Technology

Visualized: The State of Central Bank Digital Currencies

Visualized: The State of Central Bank Digital Currencies

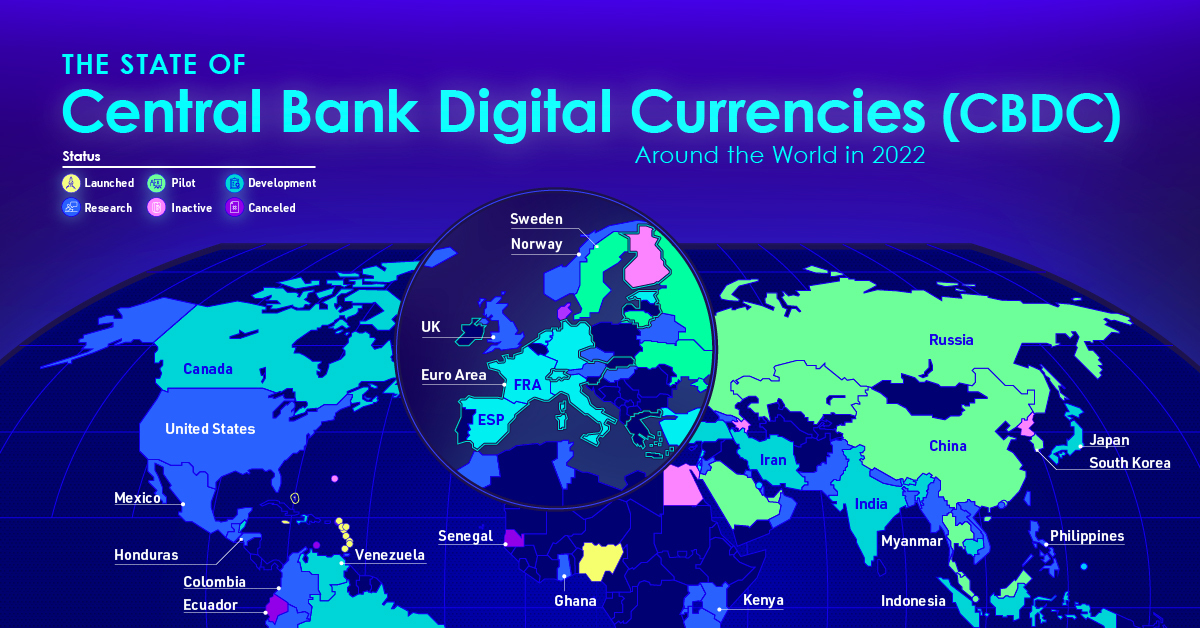

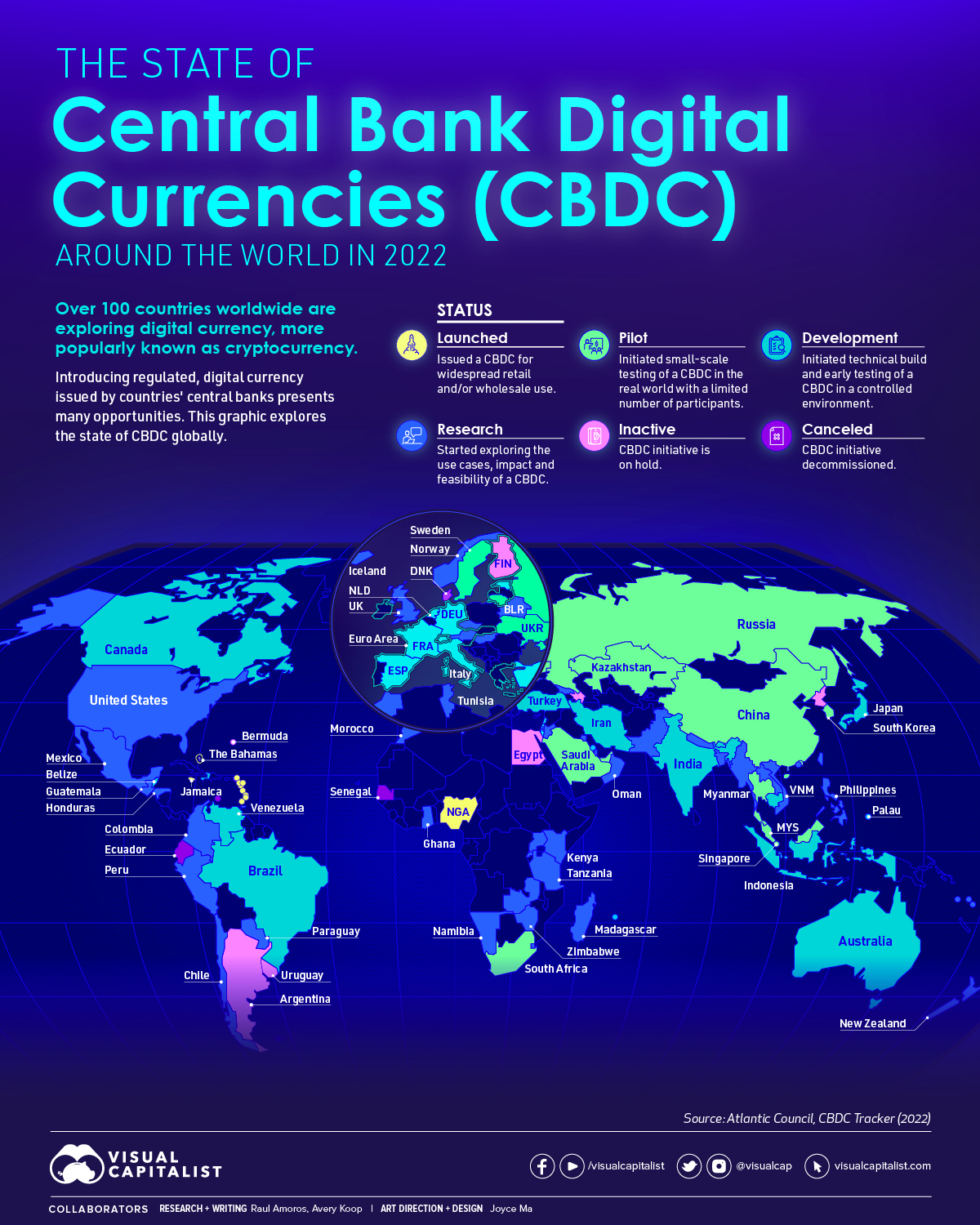

Central banks around the world are getting involved in digital currencies, but some are further ahead than others.

In this map, we used data from the Atlantic Council’s Currency Tracker to visualize the state of each central banks’ digital currency effort.

Digital Currency – The Basics

Digital currencies have been around since the 1980s, but didn’t become widely popular until the launch of Bitcoin in 2009. Today, there are thousands of digital currencies in existence, also referred to as “cryptocurrencies”.

A defining feature of cryptocurrencies is that they are based on a blockchain ledger. Blockchains can be either decentralized or centralized, but the most known cryptocurrencies today (Bitcoin, Ethereum, etc.) tend to be decentralized in nature. This makes transfers and payments very difficult to trace because there is no single entity with full control.

Government-issued digital currencies, on the other hand, will be controlled by a central bank and are likely to be easily trackable. They would have the same value as the local cash currency, but instead issued digitally with no physical form.

Central Bank Digital Currencies Worldwide

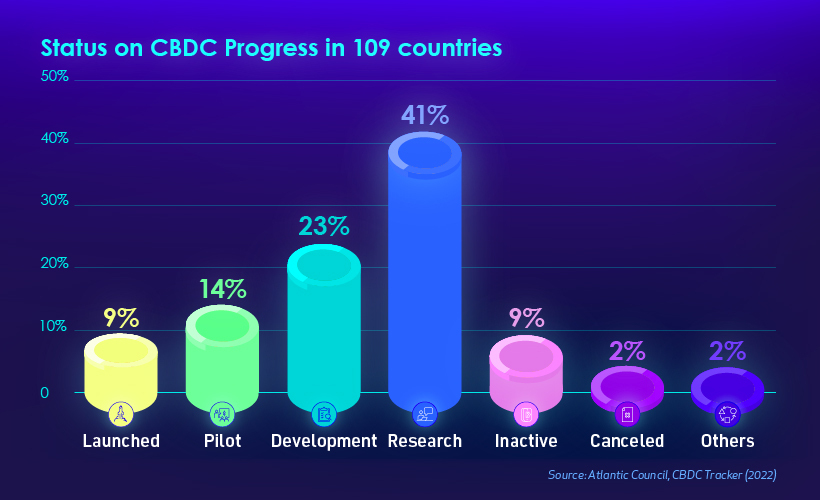

105 countries are currently exploring centralized digital currencies. Together, they represent 95% of global GDP. The table below lists the data used in the infographic.

| Country | Status | Use Case |

|---|---|---|

| Nigeria | Launched | Retail |

| The Bahamas | Launched | Retail |

| Jamaica | Launched | Retail |

| Anguila | Launched | Retail |

| Saint Kitts and Nevis | Launched | Retail |

| Antigua and Barbuda | Launched | Retail |

| Montserrat | Launched | Retail |

| Dominica | Launched | Retail |

| Saint Lucia | Launched | Retail |

| Saint Vincent and the Grenadines | Launched | Retail |

| Grenada | Launched | Retail |

| Sweden | Pilot | Retail |

| Lithuania | Pilot | Retail |

| Ukraine | Pilot | Undecided |

| Kazakhstan | Pilot | Retail |

| Russia | Pilot | Retail |

| China | Pilot | Both |

| Thailand | Pilot | Both |

| Hong Kong | Pilot | Both |

| South Korea | Pilot | Retail |

| Saudi Arabia | Pilot | Wholesale |

| United Arab Emirates | Pilot | Wholesale |

| Singapore | Pilot | Wholesale |

| Malaysia | Pilot | Wholesale |

| South Africa | Pilot | Both |

| Canada | Development | Both |

| Belize | Development | Undecided |

| Haiti | Development | Both |

| Venezuela | Development | Both |

| Brazil | Development | Retail |

| Turkey | Development | Retail |

| Iran | Development | Retail |

| Bahrain | Development | Wholesale |

| India | Development | Both |

| Mauritius | Development | Both |

| Bhutan | Development | Both |

| Cambodia | Development | Retail |

| Indonesia | Development | Both |

| Palau | Development | Both |

| Australia | Development | Both |

| Japan | Development | Both |

| Spain | Development | Retail |

| France | Development | Both |

| Netherlands | Development | Retail |

| Switzerland | Development | Wholesale |

| Italy | Development | Undecided |

| Germany | Development | Undecided |

| Estonia | Development | Retail |

| Lebanon | Development | Retail |

| Israel | Development | Retail |

| Euro Area | Development | Both |

| United States | Research | Retail |

| Mexico | Research | Retail |

| Guatemala | Research | Undecided |

| Honduras | Research | Undecided |

| Trinidad andd Tobago | Research | Undecided |

| Colombia | Research | Undecided |

| Peru | Research | Undecided |

| Paraguay | Research | Undecided |

| Chile | Research | Retail |

| Iceland | Research | Retail |

| UK | Research | Both |

| Morocco | Research | Retail |

| Ghana | Research | Retail |

| Namibia | Research | Undecided |

| Eswatini | Research | Both |

| Madagastar | Research | Retail |

| Zimbabwe | Research | Undecided |

| Zambia | Research | Undecided |

| Tanzania | Research | Undecided |

| Rwanda | Research | Undecided |

| Uganda | Research | Undecided |

| Kenya | Research | Retail |

| Tunisia | Research | Wholesale |

| Oman | Research | Undecided |

| Kuwait | Research | Retail |

| Jordan | Research | Undecided |

| Georgia | Research | Retail |

| Belarus | Research | Undecided |

| Norway | Research | Retail |

| Czech Republich | Research | Undecided |

| Pakistan | Research | Retail |

| Nepal | Research | Undecided |

| Bangladesh | Research | Undecided |

| Myanmar | Research | Undecided |

| Laos | Research | Both |

| Vietnam | Research | Undecided |

| Macau | Research | Undecided |

| Taiwan | Research | Both |

| Philippines | Research | Retail |

| New Zealand | Research | Retail |

| Vanuatu | Research | Undecided |

| Fiji | Research | Undecided |

| Tonga | Research | Undecided |

| Palestine | Research | Retail |

| Jordan | Research | Undecided |

| Austria | Research | Wholesale |

| Hungary | Research | Retail |

| Bermuda | Inactive | Undecided |

| Sint Maarten | Inactive | Retail |

| Curaçao | Inactive | Retail |

| Argentina | Inactive | Undecided |

| Uruguay | Inactive | Retail |

| Denmark | Inactive | Retail |

| Azerbaijan | Inactive | Undecided |

| Egypt | Inactive | Undecided |

| North Korea | Inactive | Undecided |

| Finland | Inactive | Retail |

| Ecuador | Cancelled | Retail |

| Senegal | Cancelled | Retail |

When aggregated, we can see that the majority of countries are in the research stage.

We’ve also divided the map by region to make viewing easier.

Africa

Asia

Europe

Middle East

South America

North America

What are the Benefits?

A major benefit of government-issued digital currencies is that they can improve access for underbanked people.

This is not a huge issue in developed countries like the U.S., but many people in developing nations have no access to banks and other financial services (hence the term underbanked). As the number of internet users continues to climb, digital currencies represent a sound solution.

To learn more about this topic, visit this article from Global Finance, which lists the world’s most underbanked countries in 2021.

The 9%

Just 9% of countries have launched a digital currency to date.

This includes Nigeria, which became the first African country to do so in October 2021. Half of the country’s 200 million population is believed to have no access to bank accounts.

Adoption of the eNaira (the digital version of the naira) has so far been relatively sluggish. The eNaira app has accumulated 700,000 downloads as of April 2022. That’s equal to 0.35% of the population, though not all of the downloads are users in Nigeria.

Conversely, 33.4 million Nigerians were reported to be trading or owning crypto assets, despite the Central Bank of Nigeria’s attempts to restrict usage.

Status in the U.S.

America’s central bank, the Federal Reserve, has not decided on whether it will implement a central bank digital currency (CBDC).

Our key focus is on whether and how a CBDC could improve on an already safe and efficient U.S. domestic payments system.

– Federal Reserve

To learn more, check out the Federal Reserve’s January 2022 paper on the pros and cons of CBDCs.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees