Cannabis

The Story of Cannabis: What Investors Need to Know

The Story of Cannabis: What Investors Need to Know

It’s not often that a multi-billion dollar industry appears out of nowhere.

Despite the fact that the first-recorded cannabis use by humans was from as far back as 6,000 years ago, the emerging cannabis market remains a challenging enigma for most investors to wrap their heads around. The opportunity is there, but there are few precedents for companies pioneering in the space.

What will users look for in a legal cannabis product, and how can investors and companies prepare to make the most of this Wild West of a market?

What Investors Need to Know

Today’s infographic comes to us from The Green Organic Dutchman, and it serves as an introduction to the story of cannabis, providing context around the plant, its history, market trends, and the potential of emerging legal markets.

It’s the first part in an eight-part infographic series called “From Soil to Sale”, that will dive deeper into these trends and what they mean to investors.

The Bird’s Eye View

Cannabis has a 6,000 year history of human use – however, since becoming illegal in the early 20th century, it’s fair to say the knowledge gap has broadened as to the plant’s uses and potential.

A Quick Overview:

The female cannabis plant produces clusters of buds which are trimmed down for commercial use. Trichomes are small “hairs” on the outside of cannabis flower that produce and secrete resin, including the cannabinoids and terpenes sought after by users.

There are over 750 compounds found in the plant, including at least 104 cannabinoids.

THC is the cannabinoid you are likely most familiar with (it’s the psychoactive one), but another cannabinoid that is being intensely studied is CBD – a non-psychoactive medicine that has wide applications to several diseases.

Key Industry Trends

As the legal industry takes off, here are three consumer-focused trends to keep in mind as you watch the cannabis sector:

1. Environmental Sustainability

Indoor cultivation of cannabis is both energy and carbon intensive, while outdoor cultivation uses massive amounts of water. With these potential impacts in mind, consumers will demand cannabis products that minimize effects on the environment.

2. Organic Products

More consumers are leaning organic. The global organic market is expected to blossom into a $320.5 billion market by 2025 – and organic cannabis will likely see similar uptake.

3. Cannabis Retail Products

The market for cannabis-infused food and beverages is expected to grow at a 25% CAGR between 2018 and 2022.

In large legal markets like California and Canada, there is a multi-billion dollar opportunity for investors and companies in the cannabis space – and we will continue to demystify the legal cannabis market and how it works as we continue through this infographic series.

This is part one of an eight-part series. Stay tuned by subscribing to Visual Capitalist for free, as we go into the cannabis market in more depth.

Politics

Timeline: Cannabis Legislation in the U.S.

