Technology

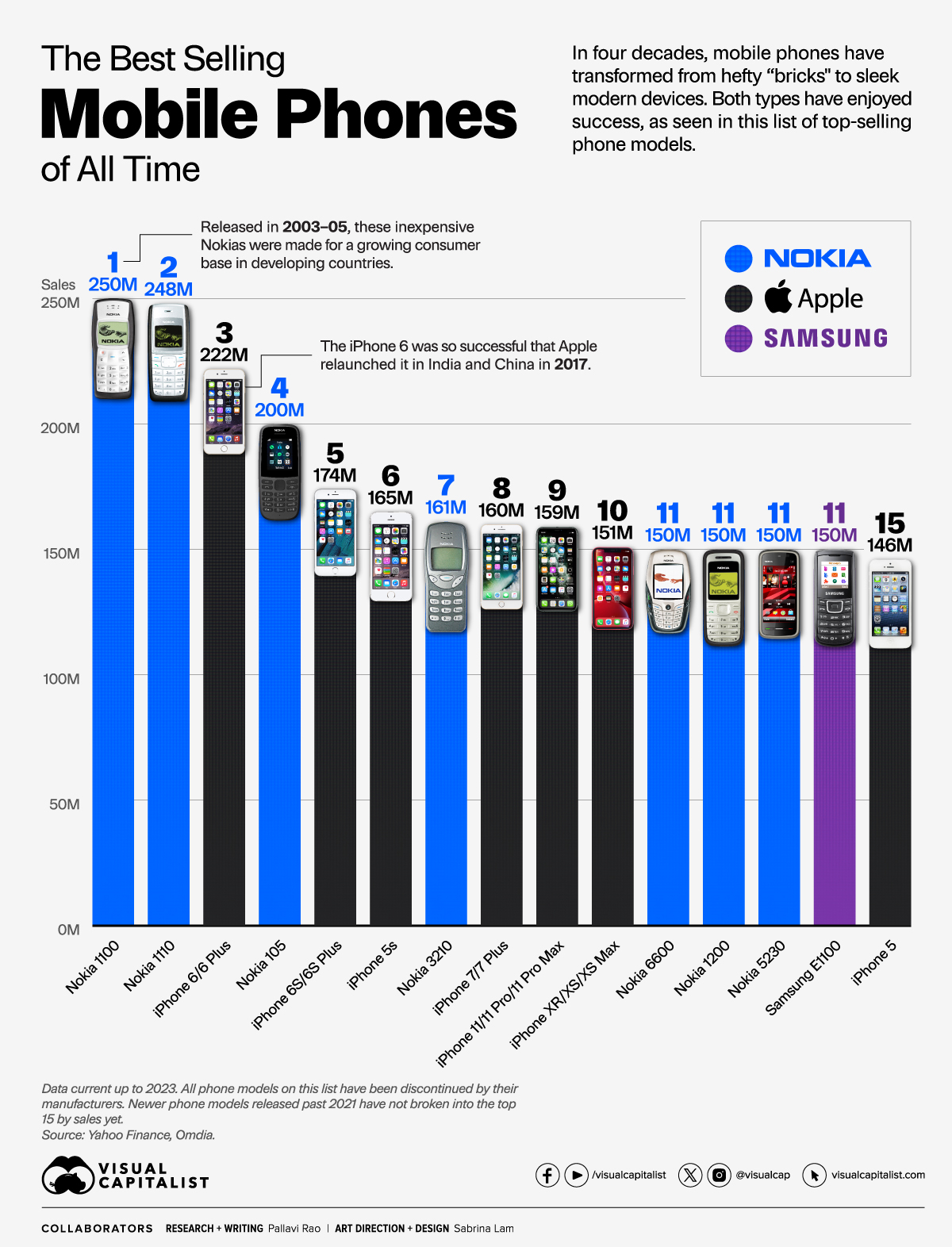

Ranked: The 15 Best-Selling Mobile Phones of All Time

Ranked: The Best-Selling Mobile Phones of All Time

In 2021, the world had 7.1 billion mobile phone users, roughly 90% of the global population. The mobile phone is now one of humanity’s most ubiquitous pieces of technology, and these sleek modern devices are a far cry from their hefty, brick-like predecessors.

But what are the most sold mobile phones of all time?

Using data from Wikipedia, Yahoo Finance, and tech analyst firm Omdia, we chart out the sales of the mobile phones that have enjoyed unmitigated success.

The Most Sold Mobile Phones of All Time

Heading the list of most sold phones ever is the much-beloved Nokia 1100, recording more than 250 million sales in six years before being discontinued in 2009.

Despite existing at the same time as the first mass-market smartphones (the Nokia E-series and then the iPhone), the 1100s’ price, focus on basic functionality, and pocket size made it a favorite in developing countries.

At second place, another variant of the same line, the Nokia 1110, sold 248 million units.

| Rank | Mobile Phone | All-Time Sales |

|---|---|---|

| 1 | Nokia 1100 | 250M |

| 2 | Nokia 1110 | 248M |

| 3 | iPhone 6/6 Plus | 222M |

| 4 | Nokia 105 Series | 200M |

| 5 | iPhone 6S/6S Plus | 174M |

| 6 | iPhone 5s | 165M |

| 7 | Nokia 3210 | 161M |

| 8 | iPhone 7/7 Plus | 160M |

| 9 | iPhone 11/11 Pro/ 11 Pro Max | 159M |

| 10 | iPhone XR/ XS/XS Max | 151M |

| 11T | Nokia 6600 | 150M |

| 11T | Nokia 1200 | 150M |

| 11T | Nokia 5230 | 150M |

| 11T | Samsung E1100 | 150M |

| 15 | iPhone 5 | 146M |

| 16 | Nokia 2600/ 2610/2626/2630 | 135M |

| 17T | Motorola RAZR V3 | 130M |

| 17T | Nokia 1600/ 1650/1661 | 130M |

| 19 | Nokia 3310 | 126M |

| 20 | iPhone 8/8 Plus | 125M |

Ranked third is the iPhone 6 and 6 plus, with a combined 222 million units. Their 4.7 and 5.5-inch screens ushered in the era of large screen smartphones, and they remain Apple’s best-selling iPhones and the best-selling smartphones of all time. In fact, the iPhone 6 was so popular it was re-released in 2017 at a mid-range price level.

The next 17 ranks of the most sold phones are split between Nokias and iPhones, with only the Samsung E1100 (ranked 11th) and and the Motorola Razr V3 (ranked 17th) managing to break the duopoly.

Of course, Nokia and Apple have had very different fortunes in the last decade.

After riding telecom market deregulation, first in Europe, and then in Asia, Nokia failed the transition to smartphones and quickly lost ground to Apple, Google and Samsung.

Microsoft purchased Nokia’s mobile phone business in 2014 to boost their own Windows Phone, but when that failed, Nokia’s phone business was once again sold to HMD Global. Today, HMD Global still makes Nokia phones (including revamps of earlier models) which run on Android OS.

The Modern Mobile Phone Rivalry: Apple vs. Samsung

It’s hard to believe how quickly Apple’s core business has changed from personal computing to mobile phones.

In 2009 iPhone sales contributed about 25% to the company’s revenues. By 2023, half of Apple’s $383 billion revenue came from their phones.

The iPhone routinely dominates the top 10 best-selling phones every year, as evidenced from research by tech analysts Omdia.

| 2022 Best Sellers | 2022 Sales | 2023 Best Sellers | 2023 Sales |

|---|---|---|---|

| iPhone 13 | 55M | iPhone 14 Pro Max | 31M |

| Galaxy A13 | 35M | iPhone 14 | 26M |

| iPhone 13 Pro Max | 29M | iPhone 14 Pro | 24M |

| iPhone 14 Pro Max | 23M | iPhone 13 | 22M |

| iPhone 11 | 21M | Galaxy A14 | 20M |

| iPhone 13 Pro | 19M | Galaxy A14 5G | 14M |

| iPhone 14 Pro | 18M | Galaxy A54 5G | 14M |

| Galaxy A03 Core | 18M | Galaxy S23 Ultra | 13M |

| iPhone 14 | 17M | Galaxy A04e | 11M |

| Galaxy A03 | 16M | Redmi 12C | 11M |

Source: Data shared by Omdia. Note: 2023 numbers are current up to Q3, 2023.

However, Korean electronics behemoth Samsung’s sales figures aren’t exactly lackluster either. And while the two companies’ business models differ quite a bit, their flagship devices are routinely put up against each other: Samsung winning on battery life and mid and lower-range options, and Apple winning on optimization and security. Both brands have stellar cameras.

And while Apple rules the U.S. smartphone market (52% market share), Samsung edges them out globally with a 22% market share, compared to Apple’s 19%.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)