Green

The Circular Economy: Redesigning our Planet’s Future

Think about the last item you threw away. Did you consider where that product ended up, once you threw it away?

The Earth’s growing waste problem can be traced back to a culture that treats virtually every item we buy and own as disposable. Rapid urbanisation, population growth, and industrialisation are key contributors to the burgeoning volumes of waste that humans are producing each year.

But what if there was away to get around that?

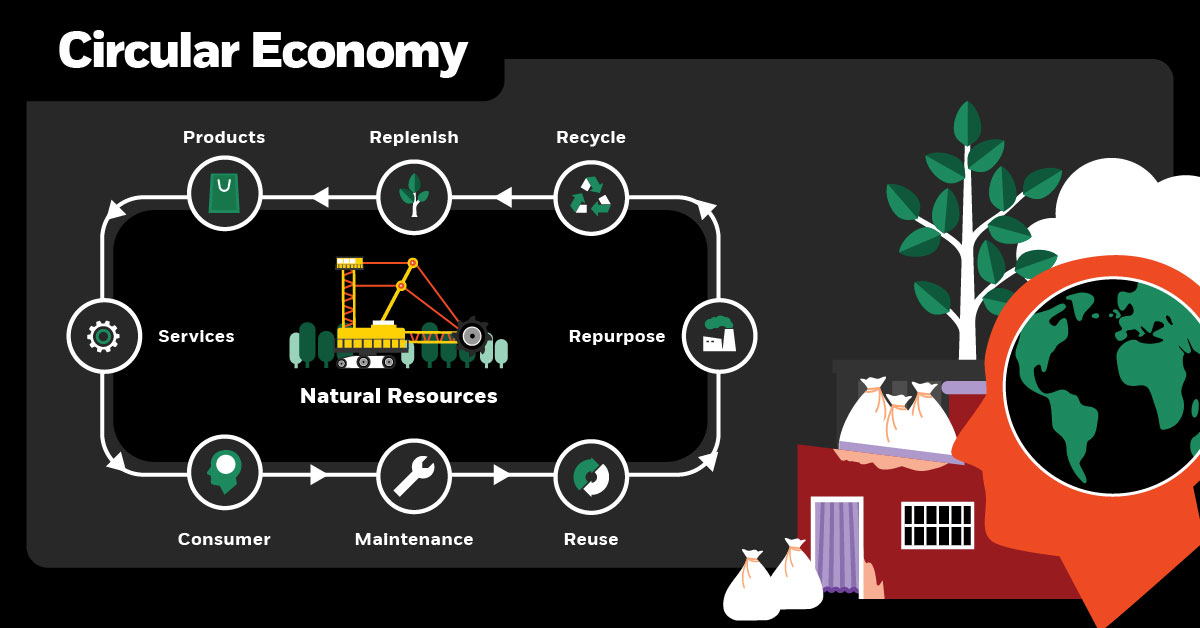

Introducing the Circular Economy

Today’s post from BlackRock highlights the key benefits of adopting a circular economy, and examines the factors that will make the biggest impact in the years to come.

A Culture of Consumption

Mass production is making products cheaper, more readily available, and more readily disposable, bringing levels of material comfort unimaginable to previous generations.

Companies are making new products at a frenetic pace to keep up with global demand─consuming finite resources as if the Earth had an infinite supply.

The intense effects of this mass consumption are visible across multiple industries:

- Construction: Construction waste alone is expected to reach 2.2 billion tonnes annually by 2025.

- Fast Fashion: Roughly 87% of clothing is discarded or burned each year, costing US$100 billion.

- Plastics: Over 95% of plastic packaging value is wasted every year, costing up to US$120 billion.

As natural resources decline and waste continues to pile up, our society is at a crossroads.

A Tale of Two Economies

Today, most of the world follows the Take-Make-Waste practices of the linear economy, with little regard for future use of these resources and products. Unfortunately, most of this ends up in landfills─by 2050, we could be producing 3.4 billion tonnes of waste each year.

The circular economy, by contrast, is focused on redesigning our systems, processes, and products to enable goods to be used longer, repurposed, or recycled more efficiently.

The circular economy is a major transformational force that will last decades…investors are increasingly considering sustainability factors when making investment decisions.

—BlackRock

Companies and governments that choose to adopt a circular economic model could end up saving €600 billion (US$663 billion) annually─and potentially add €1.8 trillion (US$2 trillion) in additional benefits to Europe’s overall economy.

Designing a Better Future

Three major factors are driving the gradual, global shift to a circular economy.

- Economic

Companies will need to switch from wasteful to sustainable practices, and many are taking steps towards a better future. The New Plastics Economy Global Commitment was signed in 2018 by over 400 organisations to eliminate plastic waste and pollution.

- Regulatory

Regulations such as bans on single-use plastics and international waste imports are growing more stringent, and some governments are also offering tax incentives for corporations that follow sustainable practices.

- Society

More consumers are actively researching and questioning the impacts of the products they buy, and consumer demand is showing a preference for reusable products and practices.

While few public companies today are actively using a circular economy, several major brands are leading the way in sustainable business practices.

- Philips: Light-as-a-service that provides access to lighting rather than ownership of lightbulbs

- Levi Strauss: Repurposing old garments into building insulation, upholstery, and new clothing

- Toshiba: First multi-function printer, heat-sensitive erasable toner can do up to five reprints per page

- Renault: Revamped old vehicle drive trains, engines, and gearboxes to almost-new condition

Companies and governments in the circular economy have a structural advantage to solve some of the world’s biggest economic issues ─ giving them a strong, long-term market for goods and services, the potential to lower costs, and open profitable new business streams.

Lasting Impact on People, Planet, and Profit

In order for the circular economic model to achieve widespread adoption, both sustainable investment and partnerships across sectors are needed.

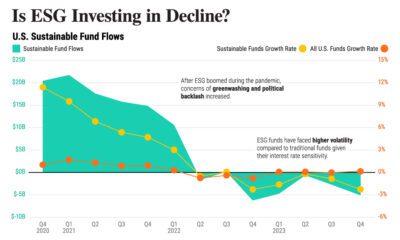

This rally for change is making an impact on financial markets─sustainable investments around the world grew from US$13.3 trillion in 2012 to US$30.7 trillion in 2018.

Healthy economies rely on a healthy environment, and building a circular economy is integral to the future health of our economy, planet, and society.

