Technology

Ranked: The Most Innovative Companies in 2023

The Most Innovative Companies in 2023

Every year, Boston Consulting Group (BCG) releases their Most Innovative Companies ranking. Based on a survey of over 1,000 innovation executives polled in Dec. 2022 and Jan. 2023, BCG assessed a company’s performance on four dimensions:

- Global mindshare: the number of votes received from all global innovation executives

- Industry peer view: the number of votes received from executives in a company’s own industry

- Industry disruption: the Diversity Index (Herfindahl-Hirschman) of votes across industries

- Value creation: total shareholder return, including share buybacks, over the 3-year period from Jan. 2020 through Dec. 2022.

We’ve provided a more visual representation of these results in the graphic above.

Data and Highlights

The 2023 ranking can be found in the table below.

For the fourth straight year, Apple is considered the most innovative company in the world. In fact, Apple has held this title every year since 2005 with the exception of 2019.

| Rank | Company | Industry | Change in Rank (+ or -) |

|---|---|---|---|

| 1 | 🇺🇸 Apple | Technology | - |

| 2 | 🇺🇸 Tesla | Transportation & energy | +3 |

| 3 | 🇺🇸 Amazon | Technology | - |

| 4 | 🇺🇸 Alphabet | Technology | - |

| 5 | 🇺🇸 Microsoft | Technology | -3 |

| 6 | 🇺🇸 Moderna | Healthcare | +1 |

| 7 | 🇰🇷 Samsung | Technology | -1 |

| 8 | 🇨🇳 Huawei | Technology | - |

| 9 | 🇨🇳 BYD Company | Transportation & energy | Returned |

| 10 | 🇩🇪 Siemens | Technology | +10 |

| 11 | 🇺🇸 Pfizer | Healthcare | +7 |

| 12 | 🇺🇸 Johnson & Johnson | Healthcare | +15 |

| 13 | 🇺🇸 SpaceX | Transportation & energy | Returned |

| 14 | 🇺🇸 Nvidia | Technology | +1 |

| 15 | 🇺🇸 ExxonMobil | Transportation & energy | Returned |

| 16 | 🇺🇸 Meta | Technology | -5 |

| 17 | 🇺🇸 Nike | Consumer goods & services | -5 |

| 18 | 🇺🇸 IBM | Technology | -8 |

| 19 | 🇺🇸 3M | Consumer goods & services | +18 |

| 20 | 🇮🇳 Tata Group | Transportation & energy | Returned |

| 21 | 🇨🇭 Roche | Healthcare | Returned |

| 22 | 🇺🇸 Oracle | Technology | -3 |

| 23 | 🇩🇪 BioNTech | Healthcare | New |

| 24 | 🇬🇧 Shell | Transportation & energy | Returned |

| 25 | 🇫🇷 Schneider Electric | Transportation & energy | New |

| 26 | 🇺🇸 P&G | Consumer goods & services | +8 |

| 27 | 🇨🇭 Nestlé | Consumer goods & services | +22 |

| 28 | 🇺🇸 General Electric | Transportation & energy | +1 |

| 29 | 🇨🇳 Xiaomi | Technology | +2 |

| 30 | 🇺🇸 Honeywell | Transportation & energy | New |

| 31 | 🇯🇵 Sony | Technology | -22 |

| 32 | 🇨🇳 Sinopec | Transportation & energy | New |

| 33 | 🇯🇵 Hitachi | Transportation & energy | +6 |

| 34 | 🇺🇸 McDonald's | Consumer goods & services | Returned |

| 35 | 🇺🇸 Merck | Healthcare | Returned |

| 36 | 🇨🇳 ByteDance | Technology | - |

| 37 | 🇩🇪 Bosch | Transportation & energy | -11 |

| 38 | 🇺🇸 Dell | Technology | -24 |

| 39 | 🇨🇭 Glencore | Transportation & energy | New |

| 40 | 🇺🇸 Stripe | Technology | New |

| 41 | 🇸🇦 Saudi Aramco | Transportation & energy | New |

| 42 | 🇺🇸 Coca-Cola | Consumer goods & services | -6 |

| 43 | 🇩🇪 Mercedes-Benz Group | Transportation & energy | Returned |

| 44 | 🇨🇳 Alibaba | Technology | -22 |

| 45 | 🇺🇸 Walmart | Consumer goods & services | -32 |

| 46 | 🇨🇳 PetroChina | Transportation & energy | New |

| 47 | 🇯🇵 NTT | Telecommunications | New |

| 48 | 🇨🇳 Lenovo | Technology | -24 |

| 49 | 🇩🇪 BMW | Transportation & energy | Returned |

| 50 | 🇬🇧 Unilever | Consumer goods & services | - |

BCG added additional context on several companies in its report, including Germany’s Bosch (37th). According to BCG, the engineering and technology company has a global R&D organization of 84,800 employees across 130 locations. Bosch has also maintained R&D spending (as a share of sales) at between 7.6% and 8.2% from 2018 through 2021.

Another highlight was Samsung (7th), which spent over $17 billion (9% of annual sales) on R&D in 2021, making the South Korean conglomerate one of the world’s largest spenders on innovation. Samsung was also granted 6,300 U.S. patents in 2022, the most out of any company.

As this ranking shows, innovative companies aren’t just tech companies. McDonald’s (34th) is considered by BCG as the “restaurant industry frontrunner in technology innovation and investment”.

For example, McDonald’s recently acquired Apprente, a startup that develops voice-based technologies, and Dynamic Yield, a firm specializing in creating customizable online experiences. McDonald’s aims to leverage these technologies to improve ordering times and offer customers better choices.

Companies by Nationality

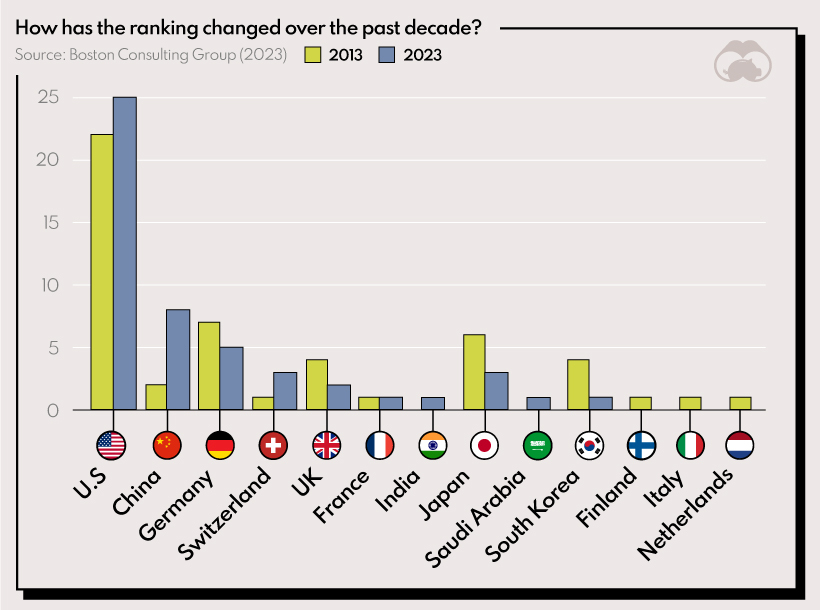

Now let’s examine the ranking through a different lens—nationality. The following chart compares the country breakdowns of the 2013 and 2023 rankings.

The U.S. and China are the only two countries that have increased their share from 2013, pushing out firms from European countries like Germany, the UK, and Italy. We can also see significant declines in Japanese and South Korean representation.

Given China’s economic growth, it’s likely that Chinese firms will continue to represent more of BCG’s ranking in the future. So far, the country’s strongest innovator is Huawei (8th), which has made the top 50 list every year since 2014, when it debuted at 50th place.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees