Markets

Discount Domination: Dollar Stores are Thriving in America

The retail landscape is in a constant state of flux.

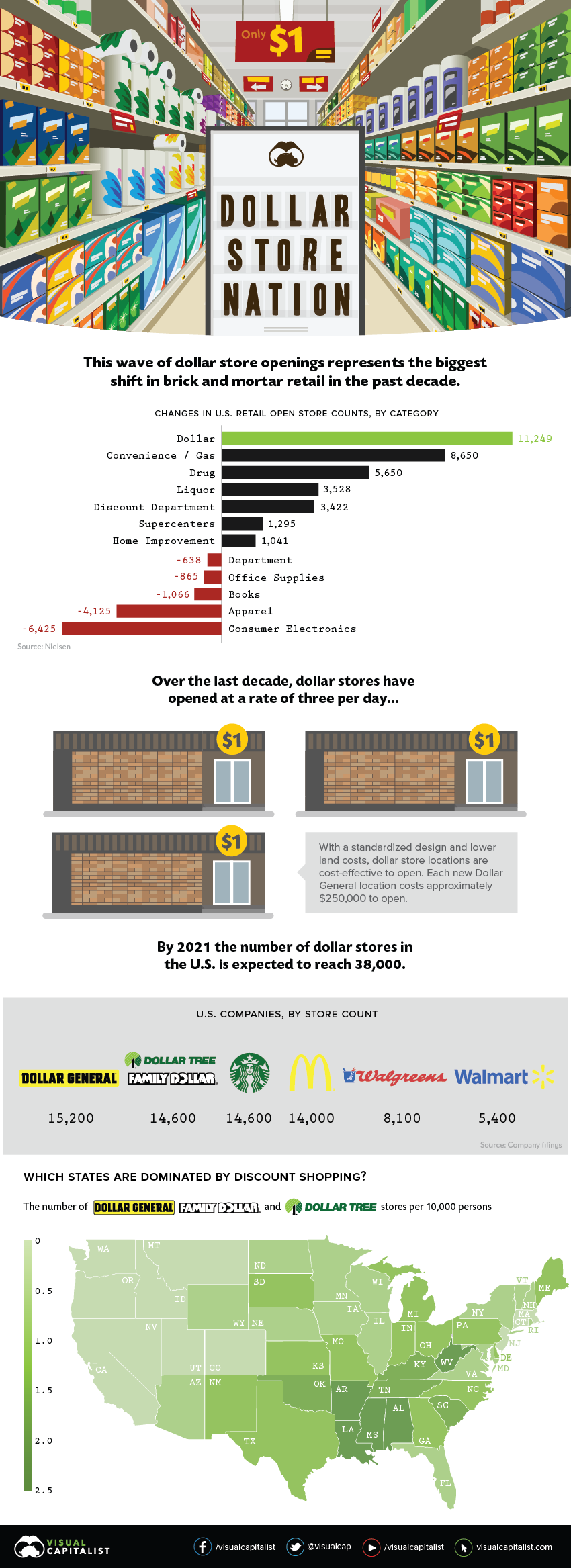

E-commerce is indisputably disrupting almost every imaginable aspect of retail, creating what has been coined as the “retail apocalypse”. As a result, certain segments of the market have had well publicized meltdowns – electronics and apparel, in particular – and the U.S. now has far more retail floor space available than any other nation.

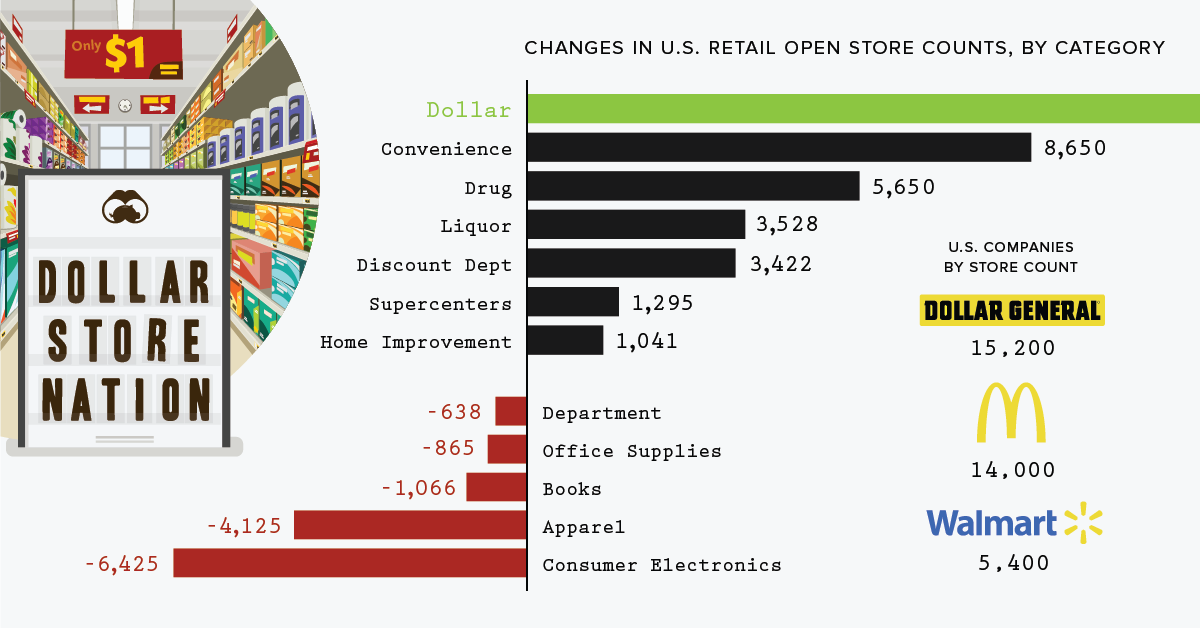

That said, there is one type of store that’s thriving in this unpredictable landscape – dollar stores. Today, we examine data from the Institute of Local Self-Reliance, which puts the scale of the United States’ dollar store boom into perspective.

Escaping the Retail Apocalypse

The rise of e-commerce giants like Amazon has led to a relentless wave of closures for brick and mortar retailers. Department stores and consumer electronics are taking hard hits, yet a curious trend emerges through the cracks – dollar stores are multiplying like rabbits.

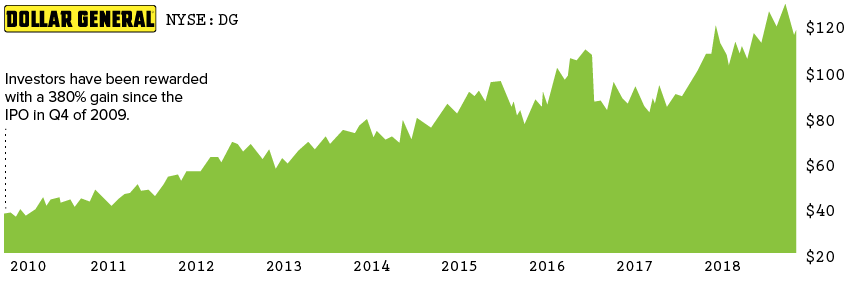

The persistent growth of dollar stores is the biggest retail trend in the past decade. Between 2007 and 2017, over 11,000 new dollar stores were opened; that’s roughly 93 new stores a month, or three per day. Dollar General, in particular, is reaping the rewards: the company has a market cap of over $30 billion.

Compared to mammoth retailer Walmart, Dollar General is the little store that could. Despite reporting lower sales per square foot, Dollar General outperforms Walmart in 5-year gross profit margins.

| Store | Sales per square foot | 5-year gross profit margins | Cost of a new store |

|---|---|---|---|

| Dollar General | $184 | 30.9% | $250,000 |

| Walmart | $432 | 25.1% | $15,000,000 |

Sources: Bloomberg, E-Marketer

This whopping difference in launching a new location contributes to the fast and furious spread of dollar stores. Dollar General and Dollar Tree (which now owns Family Dollar) boast 30,000 stores between them, eclipsing the six biggest U.S. retailers combined. Their combined annual sales also rival Apple Stores, including iTunes.

