Technology

Mapping the Major Bitcoin Forks

Mapping the Major Bitcoin Forks

The emergence of Bitcoin took the world by storm through its simplicity and innovation. Yet, plenty of confusion remains around the term itself.

The Bitcoin blockchain—not to be confused with the bitcoin cryptocurrency—involves a vast global network of computers operating on the same distributed database to process massive volumes of data every second.

These transactions tell the network how to alter this distributed database in real-time, which makes it crucial for everyone to agree on how these changes should be applied. When the community can’t come to a mutual agreement on what changes, or when such rule changes should take effect, it results in a blockchain fork.

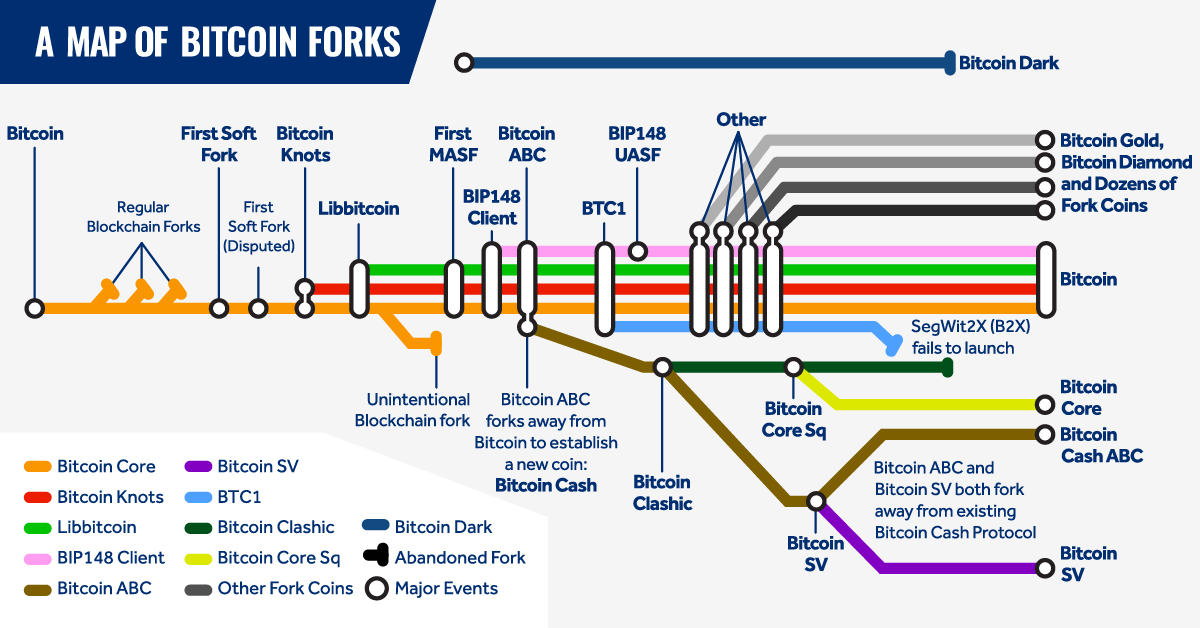

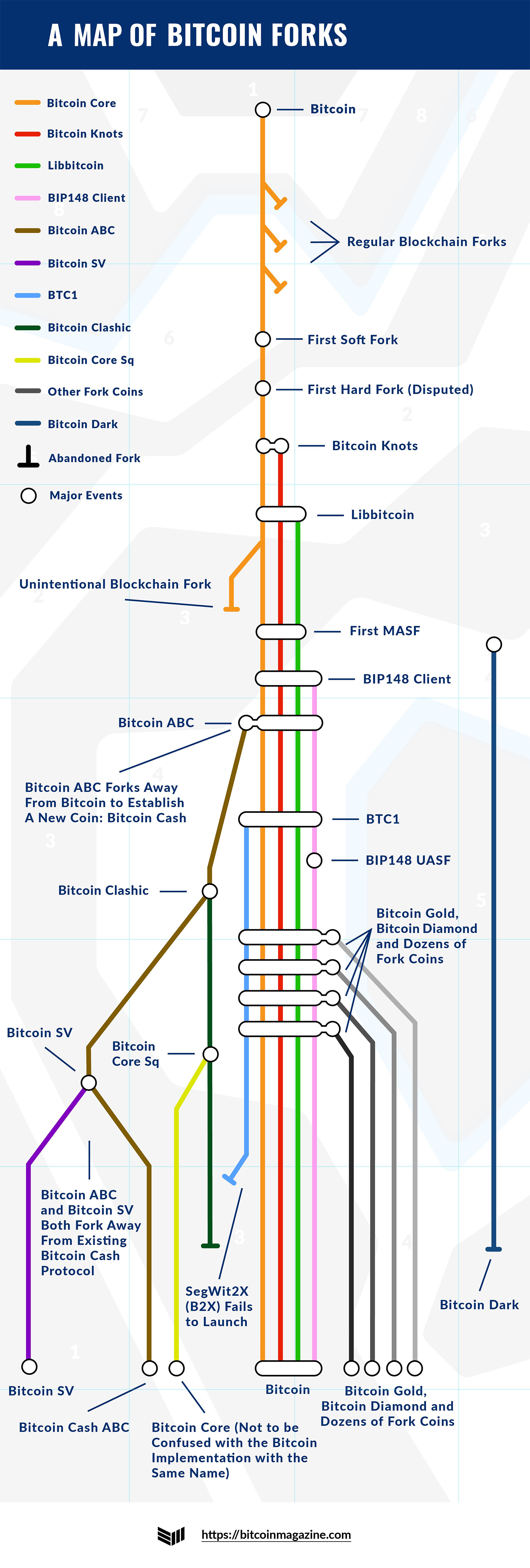

Today’s unique subway-style map by Bitcoin Magazine shows the dramatic and major forks that have occurred for Bitcoin. But what exactly is a Blockchain fork?

Types of Blockchain Forks

Forks are common practice in the software industry and happen for one of two reasons:

- Split consensus within the community

These forks are generally disregarded by the community because they are temporary, except in extreme cases. The longer of the two chains is used to continue building the blockchain. - Changes to the underlying rules of the blockchain

A permanent fork which requires an upgrade to the current software in order to continue participating in the network.

There are four major types of forks that can occur:

1. Soft Forks

Soft forks are like gradual software upgrades—bug fixes, security checks, and new features—for those that upgrade right away.

These forks are “backwards compatible” with the older software; users who haven’t upgraded still have access to the network but may not be able to use all functionality in the current version.

2. Hard Forks

Hard forks are like a new OS release—upgrading is mandatory to continue using the software. Because of this, hard forks aren’t compatible with older versions of the network.

Hard forks are a permanent division of the blockchain. As long as enough people support both chains, however, they will both continue to exist.

The three types of hard forks are:

- Planned

Scheduled upgrades to the network, giving users a chance to prepare. These forks typically involve abandoning the old chain. - Contentious

Caused by disagreements in the community, forming a new chain. This usually involves major changes to the code. - Spin-off Coins

Changes to Bitcoin’s code that create new coins. Litecoin is an example of this—key changes included reducing mining time from 10 minutes to 2.5 minutes, and increasing the coin supply from 21 million to 84 million.

3. Codebase Forks

Codebase forks copy the Bitcoin code, allowing developers to make minor tweaks without having to develop the entire blockchain code from scratch. Codebase forks can create a new cryptocurrency or cause unintentional blockchain forks.

4. Blockchain Forks

Blockchain forks involve branching or splitting a blockchain’s whole transaction history. Outcomes range from “orphan” blocks to new cryptocurrencies.

Splitting off the Bitcoin network to form a new currency is much like a religious schism—while most of the characteristics and history are preserved, a fork causes the new network to develop a distinct identity.

Summarizing Major Bitcoin Forks

Descriptions of major forks that have occurred in the Bitcoin blockchain:

- Bitcoin / Bitcoin Core

The first iteration of Bitcoin was launched by Satoshi Nakamoto in 2009. Future generations of Bitcoin (aka Bitcoin 0.1.0) were renamed Bitcoin Core, or Bitcore, as other blockchains and codebases formed. - BTC1

A codebase fork of Bitcoin. Developers released a hard fork protocol called Segwit2x, with the intention of having all Bitcoin users eventually migrate to the Segwit2x protocol. However, it failed to gain traction and is now considered defunct. - Bitcoin ABC

Also a codebase fork of Bitcoin, Bitcoin ABC was intentionally designed to be incompatible with all Bitcoin iterations at some point. ABC branched off to form Bitcoin Cash in 2017. - Bitcoin Gold, Bitcoin Diamond, Other Fork Coins

After the successful yet contentious launch of Bitcoin Cash, other fork coins began to emerge. Unlike the disagreement surrounding Bitcoin Cash, most were simply regarded as a way to create new coins.

Some of the above forks were largely driven by ideology (BTC1), some because of mixed consensus on which direction to take a hard fork (Bitcoin ABC), while others were mainly profit-driven (Bitcoin Clashic)—or a mix of all three.

Where’s the Next Fork in the Road?

Forks are considered an inevitability in the blockchain community. Many believe that forks help ensure that everyone involved—developers, miners, and investors—all have a say when disagreements occur.

Bitcoin has seen its fair share of ups and downs. Crypto investors should be aware that Bitcoin, as both a protocol and a currency, is complex and always evolving. Even among experts, there is disagreement on what constitutes a soft or hard fork, and how certain geopolitical events have played a role in Bitcoin’s evolution.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees