Green

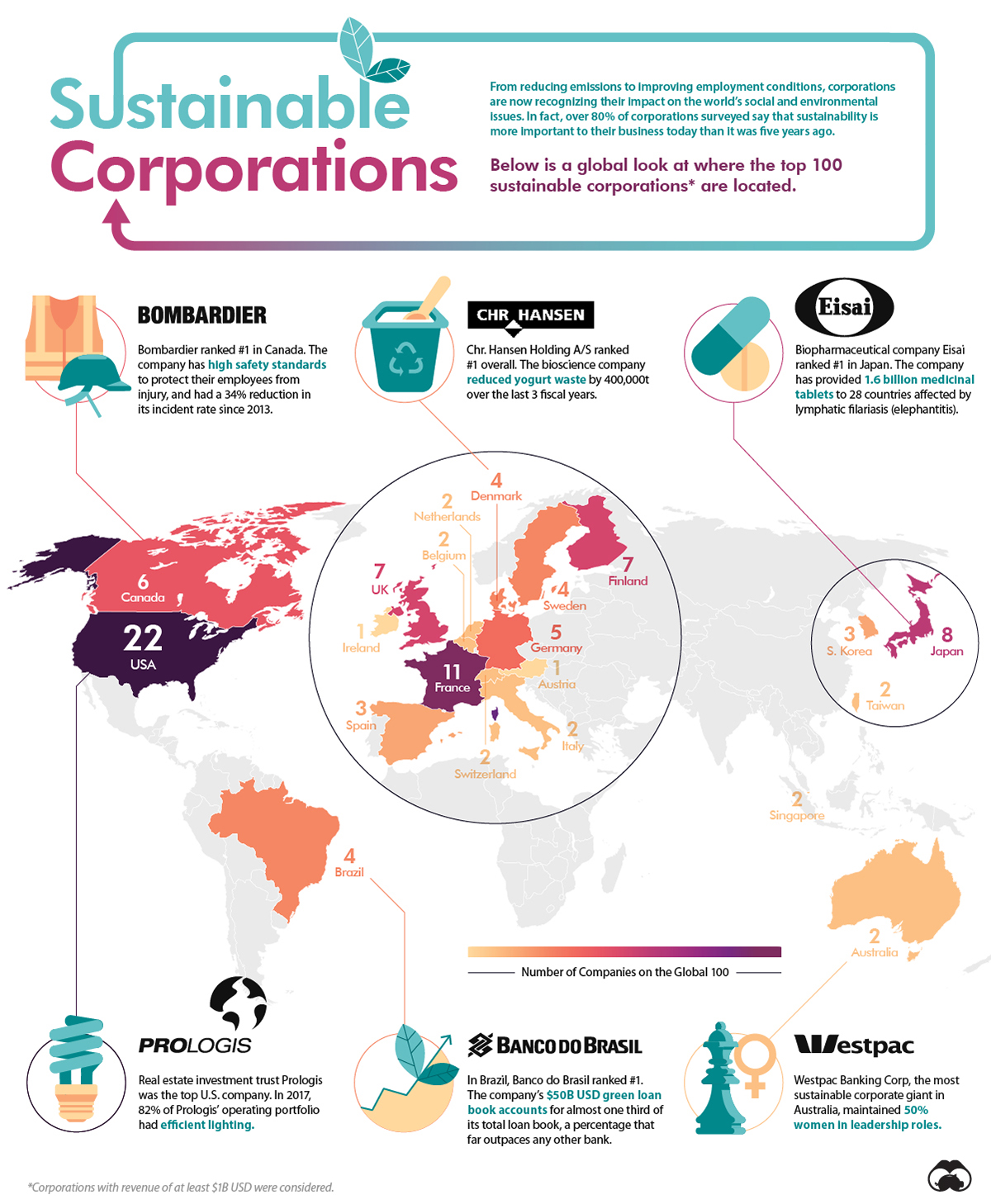

Mapped: The Countries With the Most Sustainable Corporate Giants

Mapped: The Countries With the Most Sustainable Corporate Giants

From plastic-filled oceans to unequal pay, sustainability is a hot topic these days. Many people are wondering how we’ll move the needle on these important issues, and the business world is being pressured to take action.

Society is demanding that companies, both public and private, serve a social purpose. To prosper over time, every company must not only deliver financial performance, but also show how it makes a positive contribution to society.

— Larry Fink, CEO of BlackRock, the world’s largest asset manager

Which of the world’s largest companies are stepping up to the plate on these issues?

The Global 100 Index

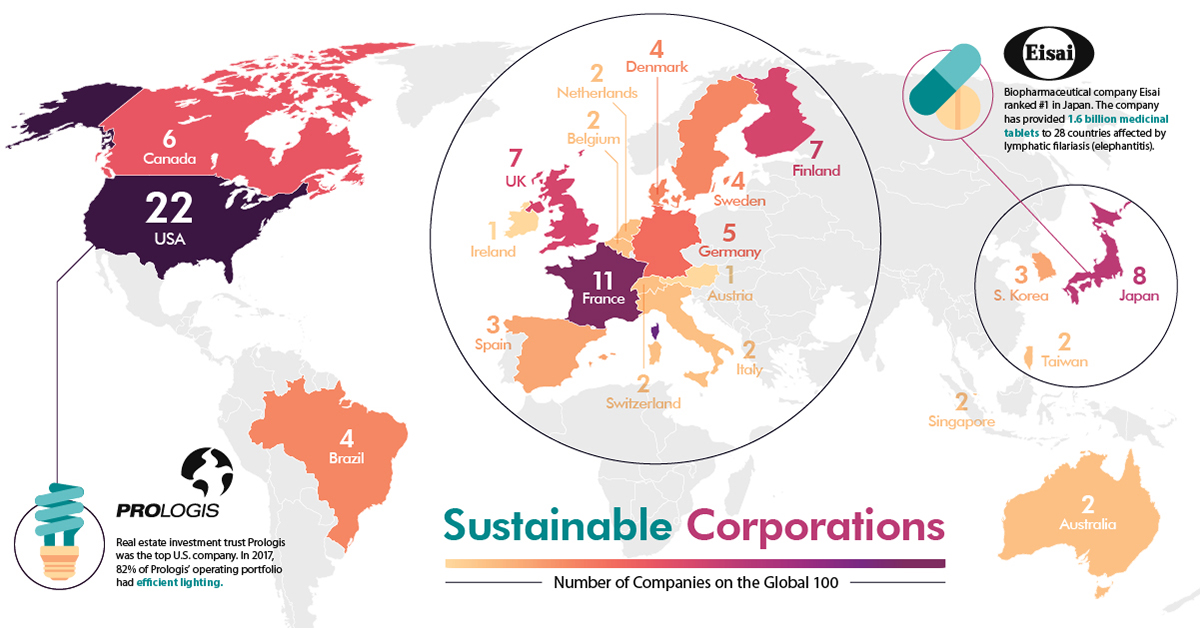

Today’s visualization pulls data from Corporate Knight’s 2019 Global 100 report, which ranks the most sustainable corporations in the world.

Any public company with revenue of at least $1B USD is screened for various factors such as sufficient sustainability reporting. The resulting corporations are scored on an industry-specific mix of performance metrics in the following areas:

- Resource Management

- Employee Management

- Financial Management

- Clean Revenue

- Supplier Performance

The final ranking represents the top companies from each sector, with the number from each sector based on the relative size of its market capitalization.

Sustainable Corporations by Country

Here’s all the countries that had companies on the list:

| Country | Number of Companies on the Global 100 |

|---|---|

| United States | 22 |

| France | 11 |

| Japan | 8 |

| Finland | 7 |

| United Kingdom | 7 |

| Canada | 6 |

| Germany | 5 |

| Brazil | 4 |

| Denmark | 4 |

| Sweden | 4 |

| South Korea | 3 |

| Spain | 3 |

| Australia | 2 |

| Belgium | 2 |

| Italy | 2 |

| Netherlands | 2 |

| Singapore | 2 |

| Switzerland | 2 |

| Taiwan | 2 |

| Austria | 1 |

| Ireland | 1 |

The U.S. tops the list with 22 companies – far more than any other country. European countries also dominate the list and have 51 companies on the G100 overall. Notably, the populous countries of India and China have no representation on the list.

The Top 10 Companies

So, which individual companies made the list? Here’s a snapshot of the star players:

| Rank | Company | Country | Industry | Overall Score |

|---|---|---|---|---|

| 1 | Chr. Hansen Holding A/S | Denmark | Food or other Chemical Agents | 82.99% |

| 2 | Kering SA | France | Apparel and Accessories | 81.55% |

| 3 | Neste Corporation | Finland | Petroleum Refineries | 80.92% |

| 4 | Ørsted | Denmark | Wholesale Power | 80.13% |

| 5 | GlaxoSmithKline plc | United Kingdom | Biopharmaceuticals | 79.41% |

| 6 | Prologis, Inc. | United States | Real Estate Investment Trusts | 79.12% |

| 7 | Umicore | Belgium | Primary Metals Products | 79.05% |

| 8 | Banco do Brasil S.A. | Brazil | Banks | 78.15% |

| 9 | Shinhan Financial Group Co. | South Korea | Banks | 77.75% |

| 10 | Taiwan Semiconductor | Taiwan | Semiconductor Equipment | 77.71% |

Chr. Hansen Holding A/S leapt from #66 in 2018 to the top spot this year. According to CEO Mauricio Graber, the company develops “cultures, enzymes, probiotics and natural colors for a rich variety of foods, confectionery, beverages, dietary supplements and even animal feed.”

A staggering 82% of Chr. Hansen’s revenue contributes to the United Nations’ Sustainability Goals. The company is using good bacteria to reduce antibiotic use, crop pesticides, and food waste. Over the last three years, the company has reduced yogurt waste by 400,000 tonnes.

What’s in it for Companies?

While societal pressure is certainly one motivating factor, Harvard Business Review notes that corporate sustainability has many benefits:

- Drives competitive advantage through stakeholder engagement

- Improves risk management

- Fosters innovation

- Improves financial performance

- Builds customer loyalty

- Attracts and engages employees

It’s clear that sustainability is a strong differentiator in the business community. The world’s largest – and smartest – companies are leading the charge towards a greener, more equitable future.

Green

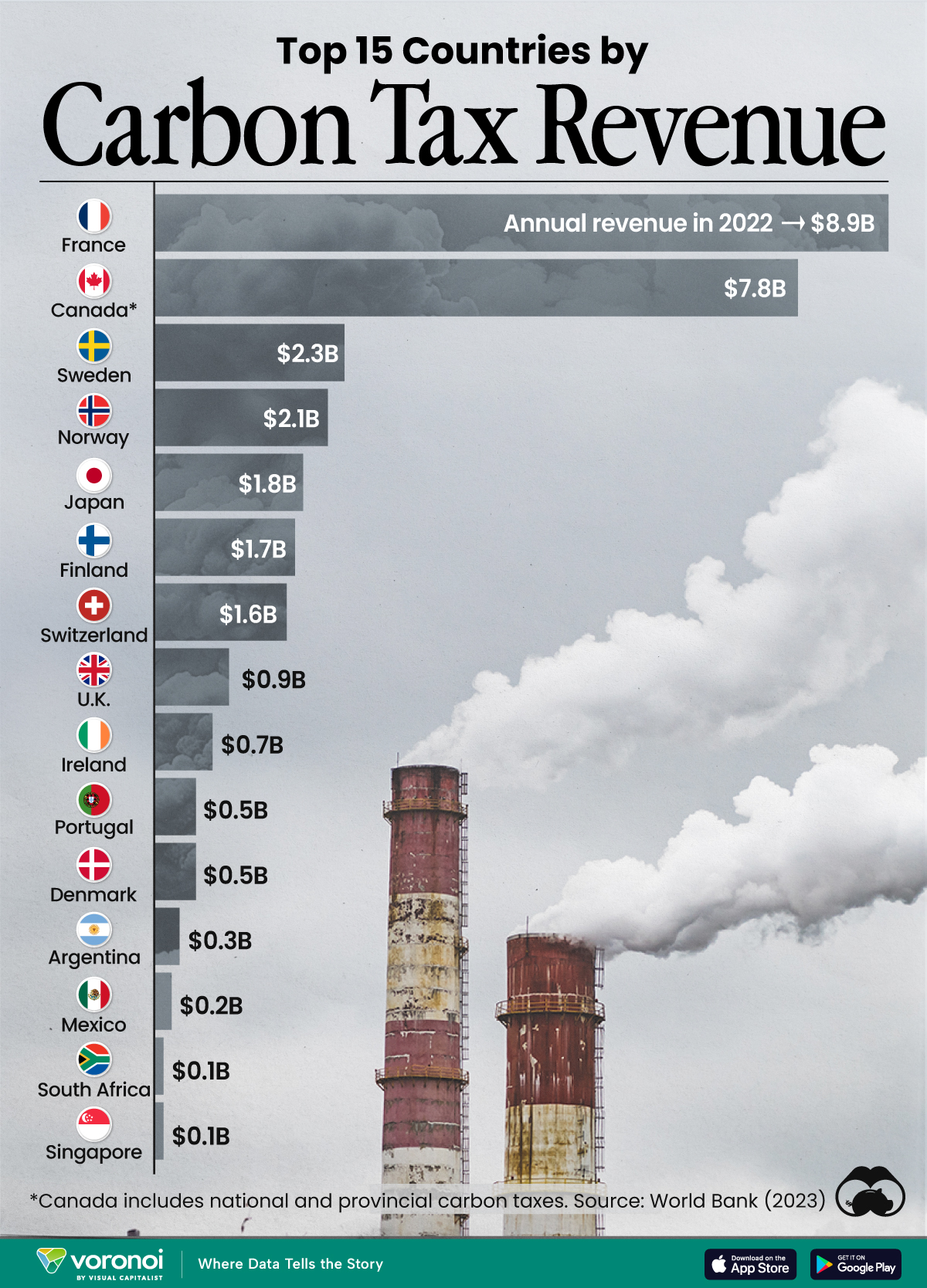

Ranking the Top 15 Countries by Carbon Tax Revenue

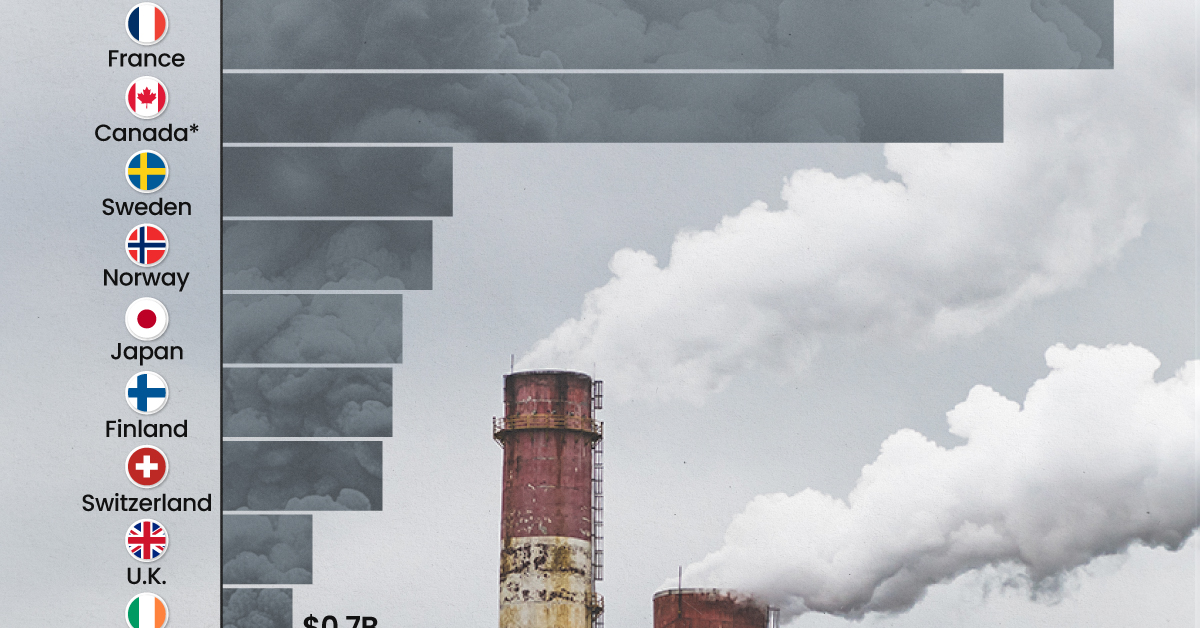

This graphic highlights France and Canada as the global leaders when it comes to generating carbon tax revenue.

Top 15 Countries by Carbon Tax Revenue

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Carbon taxes are designed to discourage CO2 emissions by increasing the cost of carbon-intensive activities and incentivizing the adoption of cleaner energy alternatives.

In this graphic we list the top 15 countries by carbon tax revenue as of 2022. The data is from the World Bank’s State and Trends of Carbon Pricing Report, published in April 2023.

France and Canada Lead in Global Carbon Tax Revenue

