Bitcoin

The Beginning of a Bitcoin Bull Run?

The Beginning of a Bitcoin Bull Run?

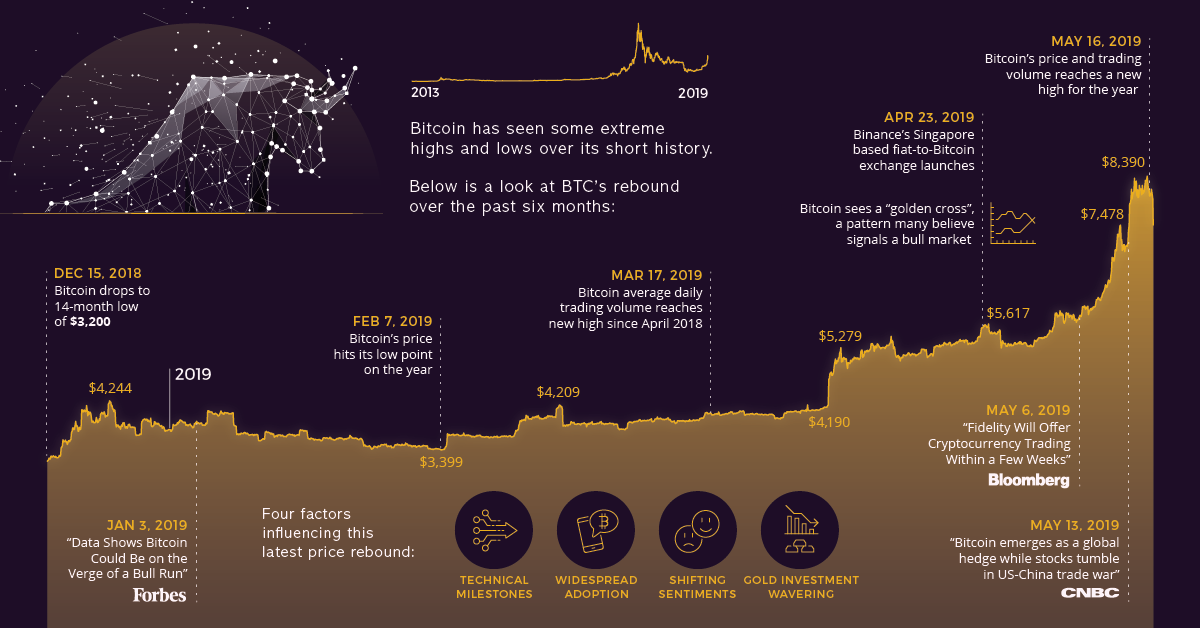

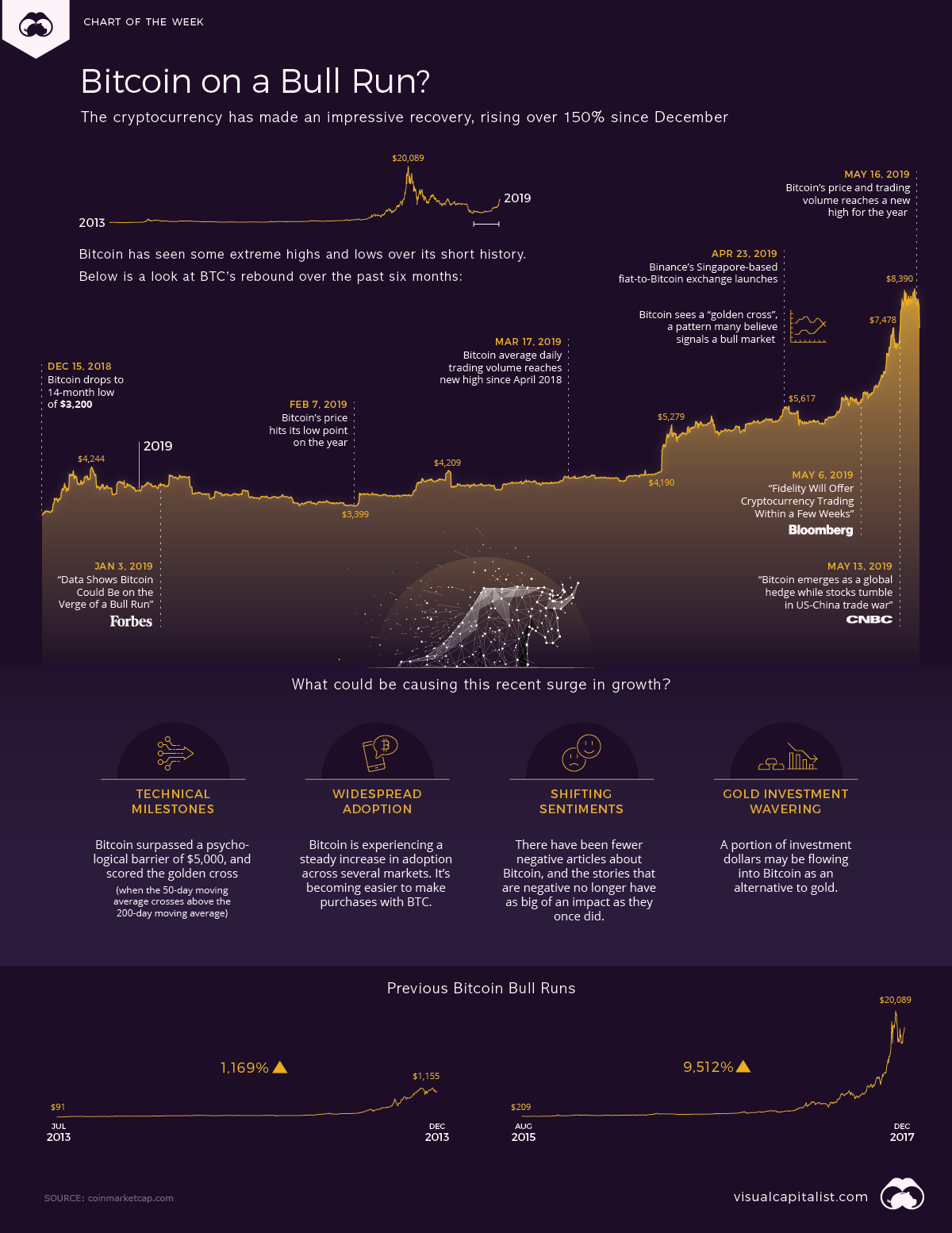

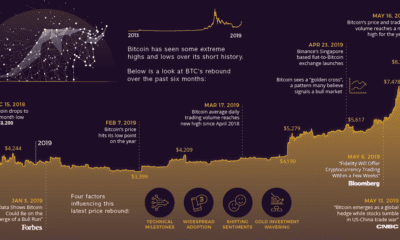

After 15 months of losses and stagnation, Bitcoin has made a miraculous recovery — rising more than 150% from its lowest point in December 2018.

In its heyday, Bitcoin had surpassed $10,000 in early December 2017, before briefly crossing the $20,000 mark for a single day on December 17th. A year later, the digital currency had fallen back to Earth, dropping below $3,200.

Now that the dust of that wild speculative frenzy has settled, Bitcoin is back on the upswing. What could be causing this most recent surge in growth?

We look at four possible explanations for the Bitcoin bull run, as originally outlined by Aaron Hankin at MarketWatch:

Technical Milestones

Bitcoin has seen several technical milestones this year, such as surpassing the psychological barrier of $5,000 in early 2019, breaking the 200-day moving average, and scoring the golden cross (when the 50-day moving average crosses above the 200-day moving average).

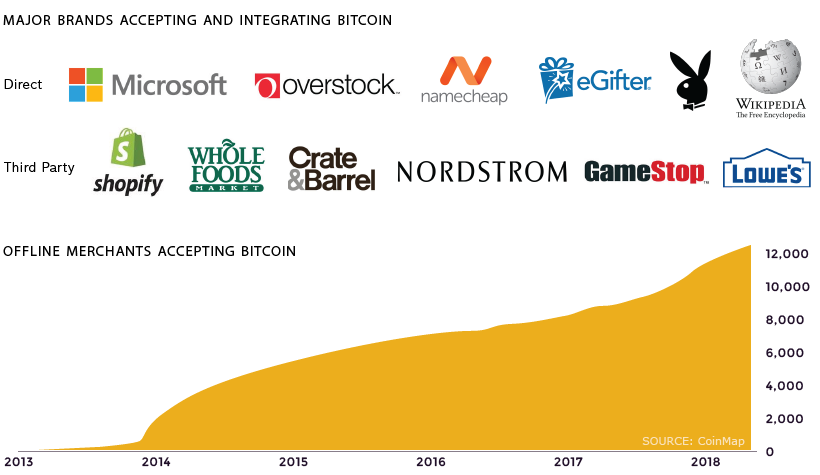

Widespread Adoption

Bitcoin is experiencing a steady increase in adoption across several markets. The term Bitcoin has become a household name — even if people don’t understand what it does, they know what it is.

Companies such as Starbucks, Microsoft, and Amazon, and Nordstrom are looking for ways to integrate cryptocurrencies into daily transactions for faster payment clearance, innovative rewards programs, and efficient customer service interactions.

Shifting Sentiments

Bitcoin has possibly seen a shift in public perception. There have been fewer negative articles about Bitcoin and cryptocurrencies, and the news stories that are negative no longer have as big of an impact as they once did.

When Binance announced hackers stole $40 million in bitcoin and when accusations of an $850-million cover-up were leveled against Bitfinex and Tether, the Bitcoin bull run barely flinched and continued to climb.

Wavering Gold Investment

Investor confidence in gold has been more stagnant in recent times. To capitalize on this, Grayscale Investments (of Digital Currency Group) posted a campaign in May 2019 promoting Bitcoin as an ideal alternative to gold because it is borderless, secure, and more efficient for storing value.

Despite the World Gold Council’s response denying those claims, the Grayscale Bitcoin Trust saw OTC Markets Group’s highest trading volumes five days later.

Where to from here?

After a long skid, it appears Bitcoin is showing signs of life again. Bitcoin’s price can be highly volatile, so it remains to be seen whether this is the beginning of a bull run, or whether this is just another bump in the roller coaster ride.

Editor’s note: The price of Bitcoin has fallen to $7,100 at time of publishing and will likely continue to experience extreme volatility. However, even at a price of $7,100, this is still a 120% increase from lows in Dec 2018. As well, an earlier version of this graphic had incorrect dates on the timeline. That has now been corrected.

Bitcoin

The 4th Bitcoin Halving Explained

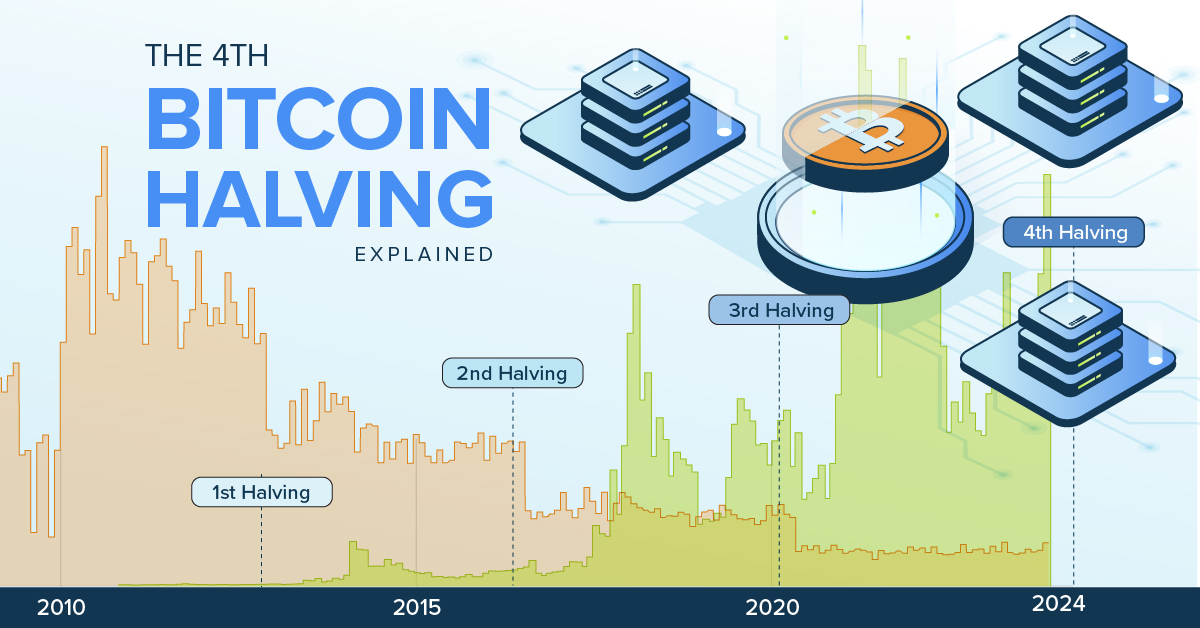

We take a deep dive on historical Bitcoin data from Coinmetrics to see what lessons the 3 previous halvings might have for the future.

The 4th Bitcoin Halving Explained

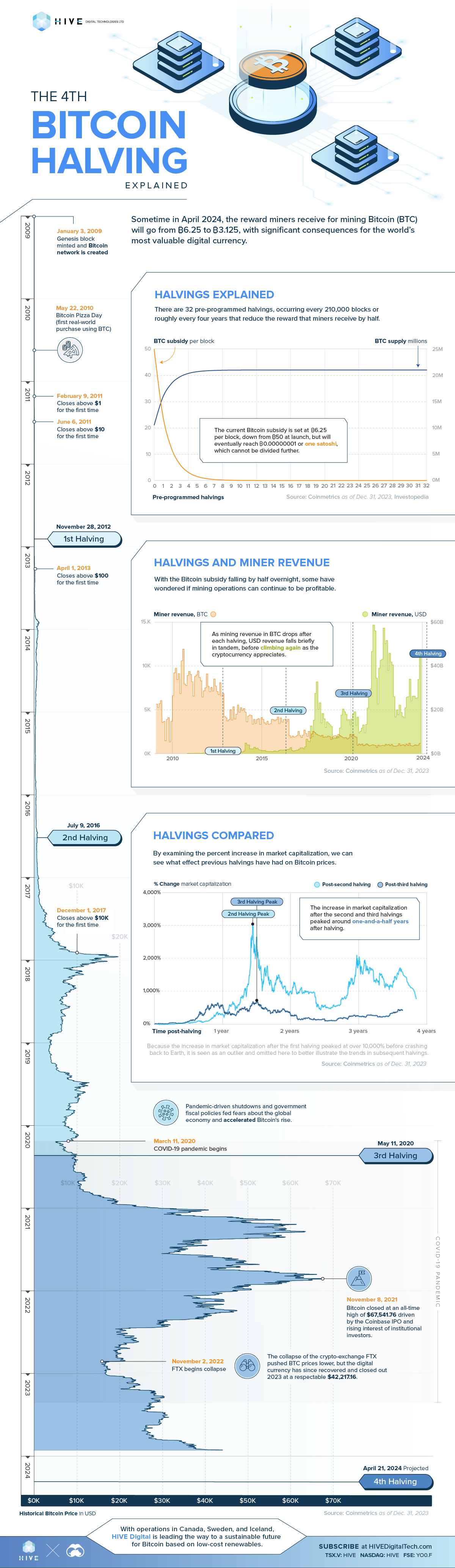

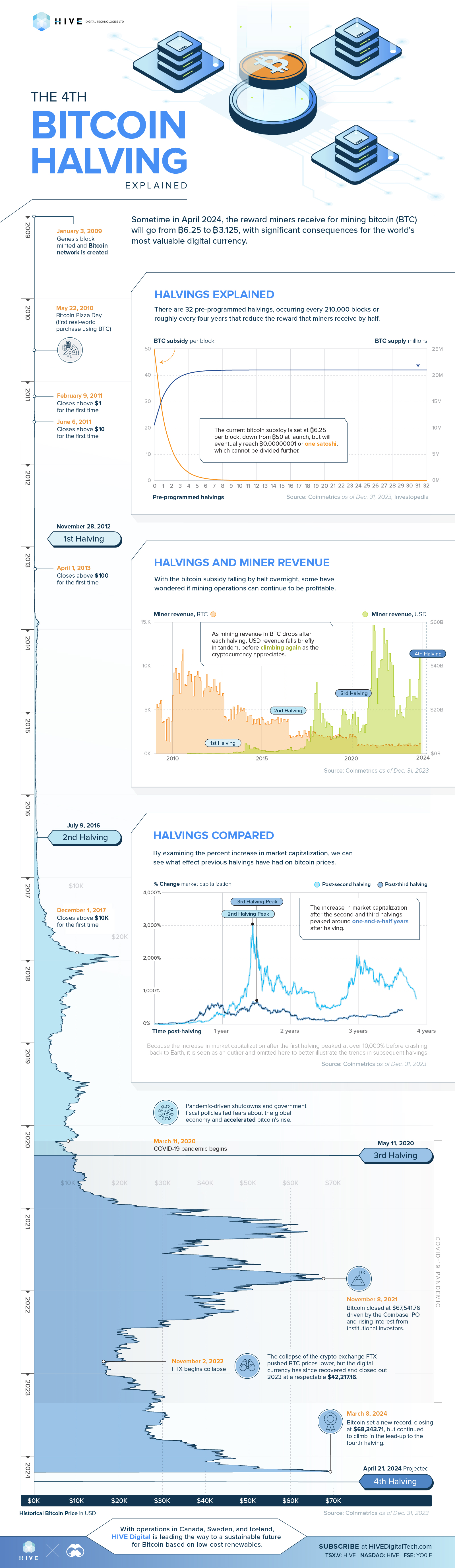

Sometime in April 2024, the reward that cryptocurrency miners receive for mining bitcoin (BTC) will go from ₿6.25 to ₿3.125, with significant consequences for the world’s most valuable digital currency.

To help understand this quadrennial event, we’ve teamed up with HIVE Digital to take a deep dive on historical bitcoin data from Coinmetrics to see what the three previous halvings might tell us about the fourth.

Bitcoin Explained

But to understand halvings, we first need to take a step back to talk a bit about how the Bitcoin network works.

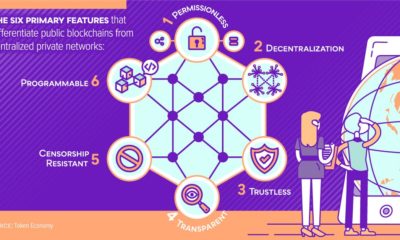

Unlike fiat currencies like the U.S. dollar or the Chinese yuan that are backed by central banks, cryptocurrencies are supported by an underlying blockchain, which contains a record of every single bitcoin transaction in a public decentralized, distributed ledger.

When you spend a bitcoin, a digital record of that transaction needs to be validated and added to the blockchain. And this is where miners come in. They legitimize and audit bitcoin transactions, and as a reward, receive bitcoin in payment.

Halvings Explained

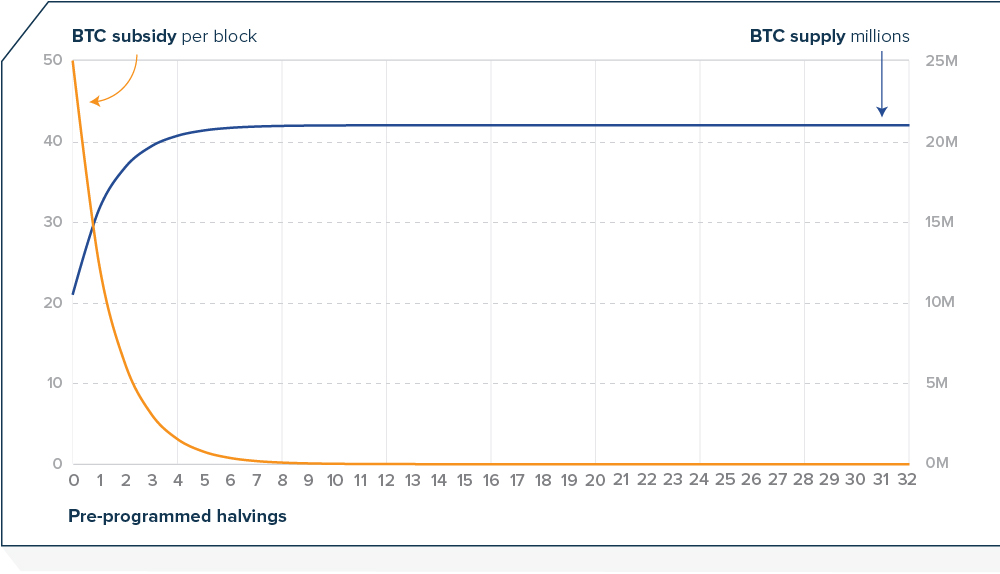

Now, quantitative easing notwithstanding, you normally can’t keep printing money forever without running into hyperinflation (think 1920s Germany or 1990s Argentina).

To get around this problem, the Bitcoin network has a pre-programmed upper limit of 21 million, with the reward that miners receive decreasing by half (hence, halving) roughly every four years.

When the Bitcoin network first launched, the reward was initially set to ₿50, an amount that was high enough to quickly increase the money supply and incentivize miners to participate in the validation process. On November 28, 2012, that reward decreased by half to ₿25, then to ₿12.5 on July 9, 2016, and on May 11, 2020, to ₿6.25.

The last halving will happen sometime in 2136, with the reward decreasing to ₿0.00000001 or one satoshi, the smallest denomination of bitcoin possible. The last bitcoin will enter circulation four years later, in 2140.

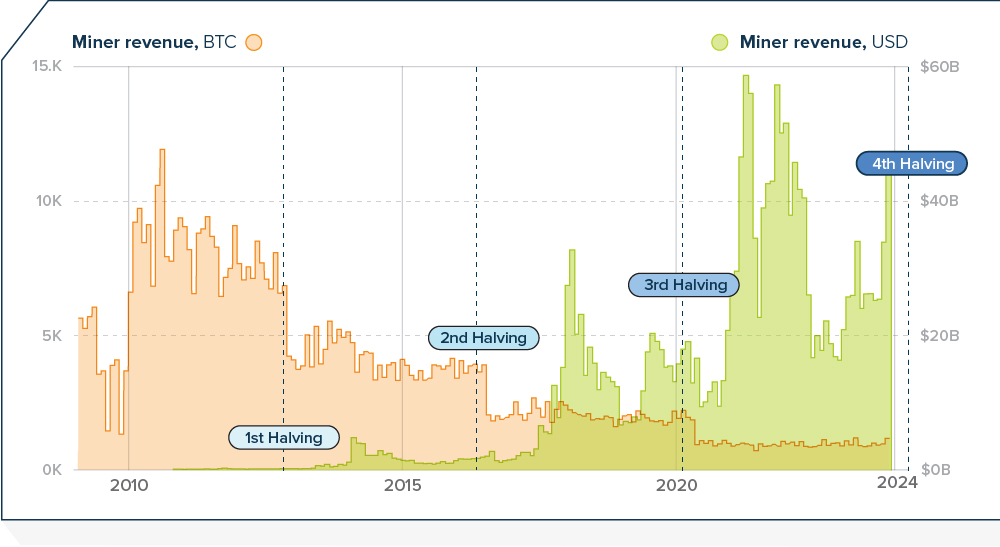

Halvings and Miner Revenue

With the fourth halving just around the corner, some have wondered whether mining will still be sustainable. Modern mining operations today are costly endeavors, often with razor-thin margins, and losing half of one’s revenue overnight would be a nightmare for any business.

And if you look at historical miner revenue in bitcoin, you can see quite clearly, the steep drop in revenue after each halving. But what’s interesting, is that if you compare that against the miner revenue in USD, there is a drop there as well, but it recovers soon thereafter as the cryptocurrency appreciates. In other words, a miner may receive less bitcoin, but that bitcoin is worth more.

Halvings Compared

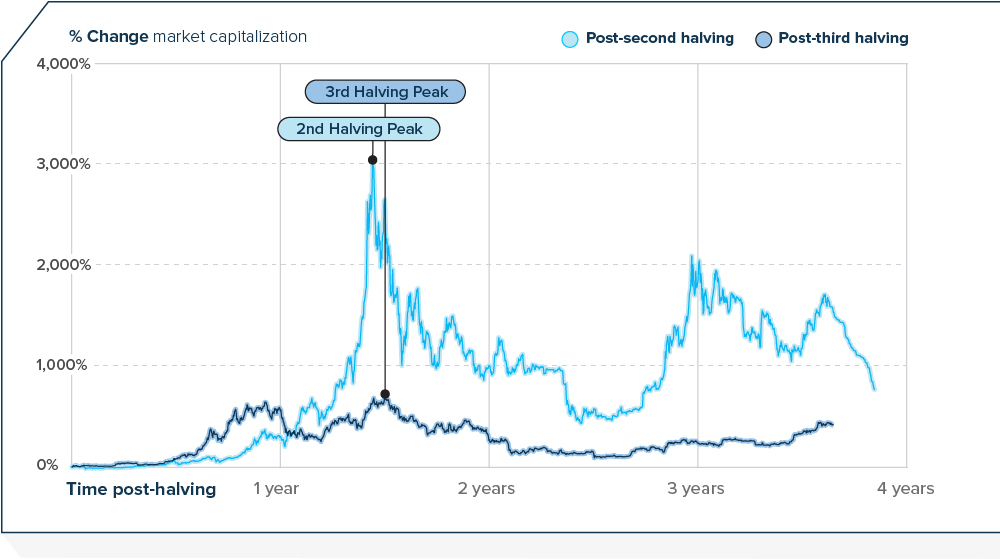

So we know that the network will continue to function after the fourth halving, but what else can we learn from previous halvings?

If we look at the percent change in market capitalization post-halvings, we can see a bit of a pattern. After both the second and third halvings, market capitalization peaked at around the year-and-half mark. The second-halving peak occurred on day 526 at around $328 billion, an increase of 3,000%, while the third-halving peak came three weeks later on day 547 at over $1.2 trillion, or an increase of just under 700%.

The post-first-halving peak happened a bit earlier, at the 372-day mark, but because the peak was so high (over 10,000%!) it is considered an outlier, and omitted to better illustrate the trend.

The 4th Bitcoin Halving Projected?

Because we know that halvings occur every 210,000 blocks and that each block takes around 10 minutes to mine, we have a good idea of when the fourth halving should happen: April 21, 2024. If the next halving follows the same pattern as the previous two, then there could be a market-capitalization peak some time during the third week of October 2025.

And with the price of bitcoin setting new records at time of writing, a lot of people will be watching very closely, indeed.

HIVE Digital is leading the way to a sustainable future for Bitcoin based on low-cost renewables.

-

Bitcoin3 years ago

Bitcoin3 years agoVisualizing the Power Consumption of Bitcoin Mining

Bitcoin mining requires significant amounts of energy, but what does this consumption look like when compared to countries and companies?

-

Bitcoin3 years ago

Bitcoin3 years agoBitcoin is Near All-Time Highs and the Mainstream Doesn’t Care…Yet

As bitcoin charges towards all-time highs, search interest is relatively low. How much attention has bitcoin’s recent rally gotten?

-

Technology5 years ago

Technology5 years agoMapped: Cryptocurrency Regulations Around the World

Cryptocurrency regulations are essential for the future of digital finance, making it more attractive for businesses, banks, and investors worldwide.

-

Blockchain5 years ago

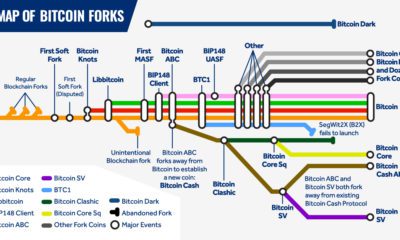

Blockchain5 years agoMapping the Major Bitcoin Forks

Bitcoin forks play a key role in Bitcoin’s evolution as a blockchain. While some have sparked controversy, most Bitcoin forks have been a sign of growth.

-

Bitcoin5 years ago

Bitcoin5 years agoThe Beginning of a Bitcoin Bull Run?

After 15 months of losses and stagnation, Bitcoin has made a miraculous recovery — going on a 150% bull run since its lows in December 2018.

-

Bitcoin5 years ago

Bitcoin5 years agoDecentralized Finance: An Emerging Alternative to the Global Financial System

What is decentralized finance? Learn how technology is changing the rules of the game, creating the potential for a new financial system to emerge.

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?