Cannabis

The Consumer Potential of Retail Cannabis

The Consumer Potential of Retail Cannabis Products

“Eat, drink, and be merry” is becoming an increasingly common mantra for cannabis consumers.

It’s also a refrain that speaks the evolving demand picture for cannabis in a post-legalization environment, as it becomes clearer what products consumers want to see coming from the sector.

Today’s infographic comes to us from The Green Organic Dutchman, and it dives deeper into the profound investor potential in cannabis retail products, like edibles and concentrates.

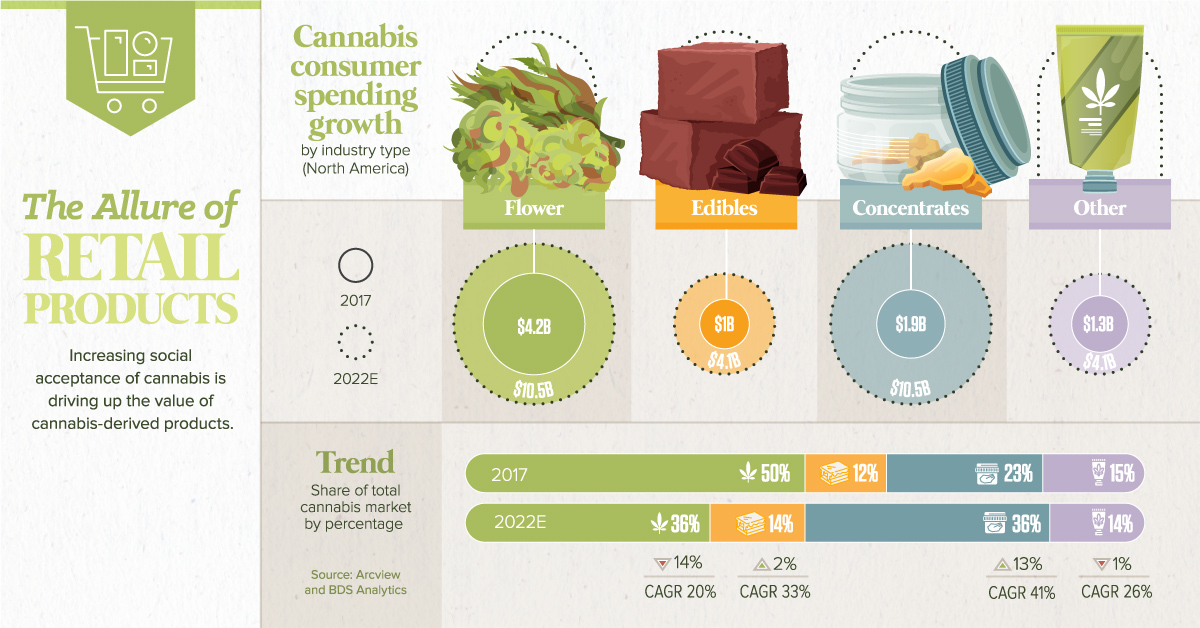

The Allure of Retail Products

As the business of cannabis matures, several trends are directing its course. Consumer spending in North America is ballooning overall, but growth largely depends on the product type.

| Product type | Flower | Edibles | Concentrates | Other |

|---|---|---|---|---|

| 2017 | $4.2B | $1B | $1.9B | $1.3B |

| 2022E | $10.5B | $4.1B | $10.5B | $4.1B |

| Trend | ↓ 14pp total share (from 50% to 36%) | ↑ 2pp total share (from 12% to 14%) | ↑ 13pp total share (from 23% to 36%) | ↓ 1pp total share (from 15% to 14%) |

| CAGR | 20% | 33% | 41% | 26% |

While seasoned consumers prefer smoking cannabis, other consumers are actually drawn to alternative forms that the plant comes in. Proprietary research from New Frontier Data reveals the products that most appeal to potential U.S. cannabis consumers:

- 69% solid edibles

- 54% liquid edibles

- 44% topicals

- 36% joints or blunts

- 32% vaporizers (vapes)

- 29% tinctures

- 21% concentrates

- 19% pipes / water pipes

The rising popularity in retail cannabis-derived products is being directed by consumers – and they’re using products for everything from relaxation to pain management.

Variety is the Spice of Life

Food and beverages, along with wellness products, are proving to be a huge draw.

Food & Beverages

Most people are aware of pot brownies, even if they haven’t tried them. The best known cannabis edibles are baked goods, and these days they’re also found as candy and chocolate.

Cannabis-infused drinks are also growing in popularity, in both alcoholic and non-alcoholic forms. Cannabis-infused water, juice, tea, coffee, and even kombucha are legally making their way onto grocery store shelves.

Of course, before edibles can become fully mainstream, there are a few considerations: stricter regulations for product consistency, not to mention appropriate packaging and labeling to keep them away from children. As an example, Canada will start allowing edibles and other products in October 2019, as they iron out these kinks a year after full legalization.

Health & Wellness

Cannabis has been treasured for its medicinal and therapeutic properties for centuries. In the present, it has re-emerged in an intersection with the wellness industry. In fact, many consumers are already using CBD-infused products in their daily life:

- Relieving anxiety

- Enhancing sleep

- Managing pain

- Personal care

Importantly, retail cannabis products are also helping consumers reduce their dependence on medications, and to kick unhealthy habits.

A Consumer-Driven Future

Consumers are not just eating cannabis up, but they are also drinking, vaping, dabbing — and the list goes on.

For these reasons, investors should keep an eye on the fast-changing multitude of products and trends within the sector, as they provide some of the best opportunities going forward.

In the final part of this series, we’ll dive into the role that the cannabidiol (CBD) compound plays in the cannabis market.

Politics

Timeline: Cannabis Legislation in the U.S.

At the federal level, cannabis is illegal, but state laws differ. This graphic looks at the timelines of cannabis legislation in the U.S.

Timeline: Cannabis Legislation in the U.S.

At the federal level, cannabis is still considered an illegal substance. That said, individual states do have the right to determine their own laws around cannabis sales and usage.

This visual from New Frontier Data looks at the status of cannabis in every state and the timeline of when medical and/or recreational use became legal.

Cannabis Through the Years

In the U.S., the oldest legalese concerning cannabis dates back to the 1600s—the colony of Virginia required every farm to grow and produce hemp. Since then, cannabis use was fairly wide open until the 1930s when the Marihuana Tax Act was enforced, prohibiting marijuana federally but still technically allowing medical use.

Jumping ahead, the Controlled Substances Act was passed in 1970, classifying cannabis as Schedule I drug—the same category as heroin. This prohibited any use of the substance.

However, the 1970s also saw a counter movement, wherein many states made the move towards decriminalization. Decriminalization means that although possessing cannabis remained illegal, a person would not be subject to jail time or prosecution for possessing certain amounts.

By the 1990s, some of the first states passed laws to allow the medical usage of cannabis, and by 2012 two states in the U.S.—Washington and Colorado—legalized the recreational use of cannabis.

Cannabis Legislation Today and Beyond

The MORE Act (the Marijuana Opportunity Reinvestment and Expungement Act) was passed in the House early 2022, and if made law, it would decriminalize marijuana federally.

“This bill decriminalizes marijuana. Specifically, it removes marijuana from the list of scheduled substances under the Controlled Substances Act and eliminates criminal penalties for an individual who manufactures, distributes, or possesses marijuana.”– U.S. Congress

Cannabis still remains illegal at the federal level, but at the state levels, cannabis is now fully legal (both for medicinal and recreational purposes) in a total of 22 states.

Over 246 million Americans have legal access to some form of marijuana products with high THC levels. Looking to the future, many new cannabis markets are expected to open up in the next few years:

The earliest states expected to open up next for recreational cannabis sales are Minnesota and Oklahoma. There is always a lag between legalization and actual sales, wherein local regulatory bodies and governments set standards. States like Kentucky, on the other hand, aren’t likely to even legalize medicinal cannabis until 2028.

It’s estimated that by 2030, there will be 69 million cannabis consumers in the country, up 33% from 2022.

Overall, the U.S. cannabis market is likely an important one to watch as legal sales hit $30 billion in 2022. By the end of the decade, that number is expected to be anywhere from $58 billion to as much as $72 billion.

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Environment2 weeks ago

Environment2 weeks agoTop Countries By Forest Growth Since 2001