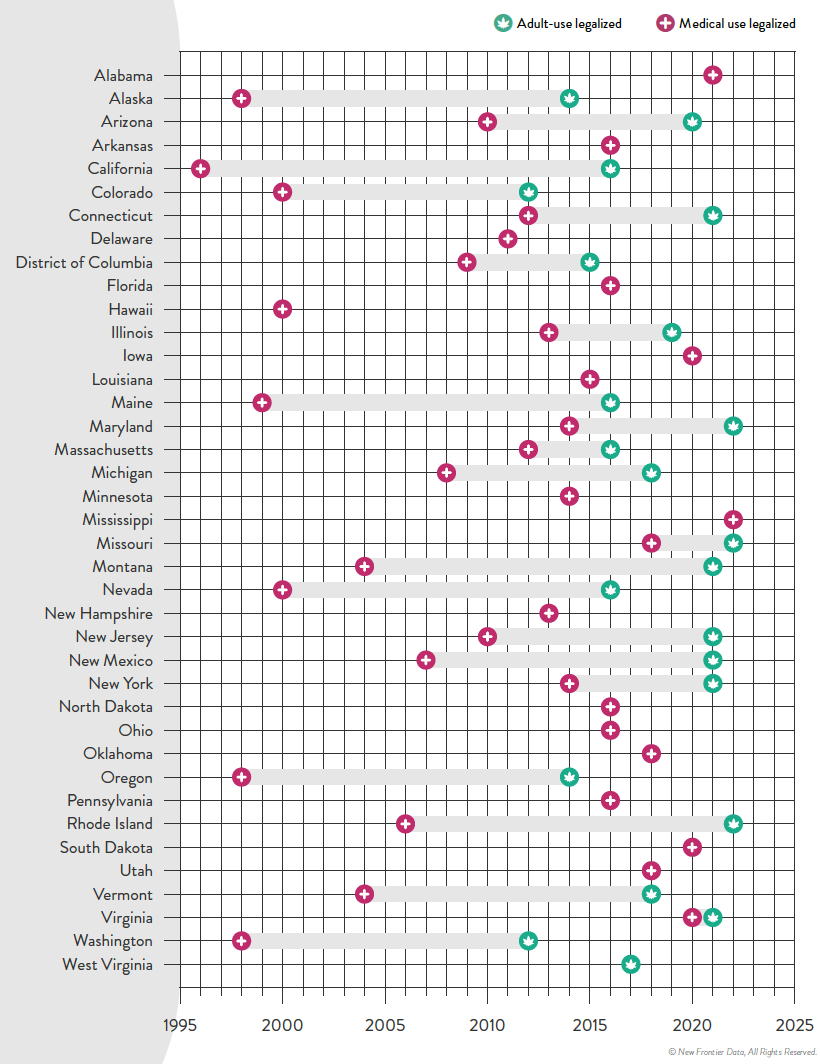

At the federal level, cannabis is illegal, but state laws differ. This graphic looks at the timelines of cannabis legislation in the U.S.

Timeline: Cannabis Legislation in the U.S.

At the federal level, cannabis is still considered an illegal substance. That said, individual states do have the right to determine their own laws around cannabis sales and usage.

This visual from New Frontier Data looks at the status of cannabis in every state and the timeline of when medical and/or recreational use became legal.

Cannabis Through the Years

In the U.S., the oldest legalese concerning cannabis dates back to the 1600s—the colony of Virginia required every farm to grow and produce hemp. Since then, cannabis use was fairly wide open until the 1930s when the Marihuana Tax Act was enforced, prohibiting marijuana federally but still technically allowing medical use.

Jumping ahead, the Controlled Substances Act was passed in 1970, classifying cannabis as Schedule I drug—the same category as heroin. This prohibited any use of the substance.

However, the 1970s also saw a counter movement, wherein many states made the move towards decriminalization. Decriminalization means that although possessing cannabis remained illegal, a person would not be subject to jail time or prosecution for possessing certain amounts.

By the 1990s, some of the first states passed laws to allow the medical usage of cannabis, and by 2012 two states in the U.S.—Washington and Colorado—legalized the recreational use of cannabis.

Cannabis Legislation Today and Beyond

The MORE Act (the Marijuana Opportunity Reinvestment and Expungement Act) was passed in the House early 2022, and if made law, it would decriminalize marijuana federally.

“This bill decriminalizes marijuana. Specifically, it removes marijuana from the list of scheduled substances under the Controlled Substances Act and eliminates criminal penalties for an individual who manufactures, distributes, or possesses marijuana.”– U.S. Congress

Cannabis still remains illegal at the federal level, but at the state levels, cannabis is now fully legal (both for medicinal and recreational purposes) in a total of 22 states.

Over 246 million Americans have legal access to some form of marijuana products with high THC levels. Looking to the future, many new cannabis markets are expected to open up in the next few years:

The earliest states expected to open up next for recreational cannabis sales are Minnesota and Oklahoma. There is always a lag between legalization and actual sales, wherein local regulatory bodies and governments set standards. States like Kentucky, on the other hand, aren’t likely to even legalize medicinal cannabis until 2028.

It’s estimated that by 2030, there will be 69 million cannabis consumers in the country, up 33% from 2022.

Overall, the U.S. cannabis market is likely an important one to watch as legal sales hit $30 billion in 2022. By the end of the decade, that number is expected to be anywhere from $58 billion to as much as $72 billion.

-

Markets2 weeks ago

Markets2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?