Politics

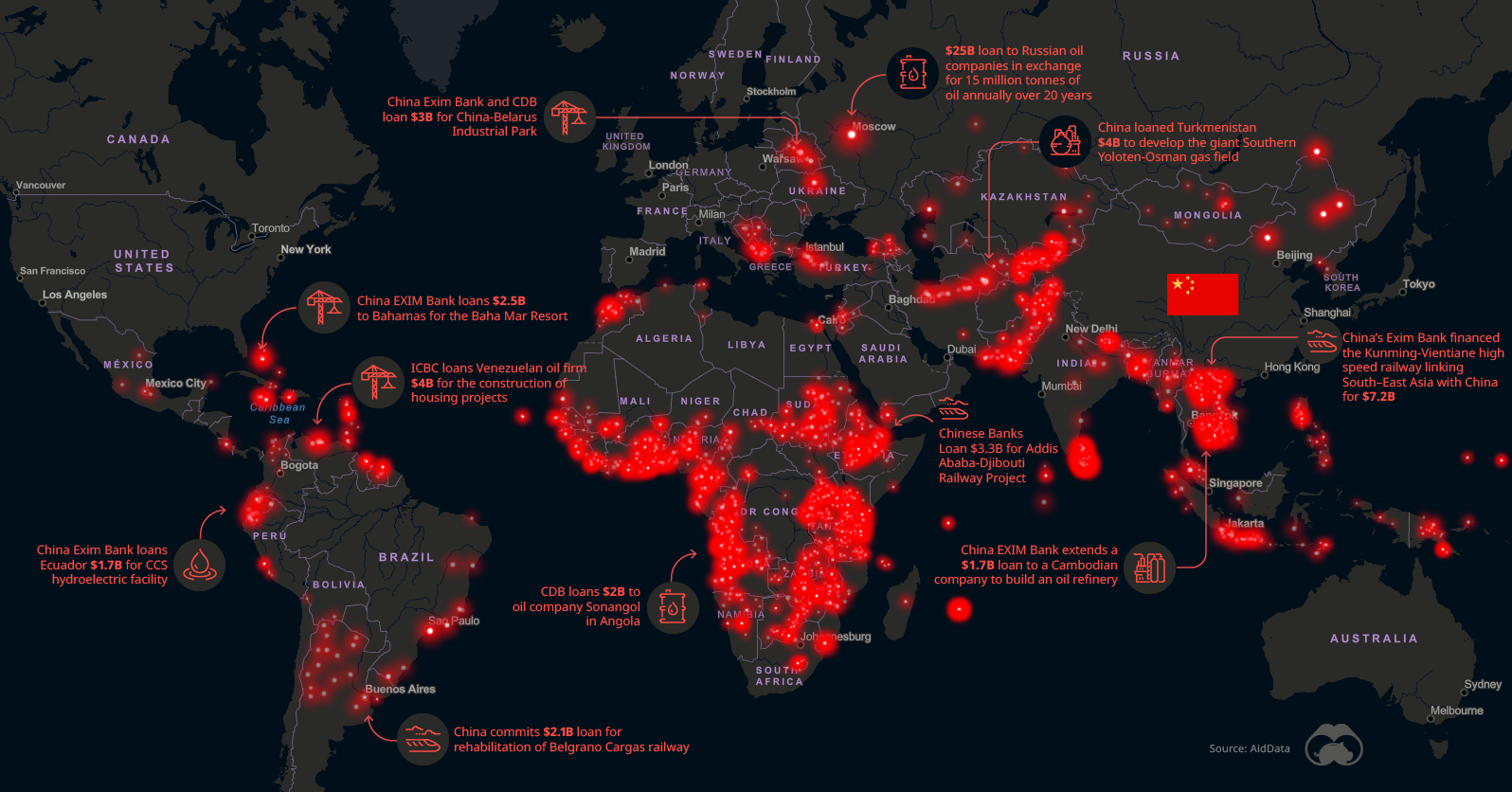

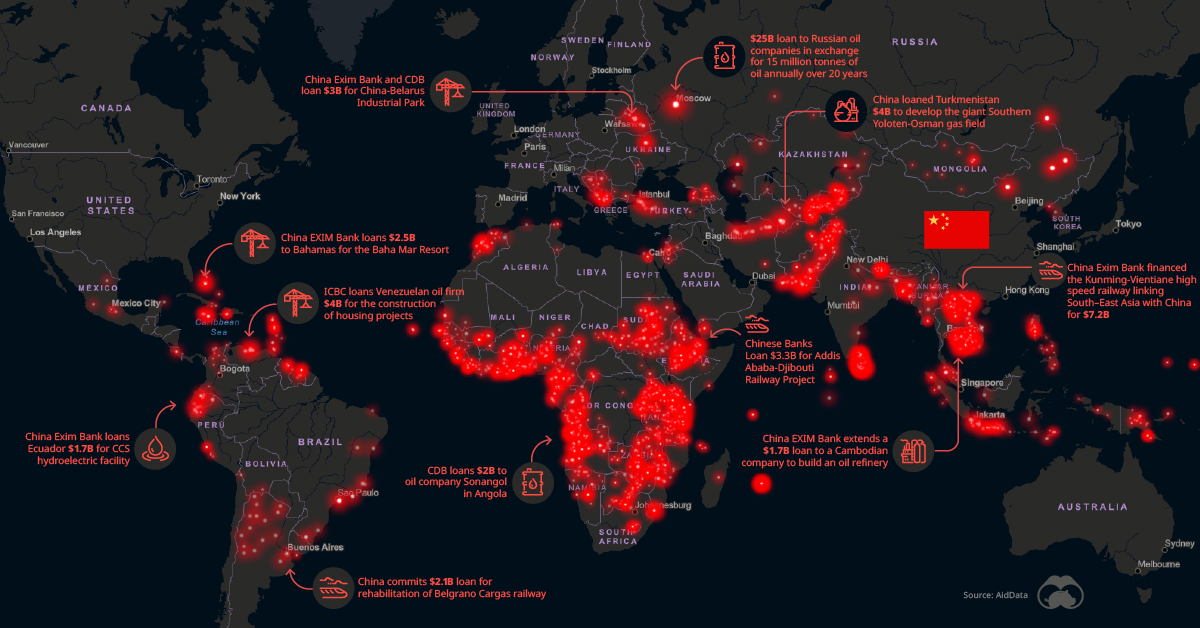

How Chinese Financing is Fueling Megaprojects Around the World

View the full-size version of this infographic.

How Chinese Financing is Fueling the World’s Megaprojects

On a mountaintop a few miles north of the bustling streets of Harare, Zimbabwe, a curving, modern complex is beginning to take shape. This building, once completed, will be the home of the African country’s parliament, and the centerpiece of a new section of the capital city.

Aside from the striking design, there’s another unique twist to this development — the entire $140 million project is a gift from Beijing. At first glance, gifting a country a new parliament building may seem extravagant, but the project is a tiny portion of China’s $270 billion in “diplomacy spending” since 2000.

AidData, a research lab at the W&M Global Research Institute, has compiled a massive database of Chinese-backed projects spanning from 2000–2017. In aggregate, it creates a comprehensive look at China’s efforts to grow its influence in countries around the world, particularly in Africa and South Asia.

Beijing has ramped up the volume and sophistication of its public diplomacy overtures, […] but infrastructure as a part of its financial diplomacy dwarfs Beijing’s other public diplomacy tools.

– Samantha Custer, Director of Policy Analysis, AidData

Below, we’ll look at three diplomacy spending hotspots around the world, and learn about key Chinese-funded megaprojects, from power plants to railway systems.

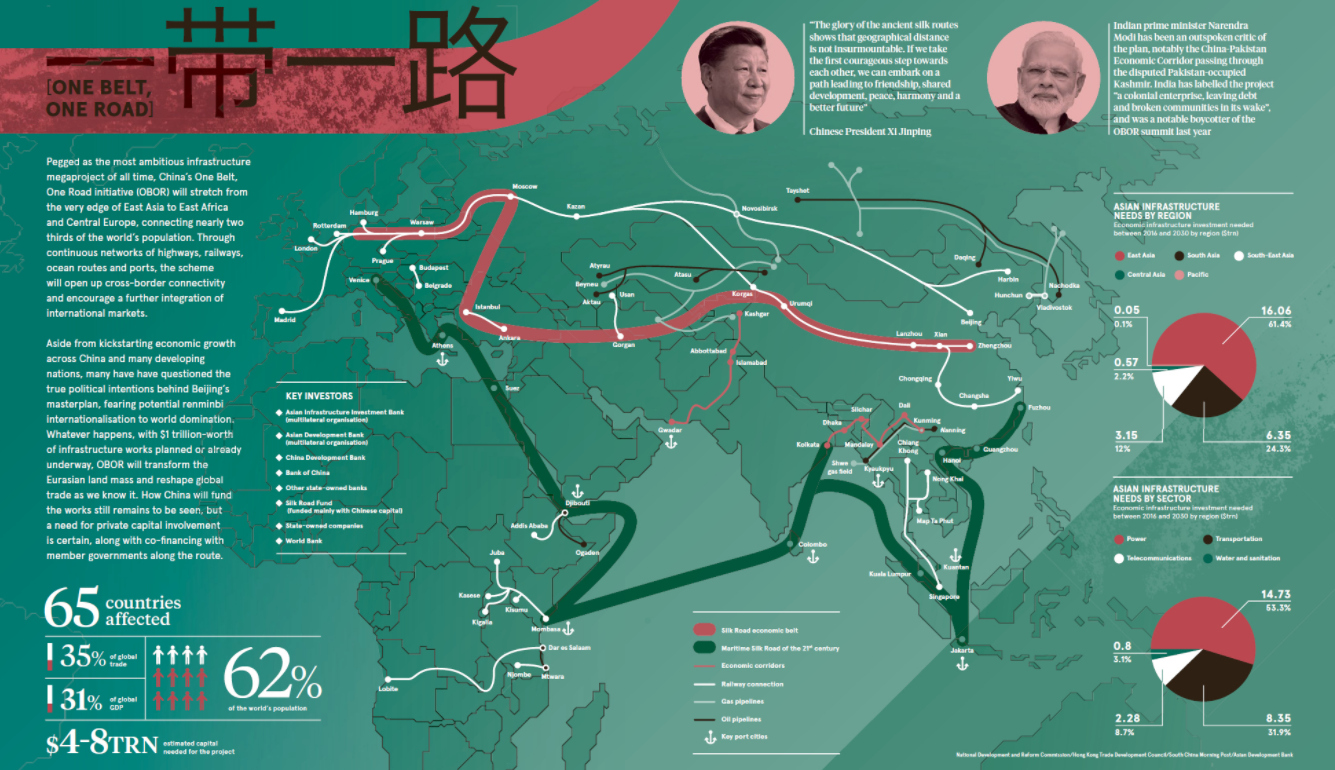

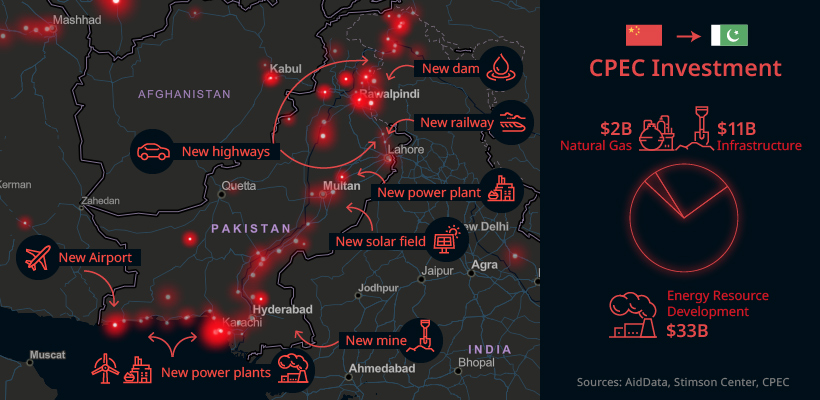

1. Pakistan

In 2015, Chinese President Xi Jingping visited Islamabad to inaugurate the China-Pakistan Economic Corridor (CPEC), kicking off a $46 billion investment that has transformed Pakistan’s transportation system and power grid. CPEC is designed to cement the strategic relationship between the two countries, and is a portion of China’s massive One Belt, One Road (OBOR) initiative.

One of the largest projects financed by China was the Karachi Nuclear Power K2/K3 project. This massive power generation project is primarily bankrolled by China’s state-owned Exim Bank which has kicked in over $6.6 billion over three phases of payments.

Billions of dollars in Chinese capital has also funded everything from highway construction to renewable energy projects across Pakistan. Pakistan’s youth unemployment rate sits as high as 40%, so jobs created by new infrastructure investments are a welcome prospect. In 2014, Pakistan had the highest public approval rating of China in the world, with nearly 80% respondents holding a favorable view of China.

