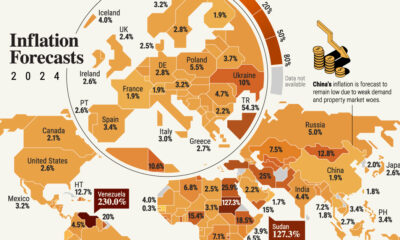

Global inflation projections look optimistic in 2024, but risks of a second wave of price pressures remain due to geopolitical shocks.

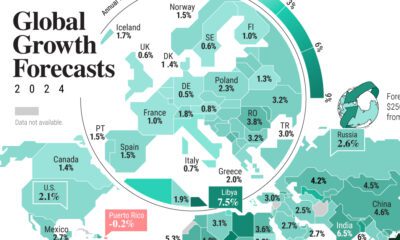

Will global GDP growth continue to be resilient in 2024? This graphic shows the economic outlook for 191 economies around the world.

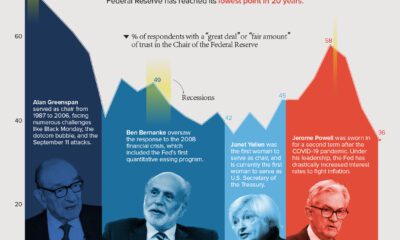

Public trust in the Federal Reserve chair has hit its lowest point in 20 years. Get the details in this infographic.

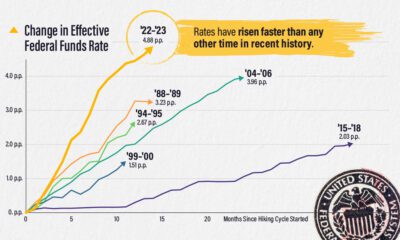

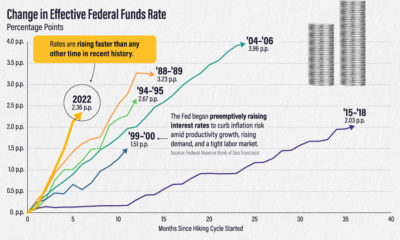

The effective federal funds rate has risen nearly five percentage points in 14 months, the fastest interest rate hikes in modern history.

Foreign investors hold $7.3 trillion of the national U.S. debt. These holdings declined 6% in 2022 amid a strong U.S. dollar and rising rates.

This infographic examines 50 years of data to highlight a clear visual trend: recessions are preceded by a cyclical low in unemployment.

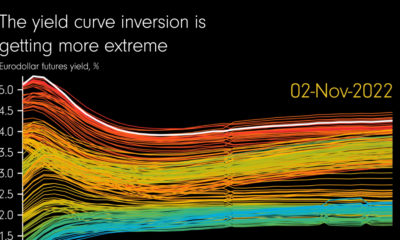

Since 1960, an inverted yield curve has preceded nearly every recession. This animation highlights how that inversion is becoming more extreme.

The effective federal funds rate has risen more than two percentage points in six months. How does this compare to other interest rate hikes?

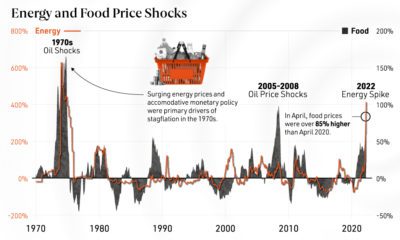

From rising inflation to food insecurity, we show why energy price shocks have far-reaching effects on the global economy.

Central bank digital currencies are coming, but progress varies greatly from country to country. View the infographic to learn more.