The Dollar Store Strategy

What makes dollar stores so lucrative? In a nutshell, they’re willing to go where others won’t.

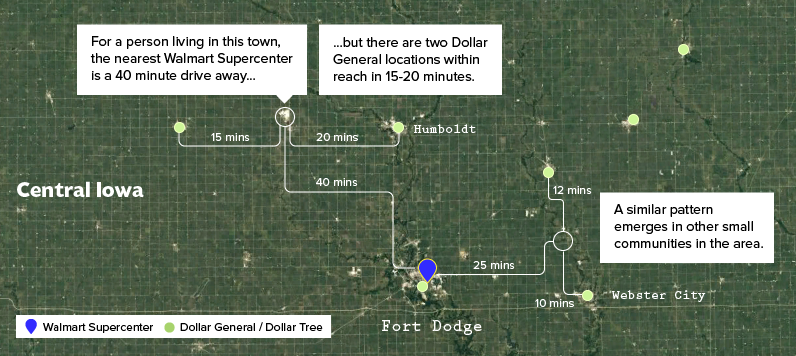

Dollar General focuses on rural areas, while Dollar Tree and Family Dollar are more prominent in urban and suburban areas. But they have one thing in common – all three chains target small towns in rural America, resulting in a high concentration per capita, especially in the South.

Wal-Mart’s 40 miles away and we can meet those people’s needs.

– David Perdue, Former CEO of Dollar General

Dollar General’s ambitious expansion into smaller towns has proven successful. Residents can find many everyday products at prices similar to those at Walmart, but without the longer drive to a Supercenter. Despite the 3,500 Walmart Supercenters spread out across the country, chances are, there’s a dollar store even closer.

Dollar stores fill a need in cash-strapped communities, saving time and gas money during a trip to the store, and then offering an affordable and enticing products inside the store itself.

America’s Grocery Gap

The no-frills shopping experience is also a quintessential trait of dollar stores. Dollar stores focus on a limited selection of private label goods, selling basics in small quantities instead of bulk.

However, there’s also a dark underbelly to this trend. Dollar stores often enter areas with no grocery stores at all, called food deserts. In the absence of choice, dollar stores are welcomed with open arms – but the lack of fresh produce and abundance of processed, packaged foods leave much to be desired.

If you live in Whole Foods-land – not the dollar store world – it’s an invisible reality that they’re supplying a lot of the groceries.

— Stacy Mitchell, Institute for Local Self-Reliance

On the other hand, when dollar stores compete with locally-owned grocery stores in the same area, sales in the latter can be cut by over 30% in some cases – taking an enormous toll on the community.

The ILSR report suggests that dollar stores may not always be a by-product of economic distress, but a cause of it. Regardless of what perspective you have on the spread of dollar stores, it’s clear they’re here to stay.

Markets

The European Stock Market: Attractive Valuations Offer Opportunities

On average, the European stock market has valuations that are nearly 50% lower than U.S. valuations. But how can you access the market?

European Stock Market: Attractive Valuations Offer Opportunities

Europe is known for some established brands, from L’Oréal to Louis Vuitton. However, the European stock market offers additional opportunities that may be lesser known.

The above infographic, sponsored by STOXX, outlines why investors may want to consider European stocks.

Attractive Valuations

Compared to most North American and Asian markets, European stocks offer lower or comparable valuations.

| Index | Price-to-Earnings Ratio | Price-to-Book Ratio |

|---|---|---|

| EURO STOXX 50 | 14.9 | 2.2 |

| STOXX Europe 600 | 14.4 | 2 |

| U.S. | 25.9 | 4.7 |

| Canada | 16.1 | 1.8 |

| Japan | 15.4 | 1.6 |

| Asia Pacific ex. China | 17.1 | 1.8 |

Data as of February 29, 2024. See graphic for full index names. Ratios based on trailing 12 month financials. The price to earnings ratio excludes companies with negative earnings.

On average, European valuations are nearly 50% lower than U.S. valuations, potentially offering an affordable entry point for investors.

Research also shows that lower price ratios have historically led to higher long-term returns.

Market Movements Not Closely Connected

Over the last decade, the European stock market had low-to-moderate correlation with North American and Asian equities.

The below chart shows correlations from February 2014 to February 2024. A value closer to zero indicates low correlation, while a value of one would indicate that two regions are moving in perfect unison.

| EURO STOXX 50 | STOXX EUROPE 600 | U.S. | Canada | Japan | Asia Pacific ex. China |

|

|---|---|---|---|---|---|---|

| EURO STOXX 50 | 1.00 | 0.97 | 0.55 | 0.67 | 0.24 | 0.43 |

| STOXX EUROPE 600 | 1.00 | 0.56 | 0.71 | 0.28 | 0.48 | |

| U.S. | 1.00 | 0.73 | 0.12 | 0.25 | ||

| Canada | 1.00 | 0.22 | 0.40 | |||

| Japan | 1.00 | 0.88 | ||||

| Asia Pacific ex. China | 1.00 |

Data is based on daily USD returns.

European equities had relatively independent market movements from North American and Asian markets. One contributing factor could be the differing sector weights in each market. For instance, technology makes up a quarter of the U.S. market, but health care and industrials dominate the broader European market.

Ultimately, European equities can enhance portfolio diversification and have the potential to mitigate risk for investors.

Tracking the Market

For investors interested in European equities, STOXX offers a variety of flagship indices:

| Index | Description | Market Cap |

|---|---|---|

| STOXX Europe 600 | Pan-regional, broad market | €10.5T |

| STOXX Developed Europe | Pan-regional, broad-market | €9.9T |

| STOXX Europe 600 ESG-X | Pan-regional, broad market, sustainability focus | €9.7T |

| STOXX Europe 50 | Pan-regional, blue-chip | €5.1T |

| EURO STOXX 50 | Eurozone, blue-chip | €3.5T |

Data is as of February 29, 2024. Market cap is free float, which represents the shares that are readily available for public trading on stock exchanges.

The EURO STOXX 50 tracks the Eurozone’s biggest and most traded companies. It also underlies one of the world’s largest ranges of ETFs and mutual funds. As of November 2023, there were €27.3 billion in ETFs and €23.5B in mutual fund assets under management tracking the index.

“For the past 25 years, the EURO STOXX 50 has served as an accurate, reliable and tradable representation of the Eurozone equity market.”

— Axel Lomholt, General Manager at STOXX

Partnering with STOXX to Track the European Stock Market

Are you interested in European equities? STOXX can be a valuable partner:

- Comprehensive, liquid and investable ecosystem

- European heritage, global reach

- Highly sophisticated customization capabilities

- Open architecture approach to using data

- Close partnerships with clients

- Part of ISS STOXX and Deutsche Börse Group

With a full suite of indices, STOXX can help you benchmark against the European stock market.

Learn how STOXX’s European indices offer liquid and effective market access.

-

Economy3 days ago

Economy3 days agoEconomic Growth Forecasts for G7 and BRICS Countries in 2024

The IMF has released its economic growth forecasts for 2024. How do the G7 and BRICS countries compare?

-

Markets2 weeks ago

Markets2 weeks agoU.S. Debt Interest Payments Reach $1 Trillion

U.S. debt interest payments have surged past the $1 trillion dollar mark, amid high interest rates and an ever-expanding debt burden.

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

We visualized the top U.S. companies by employees, revealing the massive scale of retailers like Walmart, Target, and Home Depot.

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

This graphic shows the states with the highest real GDP growth rate in 2023, largely propelled by the oil and gas boom.

-

Markets3 weeks ago

Markets3 weeks agoRanked: The World’s Top Flight Routes, by Revenue

In this graphic, we show the highest earning flight routes globally as air travel continued to rebound in 2023.

-

Markets3 weeks ago

Markets3 weeks agoRanked: The Most Valuable Housing Markets in America

The U.S. residential real estate market is worth a staggering $47.5 trillion. Here are the most valuable housing markets in the country.

-

Sports1 week ago

Sports1 week agoThe Highest Earning Athletes in Seven Professional Sports

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)