Technology

Nvidia Joins the Trillion Dollar Club

Nvidia Joins the Trillion Dollar Club

Chipmaker Nvidia is now worth nearly as much as Amazon.

America’s largest semiconductor company has vaulted past the $1 trillion market capitalization mark, a milestone reached by just a handful of companies including Apple, Amazon, and Microsoft. While many of these are household names, Nvidia has only recently gained widespread attention amid the AI boom.

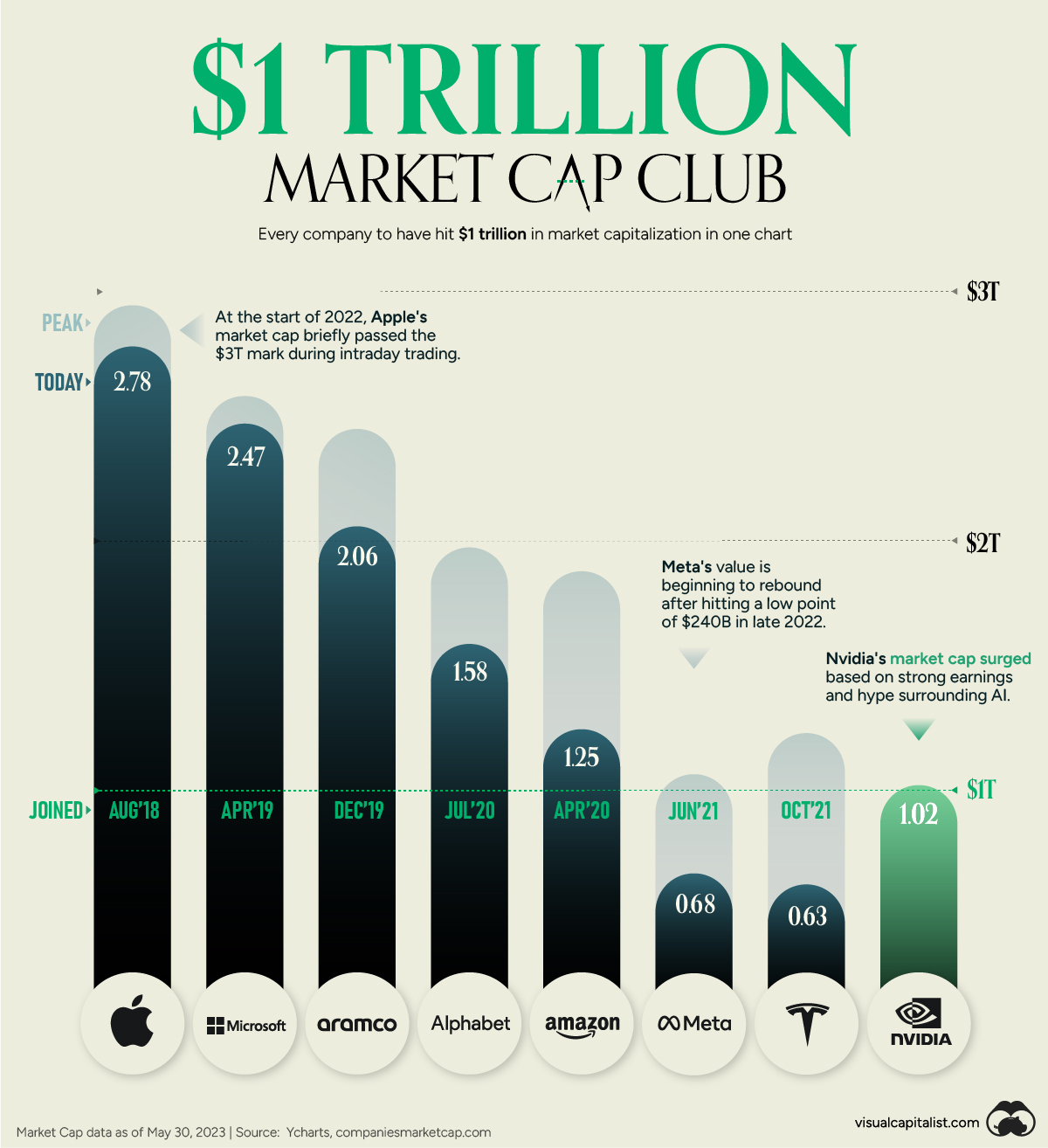

The above graphic compares Nvidia to the seven companies that have reached the trillion dollar club.

Riding the AI Wave

Nvidia’s market cap has more than doubled in 2023 to over $1 trillion.

The company designs semiconductor chips that are made of silicon slices that contain specific patterns. Just like you flip an electrical switch by turning on a light at home, these chips have billions of switches that process complex information simultaneously.

Today, they are integral to many AI functions—from OpenAI’s ChatGPT to image generation. Here’s how Nvidia stands up against companies that have achieved the trillion dollar milestone:

| Joined Club | Market Cap in trillions | Peak Market Cap in trillions |

|

|---|---|---|---|

| Apple | Aug 2018 | $2.78 | $2.94 |

| Microsoft | Apr 2019 | $2.47 | $2.58 |

| Aramco | Dec 2019 | $2.06 | $2.45 |

| Alphabet | Jul 2020 | $1.58 | $1.98 |

| Amazon | Apr 2020 | $1.25 | $1.88 |

| Meta | Jun 2021 | $0.68 | $1.07 |

| Tesla | Oct 2021 | $0.63 | $1.23 |

| Nvidia | May 2023 | $1.02 | $1.02 |

Note: Market caps as of May 30th, 2023

After posting record sales, the company added $184 billion to its market value in one day. Only two other companies have exceeded this number: Amazon ($191 billion), and Apple ($191 billion).

As Nvidia’s market cap reaches new heights, many are wondering if its explosive growth will continue—or if the AI craze is merely temporary. There are cases to be made on both sides.

Bull Case Scenario

Big tech companies are racing to develop capabilities like OpenAI. These types of generative AI require vastly higher amounts of computing power, especially as they become more sophisticated.

Many tech giants, including Google and Microsoft use Nvidia chips to power their AI operations. Consider how Google plans to use generative AI in six products in the future. Each of these have over 2 billion users.

Nvidia has also launched new products days since its stratospheric rise, spanning from robotics to gaming. Leading the way is the A100, a powerful graphics processing unit (GPU) well-suited for machine learning. Additionally, it announced a new supercomputer platform that Google, Microsoft, and Meta are first in line for. Overall, 65,000 companies globally use the company’s chips for a wide range of functions.

Bear Case Scenario

While extreme investor optimism has launched Nvidia to record highs, how do some of its fundamental valuations stack up to other giants?

As the table below shows, its price to earnings (P/E) ratio is second-only to Amazon, at 214.4. This shows how much a shareholder pays compared to the earnings of a company. Here, the company’s share price is over 200 times its earnings on a per share basis.

| P/E Ratio | Net Profit Margin (Annual) | |

|---|---|---|

| Apple | 30.2 | 25.3% |

| Microsoft | 36.1 | 36.7% |

| Aramco | 13.5 | 26.4% |

| Alphabet | 28.2 | 21.2% |

| Amazon | 294.2 | -0.5% |

| Meta | 33.9 | 19.9% |

| Tesla | 59.0 | 15.4% |

| Nvidia | 214.4 | 16.19% |

Consider how this looks for revenue of Nvidia compared to other big tech names:

$NVDA $963 billion market cap, 38x Revenue

$MSFT $2.5 trillion market cap, 12x Revenue$TSLA $612 billion market cap, 7.8x Revenue$AAPL $2.75 trillion market cap, 7.3x Revenue$GOOG $1.6 trillion market cap, 6.1x Revenue$META $672 billion market cap, 6x Revenue pic.twitter.com/VgkKAfiydx— Martin Pelletier (@MPelletierCIO) May 29, 2023

For some, Nvidia’s valuation seems unrealistic even in spite of the prospects of AI. While Nvidia has $11 billion in projected revenue for the next quarter, it would still mean significantly higher multiples than its big tech peers. This suggests the company is overvalued at current prices.

Nvidia’s Growth: Will it Last?

This is not the first time Nvidia’s market cap has rocketed up.

During the crypto rally of 2021, its share price skyrocketed over 100% as demand for its GPUs increased. These specialist chips help mine cryptocurrency, and a jump in demand led to a shortage of chips at the time.

As cryptocurrencies lost their lustre, Nvidia’s share price sank over 46% the following year.

By comparison, AI advancements could have more transformative power. Big tech is rushing to partner with Nvidia, potentially reshaping everything from search to advertising.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Science1 week ago

Science1 week agoVisualizing the Average Lifespans of Mammals

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023