In 2022, the top 15 countries generated approximately $30 billion in revenue from carbon taxes.

France and Canada lead in this regard, accounting for over half of the total amount. Both countries have implemented comprehensive carbon pricing systems that cover a wide range of sectors, including transportation and industry, and they have set relatively high carbon tax rates.

| Country | Government revenue in 2022 ($ billions) |

|---|---|

| 🇫🇷 France | $8.9 |

| 🇨🇦 Canada | $7.8 |

| 🇸🇪 Sweden | $2.3 |

| 🇳🇴 Norway | $2.1 |

| 🇯🇵 Japan | $1.8 |

| 🇫🇮 Finland | $1.7 |

| 🇨🇭 Switzerland | $1.6 |

| 🇬🇧 United Kingdom | $0.9 |

| 🇮🇪 Ireland | $0.7 |

| 🇩🇰 Denmark | $0.5 |

| 🇵🇹 Portugal | $0.5 |

| 🇦🇷 Argentina | $0.3 |

| 🇲🇽 Mexico | $0.2 |

| 🇸🇬 Singapore | $0.1 |

| 🇿🇦 South Africa | $0.1 |

In Canada, the total carbon tax revenue includes both national and provincial taxes.

While carbon pricing has been recognized internationally as one of the more efficient mechanisms for reducing CO2 emissions, research is divided over what the global average carbon price should be to achieve the goals of the Paris Climate Agreement, which aims to limit global warming to 1.5–2°C by 2100 relative to pre-industrial levels.

A recent study has shown that carbon pricing must be supported by other policy measures and innovations. According to a report from Queen’s University, there is no feasible carbon pricing scenario that is high enough to limit emissions sufficiently to achieve anything below 2.4°C warming on its own.

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?