Technology

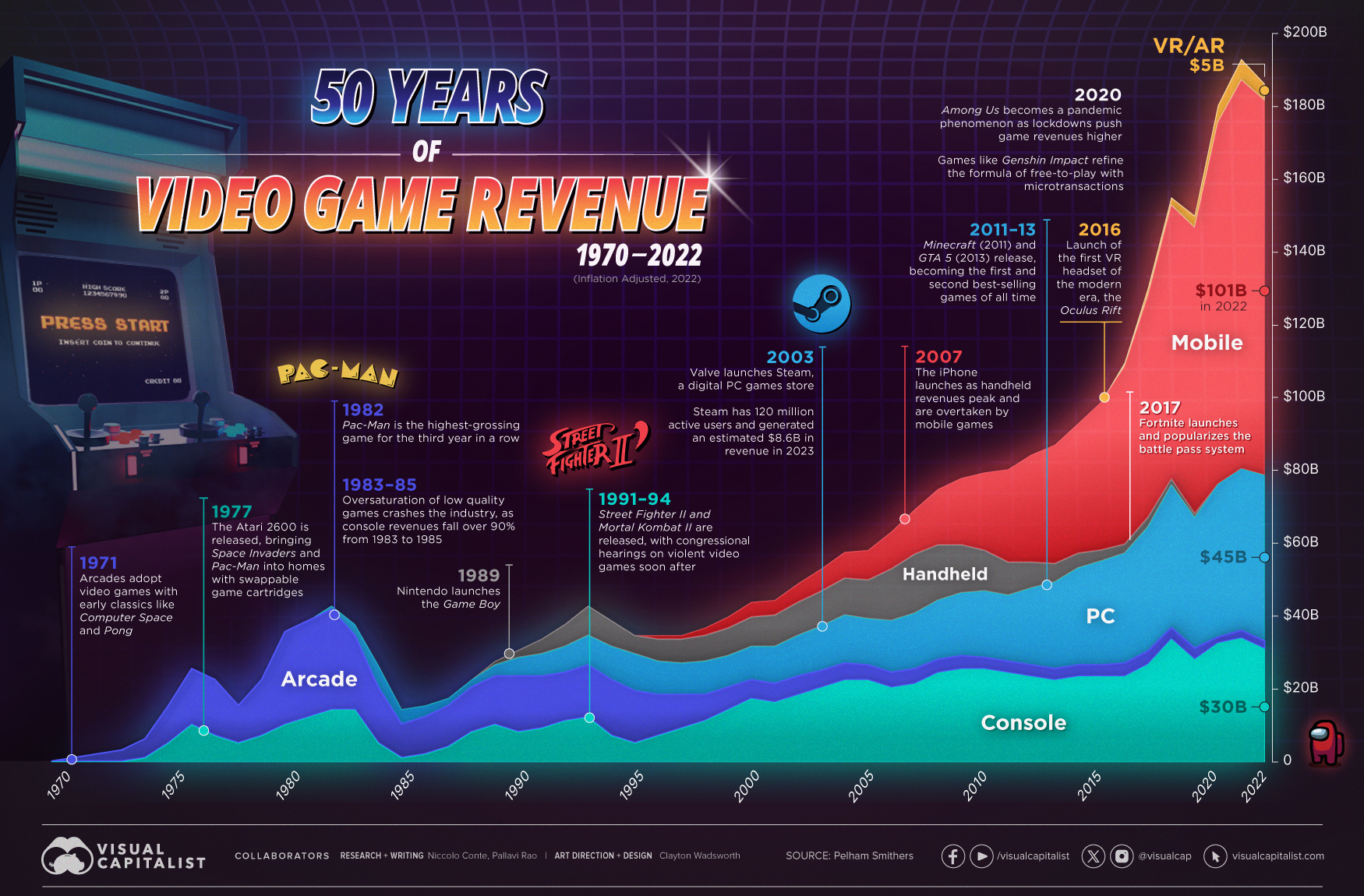

50 Years of Video Game Industry Revenues, by Platform

Click to view this graphic in a higher-resolution.

50 Years of Video Game Industry Revenues, by Platform

Video killed the radio star.

And the video game industry’s explosive growth over the last five decades has killed any skepticism of its strength and staying power in the larger media and entertainment space.

We visualize the video game industry’s inflation-adjusted revenues every year, from its humble beginnings in 1970 to the media juggernaut it is now, worth more than $180 billion of revenue in 2022. All data presented in the chart and in this article was provided by UK-based market intelligence firm Pelham Smithers.

| Year | Total Game Industry Revenue (USD, Billions) | % Increase (YoY) |

|---|---|---|

| 1970 | $0 | N/A |

| 1971 | $1 | N/A |

| 1972 | $2 | 100% |

| 1973 | $3 | 50% |

| 1974 | $6 | 100% |

| 1975 | $15 | 150% |

| 1976 | $25 | 67% |

| 1977 | $22 | -12% |

| 1978 | $15 | -32% |

| 1979 | $22 | 47% |

| 1980 | $35 | 59% |

| 1981 | $38 | 9% |

| 1982 | $42 | 11% |

| 1983 | $37 | -12% |

| 1984 | $26 | -30% |

| 1985 | $14 | -46% |

| 1986 | $15 | 7% |

| 1987 | $17 | 13% |

| 1988 | $22 | 29% |

| 1989 | $27 | 23% |

| 1990 | $30 | 11% |

| 1991 | $33 | 10% |

| 1992 | $37 | 12% |

| 1993 | $42 | 14% |

| 1994 | $38 | -10% |

| 1995 | $34 | -11% |

| 1996 | $34 | 0% |

| 1997 | $34 | 0% |

| 1998 | $36 | 6% |

| 1999 | $39 | 8% |

| 2000 | $43 | 10% |

| 2001 | $44 | 1% |

| 2002 | $48 | 10% |

| 2003 | $52 | 8% |

| 2004 | $57 | 9% |

| 2005 | $57 | 1% |

| 2006 | $62 | 9% |

| 2007 | $68 | 10% |

| 2008 | $74 | 8% |

| 2009 | $77 | 4% |

| 2010 | $78 | 2% |

| 2011 | $79 | 1% |

| 2012 | $83 | 5% |

| 2013 | $85 | 3% |

| 2014 | $91 | 7% |

| 2015 | $97 | 6% |

| 2016 | $108 | 11% |

| 2017 | $128 | 19% |

| 2018 | $152 | 19% |

| 2019 | $147 | -3% |

| 2020 | $177 | 20% |

| 2021 | $190 | 7% |

| 2022 | $183 | -4% |

Note: Numbers are rounded to the nearest billion.

From an industry that was nearly wiped out by a market crash, to the highest-earning media sector today, video games have had a tumultuous journey.

As medium has evolved, so too have the consumer preferences for different gaming platforms. Which formats led the overall industry’s revenue growth through the years?

Arcades, Home Consoles, Handheld Gaming

The history of mass-market consumer-oriented video games starts with Atari.

The company that released Computer Space (1971) and Pong (1972) on coin-operated arcade machines took the market by storm, spawning a series of competitors, earning an estimated $35-40 per day, and selling nearly 8,000 units in two years.

For an industry that barely existed until a couple years prior, those numbers spurred the inception of video games as a legitimate (and profitable) form of entertainment.

| Year | Arcade Revenues (USD, Billions) | Console Revenues (USD, Billions) | Handheld Revenues (USD, Billions) |

|---|---|---|---|

| 1970 | $0 | N/A | N/A |

| 1971 | $1 | N/A | N/A |

| 1972 | $2 | N/A | N/A |

| 1973 | $3 | N/A | N/A |

| 1974 | $5 | $1 | N/A |

| 1975 | $10 | $5 | N/A |

| 1976 | $15 | $10 | N/A |

| 1977 | $15 | $7 | N/A |

| 1978 | $10 | $5 | N/A |

| 1979 | $15 | $7 | N/A |

| 1980 | $25 | $10 | N/A |

| 1981 | $26 | $12 | N/A |

| 1982 | $27 | $14 | N/A |

| 1983 | $20 | $14 | N/A |

| 1984 | $15 | $5 | N/A |

| 1985 | $9 | $1 | N/A |

| 1986 | $10 | $2 | N/A |

| 1987 | $11 | $4 | N/A |

| 1988 | $12 | $8 | N/A |

| 1989 | $13 | $10 | $1 |

| 1990 | $15 | $8 | $2 |

| 1991 | $14 | $9 | $4 |

| 1992 | $13 | $11 | $6 |

| 1993 | $14 | $12 | $8 |

| 1994 | $15 | $7 | $7 |

| 1995 | $14 | $5 | $5 |

| 1996 | $11 | $7 | $6 |

| 1997 | $9 | $9 | $7 |

| 1998 | $7 | $11 | $7 |

| 1999 | $6 | $14 | $8 |

| 2000 | $5 | $17 | $8 |

| 2001 | $5 | $16 | $9 |

| 2002 | $5 | $18 | $9 |

| 2003 | $5 | $20 | $10 |

| 2004 | $5 | $22 | $10 |

| 2005 | $4 | $22 | $11 |

| 2006 | $4 | $20 | $14 |

| 2007 | $4 | $21 | $16 |

| 2008 | $4 | $24 | $15 |

| 2009 | $4 | $25 | $13 |

| 2010 | $3 | $25 | $11 |

| 2011 | $3 | $24 | $9 |

| 2012 | $3 | $23 | $7 |

| 2013 | $3 | $22 | $5 |

| 2014 | $3 | $23 | $4 |

| 2015 | $3 | $23 | $3 |

| 2016 | $4 | $23 | $3 |

| 2017 | $4 | $26 | $3 |

| 2018 | $3 | $33 | $2 |

| 2019 | $3 | $28 | $1 |

| 2020 | $2 | $32 | $0 |

| 2021 | $2 | $33 | $0 |

| 2022 | $2 | $30 | $0 |

| Share of Total Industry Revenue in 2022 | 1.1% | 16.6% | 0.0% |

Note: Numbers are rounded to the nearest billion.

Within just seven years, thanks to the proliferation of arcade games, the video game industry generated more revenue than the American box office and music industry put together.

Then, in the 1980s, a once little-known playing card company in Japan released one of the best-selling video game franchises ever, Super Mario Bros on their home console the Nintendo Entertainment System (NES).

A few years later, at the cusp of the ’90s, Nintendo released the iconic Game Boy on which enthusiasts could play Tetris—a popular arcade game—from the comfort of their bed, cementing video games’ place in consumers’ homes.

PC Gaming, Mobile Gaming, and Virtual Reality

By the ’90s, another technological boom was taking place: the rise of personal computing.

Naturally, companies developed video games (like Doom, Prince of Persia, Dangerous Dave) for this new platform, taking advantage of increased computing power, bigger screens, and more flexibility in programming.

While home consoles still accounted for the majority share of the industry’s revenues, handheld devices and PC gaming split the difference as arcade revenues began to drop rapidly.

| Year | PC Revenues (USD, Billions) | Mobile Revenues (USD, Billions) | VR/AR Revenues (USD, Billions) |

|---|---|---|---|

| 1982 | $1 | N/A | N/A |

| 1983 | $3 | N/A | N/A |

| 1984 | $6 | N/A | N/A |

| 1985 | $4 | N/A | N/A |

| 1986 | $3 | N/A | N/A |

| 1987 | $2 | N/A | N/A |

| 1988 | $2 | N/A | N/A |

| 1989 | $3 | N/A | N/A |

| 1990 | $5 | N/A | N/A |

| 1991 | $6 | N/A | N/A |

| 1992 | $7 | N/A | N/A |

| 1993 | $8 | N/A | N/A |

| 1994 | $9 | N/A | N/A |

| 1995 | $10 | N/A | N/A |

| 1996 | $9 | $1 | N/A |

| 1997 | $9 | $1 | N/A |

| 1998 | $9 | $2 | N/A |

| 1999 | $9 | $3 | N/A |

| 2000 | $9 | $4 | N/A |

| 2001 | $10 | $4 | N/A |

| 2002 | $11 | $5 | N/A |

| 2003 | $12 | $6 | N/A |

| 2004 | $13 | $7 | N/A |

| 2005 | $13 | $8 | N/A |

| 2006 | $14 | $10 | N/A |

| 2007 | $15 | $12 | N/A |

| 2008 | $16 | $15 | N/A |

| 2009 | $17 | $18 | N/A |

| 2010 | $18 | $21 | N/A |

| 2011 | $18 | $25 | N/A |

| 2012 | $21 | $29 | N/A |

| 2013 | $23 | $32 | N/A |

| 2014 | $26 | $35 | N/A |

| 2015 | $28 | $40 | N/A |

| 2016 | $30 | $48 | $1 |

| 2017 | $34 | $60 | $2 |

| 2018 | $39 | $74 | $2 |

| 2019 | $35 | $77 | $3 |

| 2020 | $41 | $98 | $5 |

| 2021 | $44 | $105 | $6 |

| 2022 | $45 | $101 | $5 |

| Share of Total Industry Revenue in 2022 | 24.5% | 55.3% | 2.5% |

Note: Numbers are rounded to the nearest billion.

However, handheld gaming revenues peaked in 2007, the year the iPhone launched, and have steadily declined since then as smartphone adoption has grown.

With smartphones came the mobile gaming juggernaut, which has made up more than half of the gaming industry’s revenues since 2019.

In the last few years however, the development of augmented and virtual reality’s more immersive, and sensory-heavy experiences have created yet another platform for video games, and yet another avenue for growth.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Environment2 weeks ago

Environment2 weeks agoTop Countries By Forest Growth Since 2001