Technology

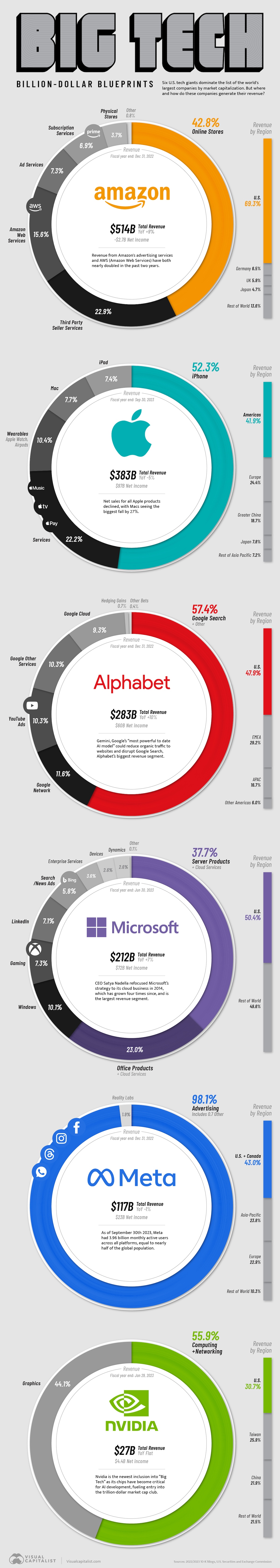

Visualizing How Big Tech Companies Make Their Billions

Visualizing How Big Tech Companies Make Their Billions

First there was oil, then tobacco, then pharma. The “Big” epithet has always denoted the unique scale and power of certain industries, and today’s Big Tech companies are the perfect example.

These six tech giants—Alphabet, Amazon, Apple, Microsoft, Meta (formerly Facebook), and Nvidia—are each one of the eight most valuable companies in the world by market capitalization.

Thanks to the ubiquity of their business, they routinely pull in an annual revenue that exceeds many national GDPs. We visualize how and where Big Tech’s revenues came from, per their latest full-year SEC filings.

Big Tech Spotlight: Alphabet, Amazon, and Meta

First we look at Alphabet, Amazon, and Meta, whose financial years ended in December 2022.

Alphabet made slightly north of $280 billion in 2022, nearly 60% of that coming from monetizing Google Search and other related activities.

Their $60 billion profit is the third-highest amongst its Big Tech peers. Their net profit margin (net income divided by total revenue) stood at 21.2% for the year, or 21 cents in profit for every dollar of revenue earned.

Here’s a quick look at the numbers.

| Company | Revenue | Profit | Net Profit Margin | Revenue Change (YoY) |

|---|---|---|---|---|

| Alphabet | $282.8B | $60.0B | 21.2% | 10% |

| Amazon | $514.0B | $-2.7B | -0.5% | 9% |

| Meta | $116.6B | $23.2B | 19.9% | -1% |

At $514 billion, e-commerce giant Amazon logged its highest revenue ever, beating its Big Tech peers by landslide.

However, severance payouts and a $720 million impairment charge (due to shutting some of their physical grocery stores), hurt the company’s bottom-line. Amazon posed a nearly $3 billion net loss for the year, and, consequently, a negative net profit margin (-0.53%).

Meta pulled in close to $117 billion in 2022 and turned a $23 billion profit, for a nearly 20% net margin. Meta’s slight year-on-year revenue decline (-1%) was attributed to foreign exchange movement.

Big Tech Spotlight: Apple, Microsoft, and Nvidia

Apple is an investor darling for a reason. Consider: $383 billion revenue (for financial year ending Sep. 2023) and $97 billion in profit—second-most in the world after oil giant Saudi Aramco.

Finally, Apple’s 25% net profit margin is the second-highest amongst the Big Tech companies.

Nevertheless, even Apple has less-than-stellar years on occasion. Sales for all Apple products declined year-on year, pulling revenue down 5%. The iPhone continues to be the company’s chief moneymaker, contributing 52% of total revenue.

| Company | Revenue | Profit | Net Profit Margin | Revenue Change (YoY) |

|---|---|---|---|---|

| Apple | $383.3B | $97.0B | 25.3% | -5% |

| Microsoft | $211.9B | $72.4B | 34.1% | 7% |

| Nvidia | $27.0B | $4.37B | 15.9% | Flat |

Meanwhile, Microsoft earned nearly $212 billion for its financial year ending July 2023, led by gains in their cloud and server segment, which CEO Satya Nadella prioritized back in 2014.

The company’s $72 billion net income meant the company raked in 34 cents for every dollar it made, the highest profit margin in Big Tech.

Finally, chip-designer Nvidia—the newest entrant into the trillion dollar club—made about $27 billion for the financial year ending January 2023, with a $4 billion profit. Net profit margin stood at 15.9%.

However, the company’s profile amongst investors is rising rapidly, due to its critical position in the growing AI chip business. The company has already registered a more-than-four-fold profit increase in 2023 so far—even without accounting for the last four months of the year.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001