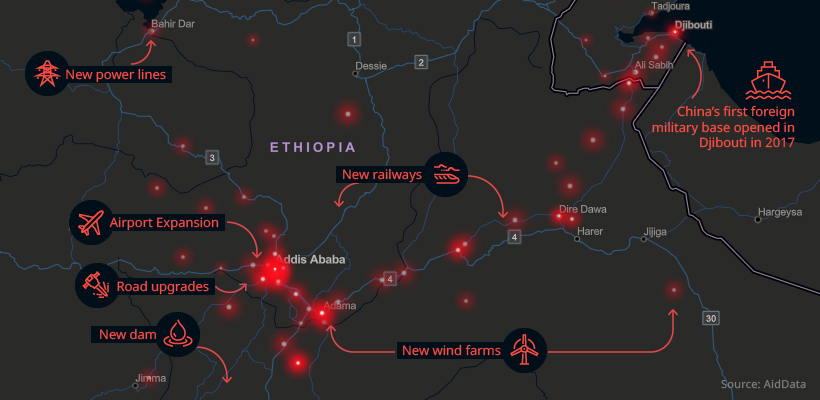

2. Ethiopia

Ethiopia has seen a number of changes within its borders thanks to Chinese financing. This is particularly evident in its capital, Addis Ababa, where a slew of transportation projects — from new ring roads to Sub-Saharan Africa’s first metro system — transformed the city.

One of the most striking symbols of Chinese influence in Addis Ababa is the futuristic African Union (AU) headquarters. The $200 million complex was gifted to the city by Beijing in 2012.

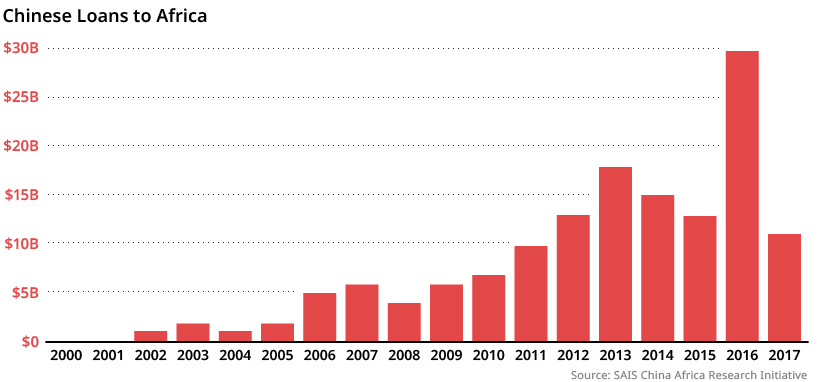

Though Ethiopia is a clear example of Chinese investment transforming a country’s infrastructure, a number of other African nations have experienced a similar influx of money from Beijing. This financing pipeline has increased dramatically in recent years.

3. Sri Lanka

In the wake of political turmoil, Sri Lanka is increasingly looking to China for loans. From 2000 to 2017, over $12 billion in loans and grants have poured into the deeply-indebted country.

Perhaps the most contentious symbol of the relationship between the two countries is a port on the south coast of the island nation, at a strategic point along one of the world’s busiest shipping lanes. The Hambantota Port project — which was completed in 2011 — followed a now familiar path. Eschewing an open bidding process, Beijing’s government financed the project and hired a state-owned firm to construct the port, primarily using Chinese workers.

By 2017, Sri Lanka’s government was burdened by debt the previous administration had taken on. After months of negotiations, the port was handed over with the land around it leased to China for 99 years. This handover was a strategic victory for China, which now has a shipping foothold within close proximity of its regional rival, India.

John Adams said infamously that a way to subjugate a country is through either the sword or debt. China has chosen the latter.

– Brahma Chellaney

Playing the Long Game

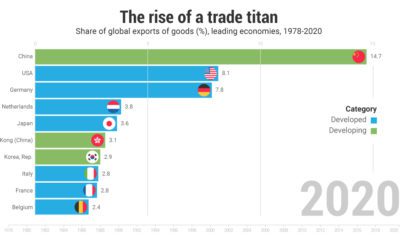

Africa’s economic rise will likely be a major contributor to global growth in coming years. Already, six of the 10 fastest growing economies in the world are located in Africa. China is also the top trading partner on the continent, with the United States sitting in third place.

OBOR spending has also earned China plenty of influence in the rest of Asia as well. If the ambitious megaproject continues along its current trajectory, China will be the central player in a more prosperous, interconnected Asia.

Economy

The Bloc Effect: International Trade with Geopolitical Allies on the Rise

Rising geopolitical tensions are shaping the future of international trade, but what is the effect on trading among G7 and BRICS countries?

The Bloc Effect: International Trade with Allies on the Rise

International trade has become increasingly fragmented over the last five years as countries have shifted to trading more with their geopolitical allies.

This graphic from The Hinrich Foundation, the first in a three-part series covering the future of trade, provides visual context to the growing divide in trade in G7 and pre-expansion BRICS countries, which are used as proxies for geopolitical blocs.

Trade Shifts in G7 and BRICS Countries

This analysis uses IMF data to examine differences in shares of exports within and between trading blocs from 2018 to 2023. For example, we looked at the percentage of China’s exports with other BRICS members as well as with G7 members to see how these proportions shifted in percentage points (pp) over time.

Countries traded nearly $270 billion more with allies in 2023 compared to 2018. This shift came at the expense of trade with rival blocs, which saw a decline of $314 billion.

Country Change in Exports Within Bloc (pp) Change in Exports With Other Bloc (pp)

🇮🇳 India 0.0 3.9

🇷🇺 Russia 0.7 -3.8

🇮🇹 Italy 0.8 -0.7

🇨🇦 Canada 0.9 -0.7

🇫🇷 France 1.0 -1.1

🇪🇺 EU 1.1 -1.5

🇩🇪 Germany 1.4 -2.1

🇿🇦 South Africa 1.5 1.5

🇺🇸 U.S. 1.6 -0.4

🇯🇵 Japan 2.0 -1.7

🇨🇳 China 2.1 -5.2

🇧🇷 Brazil 3.7 -3.3

🇬🇧 UK 10.2 0.5

All shifts reported are in percentage points. For example, the EU saw its share of exports to G7 countries rise from 74.3% in 2018 to 75.4% in 2023, which equates to a 1.1 percentage point increase.

The UK saw the largest uptick in trading with other countries within the G7 (+10.2 percentage points), namely the EU, as the post-Brexit trade slump to the region recovered.

Meanwhile, the U.S.-China trade dispute caused China’s share of exports to the G7 to fall by 5.2 percentage points from 2018 to 2023, the largest decline in our sample set. In fact, partly as a result of the conflict, the U.S. has by far the highest number of harmful tariffs in place.

The Russia-Ukraine War and ensuing sanctions by the West contributed to Russia’s share of exports to the G7 falling by 3.8 percentage points over the same timeframe.

India, South Africa, and the UK bucked the trend and continued to witness advances in exports with the opposing bloc.

Average Trade Shifts of G7 and BRICS Blocs

Though results varied significantly on a country-by-country basis, the broader trend towards favoring geopolitical allies in international trade is clear.

Bloc Change in Exports Within Bloc (pp) Change in Exports With Other Bloc (pp)

Average 2.1 -1.1

BRICS 1.6 -1.4

G7 incl. EU 2.4 -1.0

Overall, BRICS countries saw a larger shift away from exports with the other bloc, while for G7 countries the shift within their own bloc was more pronounced. This implies that though BRICS countries are trading less with the G7, they are relying more on trade partners outside their bloc to make up for the lost G7 share.

A Global Shift in International Trade and Geopolitical Proximity

The movement towards strengthening trade relations based on geopolitical proximity is a global trend.

The United Nations categorizes countries along a scale of geopolitical proximity based on UN voting records.

According to the organization’s analysis, international trade between geopolitically close countries rose from the first quarter of 2022 (when Russia first invaded Ukraine) to the third quarter of 2023 by over 6%. Conversely, trade with geopolitically distant countries declined.

The second piece in this series will explore China’s gradual move away from using the U.S. dollar in trade settlements.

Visit the Hinrich Foundation to learn more about the future of geopolitical trade

-

Economy2 days ago

Economy2 days agoEconomic Growth Forecasts for G7 and BRICS Countries in 2024

The IMF has released its economic growth forecasts for 2024. How do the G7 and BRICS countries compare?

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

We visualized the top U.S. companies by employees, revealing the massive scale of retailers like Walmart, Target, and Home Depot.

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

We visualized product categories that saw the highest % increase in price due to U.S. inflation as of March 2024.

-

Economy1 month ago

Economy1 month agoG20 Inflation Rates: Feb 2024 vs COVID Peak

We visualize inflation rates across G20 countries as of Feb 2024, in the context of their COVID-19 pandemic peak.

-

Economy1 month ago

Economy1 month agoMapped: Unemployment Claims by State

This visual heatmap of unemployment claims by state highlights New York, California, and Alaska leading the country by a wide margin.

-

Economy2 months ago

Economy2 months agoConfidence in the Global Economy, by Country

Will the global economy be stronger in 2024 than in 2023?

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees