Cannabis

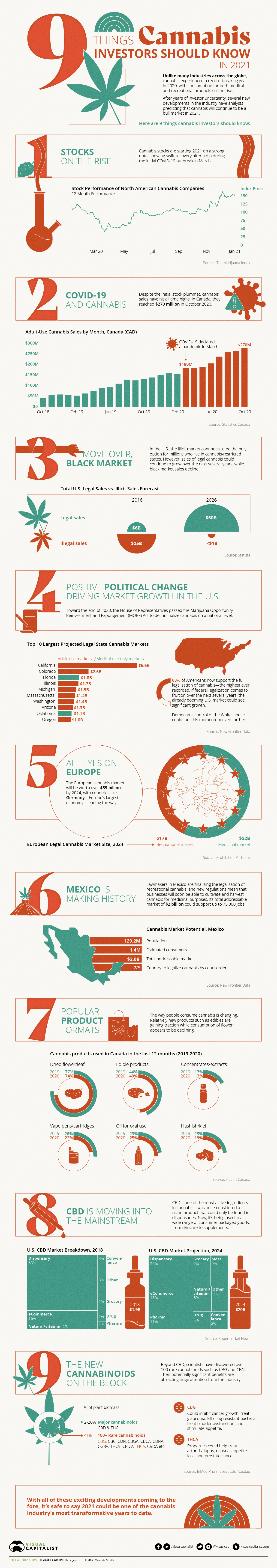

9 Things Investors Should Know About the Cannabis Industry in 2021

9 Things Cannabis Investors Should Know in 2021

Unlike dozens of other industries across the globe, cannabis experienced significant growth as a result of the COVID-19 pandemic.

In fact, with consumption for both medical and recreational products on the rise, 2020 was a record-breaking year for the industry. After years of investor uncertainty, analysts are predicting a continued bull market in 2021, with several new and exciting developments on the horizon.

Here are nine things cannabis investors need to know.

1. Cannabis Stocks on the Rise

While asset prices took a dip during the initial stage of the COVID-19 outbreak in March, the cannabis sector recovered swiftly after reporting impressive numbers.

Even though cannabis investors have experienced some ups and downs in the last several years, 2021 looks more hopeful.

2. COVID-19 and Cannabis

Cannabis has become an attractive option for people spending more time at home, both as a means of entertainment, and to reduce stress and anxiety associated with the pandemic.

As a result, cannabis sales are soaring. In Canada, monthly sales reached an all-time high of $270 million (CAD) in October 2020, a dramatic increase from $180 million just six months earlier.

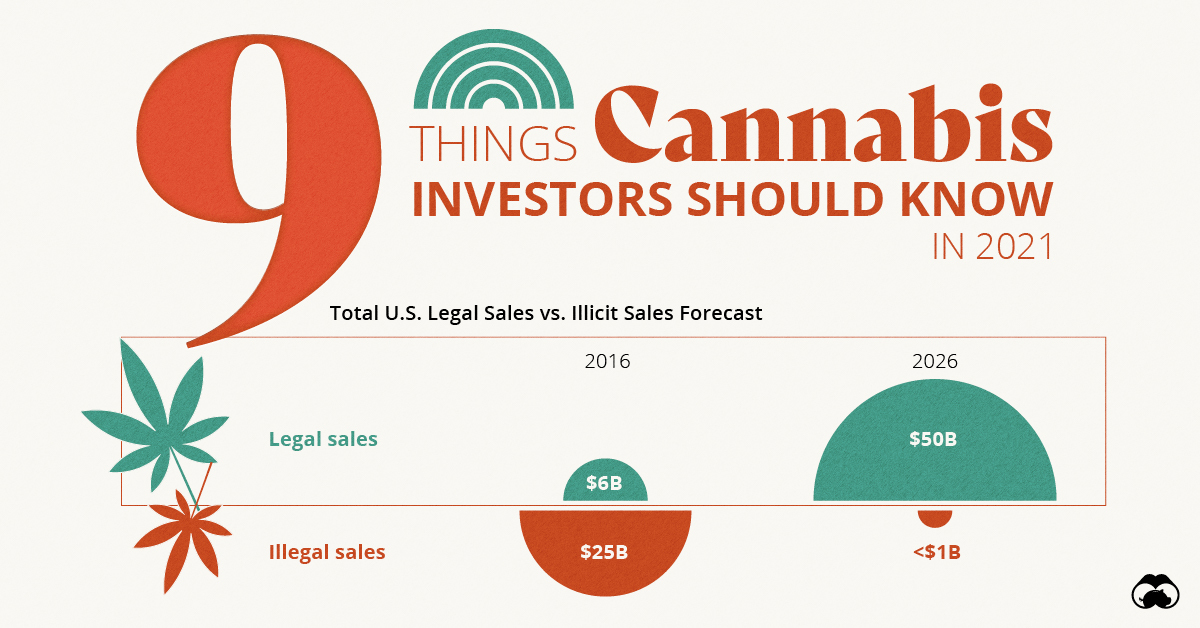

3. Cannabis Black Market No More?

For millions of U.S. citizens who live in states where the sale of cannabis is still restricted, the illicit market continues to be their only option.

But with loosening restrictions and legal cannabis becoming more widely available, legal sales are predicted to reach $50 billion by 2026 while illegal sales will plummet to less than $1 billion by the same year.

| Year | U.S. Legal Cannabis Sales | U.S. Illegal Cannabis Sales |

|---|---|---|

| 2016 | $6 billion | $25 billion |

| 2026 | $50 billion | <$1 billion |

4. Political Change Driving Market Growth

Almost 70% of Americans now support the full legalization of cannabis—the highest figure ever recorded.

States where cannabis is legal are now paving the way for cannabis sales, with California expected to pull in over $6 billion by 2021 alone. If federal legalization comes to fruition over the next several years, the already booming U.S. market could see further growth.

5. All Eyes on the European Cannabis Market

The European cannabis market has been on investors’ radar for several years, and with good reason—it is one of the largest cannabis markets in the world.

Driven primarily by medicinal products, the market will be valued at over $39 billion by 2024, with countries like Germany—Europe’s largest economy—leading the way.

In late 2020, the market experienced its biggest breakthrough yet, with the European Union ruling that products containing CBD (one of the most active ingredients in cannabis) are no longer listed as narcotics.

6. Making History in Mexico

Mexico is another market that is piquing the interest of investors and cannabis companies the world over. That’s because it could soon be the third country in the world to legalize recreational cannabis by court order.

With a total addressable market of $2 billion and the potential to support up to 75,000 jobs, these new regulations could change the dynamic of the global market for the better.

7. Most Popular Cannabis Products

Given the flurry of product innovation in the market, consumption of cannabis is quickly changing.

Relatively new products such as edibles and oils are gaining traction, while consumption of flower appears to be declining. This could be due in part to oral products being perceived as a healthier alternative to smoking.

8. CBD Products are Moving into the Mainstream

Although CBD was once considered a niche product that could only be found in dispensaries, growing awareness of the benefits and safety of these products are causing companies operating in the consumer packaged goods industry to take notice.

The cannabis compound is a new addition to a wide range of products such as skincare, makeup, and supplements that can now be purchased almost anywhere—from ecommerce sites to local grocery stores.

9. The New Cannabinoids on the Block

Beyond CBD, scientists have discovered over 100 rare, or minor cannabinoids such as CBG and CBN, that could have even more significant benefits than their major cannabinoid counterparts.

For example, preliminary research shows that CBG could inhibit cancer growth, help treat glaucoma, bladder dysfunction, and kill drug-resistant bacteria.

These discoveries are not only attracting huge attention from the cannabis industry, but from the pharmaceutical industry as well.

Milestones in the Making

With all of these exciting developments coming to the fore, it’s safe to say 2021 could be one of the cannabis industry’s most transformative years to date.

Politics

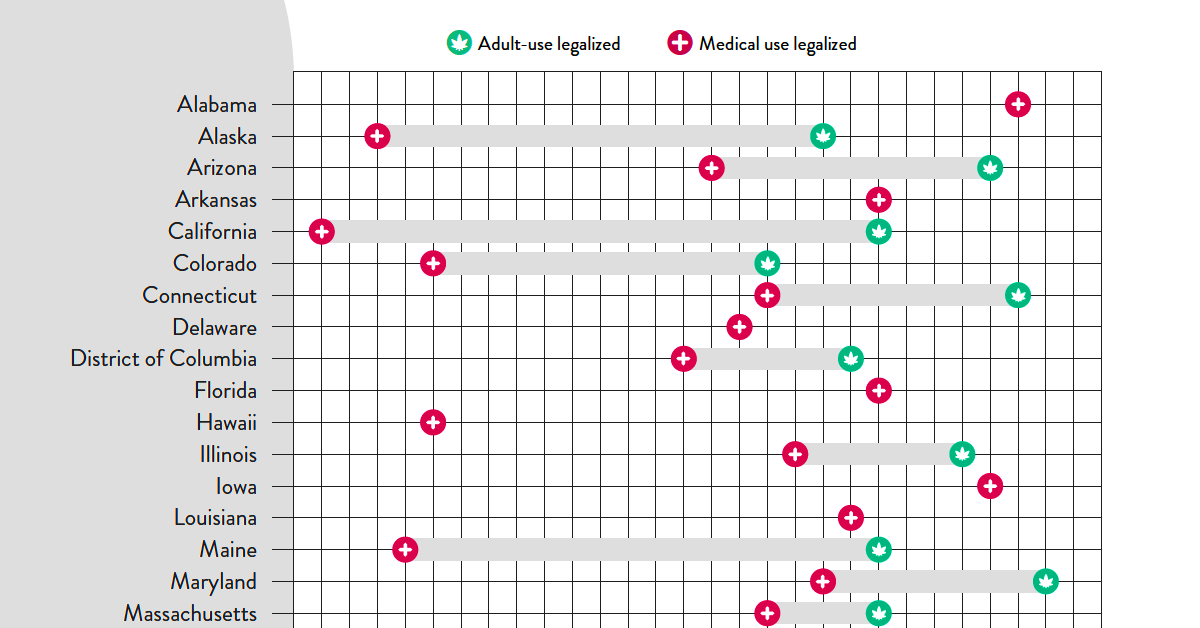

Timeline: Cannabis Legislation in the U.S.

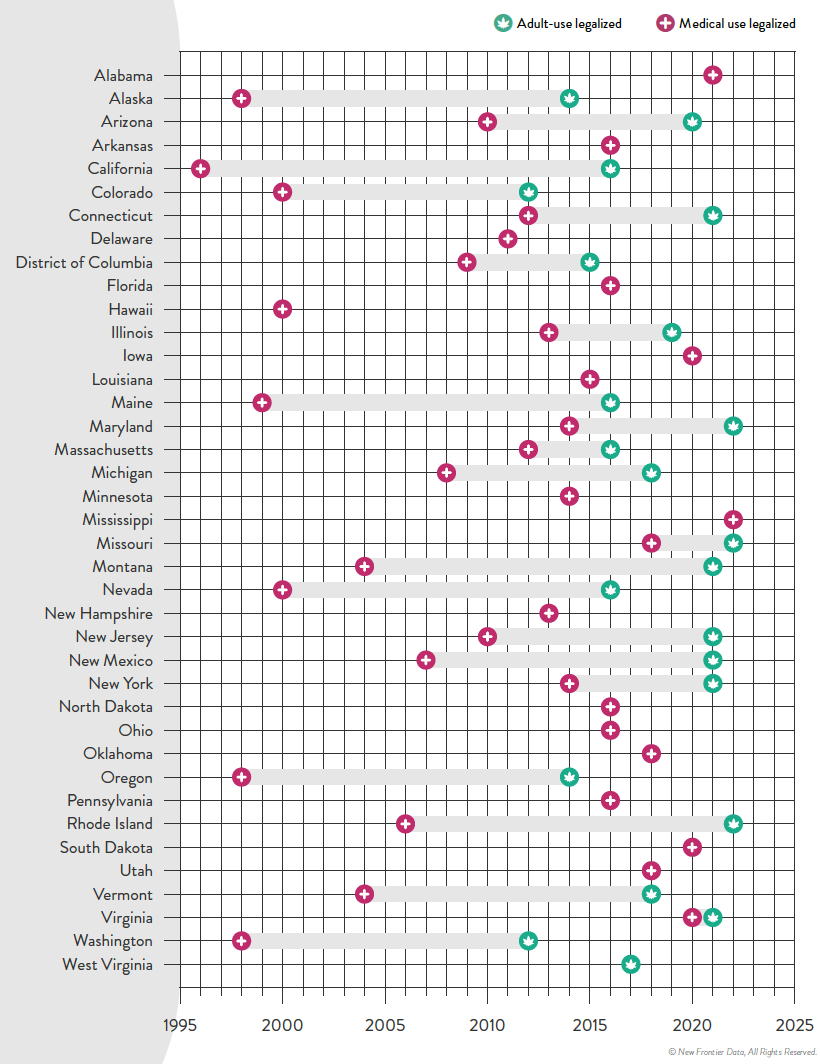

At the federal level, cannabis is illegal, but state laws differ. This graphic looks at the timelines of cannabis legislation in the U.S.

Timeline: Cannabis Legislation in the U.S.

At the federal level, cannabis is still considered an illegal substance. That said, individual states do have the right to determine their own laws around cannabis sales and usage.

This visual from New Frontier Data looks at the status of cannabis in every state and the timeline of when medical and/or recreational use became legal.

Cannabis Through the Years

In the U.S., the oldest legalese concerning cannabis dates back to the 1600s—the colony of Virginia required every farm to grow and produce hemp. Since then, cannabis use was fairly wide open until the 1930s when the Marihuana Tax Act was enforced, prohibiting marijuana federally but still technically allowing medical use.

Jumping ahead, the Controlled Substances Act was passed in 1970, classifying cannabis as Schedule I drug—the same category as heroin. This prohibited any use of the substance.

However, the 1970s also saw a counter movement, wherein many states made the move towards decriminalization. Decriminalization means that although possessing cannabis remained illegal, a person would not be subject to jail time or prosecution for possessing certain amounts.

By the 1990s, some of the first states passed laws to allow the medical usage of cannabis, and by 2012 two states in the U.S.—Washington and Colorado—legalized the recreational use of cannabis.

Cannabis Legislation Today and Beyond

The MORE Act (the Marijuana Opportunity Reinvestment and Expungement Act) was passed in the House early 2022, and if made law, it would decriminalize marijuana federally.

“This bill decriminalizes marijuana. Specifically, it removes marijuana from the list of scheduled substances under the Controlled Substances Act and eliminates criminal penalties for an individual who manufactures, distributes, or possesses marijuana.”– U.S. Congress

Cannabis still remains illegal at the federal level, but at the state levels, cannabis is now fully legal (both for medicinal and recreational purposes) in a total of 22 states.

Over 246 million Americans have legal access to some form of marijuana products with high THC levels. Looking to the future, many new cannabis markets are expected to open up in the next few years:

The earliest states expected to open up next for recreational cannabis sales are Minnesota and Oklahoma. There is always a lag between legalization and actual sales, wherein local regulatory bodies and governments set standards. States like Kentucky, on the other hand, aren’t likely to even legalize medicinal cannabis until 2028.

It’s estimated that by 2030, there will be 69 million cannabis consumers in the country, up 33% from 2022.

Overall, the U.S. cannabis market is likely an important one to watch as legal sales hit $30 billion in 2022. By the end of the decade, that number is expected to be anywhere from $58 billion to as much as $72 billion.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees