Technology

Which U.S. Generation Wields the Most Cultural Power?

Introducing our new index, which ranks U.S. generations on their economic, political, and cultural influence.

Which U.S. Generation Wields the Most Cultural Power?

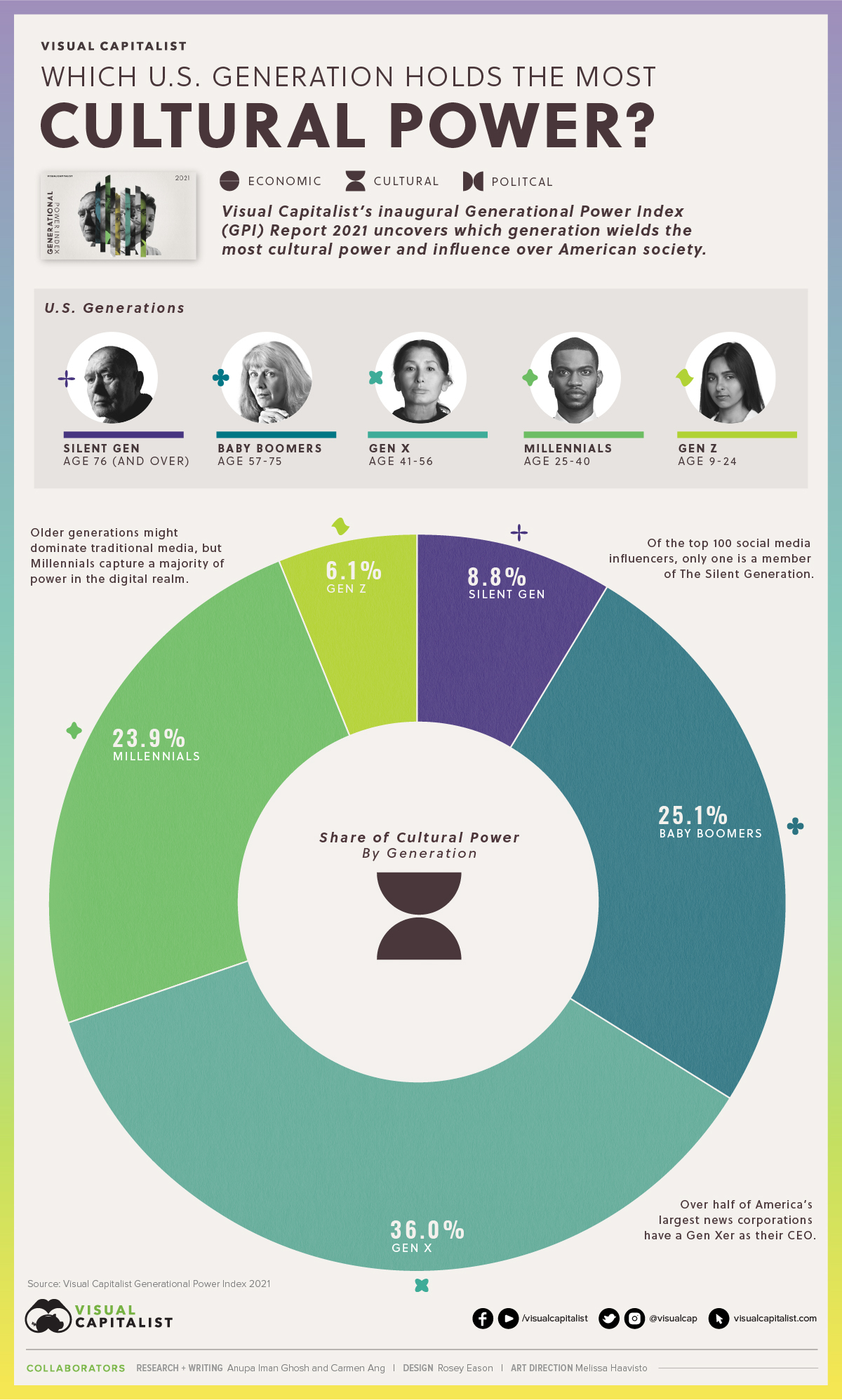

This year, our team put together Visual Capitalist’s inaugural Generational Power Index (GPI), which looks at power dynamics across generations in America.

We considered three categories in our quest to quantify power: economics, political, and cultural. And while it turns out Baby Boomers dominate when it comes to economics and political factors—cultural influence is a different story.

Here’s a look at which U.S. generation holds the most cultural power, and how this power dynamic is expected to shift in the coming years.

Generations and Power, Defined

Before we get started, it’s important to clarify which generations we’ve included in our research, along with their age and birth year ranges.

| Generation | Age range (years) | Birth year range |

|---|---|---|

| The Silent Generation | 76 and over | 1928-1945 |

| Baby Boomers | 57-75 | 1946-1964 |

| Gen X | 41-56 | 1965-1980 |

| Millennials | 25-40 | 1981-1996 |

| Gen Z | 9-24 | 1997-2012 |

| Gen Alpha | 8 and below | 2013-present |

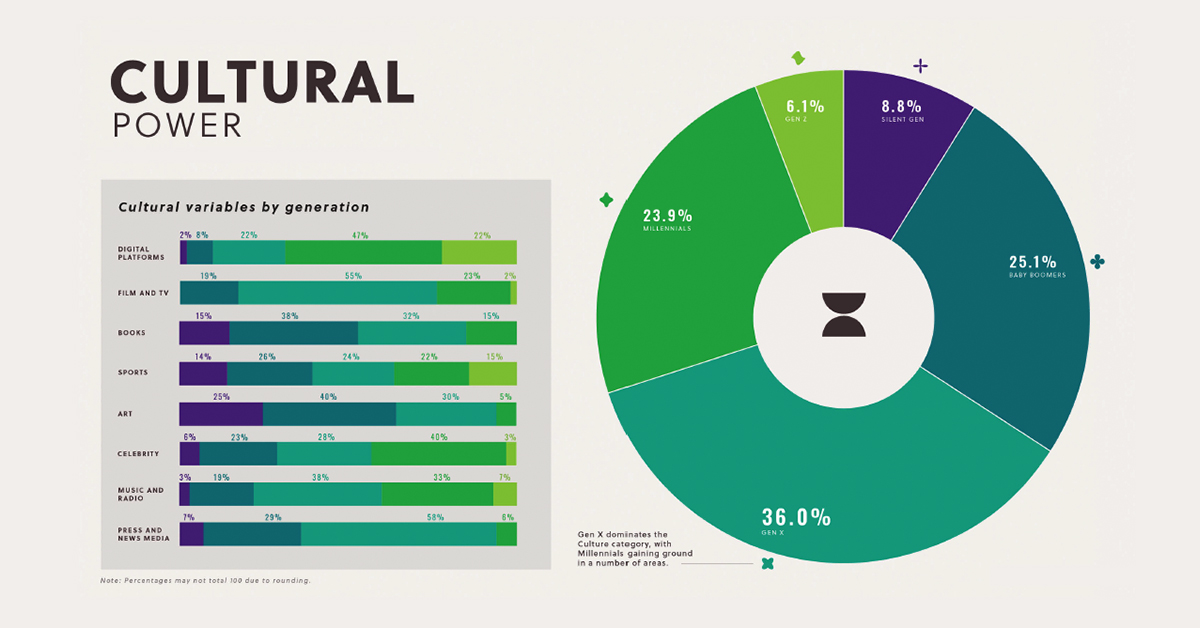

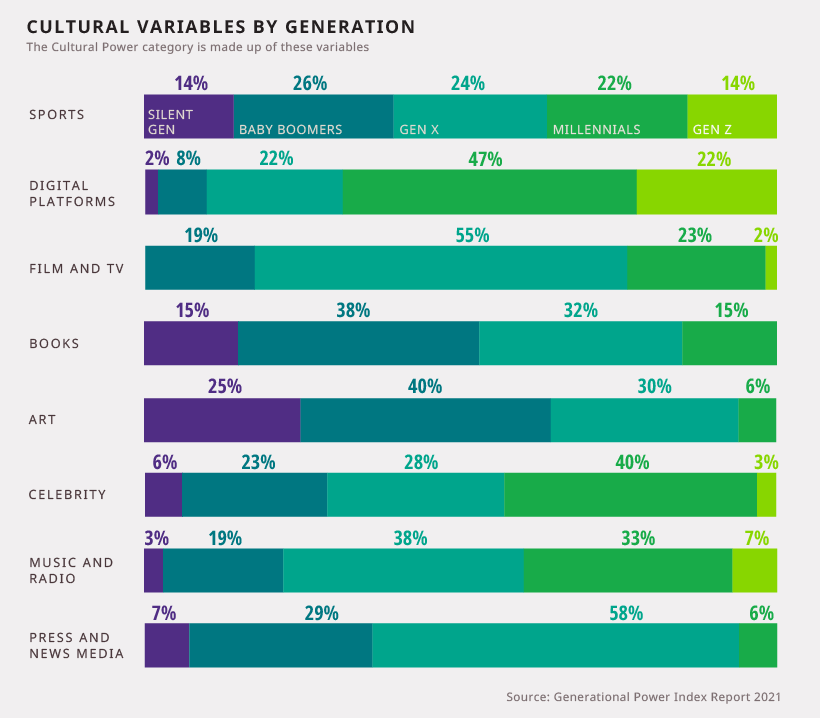

Using these age groups as a framework, we then calculated the Cultural Power category using these distinct equally-weighted variables:

With this methodology in mind, here’s how the Cultural Power category shakes out, using insights from the GPI.

Share of Cultural Power by Generation

Overall, we found that Gen X captures the largest share of cultural power, at 36%.

| Generation | Cultural Power Share |

|---|---|

| The Silent Generation | 8.8% |

| Baby Boomers | 25.1% |

| Gen X | 36.0% |

| Millennials | 23.9% |

| Gen Z | 6.1% |

| Gen Alpha | 0.00% |

| Total | 99.9% |

*Note: figures may not add up to 100% due to rounding.

Gen X is particularly dominant in the film and TV industry, along with news media. For instance, over half of America’s largest news corporations have a Gen Xer as their CEO, and roughly 50% of Oscar winners in 2020 were members of Gen X.

Baby Boomers come in second place, capturing a 25% share of cultural power. They show particular dominance in traditional entertainment like books and art. For example, 42% of the authors on the NYT’s best-selling books list were Baby Boomers.

However, these older generations fall short in one critical category—digital platforms.

The Dominance of Digital

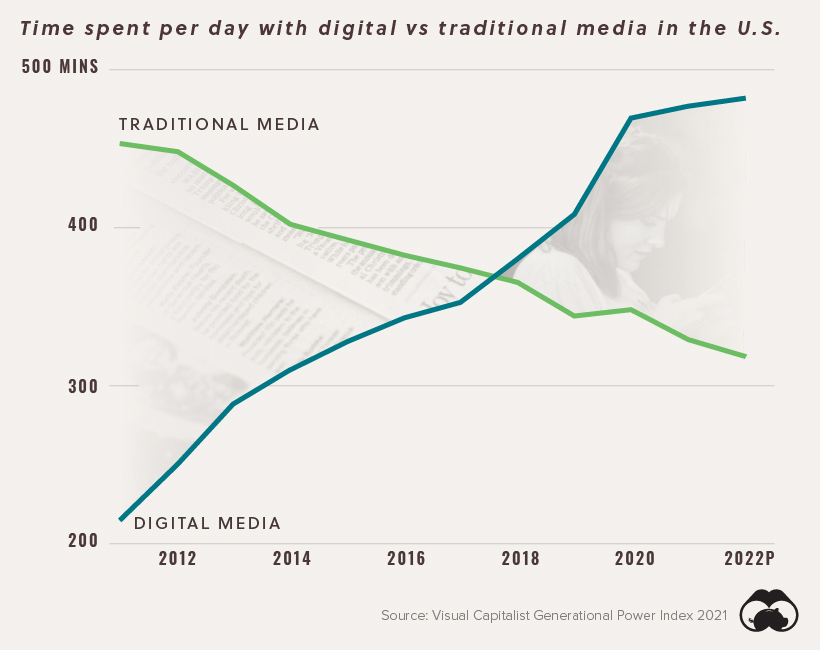

Why is digital so important when it comes to cultural power? Because digital media becoming increasingly more popular than traditional media sources (e.g. TV, radio).

In 2020, Americans spent nearly 8 hours per day consuming digital media, nearly two hours more per day than they spent with traditional media.

This divide is expected to grow even further over the next few years. With younger generations dominating the digital space, Gen X may soon lose its place as the top dog of the culture category.

Celebrity 2.0: The Social Influencer

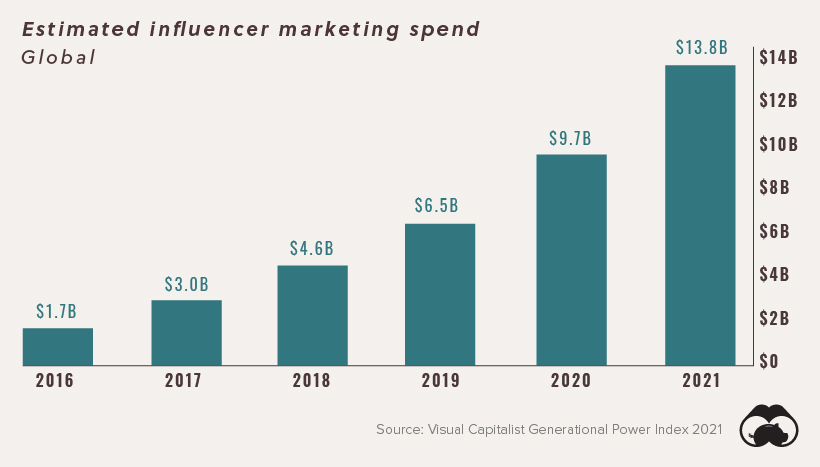

As audiences flock to online channels, advertisers have followed suit—and they’re willing to spend good money to gain access to their target demographics.

In fact, spend on influencer marketing has steadily increased in the last five years, and it’s expected to reach $13.8 billion by the end of 2021.

This shift to social media advertising is redefining the notion of celebrity, and who reaps the financial benefits of content creation. For instance, six-year-old Vlogger Like Nastya made an estimated $7.7 million per month from her YouTube channel in 2020. And keep in mind, this estimate is purely based on YouTube revenue—it doesn’t even include corporate partnerships and/or merchandise sales.

With all these shifts occurring, culture as we know it is at a crossroads. And as we continue to move towards a digital dominant society, those who hold power in traditional realms will either adapt or pass along the torch.

Download the Generational Power Report (.pdf)

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001