Cannabis

The Hidden Problem Looming Over the Cannabis Edibles Market

A Problem Looming Over the Cannabis Edibles Market

The boom in legal cannabis has been absolutely historic.

According to ArcView Research, it’s already a multi-billion dollar industry – and by 2022, the legal market could be worth $32 billion globally.

As in any nascent industry, the early days of cannabis have been exciting and formative. As it begins to mature, it’ll become clearer what products will drive future growth.

In this context, cannabis edibles and beverages have taken center stage – and today’s infographic from Trait Biosciences outlines the magnitude of this opportunity, along with some of the challenges the market faces going forward.

The Rise of Edibles

From dark chocolate to CBD-infused beverages, the cannabis edibles market is one of the most diverse and exciting markets for both consumers and businesses.

Edibles and beverages have already more than doubled in their share of the overall cannabis market since 2011, and the market is expected to grow in size from $1 billion to $4.1 billion between the years 2017 and 2022.

This year, the Specialty Food Association even named cannabis edibles and beverages as a “Food Trend of the Year” – a nod to the fact that edibles are going mainstream, even within the scope of the much larger food and beverages industry.

Not surprisingly, as this category emerges, there are many big brands exploring options in the edibles market, including Constellation Brands, Molson Coors, Mondelez, Carl’s Jr, Anheuser Busch, Neal Brothers, and Coca-Cola. In particular, the beverages space seems to be hot: Constellation shelled out $4 billion for a stake in the largest cannabis company globally (Canopy Growth), and beer-maker Anheuser Busch partnered with Tilray to research THC and CBD drinks.

Marketplace Risks

There are four major sources of risk that could impact future growth potential for companies in the fast-moving cannabis edibles market:

- Regulatory risks:

Regulators are becoming increasingly concerned about the dosage, packaging, and labeling of edibles products - Stiff competition:

Mega brands are entering the edibles space at a blistering pace, and could dominate market share from newer entrants - Taxes:

Complex layers of taxation could decrease demand for edibles, such as in California, while also pushing consumers towards the black market - Consumer concerns:

Unpredictable dosage amounts, taste, and even toxins have surfaced as issues with the media, as consumers voice their concerns with edible products

But above and beyond these known risks, there is another potential hindrance to the edibles and beverages market that flies under the radar: how cannabinoids are absorbed into the bloodstream when ingested.

The Journey Into the Bloodstream

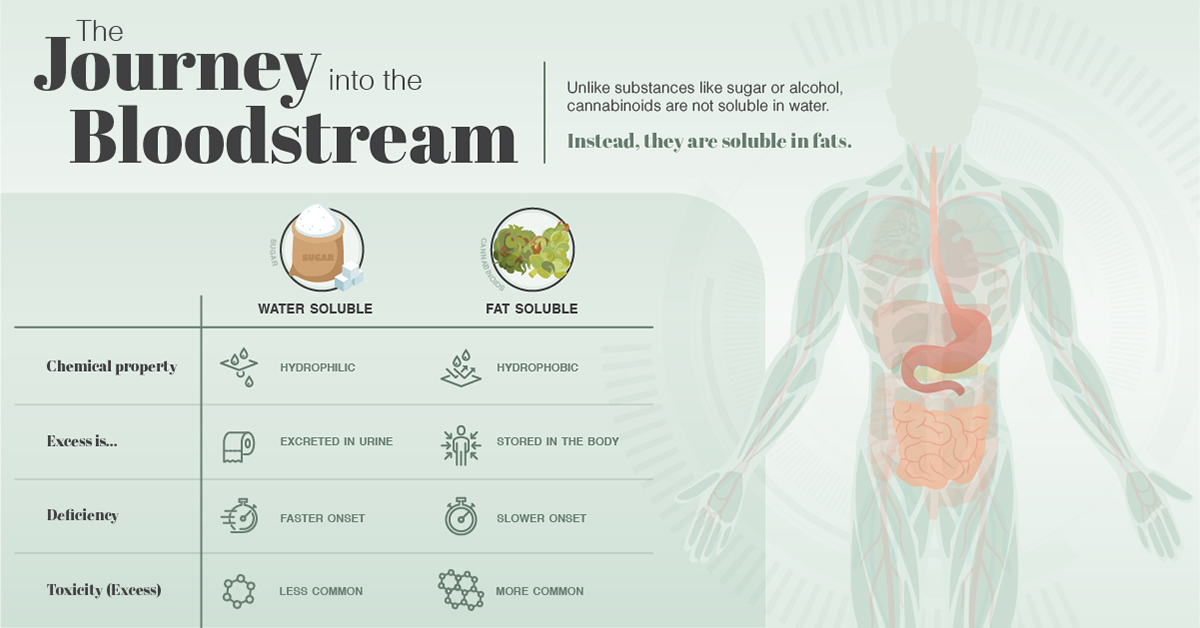

Unlike substances like sugar or alcohol, cannabinoids are not soluble in water. Instead, they are soluble in fats.

A substance such as sugar can enter the bloodstream within 10-15 minutes of ingesting. On the other hand, fat soluble substances such as cannabinoids have to wait – which is why sometimes edibles take hours to kick in.

Ultimately, cannabinoids are absorbed through the body’s fat. This happens in the small intestines, which help distribute them to the rest of the body.

Implications for Edibles and Beverages

For some cannabis producers, fat-solubility just means slow onset times and a generally undesirable taste. For other products, like CBD beverages, it creates bigger problems. Water and oil simply don’t mix.

To get around this, producers are using special emulsion techniques to make oil particles smaller, so that they mix with water better, increase bioavailability, and speed up onset times.

- Macroemulsion:

Think of this as mixing oil and vinegar. It’s your common emulsion that will separate over time, since oil and water don’t mix - Nanoemulsion:

Stable but thermodynamically unstable. Uses surfactants to keep water/oil binded - Microemulsion:

Stable, but uses a higher concentration of surfactants (which lower the surface tension between two liquids)

While these techniques are seeing increased usage by producers of cannabis products, they do have their own set of limitations.

Oil and water solutions still unbind over time, and products may only have a limited shelflife. Reporting by WSJ has found that these beverages also have a questionable aftertaste for many consumers, and onset times of these products are still not as fast as smoking or vaping.

It’s also worth noting that various health regulators, scientific journals, and international organizations have raised concerns about using nano-sized particles in food and beverages.

For example, the Canadian government warns that there is a “causal relationship between nanoparticle exposure and adverse health effects”, while the respected scientific journal Nature warns that nanoparticles “may behave differently within the human body”, and that “safety of nanoparticles should be judged on a case-by-case basis”.

Next Steps?

The cannabis edibles market is poised to be the next big thing – but when it comes to how these cannabinoids get absorbed by the body, there is still much work to be done.

How will the industry and consumers move forward to capitalize on growing opportunities in the edibles and beverages market?

Politics

Timeline: Cannabis Legislation in the U.S.

At the federal level, cannabis is illegal, but state laws differ. This graphic looks at the timelines of cannabis legislation in the U.S.

Timeline: Cannabis Legislation in the U.S.

At the federal level, cannabis is still considered an illegal substance. That said, individual states do have the right to determine their own laws around cannabis sales and usage.

This visual from New Frontier Data looks at the status of cannabis in every state and the timeline of when medical and/or recreational use became legal.

Cannabis Through the Years

In the U.S., the oldest legalese concerning cannabis dates back to the 1600s—the colony of Virginia required every farm to grow and produce hemp. Since then, cannabis use was fairly wide open until the 1930s when the Marihuana Tax Act was enforced, prohibiting marijuana federally but still technically allowing medical use.

Jumping ahead, the Controlled Substances Act was passed in 1970, classifying cannabis as Schedule I drug—the same category as heroin. This prohibited any use of the substance.

However, the 1970s also saw a counter movement, wherein many states made the move towards decriminalization. Decriminalization means that although possessing cannabis remained illegal, a person would not be subject to jail time or prosecution for possessing certain amounts.

By the 1990s, some of the first states passed laws to allow the medical usage of cannabis, and by 2012 two states in the U.S.—Washington and Colorado—legalized the recreational use of cannabis.

Cannabis Legislation Today and Beyond

The MORE Act (the Marijuana Opportunity Reinvestment and Expungement Act) was passed in the House early 2022, and if made law, it would decriminalize marijuana federally.

“This bill decriminalizes marijuana. Specifically, it removes marijuana from the list of scheduled substances under the Controlled Substances Act and eliminates criminal penalties for an individual who manufactures, distributes, or possesses marijuana.”– U.S. Congress

Cannabis still remains illegal at the federal level, but at the state levels, cannabis is now fully legal (both for medicinal and recreational purposes) in a total of 22 states.

Over 246 million Americans have legal access to some form of marijuana products with high THC levels. Looking to the future, many new cannabis markets are expected to open up in the next few years:

The earliest states expected to open up next for recreational cannabis sales are Minnesota and Oklahoma. There is always a lag between legalization and actual sales, wherein local regulatory bodies and governments set standards. States like Kentucky, on the other hand, aren’t likely to even legalize medicinal cannabis until 2028.

It’s estimated that by 2030, there will be 69 million cannabis consumers in the country, up 33% from 2022.

Overall, the U.S. cannabis market is likely an important one to watch as legal sales hit $30 billion in 2022. By the end of the decade, that number is expected to be anywhere from $58 billion to as much as $72 billion.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees