Technology

Why Big Data Keeps Getting Bigger

Why Big Data Keeps Getting Bigger

The sun never sets on the creation of new data.

Yes, the rate of generation may slow down at night as people send fewer emails and watch fewer videos. But for every person hitting the hay, there is another person on the opposite side of the world that is turning their smartphone on for the day.

As a result, the scale of data being generated—even when we look at it through a limited lens of one minute at a time—is quite mind-boggling to behold.

The Data Explosion, by Source

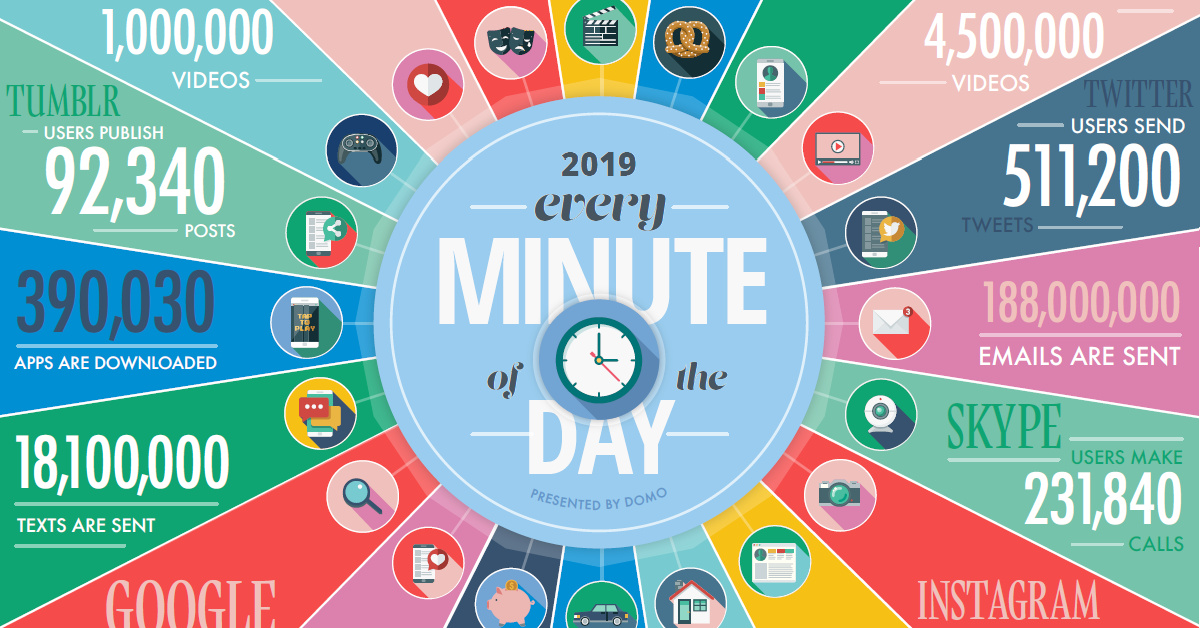

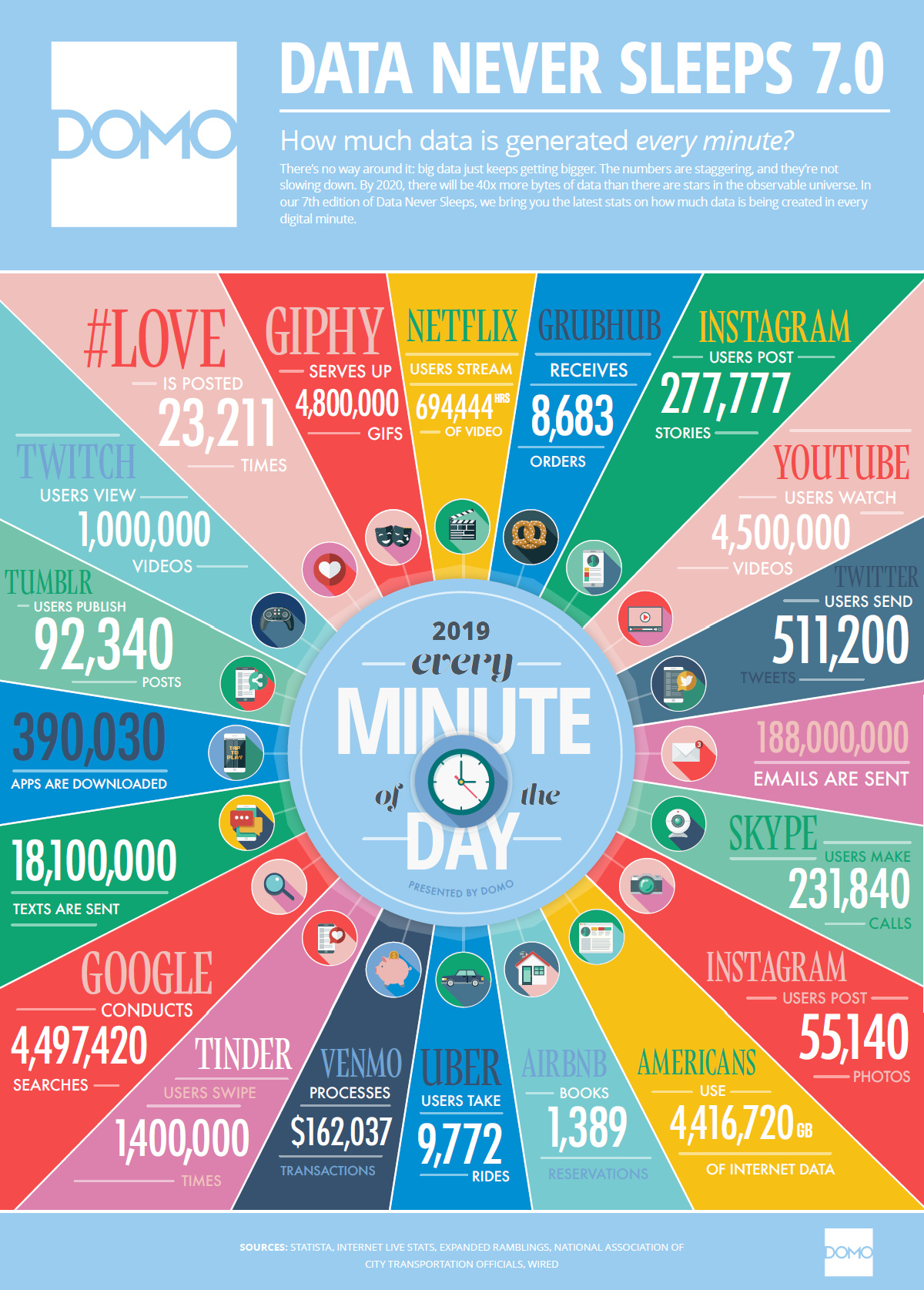

Today’s infographic comes to us from Domo, and it shows the amount of new data generated each minute through several different platforms and technologies.

Let’s start by looking at what happens every minute from a broad perspective:

- Americans use 4,416,720 GB of internet data

- There are 188,000,000 emails sent

- There are 18,100,000 texts sent

- There are 390,030 apps downloaded

Now lets look at platform-specific data on a per minute basis:

- Giphy serves up 4,800,000 gifs

- Netflix users stream 694,444 hours of video

- Instagram users post 277,777 stories

- Youtube users watch 4,500,000 videos

- Twitter users send 511,200 tweets

- Skype users make 231,840 calls

- Airbnb books 1,389 reservations

- Uber users take 9,772 rides

- Tinder users swipe 1,400,000 times

- Google conducts 4,497,420 searches

- Twitch users view 1,000,000 videos

Imagine being given the task to build a server infrastructure capable of handling any of the above items. It’s a level of scale that’s hard to comprehend.

Also, imagine how difficult it is to make sense of this swath of data. How does one even process insights from the many billions of Youtube videos watched per day?

Why Big Data is Going to Get Even Bigger

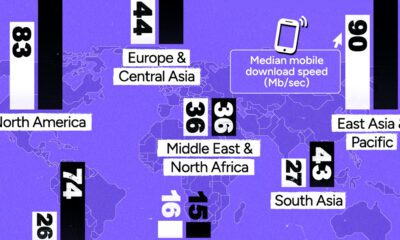

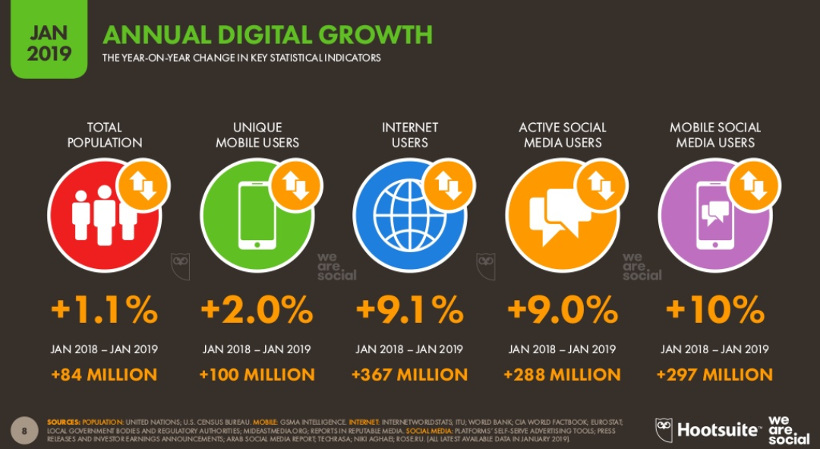

The above statistics are already mind-bending, but consider that the global total of internet users is still growing at roughly a 9% clip. This means the current rate of data creation is still just scratching the surface of its ultimate potential.

In fact, as We Are Social’s recent report on internet usage reveals, a staggering 367 million new internet users were added in between January 2018 and January 2019:

Global internet penetration sits at 57% in 2019, meaning that billions of more people are going to be using the above same services—including many others that don’t even exist yet.

Combine this with more time spent on the internet per user and technologies like 5G, and we are only at the beginning of the big data era.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001