Bitcoin

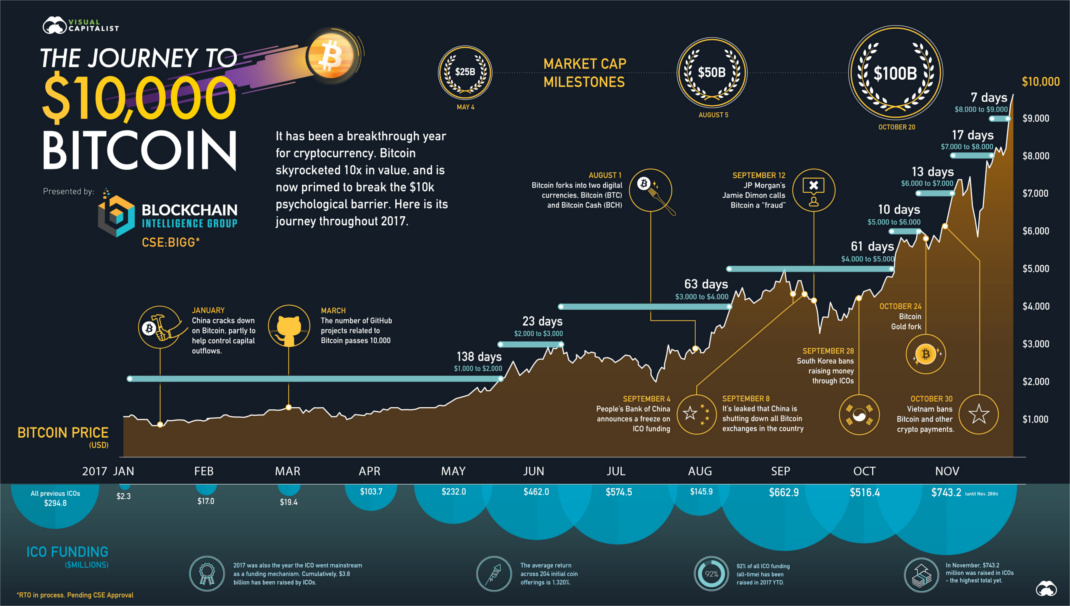

Visualizing the Journey to $10,000 Bitcoin

View a high resolution version of this graphic

Visualizing the Journey to $10,000 Bitcoin

View the high resolution version of today’s graphic by clicking here.

It has been a breakthrough year for the world’s original cryptocurrency – and on November 28th, 2017, the bitcoin price blew past the psychological barrier of $10,000 with unprecedented pace. After all, it was only two days prior that the cryptocurrency was trading at $9,000.

Today’s infographic from Blockchain Intelligence Group helps to visualize the ups and downs of this incredible journey to $10,000.

The Journey to $10,000 Bitcoin

Here are some of the key events that transpired over the last 11 months:

| Timeframe | Description |

|---|---|

| January 2, 2017 | Bitcoin closes above the $1k mark for first time in 1,124 days |

| Mid-January 2017 | China cracks down on crypto, partly to help control capital outflows |

| March 2017 | The number of GitHub projects related to Bitcoin passes 10,000 |

| May 4, 2017 | Bitcoin surpasses $25B in market capitalization |

| August 1, 2017 | Bitcoin forks into two digital currencies, Bitcoin (BTC) and Bitcoin Cash (BCH) |

| August 5, 2017 | Bitcoin surpasses $50B in market capitalization |

| September 4, 2017 | People’s Bank of China announces that it’s implementing a freeze on ICO funding. |

| September 8, 2017 | It’s leaked that China is shutting down all Bitcoin exchanges in the country |

| September 12, 2017 | JP Morgan’s Jamie Dimon calls Bitcoin a “fraud” |

| September 28, 2017 | South Korea bans raising money through ICOs |

| October 20, 2017 | Bitcoin passes $100B in market capitalization |

| October 24, 2017 | Bitcoin again forks into two digital currencies, Bitcoin (BTC) and Bitcoin Gold (BTG) |

| October 30, 2017 | Vietnam bans Bitcoin and other crypto payments |

| November 26, 2017 | Bitcoin passes $150B in market capitalization |

| November 28, 2017 | Bitcoin trades at $10k for the first time. |

And here is how long it took bitcoins to hit each $1,000 barrier:

| Time | Exact Period | Description |

|---|---|---|

| 138 days | Jan 2, 2017 -> May 20, 2017 | $1,000 to $2,000 |

| 23 days | May 20, 2017 -> June 11, 2017 | $2,000 to $3,000 |

| 63 days | June 11, 2017 -> Aug 13, 2017 | $3,000 to $4,000 |

| 61 days | Aug 13, 2017 -> Oct 12, 2017 | $4,000 to $5,000 |

| 10 days | Oct 12, 2017 -> Oct 21, 2017 | $5,000 to $6,000 |

| 13 days | Oct 21, 2017 -> Nov 2, 2017 | $6,000 to $7,000 |

| 17 days | Nov 2, 2017 -> Nov 19, 2017 | $7,000 to $8,000 |

| 7 days | Nov 19, 2017 -> Nov 26, 2017 | $8,000 to $9,000 |

| 2 days | Nov 26, 2017 -> Nov 28, 2017 | $9,000 to $10,000 |

Note: These time periods are calculated based on closing prices for the Bitcoin Price Index on Coindesk.

The Year of the ICO

While the journey to $10,000 bitcoin is an incredible one, it is part of a wider story as well.

Initial Coin Offerings (ICOs) for other cryptocurrencies have also boomed, and more than 92% of all funds raised through ICOs happened in this year alone. With this mechanism hitting the mainstream, about $3.8 billion have been raised through ICOs in total.

Further, they’ve been profitable as well for speculators. A report from Mangrove Capital last month noted that the average return across 204 ICOs it was tracking was 1,320%.

Despite being temporarily banned in China and South Korea, ICOs have not been slowing down. So far in this month (up to Nov 26, 2017), ICOs have already hit new highs with $743.2 million raised, surpassing the earlier record-holding month of September 2017 ($662.9 million).

Note: this article was originally published on Nov. 27th as Bitcoin was trading at ~$9,600. The article and graphic have since been updated to reflect hitting the $10k total.

Bitcoin

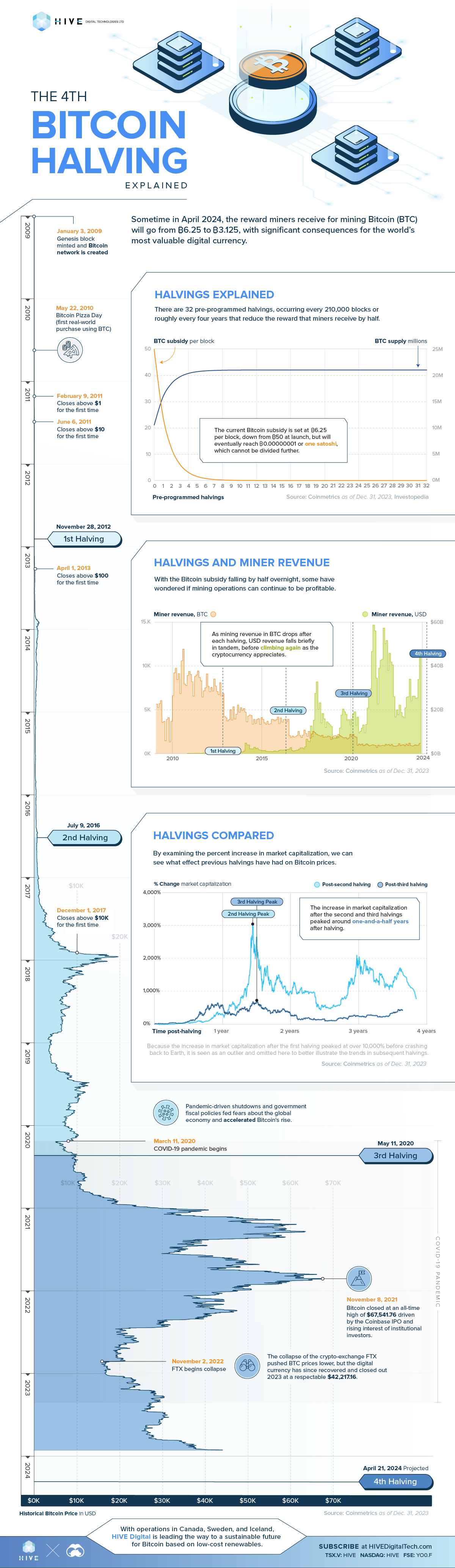

The 4th Bitcoin Halving Explained

We take a deep dive on historical Bitcoin data from Coinmetrics to see what lessons the 3 previous halvings might have for the future.

The 4th Bitcoin Halving Explained

Sometime in April 2024, the reward that cryptocurrency miners receive for mining bitcoin (BTC) will go from ₿6.25 to ₿3.125, with significant consequences for the world’s most valuable digital currency.

To help understand this quadrennial event, we’ve teamed up with HIVE Digital to take a deep dive on historical bitcoin data from Coinmetrics to see what the three previous halvings might tell us about the fourth.

Bitcoin Explained

But to understand halvings, we first need to take a step back to talk a bit about how the Bitcoin network works.

Unlike fiat currencies like the U.S. dollar or the Chinese yuan that are backed by central banks, cryptocurrencies are supported by an underlying blockchain, which contains a record of every single bitcoin transaction in a public decentralized, distributed ledger.

When you spend a bitcoin, a digital record of that transaction needs to be validated and added to the blockchain. And this is where miners come in. They legitimize and audit bitcoin transactions, and as a reward, receive bitcoin in payment.

Halvings Explained

Now, quantitative easing notwithstanding, you normally can’t keep printing money forever without running into hyperinflation (think 1920s Germany or 1990s Argentina).

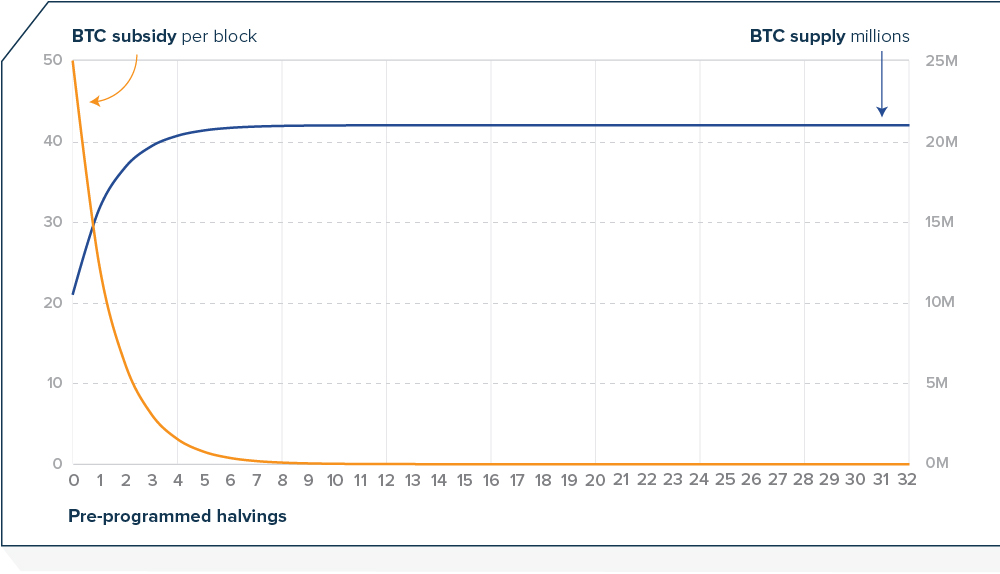

To get around this problem, the Bitcoin network has a pre-programmed upper limit of 21 million, with the reward that miners receive decreasing by half (hence, halving) roughly every four years.

When the Bitcoin network first launched, the reward was initially set to ₿50, an amount that was high enough to quickly increase the money supply and incentivize miners to participate in the validation process. On November 28, 2012, that reward decreased by half to ₿25, then to ₿12.5 on July 9, 2016, and on May 11, 2020, to ₿6.25.

The last halving will happen sometime in 2136, with the reward decreasing to ₿0.00000001 or one satoshi, the smallest denomination of bitcoin possible. The last bitcoin will enter circulation four years later, in 2140.

Halvings and Miner Revenue

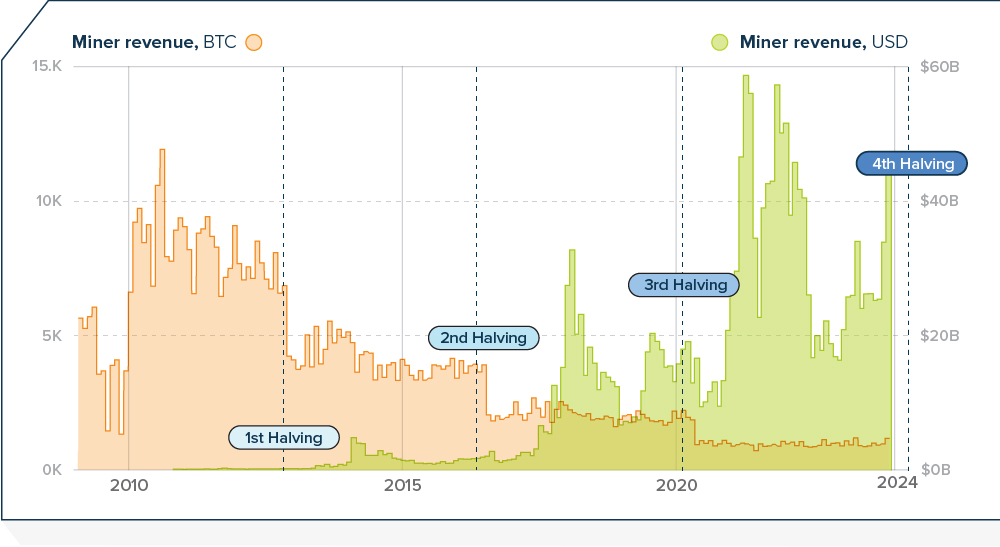

With the fourth halving just around the corner, some have wondered whether mining will still be sustainable. Modern mining operations today are costly endeavors, often with razor-thin margins, and losing half of one’s revenue overnight would be a nightmare for any business.

And if you look at historical miner revenue in bitcoin, you can see quite clearly, the steep drop in revenue after each halving. But what’s interesting, is that if you compare that against the miner revenue in USD, there is a drop there as well, but it recovers soon thereafter as the cryptocurrency appreciates. In other words, a miner may receive less bitcoin, but that bitcoin is worth more.

Halvings Compared

So we know that the network will continue to function after the fourth halving, but what else can we learn from previous halvings?

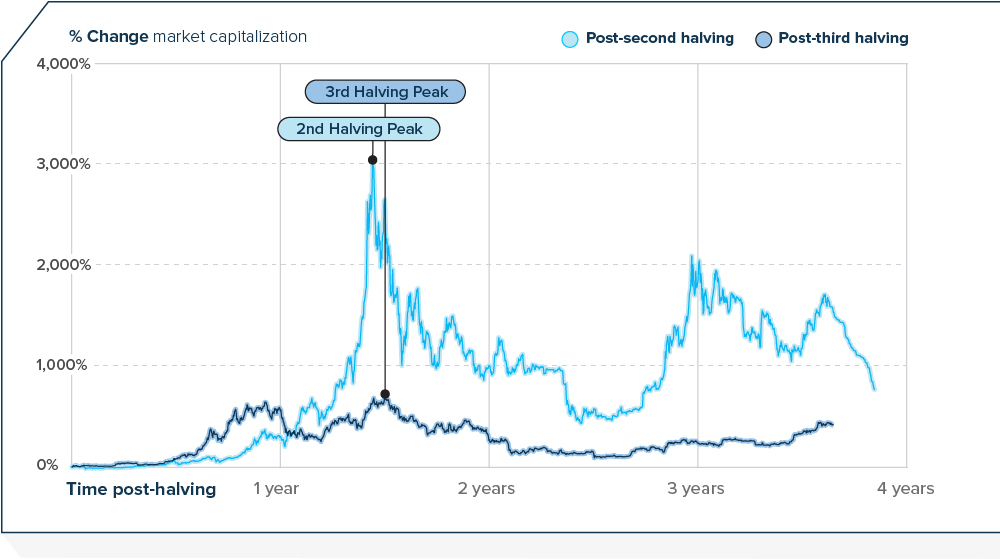

If we look at the percent change in market capitalization post-halvings, we can see a bit of a pattern. After both the second and third halvings, market capitalization peaked at around the year-and-half mark. The second-halving peak occurred on day 526 at around $328 billion, an increase of 3,000%, while the third-halving peak came three weeks later on day 547 at over $1.2 trillion, or an increase of just under 700%.

The post-first-halving peak happened a bit earlier, at the 372-day mark, but because the peak was so high (over 10,000%!) it is considered an outlier, and omitted to better illustrate the trend.

The 4th Bitcoin Halving Projected?

Because we know that halvings occur every 210,000 blocks and that each block takes around 10 minutes to mine, we have a good idea of when the fourth halving should happen: April 21, 2024. If the next halving follows the same pattern as the previous two, then there could be a market-capitalization peak some time during the third week of October 2025.

And with the price of bitcoin setting new records at time of writing, a lot of people will be watching very closely, indeed.

HIVE Digital is leading the way to a sustainable future for Bitcoin based on low-cost renewables.

-

Energy3 years ago

Energy3 years agoVisualizing the Power Consumption of Bitcoin Mining

Bitcoin mining requires significant amounts of energy, but what does this consumption look like when compared to countries and companies?

-

Bitcoin3 years ago

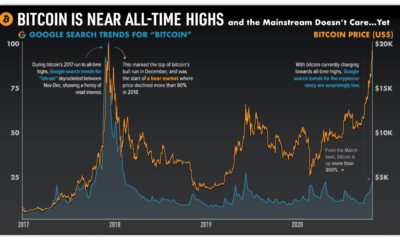

Bitcoin3 years agoBitcoin is Near All-Time Highs and the Mainstream Doesn’t Care…Yet

As bitcoin charges towards all-time highs, search interest is relatively low. How much attention has bitcoin’s recent rally gotten?

-

Technology5 years ago

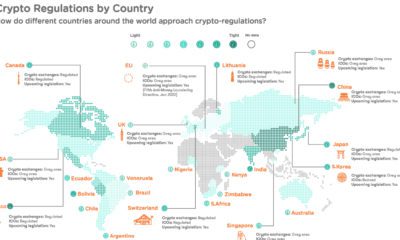

Technology5 years agoMapped: Cryptocurrency Regulations Around the World

Cryptocurrency regulations are essential for the future of digital finance, making it more attractive for businesses, banks, and investors worldwide.

-

Technology5 years ago

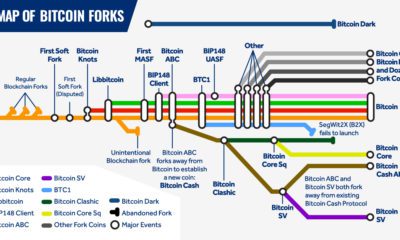

Technology5 years agoMapping the Major Bitcoin Forks

Bitcoin forks play a key role in Bitcoin’s evolution as a blockchain. While some have sparked controversy, most Bitcoin forks have been a sign of growth.

-

Cryptocurrency5 years ago

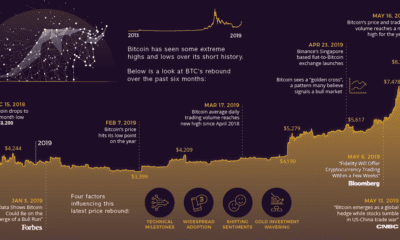

Cryptocurrency5 years agoThe Beginning of a Bitcoin Bull Run?

After 15 months of losses and stagnation, Bitcoin has made a miraculous recovery — going on a 150% bull run since its lows in December 2018.

-

Bitcoin5 years ago

Bitcoin5 years agoDecentralized Finance: An Emerging Alternative to the Global Financial System

What is decentralized finance? Learn how technology is changing the rules of the game, creating the potential for a new financial system to emerge.

-

Sports1 week ago

Sports1 week agoThe Highest Earning Athletes in Seven Professional Sports

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)