Cannabis

The Rise of Organic Cannabis in North America

The Rise of Organic Cannabis in North America

Canna-business is booming on the heels of Canada’s momentous decision to legalize cannabis nationwide, and the industry is now projected to bring in close to $95 billion by 2026.

Much like the way organic products have risen to prominence in supermarkets, consumers will start to demand high-quality products as the cannabis industry matures, as well.

Today’s infographic comes from The Green Organic Dutchman, and it elaborates on why investors and consumers alike are anticipating a growing trend towards organic cannabis.

Roots of the Movement

In a nutshell, organic refers to products grown without fertilizers, pesticides, or genetic modifications. By that definition, organic practices also help to minimize the impact of farming on an environmental level.

The organic trend originates in the post-WWII era, as technological advances transformed the efficiency of large-scale agriculture. As practices changed, farmers and scholars worried about the long-term effects that the use of synthetic chemicals could have.

Thus, the organic movement was born:

1940

The phrase “organic farming” is first coined by English agriculturalist Lord Northbourne.

1962

The book “Silent Spring” by Rachel Carson raises public awareness of the harms posed by pesticides, launching the contemporary environmental movement.

1972

The International Federation of Organic Movements (IFOM), a worldwide organization for the organic agriculture movement, is founded.

1990

The U.S. passes the Organic Food Production Act (OFPA), defining standard organic production practices.

More recently, Amazon’s acquisition of Whole Foods for $13.7 billion demonstrates the influence of consumers in catapulting organic products into the mainstream.

The Allure of Organic Cannabis

Consumers are expecting the same quality standards from other products they consume, such as cannabis.

Growing cannabis organically ensures that it is:

1. Safe for consumption

Natural cultivation methods mean that organic cannabis is often a safer end-product.

2. A premium experience

Organic cannabis offers consumers improved flavor and quality, with enhanced potency.

3. Environmentally sustainable

With organic practices, the surrounding water, soil, and biodiversity are unharmed.

Fine Print?

One caveat to choosing organic is the price differential. One gram of organic cannabis can cost 26% more than regular grade cannabis – but that’s because organic cultivation requires more attention to detail.

Nevertheless, increasing consumer demand for less chemically-laden products can outweigh this price differential in many cases. The growing market for cannabis is now on track to bring in $10 billion this year – outpacing all previous estimates.

Stay tuned for part 5 of this series, which will look at the way growing organic cannabis can be complemented by sustainable practices.

Politics

Timeline: Cannabis Legislation in the U.S.

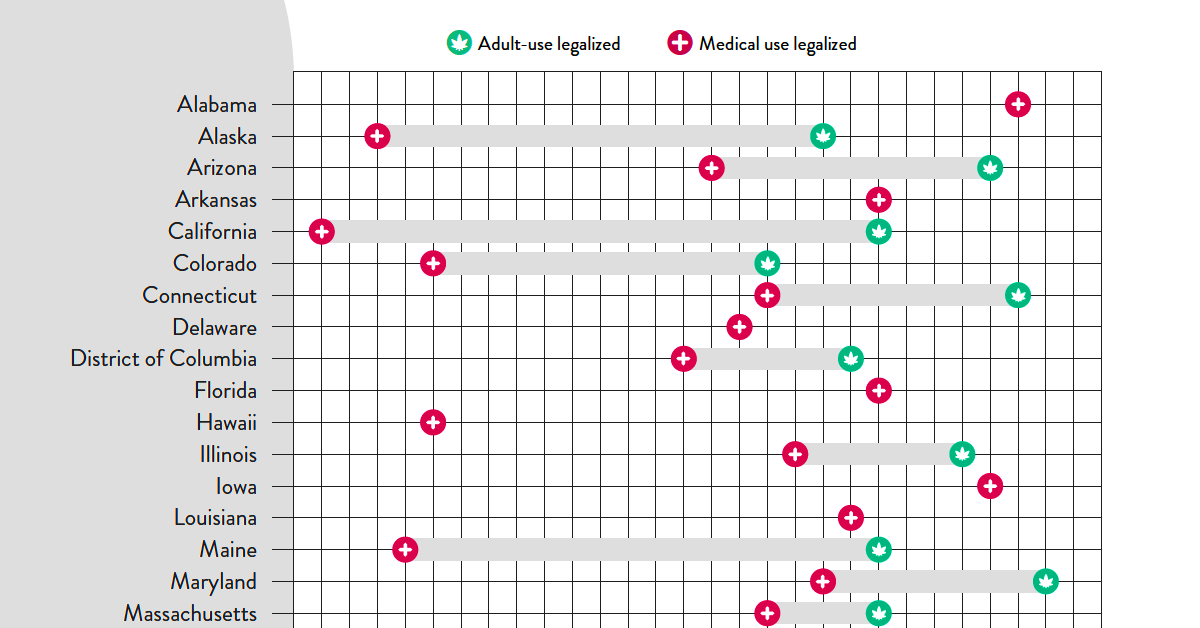

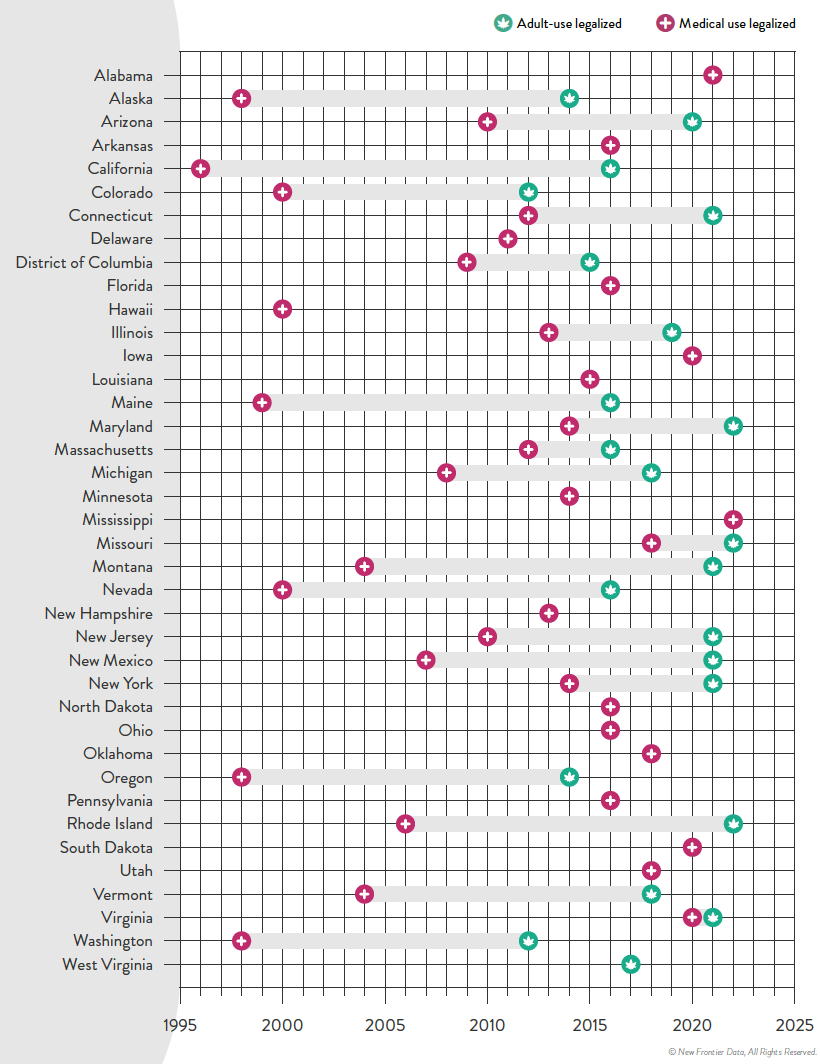

At the federal level, cannabis is illegal, but state laws differ. This graphic looks at the timelines of cannabis legislation in the U.S.

Timeline: Cannabis Legislation in the U.S.

At the federal level, cannabis is still considered an illegal substance. That said, individual states do have the right to determine their own laws around cannabis sales and usage.

This visual from New Frontier Data looks at the status of cannabis in every state and the timeline of when medical and/or recreational use became legal.

Cannabis Through the Years

In the U.S., the oldest legalese concerning cannabis dates back to the 1600s—the colony of Virginia required every farm to grow and produce hemp. Since then, cannabis use was fairly wide open until the 1930s when the Marihuana Tax Act was enforced, prohibiting marijuana federally but still technically allowing medical use.

Jumping ahead, the Controlled Substances Act was passed in 1970, classifying cannabis as Schedule I drug—the same category as heroin. This prohibited any use of the substance.

However, the 1970s also saw a counter movement, wherein many states made the move towards decriminalization. Decriminalization means that although possessing cannabis remained illegal, a person would not be subject to jail time or prosecution for possessing certain amounts.

By the 1990s, some of the first states passed laws to allow the medical usage of cannabis, and by 2012 two states in the U.S.—Washington and Colorado—legalized the recreational use of cannabis.

Cannabis Legislation Today and Beyond

The MORE Act (the Marijuana Opportunity Reinvestment and Expungement Act) was passed in the House early 2022, and if made law, it would decriminalize marijuana federally.

“This bill decriminalizes marijuana. Specifically, it removes marijuana from the list of scheduled substances under the Controlled Substances Act and eliminates criminal penalties for an individual who manufactures, distributes, or possesses marijuana.”– U.S. Congress

Cannabis still remains illegal at the federal level, but at the state levels, cannabis is now fully legal (both for medicinal and recreational purposes) in a total of 22 states.

Over 246 million Americans have legal access to some form of marijuana products with high THC levels. Looking to the future, many new cannabis markets are expected to open up in the next few years:

The earliest states expected to open up next for recreational cannabis sales are Minnesota and Oklahoma. There is always a lag between legalization and actual sales, wherein local regulatory bodies and governments set standards. States like Kentucky, on the other hand, aren’t likely to even legalize medicinal cannabis until 2028.

It’s estimated that by 2030, there will be 69 million cannabis consumers in the country, up 33% from 2022.

Overall, the U.S. cannabis market is likely an important one to watch as legal sales hit $30 billion in 2022. By the end of the decade, that number is expected to be anywhere from $58 billion to as much as $72 billion.

-

Mining1 week ago

Mining1 week agoGold vs. S&P 500: Which Has Grown More Over Five Years?

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries