Cannabis

The Allure of Craft Cannabis to Investors

The Investor Appeal in Craft Cannabis

They say if you do what you love, then the money will follow. In the multi-billion dollar cannabis business, that has certainly proved true for those who have been passionate about the plant for decades — otherwise known as craft growers.

Today’s infographic from Pasha Brands dives into the huge consumer demand for craft products, and why investors should pay attention to this trend as it extends into cannabis.

The Perfect Craft Product

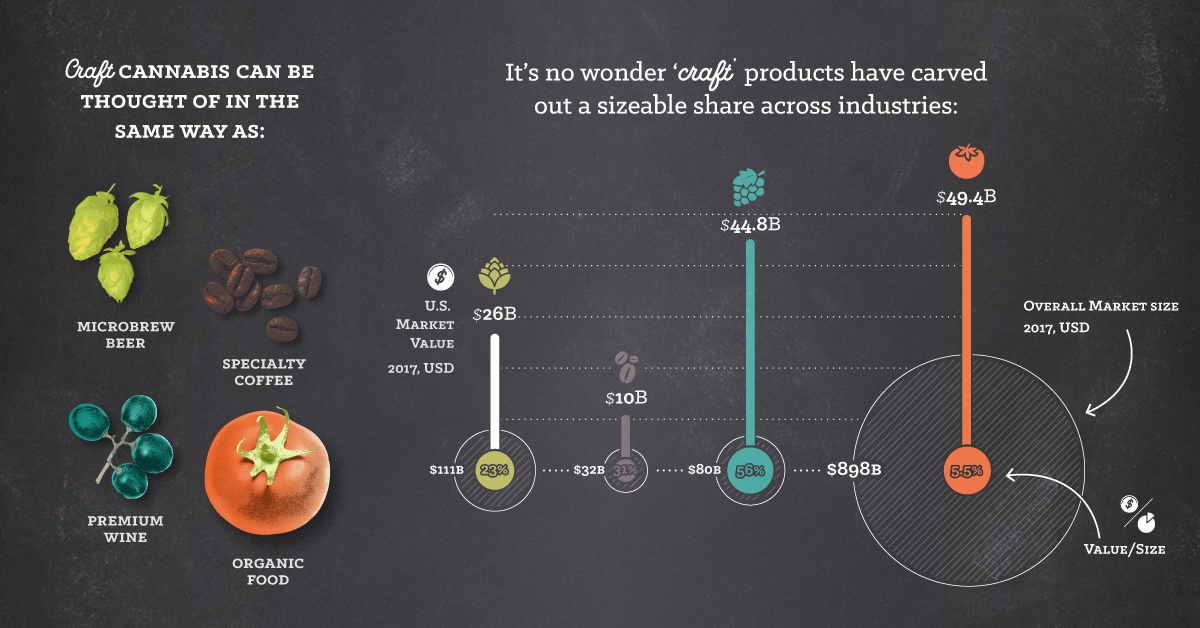

Chances are, you may have encountered any of the following at least once: microbrewed beer, specialty coffee, premium wine, or organic food. They’ve become so popular, that craft versions of all these are steadily carving a valuable niche in their original markets.

| U.S. Market Size, 2017 | Craft Market Size, 2017 | Share of total | |

|---|---|---|---|

| Beer vs Microbrew Beer | $111B | $26B | 23% |

| Coffee vs Specialty Coffee | $32B | $10B | 31% |

| Wine vs Premium Wine | $80B | $44.8B | 56% |

| Food vs Organic Food | $898B | $49.4B | 5.5% |

Whether it’s introducing flavors into brews, slow-roasting beans, producing wine in small lots, or using a conscious “farm to table” label — what they have in common is the careful attention that’s paid to the process from start to end.

Craft cannabis bears a strong resemblance to all of these in that way, as growing it involves extra care, compared to large-scale producers. For example, hand-trimming is more labor intensive than using machines, but results in products with superior quality.

What are some other characteristics of craft cannabis?

- Attention to detail

A hands-on approach allows growers to personally ensure each cannabis plant is healthy. - Sustainable practices

The use of organic farming to save energy, creating a smaller environmental footprint. - Social responsibility

Smaller growers typically leverage local connections, creating employment opportunities. - Artisanal branding

Sophisticated and modern packaging helps appeal to different types of craft cannabis consumers.

It’s clear why consumers care about craft cannabis. But what does it offer investors?

Making the Case for Craft

Investors should be paying close attention to craft cannabis for three key reasons: a higher price point, a focus on quality, and access to the retail market.

Upscale Price Tag

On average, organic cannabis has a higher price point attached to it, compared to regular grade cannabis.

- Industry average: $9.02/ gram

- Organic average: $11.40/ gram

Using organic methods to grow cannabis means that the final product on shelves boast an enhanced potency and effect. Since craft cannabis is also grown organically, it’s clear that consumers are willing to spend more to secure a premium product.

Promise of Quality

It might not come as a surprise that the most famous craft cannabis regions are also where the biggest volume of legal cannabis sales come from. California and Canada accounted for nearly 38% in global market share in 2017:

- Worldwide sales: $9.5 billion

- California sales: $3 billion

- Rest of U.S. sales: $5.5 billion

- Canada sales: $0.6 billion

- Rest of world: $0.4 billion

These two areas have a foothold in cannabis sales, and with recreational legalization unfolding in both – and 75 million people living between the two jurisdictions – it will only continue to grow.

Opening the Doors

Following nation-wide legalization in Canada and an increasing number of states in the U.S., the continent is facing a cannabis shortage. Why? As it turns out, while craft growers are abundant, they still face regulatory hurdles in order to move from the “gray” underground market into launching legal operations.

Craft cannabis could be a cornerstone for industry growth, but its growers have been in the shadows for a long time. As cannabis gains momentum, tapping into the huge network of craft growers will be key for success.

Politics

Timeline: Cannabis Legislation in the U.S.

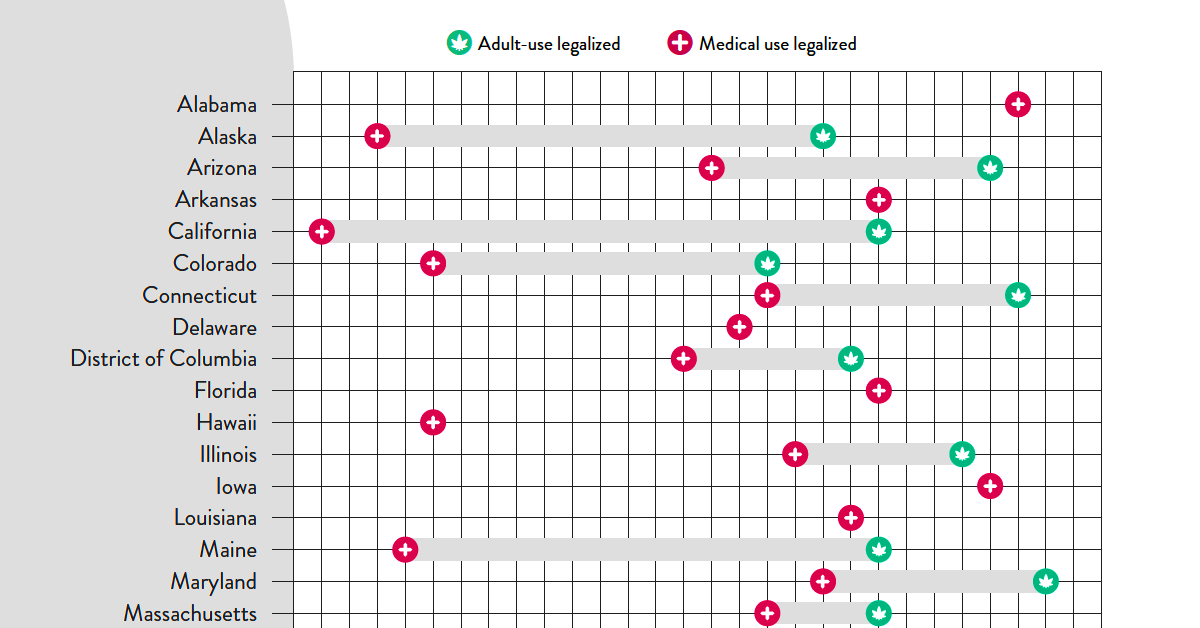

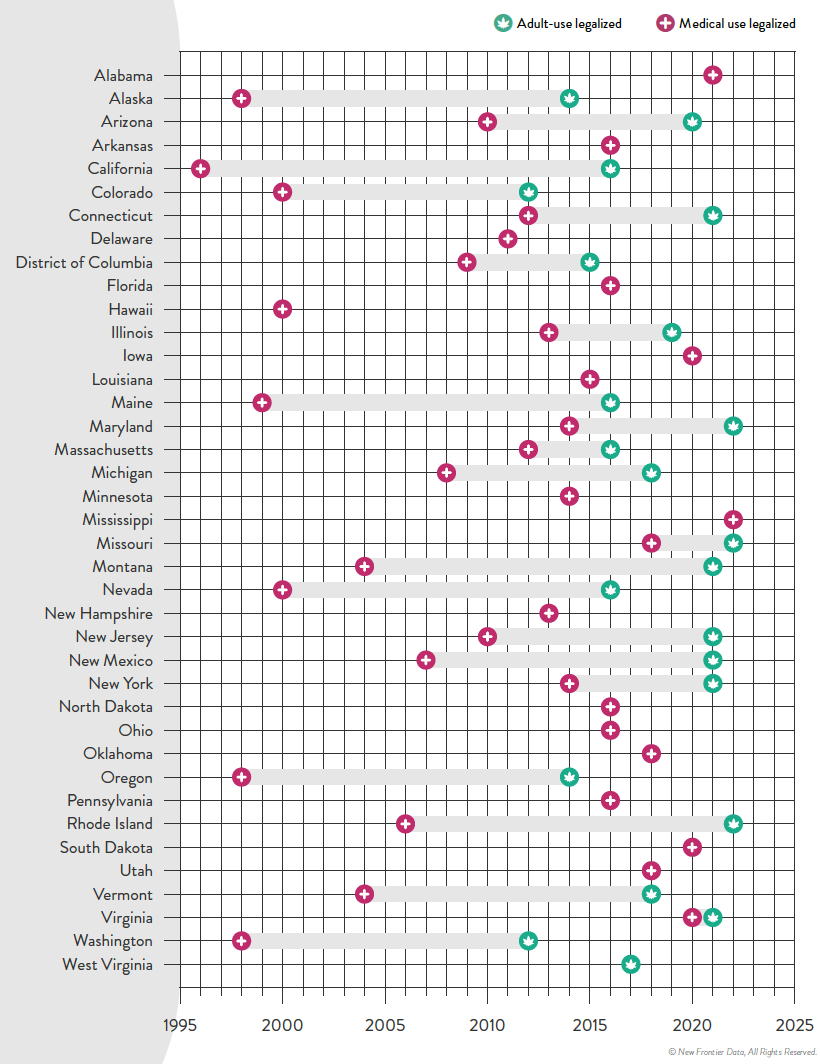

At the federal level, cannabis is illegal, but state laws differ. This graphic looks at the timelines of cannabis legislation in the U.S.

Timeline: Cannabis Legislation in the U.S.

At the federal level, cannabis is still considered an illegal substance. That said, individual states do have the right to determine their own laws around cannabis sales and usage.

This visual from New Frontier Data looks at the status of cannabis in every state and the timeline of when medical and/or recreational use became legal.

Cannabis Through the Years

In the U.S., the oldest legalese concerning cannabis dates back to the 1600s—the colony of Virginia required every farm to grow and produce hemp. Since then, cannabis use was fairly wide open until the 1930s when the Marihuana Tax Act was enforced, prohibiting marijuana federally but still technically allowing medical use.

Jumping ahead, the Controlled Substances Act was passed in 1970, classifying cannabis as Schedule I drug—the same category as heroin. This prohibited any use of the substance.

However, the 1970s also saw a counter movement, wherein many states made the move towards decriminalization. Decriminalization means that although possessing cannabis remained illegal, a person would not be subject to jail time or prosecution for possessing certain amounts.

By the 1990s, some of the first states passed laws to allow the medical usage of cannabis, and by 2012 two states in the U.S.—Washington and Colorado—legalized the recreational use of cannabis.

Cannabis Legislation Today and Beyond

The MORE Act (the Marijuana Opportunity Reinvestment and Expungement Act) was passed in the House early 2022, and if made law, it would decriminalize marijuana federally.

“This bill decriminalizes marijuana. Specifically, it removes marijuana from the list of scheduled substances under the Controlled Substances Act and eliminates criminal penalties for an individual who manufactures, distributes, or possesses marijuana.”– U.S. Congress

Cannabis still remains illegal at the federal level, but at the state levels, cannabis is now fully legal (both for medicinal and recreational purposes) in a total of 22 states.

Over 246 million Americans have legal access to some form of marijuana products with high THC levels. Looking to the future, many new cannabis markets are expected to open up in the next few years:

The earliest states expected to open up next for recreational cannabis sales are Minnesota and Oklahoma. There is always a lag between legalization and actual sales, wherein local regulatory bodies and governments set standards. States like Kentucky, on the other hand, aren’t likely to even legalize medicinal cannabis until 2028.

It’s estimated that by 2030, there will be 69 million cannabis consumers in the country, up 33% from 2022.

Overall, the U.S. cannabis market is likely an important one to watch as legal sales hit $30 billion in 2022. By the end of the decade, that number is expected to be anywhere from $58 billion to as much as $72 billion.

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Travel1 week ago

Travel1 week agoRanked: The World’s Top Flight Routes, by Revenue

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024