Technology

Mapping the Biggest Tech Talent Hubs in the U.S. and Canada

Mapping the Biggest Tech Talent Hubs in the U.S. and Canada

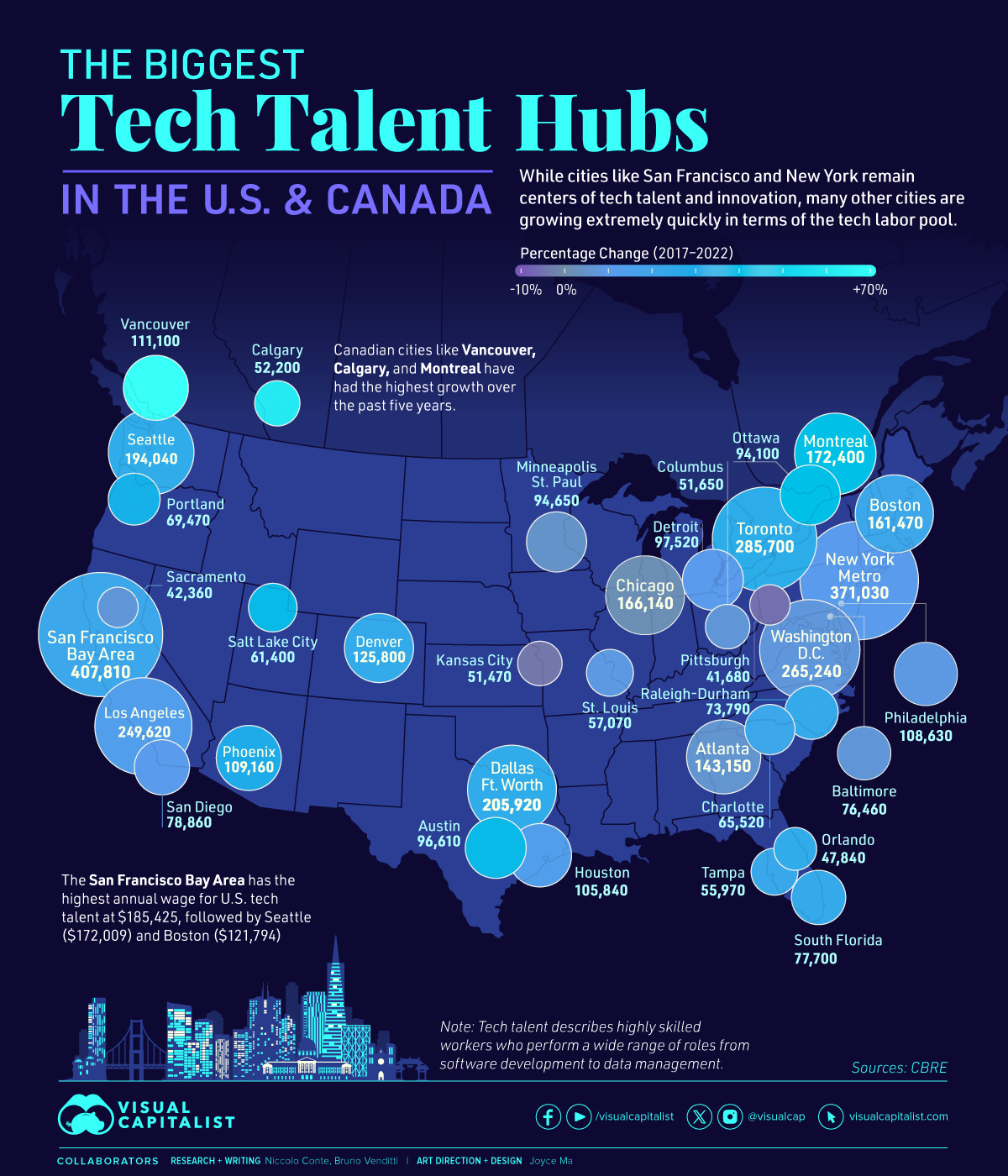

While cities like San Francisco and New York remain centers of tech talent and innovation, many other cities are growing extremely quickly in terms of the tech labor pool.

This infographic draws from a report by CBRE to determine which tech talent markets in the U.S. and Canada are the largest. The data looks at the total workforce in the sector, as well as the change in tech worker population over time in various cities.

What is Tech Talent?

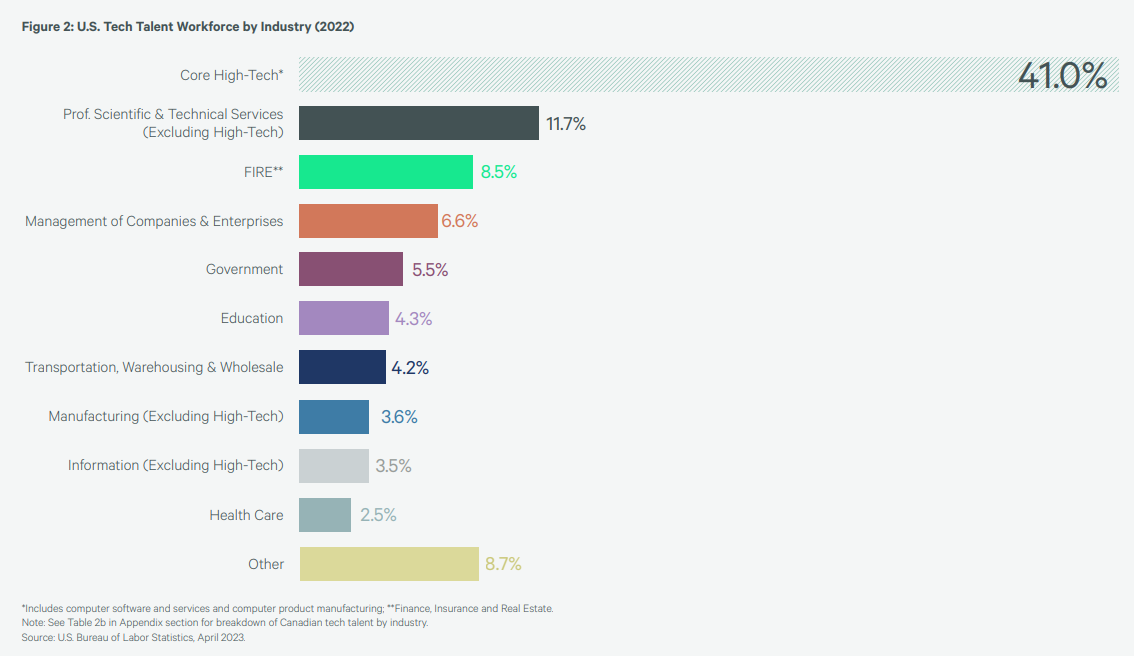

Tech talent represents a group of highly skilled workers in more than 20 technology-oriented occupations driving innovation across all industry sectors, ranging from software developers to systems and data managers.

Although these positions are concentrated within the high-tech industry, they are spread across all industry sectors.

Top tech talent markets are typically characterized by a substantial level of educational attainment and a significant concentration of young individuals. Forty-five of the top 50 talent markets have an educational attainment level above national averages.

The tech sector remains one of the top employers of highly skilled workers in North America, with over seven million workers.

California’s Bay Area, which includes Silicon Valley, remains the biggest tech hub, with a talent pool of 407,810 tech workers, compared to 378,870 in 2021.

| Market | Tech Workforce (2022) | Change (2017-2022) |

|---|---|---|

| San Francisco Bay Area | 407,810 | 23% |

| New York Metro | 371,030 | 11% |

| Toronto | 285,700 | 29% |

| Washington D.C. | 265,240 | 7% |

| Los Angeles/Orange County | 249,620 | 17% |

| Dallas/Ft. Worth | 205,920 | 28% |

| Seattle | 194,040 | 29% |

| Montreal | 172,400 | 43% |

| Chicago | 166,140 | 2% |

| Boston | 161,470 | 22% |

| Atlanta | 143,150 | 6% |

| Denver | 125,800 | 26% |

| Vancouver | 111,100 | 69% |

| Phoenix | 109,160 | 30% |

| Philadelphia | 108,630 | 7% |

| Houston | 105,840 | 12% |

| Detroit | 97,520 | 10% |

| Austin | 96,610 | 39% |

| Minneapolis/St.Paul | 94,650 | 4% |

| Ottawa | 94,100 | 40% |

| San Diego | 78,860 | 12% |

| South Florida | 77,700 | 24% |

| Baltimore | 76,460 | 5% |

| Raleigh-Durham | 73,790 | 24% |

| Portland | 69,470 | 34% |

| Charlotte | 65,520 | 21% |

| Salt Lake City | 61,400 | 39% |

| St. Louis | 57,070 | 7% |

| Tampa | 55,970 | 23% |

| Calgary | 52,200 | 61% |

| Columbus | 51,650 | 5% |

| Kansas City | 50,470 | -4% |

| Orlando | 47,840 | 26% |

| Sacramento | 42,360 | 7% |

| Pittsburgh | 41,680 | -6% |

| Cincinnati | 40,450 | 10% |

| Nashville | 39,180 | 36% |

| Cleveland | 38,130 | 6% |

| Quebec City | 36,400 | 34% |

| Indianapolis | 35,980 | 1% |

| Milwaukee | 35,260 | 14% |

| San Antonio | 33,470 | 7% |

| Virginia Beach | 31,210 | 17% |

| Edmonton | 31,100 | 45% |

| Waterloo Region, Canada | 29,700 | 52% |

| Richmond | 28,480 | 14% |

| Hartford | 27,500 | 6% |

| Inland Empire | 26,850 | 44% |

| Jacksonville | 23,620 | 17% |

| Madison | 23,530 | 45% |

The Bay Area also has the highest annual wage for U.S. tech talent at $185,425, followed by Seattle ($172,009) and Boston ($121,794)

Toronto remains the third tech hub in North America, just behind the San Francisco Bay Area and New York.

Emerging Tech Cities in Canada

Canada has attracted significant numbers of tech workers largely as a result of the country’s immigration-friendly national policy and labor cost advantage, according to a recent report from the Technology Councils of North America (TECNA) and Canada’s Tech Network (CTN).

In fact, Canadian cities like Vancouver, Calgary, and Waterloo have had the highest growth of tech workers over the past five years.

Between April 2022 and March 2023, 32,115 new workers came to Canada with the most migrating from India and Nigeria.

North America’s Next Tech Hubs

Despite the dominance of traditional tech hubs, the report also points to other cities that could receive tech talent over the next few years.

They are concentrated in the U.S. Midwest and South, like Boise (ID), Las Vegas (NE), Palm Bay (FL), and Birmingham (AL).

The report also highlights Winnipeg and Halifax as potential Canadian tech hubs.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001