Green

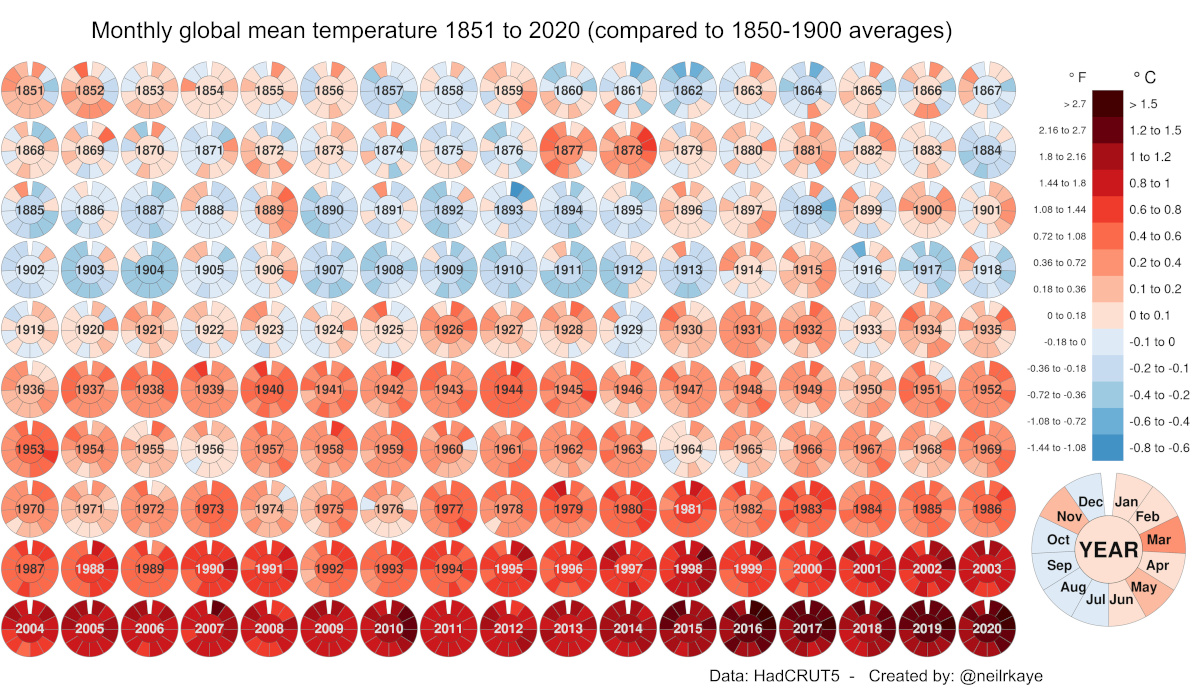

Visualized: Historical Trends in Global Monthly Surface Temperatures (1851-2020)

View the full-resolution version of this infographic

Global Temperature Graph (1851-2020)

View the high-resolution of the infographic by clicking here.

Since 1880, the Earth’s average surface temperature has risen by 0.07°C (0.13°F) every decade. That number alone may seem negligible, but over time, it adds up.

In addition, the rate of temperature change has grown significantly more dramatic over time—more than doubling to 0.18°C (0.32°F) since 1981. As a result of this global warming process, environmental crises have become the most prominent risks of our time.

In this global temperature graph, climate data scientist Neil R. Kaye breaks down how monthly average temperatures have changed over nearly 170 years. Temperature values have been benchmarked against pre-industrial averages (1850–1900).

What is Causing Global Warming?

The data visualization can be thought of in two halves, each reflecting significant trigger points in global warming trends:

- 1851-1935

Overlaps with the Second Industrial Revolution

Low-High range in global temperature increase: -0.4°C to +0.6°C - 1936-2020

Overlaps with the Third Industrial Revolution

Low-High range in global temperature increase: +0.6°C to +1.5°C and up

The global temperature graph makes it clear that for several years now, average surface temperatures have consistently surpassed 1.5°C above their pre-industrial values. Let’s dig into these time periods a bit more closely to uncover more context around this phenomenon.