Green

The Carbon Footprint of Major Travel Methods

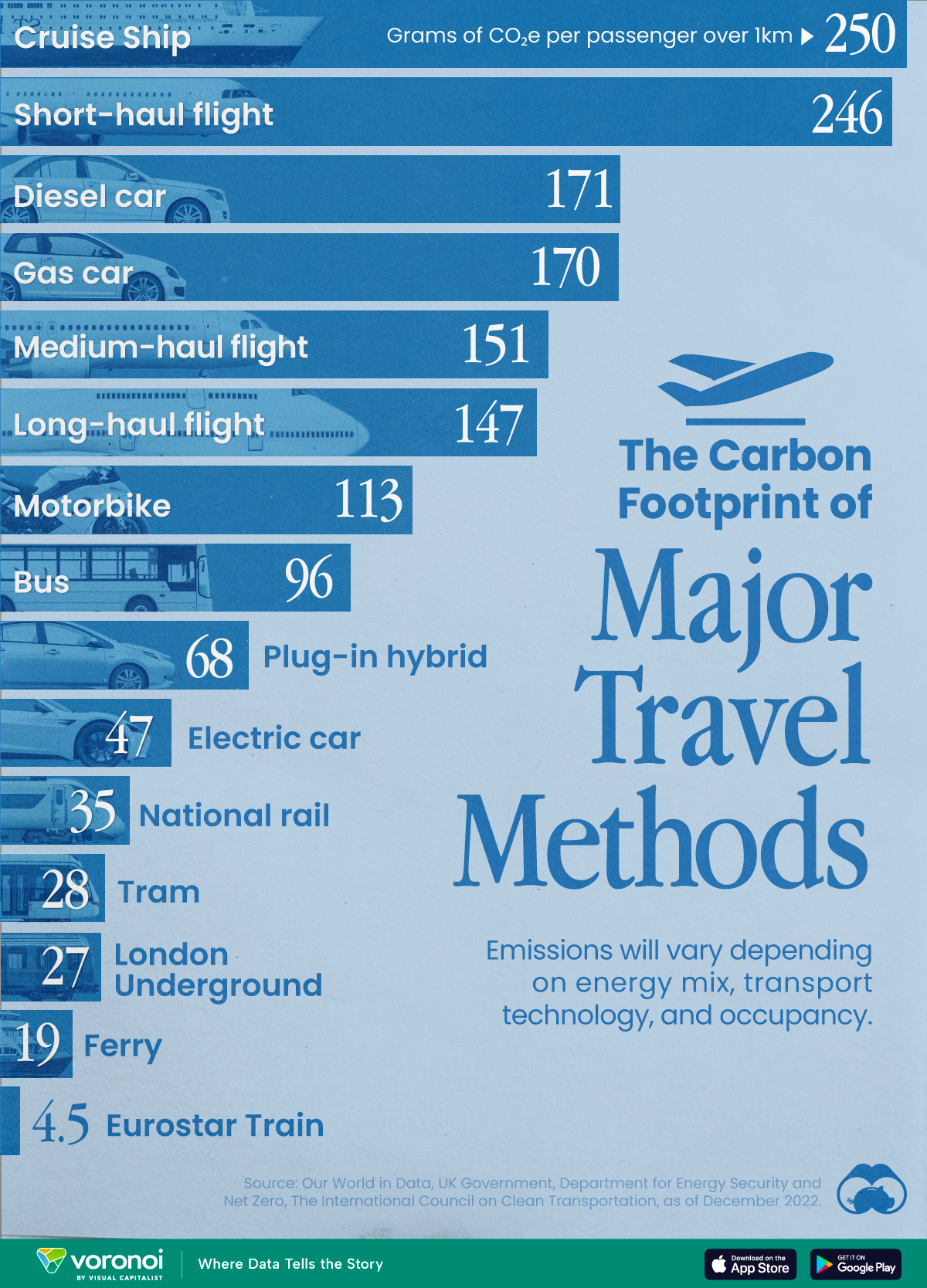

Going on a cruise ship and flying domestically are the most carbon-intensive travel methods.

The Carbon Footprint of Major Travel Methods

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that transport accounts for nearly one-quarter of global energy-related carbon dioxide (CO₂) emissions?

This graphic illustrates the carbon footprints of major travel methods measured in grams of carbon dioxide equivalent (CO₂e) emitted per person to travel one kilometer. This includes both CO₂ and other greenhouse gases.

Data is sourced from Our World in Data, the UK Government’s Department for Energy Security and Net Zero, and The International Council on Clean Transportation, as of December 2022.

These figures should be interpreted as approximations, rather than exact numbers. There are many variables at play that determine the actual carbon footprint in any individual case, including vehicle type or model, occupancy, energy mix, and even weather.

Cruise Ships are the Most Carbon-Intensive Travel Method

According to these estimates, taking a cruise ship, flying domestically, and driving alone are some of the most carbon-intensive travel methods.

Cruise ships typically use heavy fuel oil, which is high in carbon content. The average cruise ship weighs between 70,000 to 180,000 metric tons, meaning they require large engines to get moving.

These massive vessels must also generate power for onboard amenities such as lighting, air conditioning, and entertainment systems.

Short-haul flights are also considered carbon-intensive due to the significant amount of fuel consumed during initial takeoff and climbing altitude, relative to a lower amount of cruising.

| Transportation method | CO₂ equivalent emissions per passenger km |

|---|---|

| Cruise Ship | 250 |

| Short-haul flight (i.e. within a U.S. state or European country) | 246 |

| Diesel car | 171 |

| Gas car | 170 |

| Medium-haul flight (i.e. international travel within Europe, or between U.S. states) | 151 |

| Long-haul flight (over 3,700 km, about the distance from LA to NY) | 147 |

| Motorbike | 113 |

| Bus (average) | 96 |

| Plug-in hybrid | 68 |

| Electric car | 47 |

| National rail | 35 |

| Tram | 28 |

| London Underground | 27 |

| Ferry (foot passenger) | 19 |

| Eurostar (International rail) | 4.5 |

Are EVs Greener?

Many experts agree that EVs produce a lower carbon footprint over time versus traditional internal combustion engine (ICE) vehicles.

However, the batteries in electric vehicles charge on the power that comes straight off the electrical grid—which in many places may be powered by fossil fuels. For that reason, the carbon footprint of an EV will depend largely on the blend of electricity sources used for charging.

There are also questions about how energy-intensive it is to build EVs compared to a comparable ICE vehicle.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees