Technology

12 Influential Smart Home Inventions, and Why They Matter

Being influential doesn’t always translate to direct commercial success.

This pattern is the most visible in the music industry, in which many trendsetting bands often fail to achieve mainstream popularity. Artists like the Dead Kennedys, Kraftwerk, and Captain Beefheart all pioneered genres, but this translated to limited amounts of fame and fortune.

Such a paradigm can also be seen in technology, where it’s simply not possible for every new product to become the next iPhone. Like music, some tech products are well before their time, while others serve as important sources of inspiration before they ultimately fizzle out.

Influential Smart Home Inventions

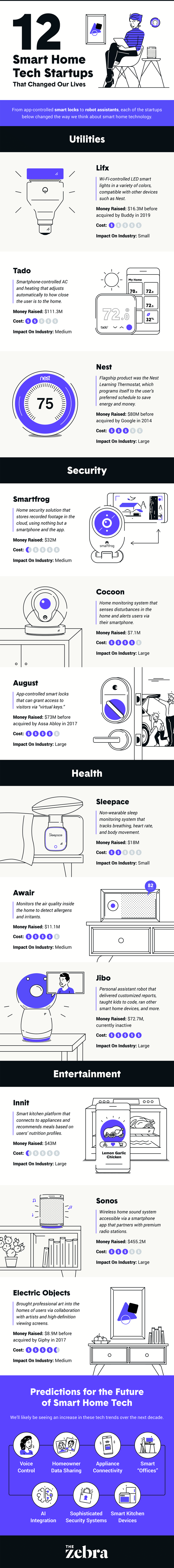

Today’s infographic from The Zebra looks at the smart home inventions helping to define the future of the nascent home IoT market.

The devices listed below may not all be massive commercial successes like the Google Nest, but many of them will be cited as influences in helping shape the smart home.

The above smart home inventions range from inactive projects like the Jibo social robot, which ran through its $73 million of funding, to more commercially successful and widely available products like the Sonos smart speaker and the Google Nest smart thermostat.

While they’ve had differing levels of adoption and success, all of the above products are expected to be major influences on the smart home market going forward.

Smart Influence

To see why these products are so interesting, let’s take a deeper look into some key spaces:

1. Utilities

Before smart technology, most home utilities were controlled inefficiently and crudely.

However, devices like tado° and Nest have shown that temperatures should be optimized based on the habits of the people that occupy the home, rather than via manual controls. To accomplish this optimization, tado° adjusts air conditioning or heating based on how close a user is to returning home, while Nest programs itself based on the users’ schedule.

Theoretically, these both allow for significant savings on energy bills, and future smart home inventions will likely follow in similar footsteps.

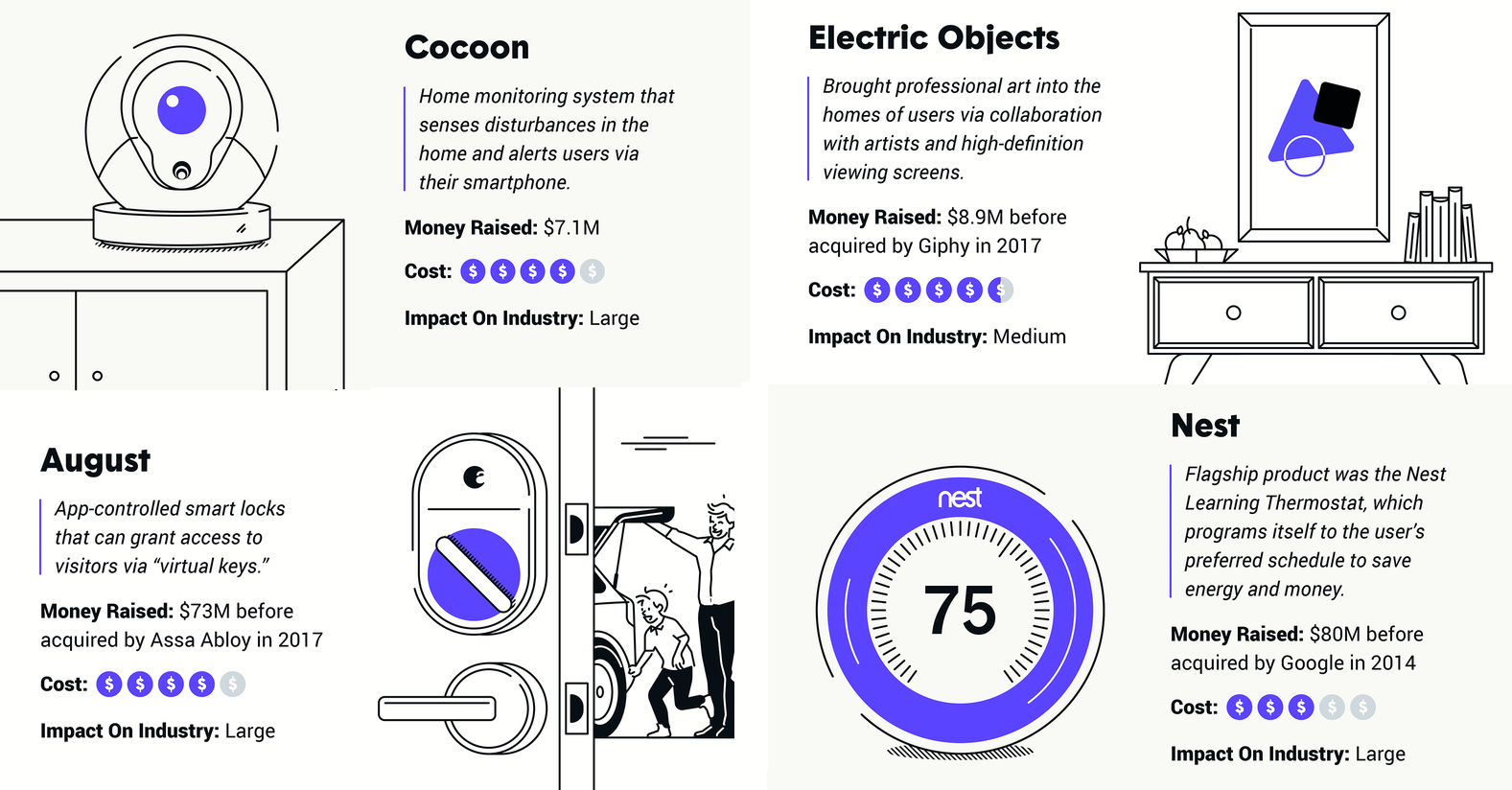

2. Security

In the past, if you were gone for a long time, your best option may have been to have friends, family, or neighbors check up on the property.

In the smart home era, security is quickly becoming a priority so that keeping an eye on your property can be easier, safer, and more effective. App-controlled smart locks like August can grant access to visitors via “virtual keys”, while Cocoon senses disturbances in the home and alerts users via smartphone.

3. Health and Entertainment

You do most of your living at home, and the smart home aims to make this experience healthier, while also making it convenient and pleasurable.

Smart home inventions such as Awair will allow you to monitor and analyze your home’s air quality, while detecting harmful allergens and irritants in real-time.

On the entertainment front, it’s worth noting that one of the most influential devices in this category — the Jibo social robot — has gone belly up. Despite this, it is commonly speculated that the robot was well before its time, and there are now a variety of companies working on similar ways to bring AI and robotics to the home.

The Future of the Smart Home

In the next decade, the smart home is expected to grow even more autonomous.

New products will be responding to trends pioneered by many of the above products, such as voice control, homeowner data sharing, appliance connectivity, AI integration, sophisticated security systems, and smart kitchen devices.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Science7 days ago

Science7 days agoVisualizing the Average Lifespans of Mammals

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023