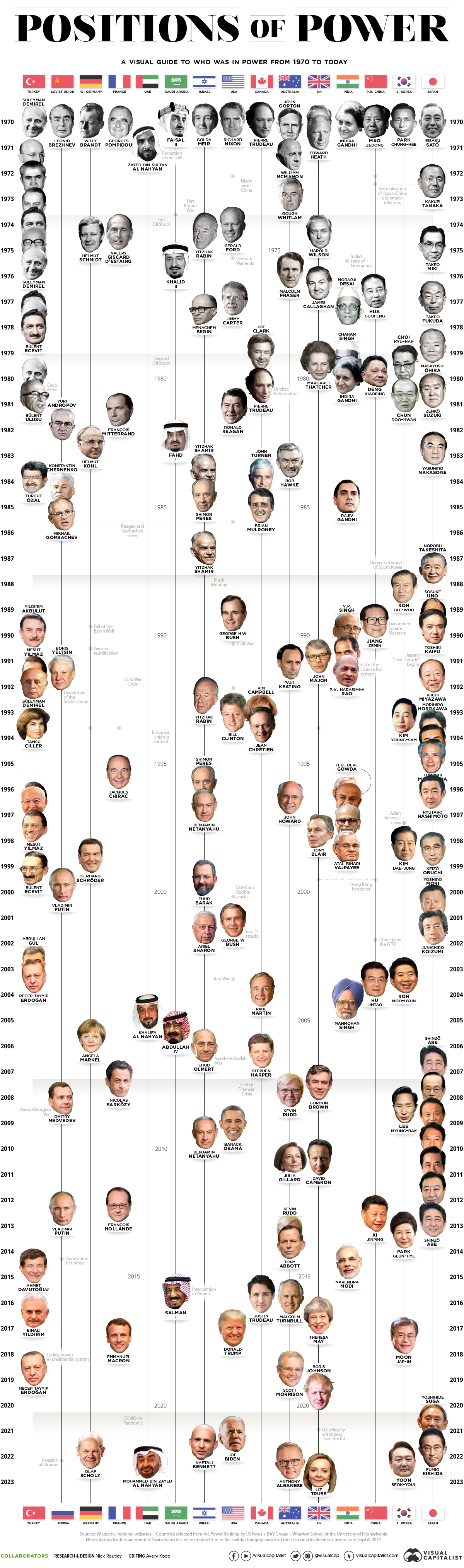

Visualized: The World Leaders In Positions of Power (1970-Today)

