Cannabis

The 6,000-Year History of Medical Cannabis

Get this infographic as a poster (and save 15% by being a VC+ member)

View a high resolution version of this graphic

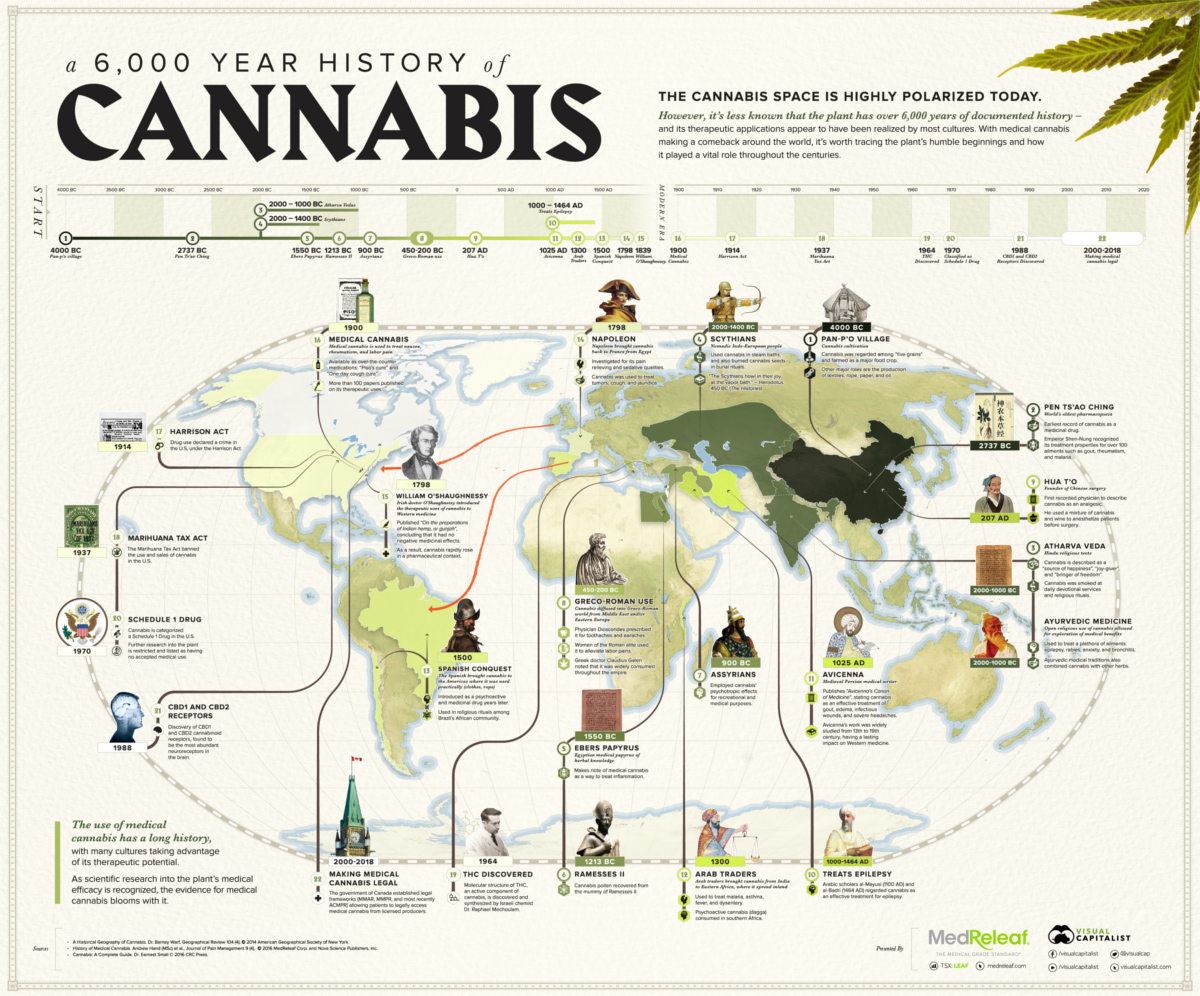

The 6,000-Year History of Medical Cannabis

View the high resolution version of today’s graphic by clicking here.

Since the early 20th century, the use of cannabis for any purpose fell out of favor by both regulators and Western culture at large.

In the United States, a wave of regulations made access to cannabis more difficult starting from the late 1900s, ultimately culminating in the Marihuana Tax Act of 1937, which effectively made cannabis use a federal offense. Meanwhile, prohibition in Canada lasted for 85 years until being lifted by recent developments.

Interestingly, however, this recent period of 20th century opposition is actually just a small speck in the wider 6,000-year timeline of cannabis. After all, the plant has been widely regarded for its therapeutic potential for many millennia by different cultures around the world.

6,000 Years of Medical Cannabis

Today’s infographic comes to us from MedReleaf, and it focuses on the medical uses of cannabis discovered by many cultures over time. With uses dating back to Ancient empires such as Rome, Egypt, and China, it helps to put into perspective recent legal and cultural developments regarding cannabis on a broader historical scale.

4000 BC: Pan-p’o village

Cannabis was regarded among “five grains” in China, and was farmed as a major food crop.

2737 BC: Pen Ts’ao Ching

Earliest record of cannabis as a medicinal drug. At this time, Emperor Shen-Nung recognized its treatment properties for over 100 ailments such as gout, rheumatism, and malaria.

2000-1400 BC: Scythians

Nomadic Indo-European peoples used cannabis in steam baths, and also burned cannabis seeds in burial rituals.

2000-1000 BC: Atharva Vedas

Cannabis was described as a “source of happiness”, “joy-giver”, and “bringer of freedom” in these Hindu religious texts. At this time, cannabis was smoked at daily devotional services and religious rituals.

2000-1000 BC: Ayurvedic Medicine

Open religious use of cannabis allowed for exploration of medical benefits. During this period, it was used to treat a variety of ailments such as epilepsy, rabies, anxiety, and bronchitis.

1550 BC: Ebers Papyrus

Egyptian medical papyrus of medical knowledge notes that medical cannabis can treat inflammation.

1213 BC: Ramesses II

Cannabis pollen has been recovered from the mummy of Ramesses II, the Egyptian pharaoh who was mummified after his death in 1213 BC.

900 BC: Assyrians

Employed the psychotropic effects of cannabis for recreational and medical purposes.

450-200 BC: Greco-Roman use

Physician Dioscorides prescribed cannabis for toothaches and earaches. Greek doctor Claudius Galen noted it was widely consumed throughout the empire. Women of the Roman elite also used cannabis to alleviate labor pains.

207 AD: Hua T’o

First recorded physician to describe cannabis as an analgesic. He used a mixture of cannabis and wine to anesthetize patients before surgery.

1000 AD: Treats Epilepsy

Arabic scholars al-Mayusi and al-Badri regard cannabis as an effective treatment for epilepsy.

1025 AD: Avicenna

The medieval Persian medical writer publishes “Avicenna’s Canon of Medicine”, stating that cannabis is an effective treatment for gout, edema, infectious wounds, and severe headaches. His work was widely studied from the 13th to 19th centuries, having a lasting impact on Western medicine.

1300 AD: Arab traders

Arab traders bring cannabis from India to Eastern Africa, where it spreads inland. It is used to treat malaria, asthma, fever, and dysentery.

1500 AD: Spanish Conquest

The Spanish brought cannabis to the Americas, where it was used for more practical purposes like rope or clothes. However, years later, it would be used as a psychoactive and medicinal drug.

1798: Napoleon

Napoleon brought cannabis back to France from Egypt, and it was investigated for its pain relieving and sedative qualities. At this time, cannabis would be used to treat tumors, cough, and jaundice.

1839: William O’Shaughnessy

Irish doctor William O’Shaughnessy introduced the therapeutic uses of cannabis to Western medicine. He concluded it had no negative medicinal effects, and the plant’s use in a pharmaceutical context would rapidly rise thereafter.

1900: Medical Cannabis

Medical cannabis was used to treat nausea, rheumatism, and labor pain. At this point in time, it is available over-the-counter in medications such as “Piso’s cure” and “One day cough cure”.

1914: Harrison Act

Drug use was declared a crime in the U.S., under the Harrison Narcotics Tax Act in 1914.

1937: Marihuana Tax Act

The Marihuana Tax Act banned the use and sales of cannabis in the United States.

1964: Discovery of THC

The molecular structure of THC, an active component of cannabis, was discovered and synthesized by Israeli chemist Dr. Raphael Mechoulam.

1970: Classified as Schedule 1 Drug

Cannabis became categorized as a Schedule 1 Drug in the U.S., which limited further research into the plant. It was listed as having “no accepted medical use”.

1988: CBD Receptors Discovered

The CBD1 and CBD2 cannabinoid receptors were discovered. Today, we know they are some of the most abundant neuroreceptors in the brain.

2000-2018: Medical cannabis legalization

Governments, such as those of Canada and various states, begin to legalize cannabis for medical purposes from licensed producers. Recreational legalization quickly starts to follow.

Politics

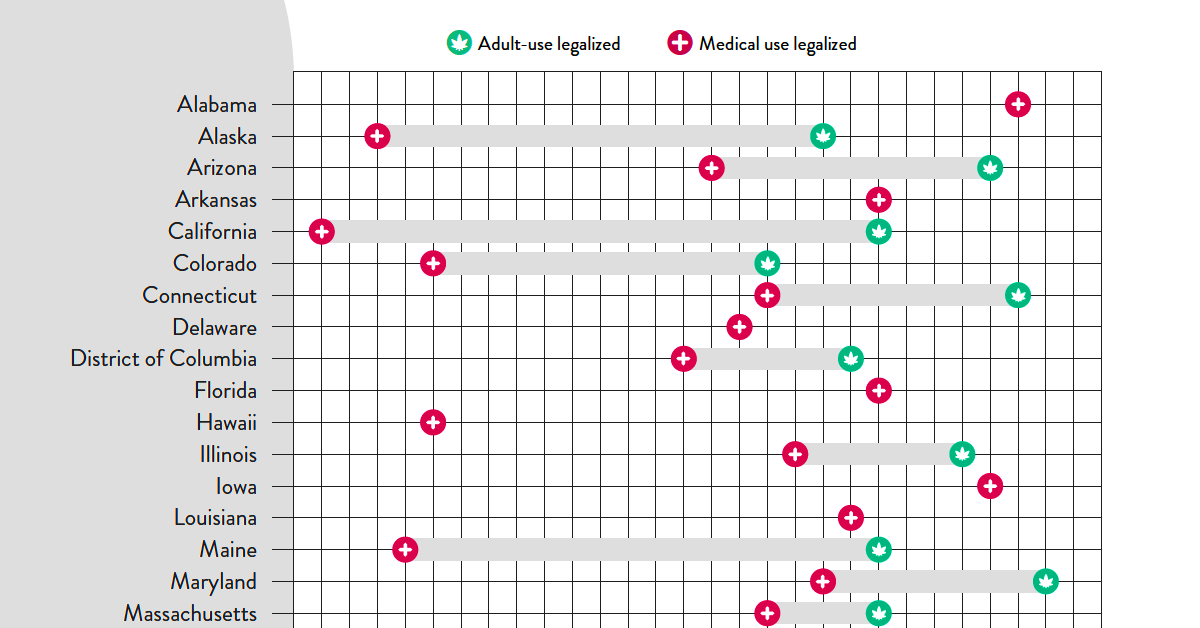

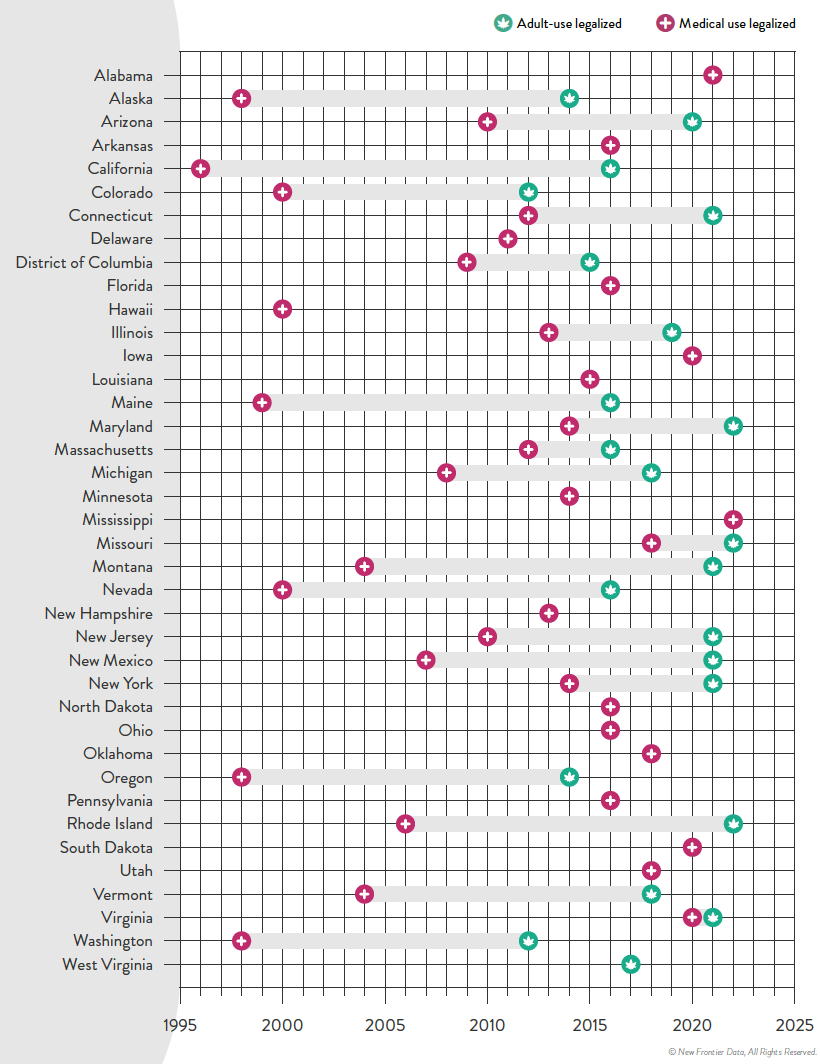

Timeline: Cannabis Legislation in the U.S.

At the federal level, cannabis is illegal, but state laws differ. This graphic looks at the timelines of cannabis legislation in the U.S.

Timeline: Cannabis Legislation in the U.S.

At the federal level, cannabis is still considered an illegal substance. That said, individual states do have the right to determine their own laws around cannabis sales and usage.

This visual from New Frontier Data looks at the status of cannabis in every state and the timeline of when medical and/or recreational use became legal.

Cannabis Through the Years

In the U.S., the oldest legalese concerning cannabis dates back to the 1600s—the colony of Virginia required every farm to grow and produce hemp. Since then, cannabis use was fairly wide open until the 1930s when the Marihuana Tax Act was enforced, prohibiting marijuana federally but still technically allowing medical use.

Jumping ahead, the Controlled Substances Act was passed in 1970, classifying cannabis as Schedule I drug—the same category as heroin. This prohibited any use of the substance.

However, the 1970s also saw a counter movement, wherein many states made the move towards decriminalization. Decriminalization means that although possessing cannabis remained illegal, a person would not be subject to jail time or prosecution for possessing certain amounts.

By the 1990s, some of the first states passed laws to allow the medical usage of cannabis, and by 2012 two states in the U.S.—Washington and Colorado—legalized the recreational use of cannabis.

Cannabis Legislation Today and Beyond

The MORE Act (the Marijuana Opportunity Reinvestment and Expungement Act) was passed in the House early 2022, and if made law, it would decriminalize marijuana federally.

“This bill decriminalizes marijuana. Specifically, it removes marijuana from the list of scheduled substances under the Controlled Substances Act and eliminates criminal penalties for an individual who manufactures, distributes, or possesses marijuana.”– U.S. Congress

Cannabis still remains illegal at the federal level, but at the state levels, cannabis is now fully legal (both for medicinal and recreational purposes) in a total of 22 states.

Over 246 million Americans have legal access to some form of marijuana products with high THC levels. Looking to the future, many new cannabis markets are expected to open up in the next few years:

The earliest states expected to open up next for recreational cannabis sales are Minnesota and Oklahoma. There is always a lag between legalization and actual sales, wherein local regulatory bodies and governments set standards. States like Kentucky, on the other hand, aren’t likely to even legalize medicinal cannabis until 2028.

It’s estimated that by 2030, there will be 69 million cannabis consumers in the country, up 33% from 2022.

Overall, the U.S. cannabis market is likely an important one to watch as legal sales hit $30 billion in 2022. By the end of the decade, that number is expected to be anywhere from $58 billion to as much as $72 billion.

-

Green1 week ago

Green1 week agoRanked: The Countries With the Most Air Pollution in 2023

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Travel2 weeks ago

Travel2 weeks agoRanked: The World’s Top Flight Routes, by Revenue