Industrial Revolutions and Advances, 1851–1935

An obvious, early anomaly on the visual worth exploring occurs between 1877–1878. During this time, the world experienced numerous unprecedented climate events, from a strong El Niño to widespread droughts. The resulting Great Famine caused the deaths of between 19–50 million people, even surpassing some of the deadliest pandemics in history.

In the first five rows of the global temperature graph, several economies progressed into the Second Industrial Revolution (~1870–1914), followed by World War I (1914-1918). Overall, there was a focus on steel production and mass-produced consumer goods over these 80+ years.

Although these technological advances brought immense improvements, they came at the cost of burning fossil fuels—releasing significant amounts of carbon dioxide and other greenhouse gases. It would take several more decades before scientists realized the full extent of their accumulation in the atmosphere, and their resulting relation to global warming.

The Modern World In the Red Zone, 1936–2020

The second half of the global temperature graph is marked by World War II (1939-1945) and its aftermath. As the dust settled, nations began to build themselves back up, and things really kicked into hyperdrive with the Third Industrial Revolution.

As globalization and trade progressed following the 1950s, people and goods began moving around more than ever before. In addition, population growth peaked at 2.1% per year between 1965 and 1970. Industrialization patterns began to intensify further to meet the demands of a rising global population and our modern world.

The Importance of Historical Temperature Trends

The history of human development is intricately linked with global warming. While part of the rise in Earth’s surface temperature can be attributed to natural patterns of climate change, these historical trends shed some light on how much human activities are behind the rapid increase in global average temperatures in the last 85 years.

The following video from Reddit user bgregory98, which leverages an extensive data set published in Nature Geoscience provides a more dramatic demonstration. It looks at the escalation of global temperatures over two thousand years. In this expansive time frame, eight of the top ten hottest years on record have occurred in the last decade alone.

Global warming and climate change are some of the most pressing megatrends shaping our future. However, with the U.S. rejoining the Paris Climate Agreement, and the reduction of global carbon emissions highlighted as a key item at the World Economic Forum’s Davos Summit 2021, promising steps are being taken.

Green

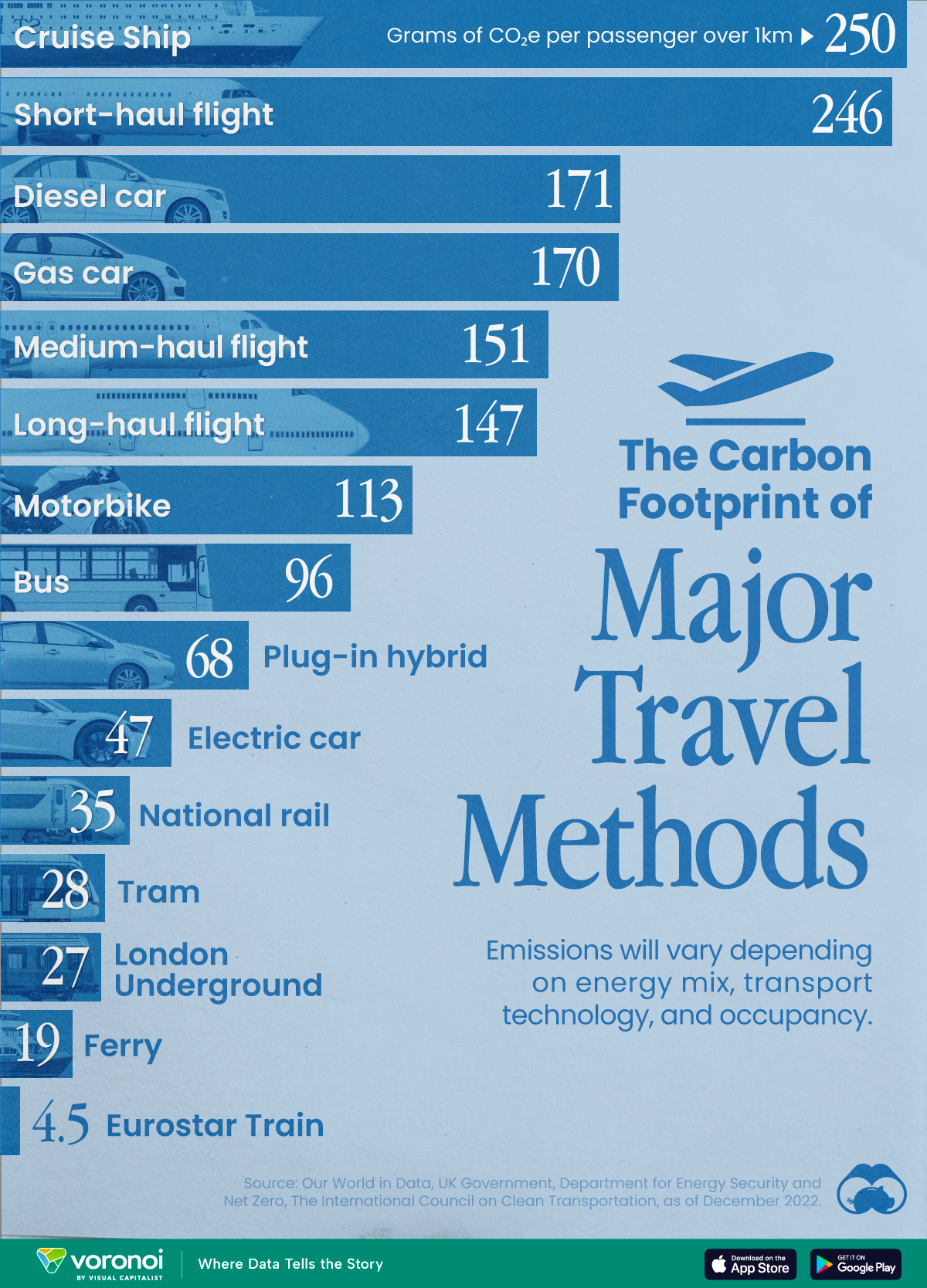

The Carbon Footprint of Major Travel Methods

Going on a cruise ship and flying domestically are the most carbon-intensive travel methods.

The Carbon Footprint of Major Travel Methods

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that transport accounts for nearly one-quarter of global energy-related carbon dioxide (CO₂) emissions?

This graphic illustrates the carbon footprints of major travel methods measured in grams of carbon dioxide equivalent (CO₂e) emitted per person to travel one kilometer. This includes both CO₂ and other greenhouse gases.

Data is sourced from Our World in Data, the UK Government’s Department for Energy Security and Net Zero, and The International Council on Clean Transportation, as of December 2022.

These figures should be interpreted as approximations, rather than exact numbers. There are many variables at play that determine the actual carbon footprint in any individual case, including vehicle type or model, occupancy, energy mix, and even weather.

Cruise Ships are the Most Carbon-Intensive Travel Method

According to these estimates, taking a cruise ship, flying domestically, and driving alone are some of the most carbon-intensive travel methods.

Cruise ships typically use heavy fuel oil, which is high in carbon content. The average cruise ship weighs between 70,000 to 180,000 metric tons, meaning they require large engines to get moving.

These massive vessels must also generate power for onboard amenities such as lighting, air conditioning, and entertainment systems.

Short-haul flights are also considered carbon-intensive due to the significant amount of fuel consumed during initial takeoff and climbing altitude, relative to a lower amount of cruising.

| Transportation method | CO₂ equivalent emissions per passenger km |

|---|---|

| Cruise Ship | 250 |

| Short-haul flight (i.e. within a U.S. state or European country) | 246 |

| Diesel car | 171 |

| Gas car | 170 |

| Medium-haul flight (i.e. international travel within Europe, or between U.S. states) | 151 |

| Long-haul flight (over 3,700 km, about the distance from LA to NY) | 147 |

| Motorbike | 113 |

| Bus (average) | 96 |

| Plug-in hybrid | 68 |

| Electric car | 47 |

| National rail | 35 |

| Tram | 28 |

| London Underground | 27 |

| Ferry (foot passenger) | 19 |

| Eurostar (International rail) | 4.5 |

Are EVs Greener?

Many experts agree that EVs produce a lower carbon footprint over time versus traditional internal combustion engine (ICE) vehicles.

However, the batteries in electric vehicles charge on the power that comes straight off the electrical grid—which in many places may be powered by fossil fuels. For that reason, the carbon footprint of an EV will depend largely on the blend of electricity sources used for charging.

There are also questions about how energy-intensive it is to build EVs compared to a comparable ICE vehicle.

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001