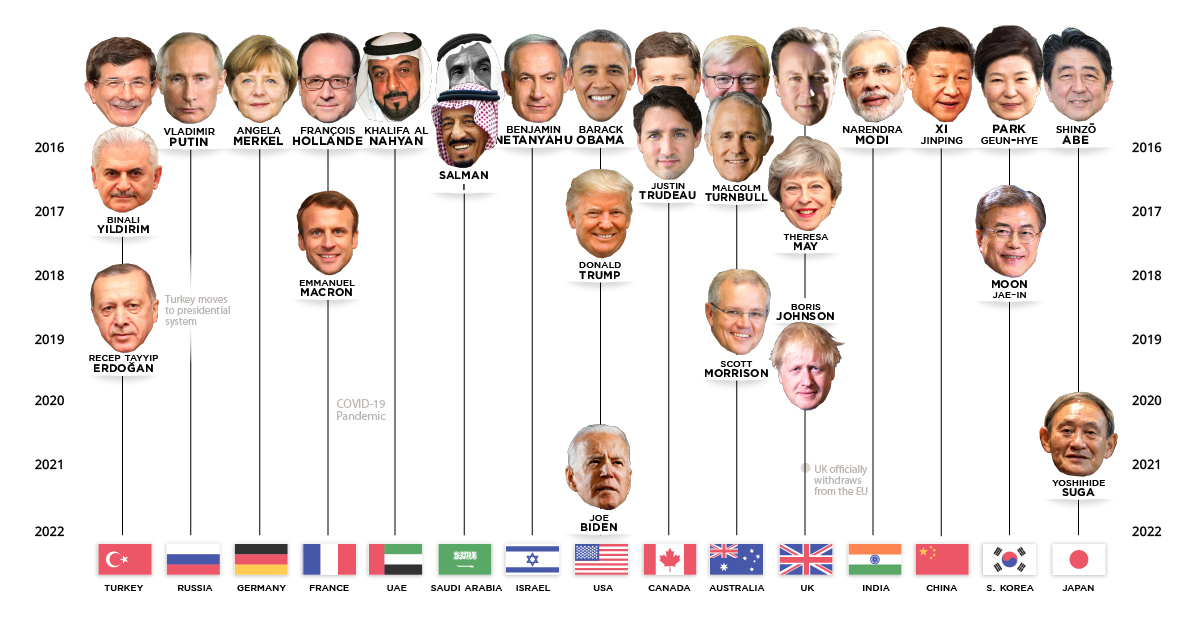

Visualized: The World Leaders In Positions of Power

Who were the world leaders when the Berlin Wall fell? How many women have been heads of state in prominent governments? And who are the newest additions to the list of world leaders?

This graphic reveals the leaders of the most influential global powers since 1970. Countries were selected based on the 2020 Most Powerful Countries ranking from the U.S. News & World Report.

Note: Switzerland has been omitted due to the swiftly changing nature of their national leadership.

The 1970s: Economic Revolutions

Our graphic starts in 1970, a year in which Leonid Brezhnev ruled the Soviet Union, while on the other side of the Iron Curtain, Willy Brandt was presiding over West Germany.

In the U.S., Richard Nixon implemented a series of economic shocks to stimulate the economy, but resigned in scandal due to the Watergate tapes in 1974. In the same time period, China was undergoing rapid industrialization and economic hardship under the final years of rule of communist revolutionary Mao Zedong, until his death in 1976.

In 1975, the King of Saudi Arabia, Faisal bin Abdulaziz Al Saud was assassinated by his nephew. The decade also marked the end of Park Chung-Hee’s dictatorship in South Korea when he was assassinated in 1979.

To cap off the decade, Margaret Thatcher became the first female prime minister of the United Kingdom in 1979, transforming the British economy using a laissez-faire economic policy that would come to be known as Thatcherism.

The 1980s: Reaganomics and the Fall of the Wall

The 1980s saw Ronald Reagan elected in the U.S., beginning an era of deregulation and economic growth. Reagan would actually meet the Soviet Union’s president, Mikhail Gorbachev in 1985 to discuss human rights and nuclear arms control amid the tensions of the Cold War.

The 1984 assassination of the Indian prime minister, Indira Gandhi was also a defining event of the decade. She was succeeded by her son, Rajiv Gandhi for only seven years before his own assassination in 1991.

The ‘80s were clearly turbulent times for world leaders, especially towards the end of the decade. In 1989, the Berlin Wall fell and Germany was reunified under chancellor Helmut Kohl. 1989 was also the year when the devastating events occurred at the Tiananmen Square protests in China, under president Deng Xiaoping. The event left a lasting mark on China’s history and politics.

The 1990s: War 2.0 and the Promise of the EU

The beginning of a new decade marked the end of the Cold War and the fall of the Soviet Union, leading to Boris Yeltsin’s position as the first president of the Russian Federation. A sense of peace, or at least the knowledge that a finger wasn’t floating above a nuclear launch button at any given moment, brought a sense of global calm.

However, this does not mean the decade was without conflict. The Gulf War began in 1990, led by the U.S. military’s Commander-in-Chief George H.W. Bush. In the mid-90s, prime minister Yitzhak Rabin of Israel was assassinated by Jewish extremists.

In spite of this, the ‘90s were a time of optimism for many. In 1993, the European project began. The European Union was founded with the support European leaders like the UK’s prime minister John Major, France’s president Francois Mitterrand, and chancellor Helmut Kohl of Germany.

The 2000s: Historic Firsts and Power Shifts

The dawn of a new century had people feeling both hopeful and scared. While Y2K didn’t end the world, many transformative events did occur, such as the 9/11 attacks in New York and the subsequent war on terror led by U.S. president George W. Bush.

On the other hand, Angela Merkel made history becoming the first female chancellor of Germany in 2005. A few years later, Barack Obama also achieved a momentous ‘first’ as the first African-American president in the United States.

The 2000s to early 2010s also revealed rapidly changing power shifts in Japan. Shinzō Abe rose to power in 2006, and after five leadership changes in seven years, he eventually circled back, ending up as prime minister again by 2013—a position he held until late 2020.

| Country | Number of Leaders Since 1970 |

|---|---|

| 🇯🇵 Japan | 25 |

| 🇹🇷 Turkey | 18 |

| 🇦🇺 Australia | 13 |

| 🇮🇳 India | 12 |

| 🇬🇧 UK | 11 |

| 🇰🇷 South Korea | 11 |

| 🇺🇸 USA | 10 |

| 🇮🇱 Israel | 10 |

| 🇨🇦 Canada | 9 |

| 🇷🇺 Russia | 7 |

| 🇫🇷 France | 7 |

| 🇩🇪 Germany | 6 |

| 🇨🇳 China | 6 |

| 🇸🇦 Saudi Arabia | 5 |

| 🇦🇪 UAE | 3 |

The 2010s: World Leaders Face Uncertainty

The 2010s were more than eventful. The Hong Kong protests under Chinese president Xi Jinping, and the annexation of Crimea led by Vladimir Putin, uncovered the wavering dominance of democracy and international law.

UK Prime Minister David Cameron’s move to introduce a Brexit referendum, resulted in just over half of the British population voting to leave the EU in 2016. This vote led to a rising feeling of protectionism and a shift away from globalization and multilateral cooperation.

Donald Trump’s U.S. presidential election was a shocking political longshot in the same year. Trump’s stint as president will likely have a longstanding impact on the course of American politics.

Two countries elected their first female leaders in this decade: president Park Geun-Hye in South Korea, and prime minister Julia Gillard in Australia. Here’s a look at which global powers have been led by women in the last 50 years.

| Country | Female Leader |

|---|---|

| 🇦🇺 Australia | Julia Gillard |

| 🇨🇦 Canada | Kim Campbell |

| 🇩🇪 Germany | Angela Merkel |

| 🇮🇳 India | Indira Gandhi |

| 🇮🇱 Israel | Golda Meir |

| 🇰🇷 South Korea | Park Geun-Hye |

| 🇹🇷 Turkey | Tansu Ciller |

| 🇬🇧 UK | Margaret Thatcher |

| 🇬🇧 UK | Theresa May |

| 🇬🇧 UK | Liz Truss |

2020 to Today

No one can avoid talking about 2020 without talking about COVID-19. Many world leaders have been praised for their positive handling of the pandemic, such as Angela Merkel in Germany. Others on the other hand, like Boris Johnson, have received critiques for slow responses and mismanagement.

The year 2020 packed about as much punch on its own as an entire decade does, from geopolitical tensions to a nail-biting 2020 U.S. election. The world is on high alert as Trump prepares his transfer of power following the riot at the U.S. Capitol.

In 2021, Joe Biden took his place as the 46th president of the United States, and Fumio Kishida became Japan’s Prime Minister on October 4th. Angela Merkel, who has been in power since 2005, was succeeded by Olaf Scholz.

In May 2022, Mohamed bin Zayed Al Nahyan became the third president of the United Arab Emirates following the death of Khalifa bin Zayed Al Nahyan.

Editor’s note: We’ll continue to update this graphic on world leaders as time goes on. Unfortunately, we were unable to include world leaders from more countries, as we were limited by the graphic format and user experience.

population

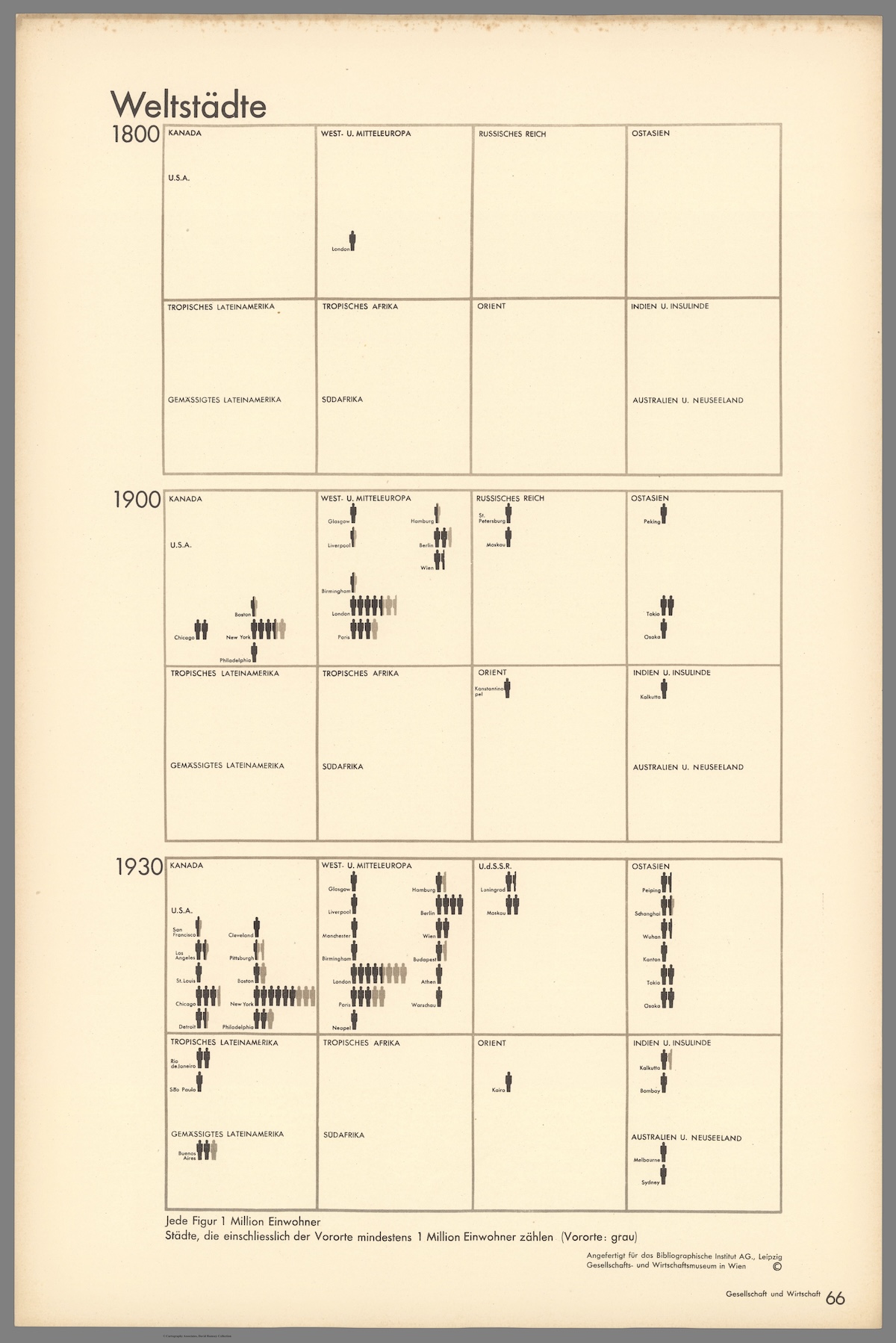

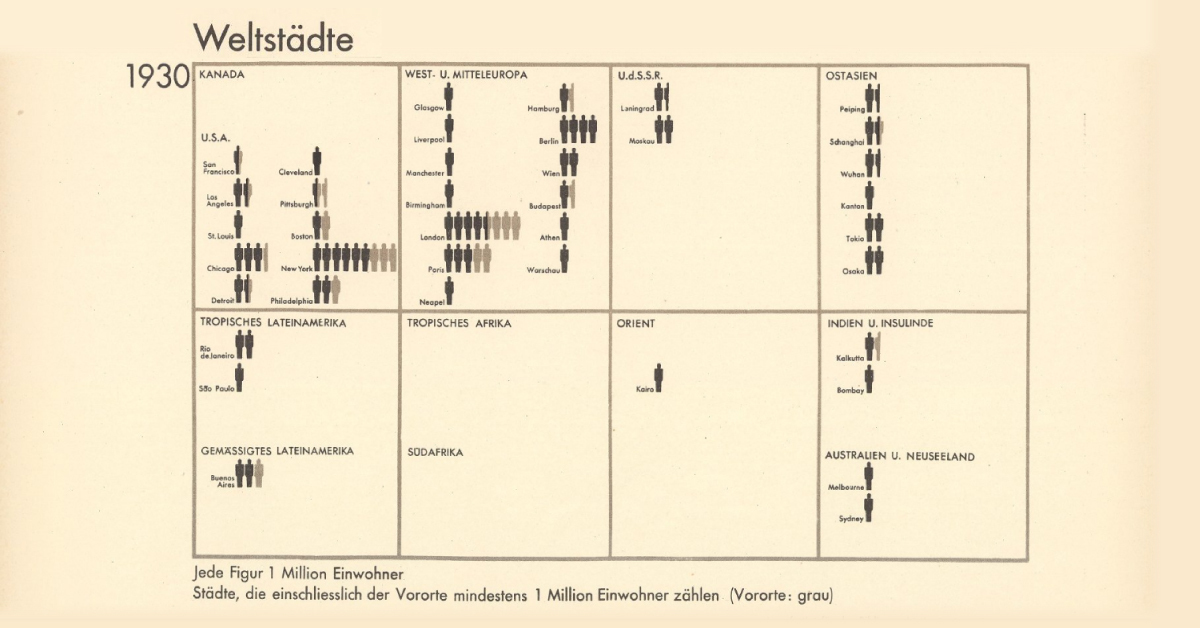

Vintage Viz: World Cities With 1 Million Residents (1800–1930)

From someone born in the 19th century, in the midst of historic population growth, comes this vintage visualization showing world cities growing ever bigger.

World Cities With At Least 1 Million Residents (1800–1930)

This chart is the latest in our Vintage Viz series, which presents historical visualizations along with the context needed to understand them.

The explosive world population boom in the last 300 years is common knowledge today. Much and more has been written about how and why it happened, why it was unusual, and how the specter of a declining population for the first time in three centuries could impact human society.

However, equally compelling, is how people in the past—those living in the midst of the early waves of this boom—were fascinated by what they were witnessing.

Evidence of this comes from today’s vintage visualization, denoting the increasing number of world cities with at least one million inhabitants through the years.

The above pictogram was made by Austrian philosopher and sociologist Otto Neurath (1882–1945), found in his book, Society and Economy, published in 1930.

World Population Doubles Between 1800 and 1930

In 1800, the world population crossed 1 billion for the first time ever.

In the next 130 years, it doubled past 2 billion.

The Second Agricultural Revolution, characterized by massive land and labor productivity, grew agricultural output more than the population and is one of the key drivers of this population growth.

And in the pictogram above, where one silhouette indicates one million inhabitants, this exponential population growth becomes far more vivid.

In 1800, for example, according to the creator’s estimates, only London had at least million residents. A century later, 15 cities now boasted of the same number. Then, three decades hence, 37 cities across the world had one million inhabitants.

| Year | Cities with One Million Residents |

|---|---|

| 1800 | 1 |

| 1900 | 15 |

| 1930 | 37 |

Importantly, the data above is based on the creator’s estimates from a century ago, and does not include Beijing (then referred to as Peking in English) in 1800. Historians now agree that the city had more than a million residents, and was the largest city in the world at the time.

Another phenomenon becoming increasingly apparent is growing urbanization—food surplus frees up large sections of the population from agriculture, driving specialization in other skills and trade, in turn leading to congregations in urban centers.

Other visualizations in the same book covered migration, Indigenous peoples, labor, religion, trade, and natural resources, reflecting the creator’s interest in the social life of individuals and their well-being.

Who Was Otto Neurath and What is His Legacy?

This vintage visualization might seem incredibly simple, simplistic even, considering how we map out population data today. But the creator Otto Neurath, and his wife Marie, were pioneers in the field of visual communication.

One of their notable achievements was the creation of the Vienna Method of pictorial statistics, which aimed to represent statistical information in a visually accessible way—the forerunner to modern-day infographics.

The Neuraths believed in using clear and simple visual language to convey complex information to a broad audience, an approach that laid the foundation for modern information design.

They fled Austria during the rise of the Nazi regime and spent their later years in various countries, including the UK. Otto Neurath’s influence on graphic design, visual communication, and the philosophy of language has endured, and his legacy is still recognized in these fields today.

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001