Technology

20 Years of Apple vs. Microsoft, by Market Capitalization

![]() See this visualization first on the Voronoi app.

See this visualization first on the Voronoi app.

Charted: 20 Years of Apple vs. Microsoft

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

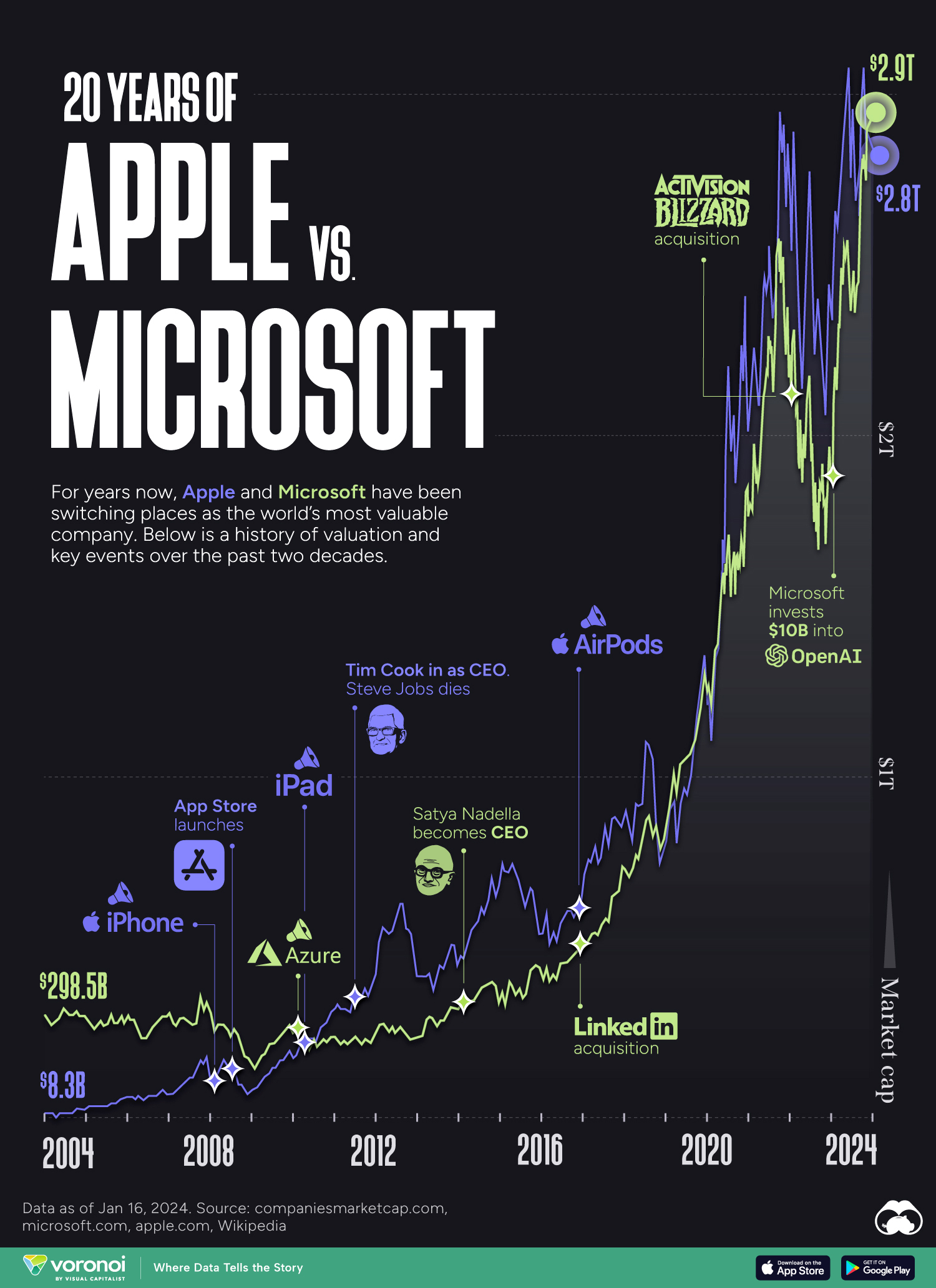

For years, Apple and Microsoft have been switching places as the world’s most valuable company, in terms of market capitalization.

In today’s chart, we explore this history, as well as key events over the past two decades, based on data from CompaniesMarketCap and both companies. Data is from January 16, 2024.

A History of the Battle for Market Cap Dominance

During the 1990s, Microsoft capitalized on the success of Windows, supplanting General Electric as the most valuable company in the U.S. in the process.

Around the same time, Apple was on the brink of bankruptcy due to intense competition in the personal computer market, high product pricing, and a lack of innovation. The company also suffered from numerous failed attempts to modernize the Macintosh operating system (Mac OS) and the failed launches of products like QuickTake digital cameras, PowerCD portable CD, audio players, speakers, and the Pippin video game console.

Over the next decade, however, after the return of Steve Jobs as the CEO, Apple’s stock performance was legendary. This can be attributed to the success of products such as the iMac, iPod, and iPhone, the launch of the famous “Think Different” advertising brand campaign, and opening the Apple Store retail chain.

| Date | Event | Company |

|---|---|---|

| Feb 2008 | iPhone | Apple |

| Jul 2008 | App Store | Apple |

| Feb 2010 | Azure | Microsoft |

| April 2010 | iPad | Apple |

| Mid-2011 | Tim Cook in as CEO. Steve Jobs dies | Apple |

| Feb 2014 | Satya Nadella becomes CEO | Microsoft |

| Dec 2016 | LinkedIn acquisition | Microsoft |

| Dec 2016 | AirPods | Apple |

| Jan 2022 | Activision Blizzard acquisition | Microsoft |

| Early-2023 | Microsoft invests $10B into OpenAI | Microsoft |

In 2004, Microsoft had a market cap of $291 billion compared to Apple’s $26 billion. By the end of that decade, Apple would reach $297 billion, surpassing its rival ($234 billion).

| Market cap (USD) | Apple | Microsoft |

|---|---|---|

| 2024* | $3.002 T | $3.009 T |

| 2023 | $2.994 T | $2.794 T |

| 2022 | $2.066 T | $1.787 T |

| 2021 | $2.901 T | $2.522 T |

| 2020 | $2.255 T | $1.681 T |

| 2019 | $1.287 T | $1.200 T |

| 2018 | $746.07 B | $780.36 B |

| 2017 | $860.88 B | $659.90 B |

| 2016 | $608.96 B | $483.16 B |

| 2015 | $583.61 B | $439.67 B |

| 2014 | $643.12 B | $381.72 B |

| 2013 | $500.74 B | $310.50 B |

| 2012 | $499.69 B | $223.66 B |

| 2011 | $377.51 B | $218.38 B |

| 2010 | $297.09 B | $234.52 B |

| 2009 | $190.98 B | $268.55 B |

| 2008 | $75.99 B | $172.92 B |

| 2007 | $174.03 B | $332.11 B |

| 2006 | $72.98 B | $291.94 B |

| 2005 | $60.79 B | $271.54 B |

| 2004 | $26.05 B | $290.71 B |

| 2003 | $7.88 B | $295.29 B |

| 2002 | $5.16 B | $276.63 B |

*As of January 2024

Since then, the top spot has been most often held by Apple. The company only fell behind Microsoft in 2018 when concerns about COVID-driven supply chain shortages affected the iPhone maker’s stock price.

More recently, the Apple vs. Microsoft race was shaken up once again. Microsoft became the world’s most valuable company in January 2024, after the rival iPhone maker’s shares had a weak start to the year due to growing concerns over demand in China.

Microsoft’s shares have also been strongly buoyed by the company’s early lead in generative artificial intelligence, mainly thanks to its early investment in ChatGPT-maker OpenAI.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Science1 week ago

Science1 week agoVisualizing the Average Lifespans of Mammals

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023